Computer Economics attended the annual user conference of Salesforce.com in October this year, where Salesforce made several important announcements, including:

Computer Economics attended the annual user conference of Salesforce.com in October this year, where Salesforce made several important announcements, including:

-

A new analytics cloud, dubbed Wave, which fills out Salesforce.com’s offerings to include native business intelligence and analytical capabilities;

-

A new version of the Salesforce1 platform, Lightning, for developing mobile apps;

- An expanded partnership with Microsoft for Windows mobile devices and new integrations with Microsoft Office, Office 365, Power BI, and Excel.

But its user conference, Dreamforce, is not just about Salesforce.com. The ecosystem of Salesforce partners is also on display: there are hundreds of partners building complementary and in many cases completely independent solutions on the Salesforce platform.

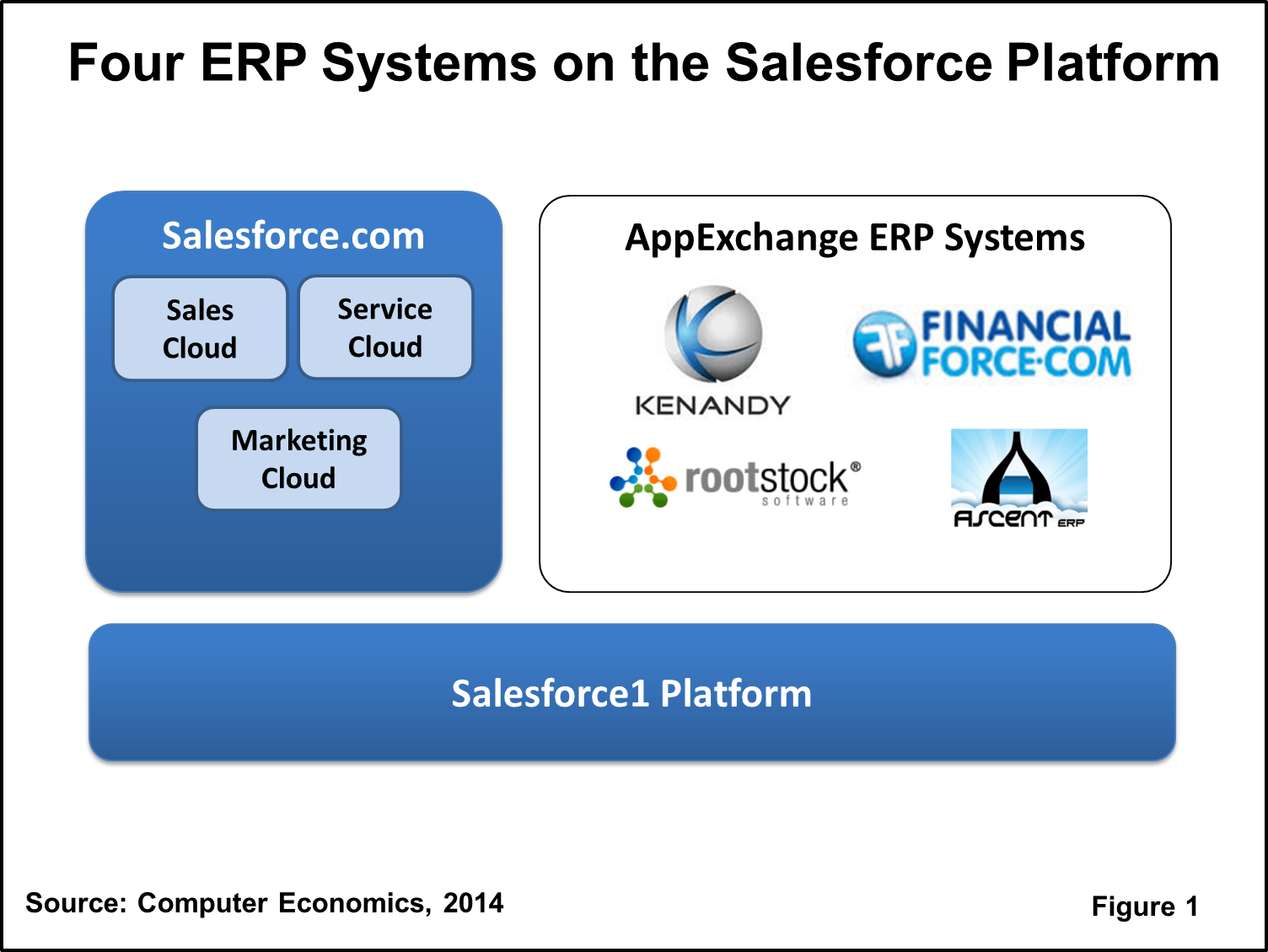

For those that follow ERP, this Research Byte outlines the latest developments with four ERP providers building on the Salesforce platform: Kenandy, FinancialForce, Rootstock, and AscentERP, along with takeaways from each of them. We conclude with one small caveat for buyers.

Kenandy Goes Up-Market

For Kenandy, the big news at Dreamforce is its success in selling into large companies. Exhibit 1 in Kenandy’s march up-market is Big Heart Pet Brands, a distributor of pet food and pet supplies, which was formed by the carve-out of the pet food business from Del Monte Foods earlier this year. Milk Bone, Kibbles, Gravy Train, and 9Lives are just a few of its well-known brands.

In an interview with Dave McLain, the firm’s CIO, he made it clear that this is no two-tier ERP configuration. Apart from a handful of point solutions and an on-premises warehouse management system (Red Prairie), a single instance of Kenandy will be providing all ERP functionality when fully rolled out. With $2 billion in annual revenue, this may well be the largest company running a cloud-only system as its only ERP system.

Why would McLain trust a young vendor such as Kenandy with such a tall order? First, he was attracted to the Salesforce platform and its promise of rapid development. In other words, he was sold on the platform and then looked for an ERP provider that was leveraging it. It helps that McClain is not your typical CIO. He worked previously in the enterprise software industry, with stints at Aspect Development, back around the turn of the century, and at i2. He is not only comfortable working with a young vendor, but he viewed Kenandy’s youth as an advantage, as he felt he would have more influence over the product roadmap. So far, he is happy with his choice.

Big Heart Pet Brands is only the first and most visible example of Kenandy’s move into larger companies. In another briefing with Computer Economics, Kenandy executives shared several large deals they have in implementation and several that are in the pipeline. Although the names are still confidential, they are large and in some cases very large, well-known, global companies.

One point that may keep SAP executives awake at night: some of these prospects are reportedly approaching Kenandy because of a determination to halt further implementation of SAP’s Business Suite in new regions of the world.

The key takeaway from Kenandy is that cloud ERP is not just for small and midsize businesses.

FinancialForce Goes Deeper

FinancialForce is another young ERP vendor, founded in 2009 as a joint venture between UNIT4 and Salesforce (UNIT4 is the majority shareholder). Last year, its acquisitions of Vana Workforce and Less Software expanded FinancialForce from financial systems and professional services automation into human capital management (HCM), order processing, inventory control, cost accounting, and functionality for product-based businesses.

This year, in a briefing with FinancialForce executives, we heard about the firm’s work to embed HR activities within operational transactions. Users can give other employees feedback on their performance right within the context of a project in the professional services system, for example. The feedback is then recorded in the HCM system so that employee performance data is gathered throughout the year instead of during an annual performance review only. FinancialForce refers to this approach as “Everyday HCM.”

The firm also reports good uptake of the “supply chain management (SCM)” capabilities that it acquired from Less Software, tripling its number of customers for this functionality. The term supply chain management is something of a misnomer. There is no real warehouse management, transportation management, or supply chain planning. Rather, SCM in this context refers to the detailed tracking of physical and intangible products from supplier, through inventory, to customers.

This can best be seen with the large percentage of deals that Less Software, and now FinancialForce, have done with value-added resellers, solution providers, and other tech industry channel partners. FinancialForce can now track and process OEM rebates (a long-standing practice in channel businesses). Product costing allows costs to be accumulated by serial number (specific identification) and can include landed cost (i.e. allocated inbound freight cost). This is a huge need for solution providers that import OEM products. Filling out the needs of today’s channel partners, FinancialForce also has a full professional services automation system, and it supports subscription billing along with management of recurring revenue.

These are not trivial product features. It is a testimony to the rapid development capabilities of the Salesforce platform that FinancialForce has been able to build out these features in such a short time.

Like Kenandy, FinancialForce is also getting into larger deals, although the names are not yet public.

The takeaway from FinancialForce is that, in some cases, the functionality of these young cloud-only vendors now rivals that of the traditional vendors.

Rootstock Expands Its Footprint and Presence

The founders of Rootstock have the advantage of having developed a cloud ERP system twice. The firm first developed its manufacturing system in 2008 on the NetSuite platform. In 2010, however, Rootstock disengaged from this partnership and rewrote its ERP system on the Salesforce platform. As a result of the re-platforming, Rootstock developed its own customer order management product and partnered with FinancialForce for its accounting systems.

Rootstock scales well to larger companies. It claims to be the largest system on the Salesforce.com platform in terms of the number of objects, pushing the boundaries of what the platform can do. All Salesforce partners, of course, benefit from the scale-out capabilities that Salesforce is building into the platform.

In terms of functionality, Rootstock has good capabilities for purchasing, production engineering, lot and serial tracking, MRP, MPS, and capacity planning, shop floor control, manufacturing costing, and PLM/PDM integration. The system can support multiple companies, multiple divisions, and multiple sites, all within a single tenant on the Salesforce platform. It also announced this year the development of a product configurator, a module where most cloud ERP systems are still relying on third-party solutions.

The build-out of functionality is making Rootstock more attractive to larger companies as well as the midsize organizations it has appealed to in the past. In a briefing with Rootstock senior leadership, they pointed to their win at CSG, a provider of print and managed services, and enterprise solutions in Australia and New Zealand. In New Zealand, CSG is the exclusive distributor for Konica Minolta. When fully deployed, Rootstock will be serving “hundreds” of users at CSG.

Other wins this year include Northeast Lantern, a maker of high quality brass and copper lighting fixtures; Wilshire Coin Mints, a retailer and wholesale distributor of coins for collectors and investors; Proveris Scientific, a manufacturer of test instrumentation for the pharmaceutical industry; Pioneer Motor Bearing, a maker of high performance industrial bearings; Pacer Group, a wire and electrical cable manufacturer; Plumb Sign, a job shop producing signage for businesses across the U.S; and Oberfield Architectural Precast, a manufacturer of precast concrete and other custom-built precast products.

In another development, Rootstock added some muscle to its advisory board this year with the addition of Jan Baan, the former founder and CEO of Baan Software, Jim Bensman, former president of SAP North America, Bill Happel, former vice president of General Motors, and Lee Wylie, former CIO of Gartner.

The takeaway from Rootstock is similar to that for FinancialForce: the functionality gap in some areas is closing between the cloud-only ERP providers and traditional vendors.

AscentERP Raises Its Profile

In a briefing, AscentERP co-founder and President Shaun McInerney said he was positively excited about his firm’s latest developments:

-

Ascent Rental, a native Force.com application for companies that rent or loan equipment. McInerney is already seeing interest from current customers in the construction industries. Event organizers and medical equipment rental businesses are also targets.

-

An iTunes app that turns Apple iOS devices (iPod Touch 5th Gen, iPhone 5, and iPad Mini) into true high-speed bar code scanners, through use of a scanner sled available from Honeywell. This plays well with AscentERP’s roots in warehouse data collection and is a key element in the case study highlighted below.

- Integration with Magento for e-commerce, allowing customers to take orders from the web, fulfill them and push shipment information back to customers. McInerney claims over 15 customers already for this functionality, which was only launched two or three months before Dreamforce.

McInerney reports an increase in new opportunities coming from Salesforce, with about half from outside the U.S. The system supports multiple currencies and base languages of English and Chinese. Like the other three vendors outlined in this Research Byte, AscentERP is also seeing its share of larger deals, which includes several in the range of 200 users, a jump from its typical user count in the past.

In our view, AscentERP gets the award for the most inspiring customer story. It put together a short video about its client Bosma Industries, a $55 million non-profit distributor of medical supplies, which also happens to be Indiana’s largest employer of people who are blind or have vision loss. AscentERP worked with Bosma to customize its system and to make it fully accessible to Bosma’s visually impaired workforce. This is where that iTunes app for warehouse data collection comes into play.

The best quote is from Bosma’s Adam Rodenbeck, who says, “If Siri can look at Facebook and help us get around on Twitter, why can’t it help get us around the warehouse?”

Click the image below to watch the 3-minute customer story.

The takeaway from AscentERP: do not underestimate the marketing value of being part of the Salesforce ecosystem.

Buyers Should Ensure Adequate Implementation Support

One thing that none of these four vendors mentioned: a lack of new sales opportunities. In fact, they all indicated that they were awash in new prospects. This is in contrast to some of the traditional ERP vendors who struggle at times to generate leads. It is always a good sign when a vendor can afford to be picky about the opportunities it chases—it lessens the likelihood that the vendor will get into situations where it cannot compete and improves the chances of success.

But the flip side of all these new deals can lead to problems if vendors are not adequately staffed to support them. Generally speaking, client should be sure to arrange for adequate consulting help when they are considering these vendors. True, these new cloud-only systems are generally easier to implement, but they do not implement themselves. The client may not need system admins or database administrators, but they do need consultants who understand how to configure the system and help implement the client’s business processes within the system. In some cases, these vendors may have consulting partners that can assist, but they can be stretched as well. It is not an insurmountable problem, but buyers should be sure they get the help they need to have a successful implementation.

The four vendors outlined in this Research Byte may not be household names. But in the coming years and months, we expect them to mature further and become more well-established as viable alternatives to the traditional ERP providers.