-

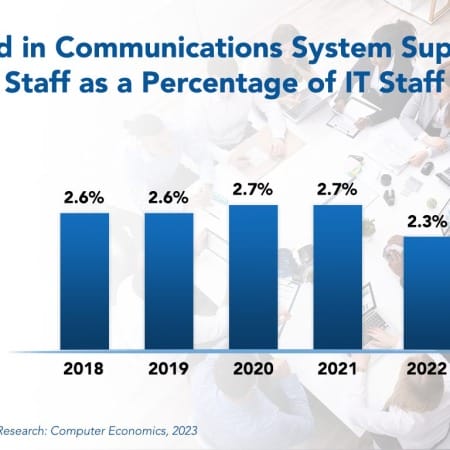

Communications System Support Staffing Ratios 2023

Hybrid work is making communications support more complicated, as workers move beyond email and texting to video conferencing and enterprise social media groups. Because of the rise of consumerization, employees and customers are demanding more immersive experiences, even virtual reality. Cloud-based communication and the rise of artificial intelligence are also changing the role of the communications support staff members. All of this is set to put greater demands on corporate communications in 2023.

June, 2023

-

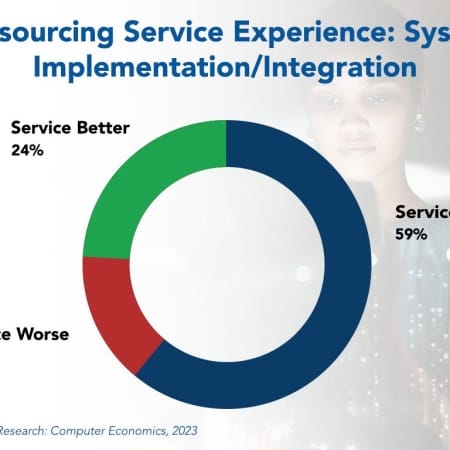

System Implementation/Integration Outsourcing Trends and Customer Experience 2023

System implementation/integration outsourcing is the use of an external service provider to assist in implementing new systems, which often includes integration with other new or existing systems. A systems integration (SI) firm can help or be responsible for some or all of the following: identifying system requirements, understanding and redesigning business processes, selecting a new system, and deploying the system.

November, 2023

-

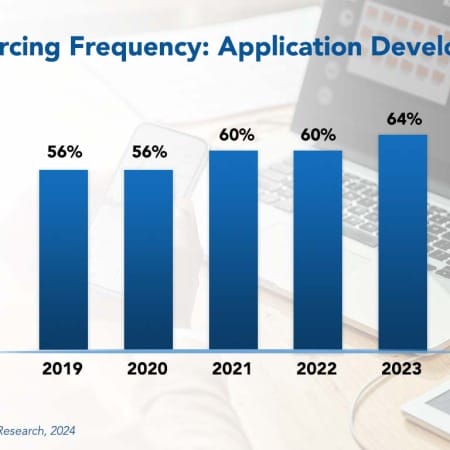

Application Development Outsourcing Trends and Customer Experience 2024

The demand for applications is constantly increasing due to digital transformation, changing business needs, and the surge in generative AI.

February, 2024

-

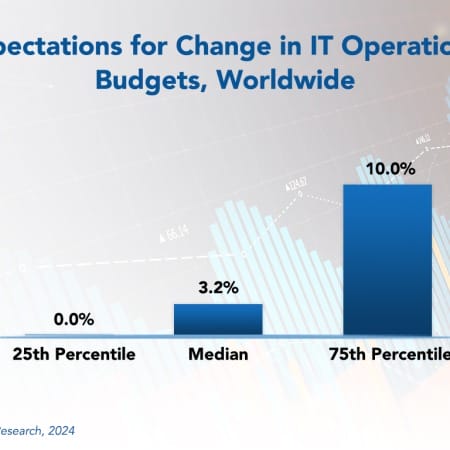

Worldwide IT Spending and Staffing Outlook for 2024

Our forecast for enterprise IT spending in 2024 is partly sunny, with a chance of strong headwinds. With stronger-than-expected economic data in the US and Europe and easing inflation, the world economy in most regions looks poised for the soft landing that central banks were aiming for. Our survey shows that IT budgets will continue to grow, and enterprises expect a slightly better 2024 than 2023. The worldwide outlook is cautiously optimistic.

March, 2024

-

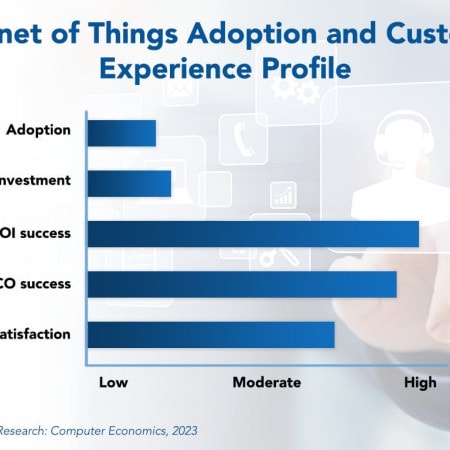

Internet of Things Adoption Trends and Customer Experience 2023

The Internet of Things (IoT) is a maturing technology and for many years it has promised benefits such as lower labor costs, better tracking of assets, improved business processes, and efficient energy management. Indeed, IoT seems like a no-brainer technology for companies to invest in. By now, if the hype were to be believed, every product in the home would be “smart” and every machine in the enterprise would be replete with sensors. Instead, IoT lags behind most of the other technologies in our Technology Trends study in terms of new investment.

June, 2023

-

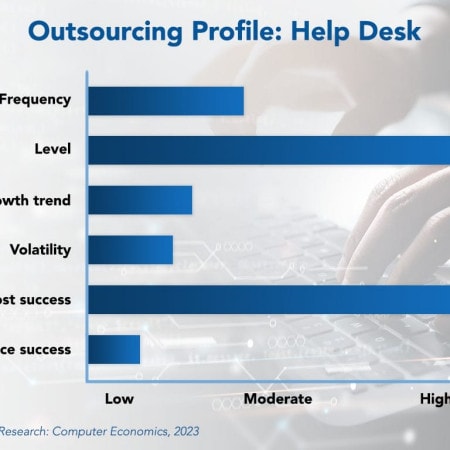

IT Help Desk Outsourcing Trends and Customer Experience 2023

The decision to turn over an IT organization’s help desk function to a service provider has a long and varied history. It is one of the services that helped establish the contemporary IT outsourcing industry. Our research shows that 50% of IT organizations surveyed currently rely on service providers to perform the help desk function, at any level of utilization.

November, 2023

-

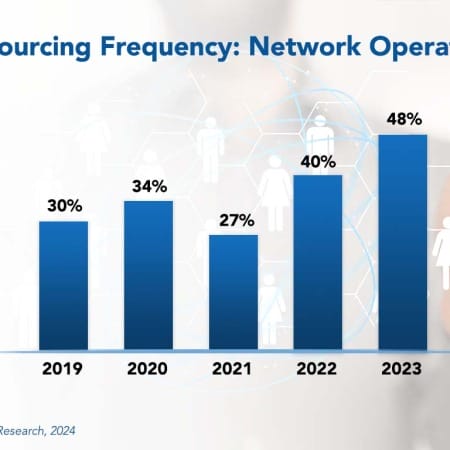

Network Operations Outsourcing Trends and Customer Experience 2024

Network operations outsourcing is an established market. Today, major IT and telecom industry service providers and even disruptive newcomers are competing with regional providers for market share. In the past, large equipment vendors only provided the hardware that serves as the network's backbone. However, these giants are beginning to recognize the potential of value-added network services. Businesses can now obtain dependable infrastructure, along with expert network design, planning, and even network support operations from a single source.

February, 2024

-

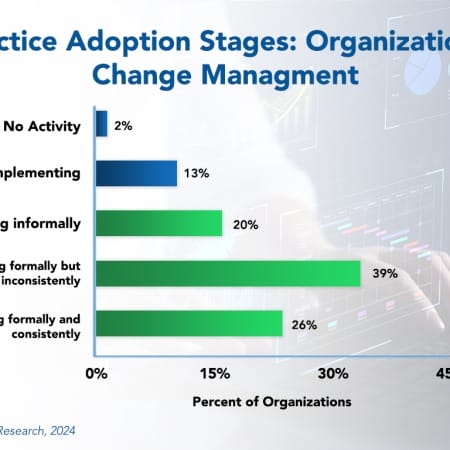

Organizational Change Management Best Practices 2024

The pace of change in many companies is increasing as new technologies allow businesses to serve customers faster, better, and cost-effectively. In most industries, therefore, new systems are essential to compete in today’s global economy. Still, some companies fall behind in formal and consistent practice of change management best practices. These best practices can help them leverage these new systems more effectively. IT leaders are not as resistant to change as they once were, but inadequate training and support, unrealistic expectations, or a lack of governance and strategic leadership might hinder them.

March, 2024

-

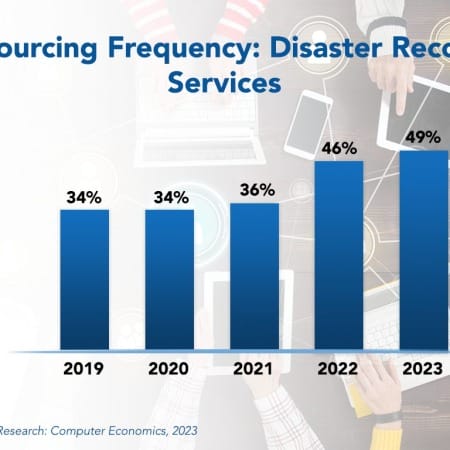

Disaster Recovery Outsourcing Trends and Customer Experience 2023

Experiences over the past three years have revealed that many organizations were not adequately prepared for a worldwide pandemic from a business continuity perspective. But most enterprises responded by establishing remote working environments on short notice and built out the network infrastructure and security measures to support them. Now, emerging from pandemic lockdowns, most businesses are retaining these remote work capabilities, even if they are to support a hybrid work model. Businesses are now more resilient, not just in facing another pandemic but in supporting remote work in the event of other natural or man-made disasters.

June, 2023

-

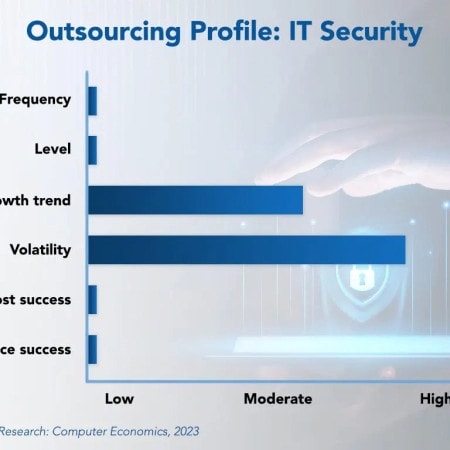

IT Security Outsourcing Trends and Customer Experience 2023

IT security is a major focus for IT leaders that continues to grow in importance. The threat landscape is evolving with increased reliance on the cloud, greater diversity in the IT service portfolio, more employees working from home, and a more burdensome regulatory environment.

November, 2023

-

Microsoft Revs Up Copilot in Dynamics 365: Will it Fly with Customers?

To capitalize on the generative AI frenzy sweeping the business world, Microsoft has been rapidly launching versions of its Copilot solutions throughout its various products. The software giant has also announced many new use cases for Copilots in individual Dynamics 365 modules. But are customers ready and willing to let Gen AI play such an important role in their core ERP processes? And are they willing to pay for it? We examine the Copilot state of play.

February, 2024

-

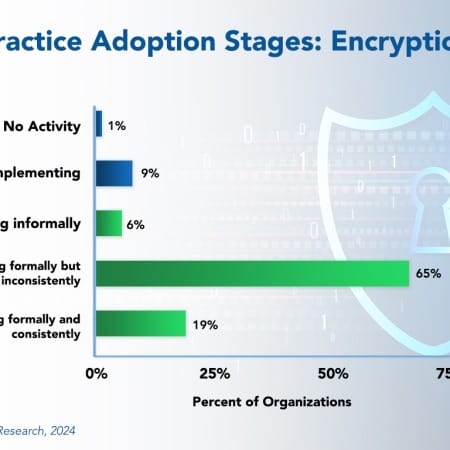

Encryption Best Practices 2024

Encryption best practices protect sensitive or confidential information, both in storage and in transit. Data encryption software and algorithms translate data into another form or code so that only those with access to a secret key—a decryption key—can read it. Banking details, health records, financial information, or other sensitive personal information must be encrypted so it cannot be intercepted, accessed, or read.

March, 2024

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 1: Executive Summary

The Computer Economics IT Spending and Staffing Benchmarks study (the "ISS"), published annually since 1990, is the definitive source for IT spending and staffing benchmarks and IT performance statistics across multiple industries and government sectors. Download a free copy of the 60+ pages Executive Summary (Chapter 1), which includes a detailed analysis of our major findings of this year's report. It also includes important, high-level IT spending and staffing ratios and trends, including metrics on IT spending as a percentage of revenue, IT spending per user, IT spending growth, IT capital budgets, IT spending priorities, and IT staff count changes.

July, 2023

-

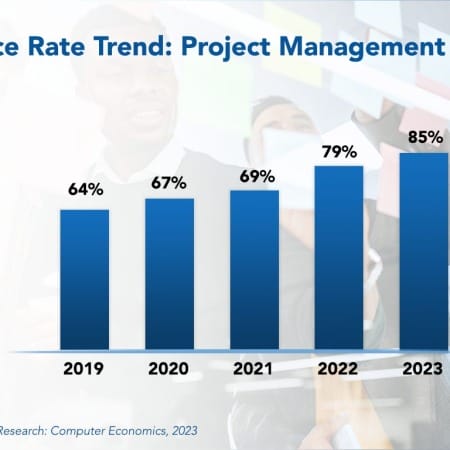

Project Management Office Best Practices 2023

To improve project success, companies often establish a formal project management office (PMO) as a center of excellence for project management disciplines. In some organizations, the PMO operates as an advisory group to project managers, who report directly to business units. In other organizations, project managers report directly to the PMO and are assigned to projects as needed. However, in recent years, the use of PMOs has grown significantly, especially for organizations that use them for all projects.

December, 2023

-

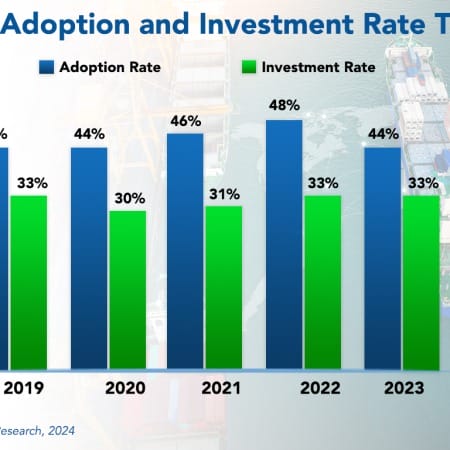

Supply Chain Management Adoption Trends and Customer Experience 2024

Supply chain management (SCM) has become a hot topic in recent years. From grocery shelves running out of toilet paper and cleaning supplies during the pandemic, to shortages of semiconductors leading to auto dealers running out of cars to sell, to cargo ships lined up at the ports of Los Angeles and Long Beach, the term “supply chain” was on everyone’s lips. But given the resolution of global supply chain issues over the past year, what does this mean for future adoption and investments of SCM systems?

February, 2024

Grid View

Grid View List View

List View