-

Data Management and Business Intelligence Staffing Sees Notable Increase After Years of Stability

In the past four years, organizations have maintained data management and business intelligence (DMBI) head count at about 5.4% of the IT staff. However, our latest data shows a significant increase. Traditionally, productivity gains from cloud-based business analysis and reporting tools mitigated the need for more staff. But there is a new business focus. This Research Byte summarizes our full report on data management and business intelligence staffing.

June, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 14: Transportation and Logistics

Chapter 14 provides benchmarks for the transportation and logistics sector. The 39 respondents in this sample range in size from a minimum of $50 million to over $80 billion. The category includes organizations that operate buses, trucks, railways, airlines, barges, and ships. The sector also includes logistics companies that transport goods, transportation companies, and regional transportation authorities that move people.

August, 2025

-

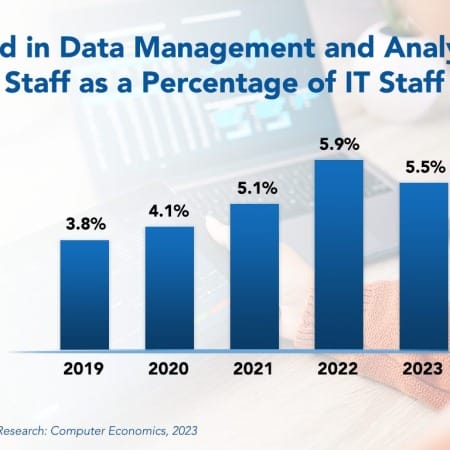

Data Management and Analytics Staffing Ratios 2023

The amount of data that IT organizations need to manage is growing with no end in sight. Whether it be sensor data from IoT devices, social networking data, online advertising and e-commerce transactions, or multimedia files, the complexity of the data to be analyzed also is increasing. With the continued growth of data and its importance in the day-to-day activities of organizations, it is surprising that the data management and analytics function has decreased this year. After significant growth over previous years, this staffing ratio has declined to 5.5% in 2023 from 5.9% in 2022.

July, 2023

-

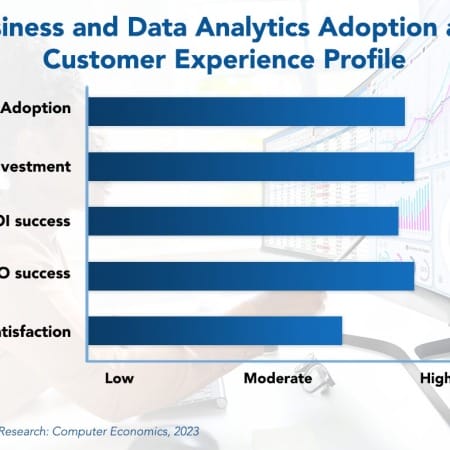

Business and Data Analytics Adoption Trends and Customer Experience 2023

Enterprises may be entering a new paradigm when it comes to business and data analytics. This may be characterized as the third phase of data usage inside the IT department. First came the use of retrospective data, where data was collected and used to analyze and understand previous performance. Second came predictive analytics, where past data was used to predict the future and make enterprise decisions. Most organizations are still mastering this phase.

December, 2023

-

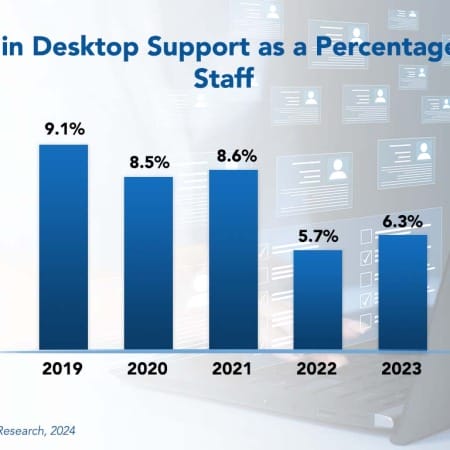

Desktop Support Staffing Ratios 2024

The desktop support function has gone through significant disruption in recent years. The COVID-19 lockdowns and the sudden shift to remote work, combined with the recent return to the office has seismically shifted the location and value of the desktop. Digital workplace technologies and the need to secure employee-owned equipment has put a strain on this function. At the same time, however, automation and other influences have made desktop support more efficient. It is always hard to right-size any IT staff function, but desktop support may be harder than normal at this time.

February, 2024

-

IT Spending Trends in Government Agencies 2024

Government agencies serve as the cornerstone of a functioning society, providing essential services and social safety nets. However, the economic and technology landscape is constantly evolving, and the threats are growing. The demands on their IT organizations are significant. What is it about government agencies that make them unique? In this report, we analyze the ways in which government agencies differ from other sectors in terms of their IT spending characteristics. We conclude with recommendations for optimizing the IT budget within government agencies.

April, 2024

-

Desktop Support Outsourcing Trends and Customer Experience 2024

The question of whether to turn over the desktop support function to a service provider is a critical and surprisingly complicated one. Our research shows a strong cost advantage to outsourcing the desktop support function, but other factors, including increased automation and self-service assistance, can change the equation, potentially making it less cost-effective.

June, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 3D: Benchmarks by Organization Size: Very Large

This year, Avasant Research is celebrating the 35th anniversary of the Computer Economics IT Spending and Staffing Benchmarks study. To mark this milestone, we have accumulated the largest sample of companies in our history (over 350 companies in our single-year sample compared to 215 last year), including a significant number of the world’s largest enterprises. For the first time, we not only have small, midsize, and large chapters but also a very large chapter for companies with over $500 million in IT spending.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 38: Technical Services

Chapter 38 provides benchmarks for technical services organizations. The 29 respondents in the sample range in size from a minimum of about $50 million to about $50 billion in annual revenue. This subsector includes firms that provide technical services, such as engineering, architectural, scientific, research, and other services.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 26: Industrial and Automotive

Chapter 26 provides benchmarks for industrial and automotive manufacturers. The 45 respondents in this subsector make auto parts, material handling equipment, engines, machinery, vehicles, and similar durable goods. The manufacturers in the sample range in size from about $50 million to over $200 billion in annual revenue.

September, 2024

-

E-commerce Sees Innovation Through Emerging Technologies

E-commerce adoption numbers are more difficult to interpret than other technologies in our Tech Trends reports. Some sectors, such as healthcare and manufacturing, may have fewer e-commerce needs than sectors like retail. As such, adoption and investment numbers have seemed low. This Research Byte provides a summary of our full report on e-commerce adoption trends and customer experience.

January, 2025

-

Declining Business Analyst Staffing Ratios but Rising Importance

The number of business analysts in the IT department is decreasing, but the importance of the role is not. Business analyst staffing is undergoing a significant transformation due to the rapid advancement of technologies such as AI, automation, and real-time data analytics. This necessitates a stronger focus on foundational IT infrastructure, leading to increased demand for technology infrastructure and support roles. This Research Byte summarizes our full report on business analyst staffing ratios.

April, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 2: Composite Benchmarks

This chapter provides composite metrics for all survey respondents across all sectors and organization sizes. The sample includes over 300 organizations and is stratified by size and sector as described in the survey methodology section. Respondents must have at least $50 million in annual revenue or IT spending greater than $1 million, and maintain at least some operations in the US or Canada. There is no upper limit on the size of survey respondents.

August, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 15: Construction and Trade Services

Chapter 15 provides benchmarks for construction and trade services companies. The 38 respondents in the sample range in size from about $50 million to over $75 billion in annual revenue. The category includes engineering and construction companies, commercial, residential, and industrial construction contractors, specialty contractors, oil field services firms, firms that provide mining services, environmental services firms, and other construction and trade services firms.

August, 2025

Grid View

Grid View List View

List View