-

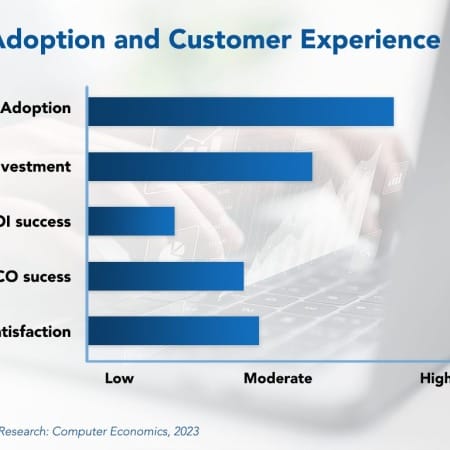

CRM Adoption Trends and Customer Experience 2023

Customer relationship management systems are one of the most widely adopted categories of enterprise applications, and investment in new CRM capabilities continues to grow. Although cloud-based CRM offerings have allowed the capabilities to move down-market to smaller companies, the need to adopt a CRM system signals that a company has reached a milestone in the building of its application portfolio, similar to when a company first moves from spreadsheets to a real accounting system. Modern CRM systems are essential for companies looking to improve their productivity and effectiveness in sales, marketing, and customer service.

October, 2023

-

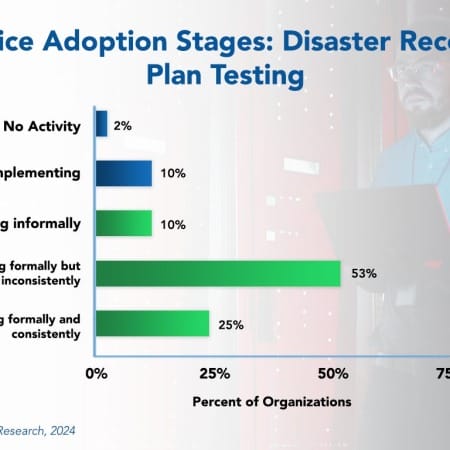

Disaster Recovery Plan Testing Best Practices 2024

In today’s unpredictable business environment, there is an increasing reliance on data and digital systems to operate efficiently. With this comes the need for robust disaster recovery (DR) plans and testing to reduce the impact of unforeseen events. The effectiveness of a DR plan can only be truly validated through routine testing. However, while this practice is growing, few organizations are testing their DR plans formally and consistently. This Research Byte summarizes our full report on disaster recovery plan testing as a best practice.

January, 2024

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 8: Retail Sector Benchmarks

Chapter 8 provides benchmarks for retailers. This sector includes retailers of clothing, jewelry, hardware, furniture, sports equipment, groceries, pharmaceuticals, and general merchandise. They include department stores, fashion stores, furniture stores, pharmacies, convenience stores, sporting goods stores, and specialty retailers. We also include hospitality and consumer services in this sector. The 39 respondents in the sample range in size from $50 million to over $100 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 24: Chemicals Subsector Benchmarks

Chapter 24 provides benchmarks for chemicals manufacturers. Chemicals manufacturers are by definition process manufacturers that produce chemical products. The sector includes manufacturers of chemicals, petrochemicals, and other chemical products. The 18 respondents in the sample range in size from a minimum of about $50 million to around $45 billion in annual revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 31: Utilities Subsector Benchmarks

Chapter 31 provides benchmarks for utilities. The 20 respondents in this subsector range in size from $85 million to $100 billion in annual revenue. This category includes gas and electric utilities, power transmission distributors, water and power utilities, and telecommunications service providers.

July, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 11: Healthcare Services Sector Benchmarks

Chapter 11 provides benchmarks for healthcare services companies. The 15 respondents in this sector include community hospital groups, national and regional hospital systems, healthcare systems, long-term care facilities, and other healthcare organizations. These organizations range in size from a minimum of about €50 million to over €15 billion in annual revenue.

September, 2023

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 8: IT Services and Solutions Sector Benchmarks

This chapter provides generative AI metrics for the IT services and solutions sector. It features a sample of 55 IT services and solutions companies including software companies, hardware companies, cloud providers, and tech consultants. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

IT Staffing Ratios: Benchmarking Metrics and Analysis for 16 Key IT Job Functions

The analysis of IT staffing data has been a core competency of Computer Economics since we began publishing our annual IT Spending and Staffing Benchmarks study in 1990. Each year, we survey more than 200 IT organizations across 10 major industry sectors, based on our sampling model, to obtain data on IT staffing levels, server counts, network infrastructure, outsourcing, and spending, among other information pertinent to the assessment of IT staffing.

March, 2024

-

Residual Value Forecast November 2023

Our quarterly Residual Value Forecast (RVF) report provides forecasts for the following categories of IT equipment: desktop computers, laptops, network equipment, printers, servers, storage devices, and other IT equipment. It also includes residual values for other non-IT equipment in the following categories: copiers, material handling equipment (forklifts), mail equipment, medical equipment, test equipment, and miscellaneous equipment such as manufacturing machinery and NC machines. Residual Value Forecasts are provided for five years for end-user, wholesale, and orderly liquidation values (OLV) prices.

November, 2023

-

Nordics Digital Services 2023–2024 RadarView™

The Nordics Digital Services 2023–2024 RadarView™ can help Nordic enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 90-page report also highlights top market trends in the Nordic region and Avasant’s viewpoint.

December, 2023

-

Media and Entertainment Digital Services 2023–2024 Market Insights™

The Media and Entertainment Digital Services 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact in the future for any digital projects in the media and entertainment space. The report also highlights key challenges that enterprises face today.

June, 2023

-

Orange Cyberdefense Reports Changing Trends in Cyber Extortion and Ransomware

Ransomware and cyber extortion are not only becoming more common but more damaging to enterprises. As cyberattacks become more sophisticated, often supported by nation-states, they are leading to high-profile and embarrassing releases of customer data. Orange Cyberdefense, which held an analyst event in Antwerp, Belgium, followed a few days later by a customer and partner event in London, England at the end of November 2022, is countering these threats by providing new managed security services offerings, including increased threat intelligence, and supporting secure access service edge (SASE).

March, 2023

Grid View

Grid View List View

List View