-

Digital Enterprise 5.0: Digital Readiness in the Era of AI

The Digital Enterprise 5.0: Digital Readiness in the Era of AI report explores the evolving digital transformation landscape for end-user enterprises. It covers numerous aspects, such as digital enterprise shifts, sectoral digital maturity, digital technology spending, generative AI strategy, digital talent approach, outsourcing decisions, and business strategy. The report offers insights into how enterprises are focusing on competition differentiation rather than cost management while increasing digital spending. It provides valuable findings for enterprises of varying sizes across sectors and geographies, enabling them to make informed decisions and successfully navigate the complexities of digital transformation in an ever-changing business environment.

April, 2024

-

IT and Apps Managed Services Market Trends: Quarterly Report for Q4 2022

In this quarterly report (Calendar Qtr 4, 2022), Avasant provides key information on IT Services Solution and Pricing Trends. The report covers market (buyer) perspective, macro trends from service provider community and finally, the pricing, solution and staffing trends in the space. The report covers trends across services including Infrastructure and Cloud Services, Application Services, and Digital Services. The geographic coverage is global, with a larger share of data points from North America. The report builds on insights gathered through our enterprise interactions, ongoing market research and data collection, as well as AvaMark Price Benchmarking database.

February, 2023

-

Salesforce Services 2023 RadarView™

The Salesforce Services 2023 RadarView™ assists organizations in identifying strategic partners for Salesforce adoption by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key Salesforce service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right Salesforce services partner. The 74-page report highlights top supply-side trends in the Salesforce space and Avasant’s viewpoint.

June, 2023

-

Generative AI Idea to Action: Execution Strategies for Enterprises and Service Providers

This report examines the recent developments in the generative AI field following the introduction of ChatGPT, outlining essential strategies for businesses and service providers to optimize their gains. It delves into the tangible benefits generative AI offers to enterprises and providers, highlighting its transformative impact on outsourcing agreements. This includes novel pricing models and productivity enhancements in IT and BPO services. Furthermore, the report identifies potential opportunities for service providers tailored to the specific needs of enterprises.

September, 2023

-

Talent Acquisition Business Process Transformation 2023–2024 RadarView™

The Talent Acquisition Business Process Transformation 2023–2024 RadarView™ assists organizations in identifying strategic partners for talent acquisition outsourcing services by offering detailed capability and experience analyses of service providers in this space. It provides a 360-degree view of the service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right talent acquisition outsourcing partner. The 55-page report highlights top supply-side trends in the talent acquisition outsourcing space and Avasant’s viewpoint on them.

December, 2023

-

The Questions to Ask About Telecommuting Before Someone Else Does

Whether allowing work from home is a good idea depends on the organization, the role, how centralized your business is, the strength of your management team, and many other variables. But if you are going to allow more telecommuting, you need certain ducks in a row.

March, 2023

-

Creating a Connected Ecosystem to Speed Innovation and Growth

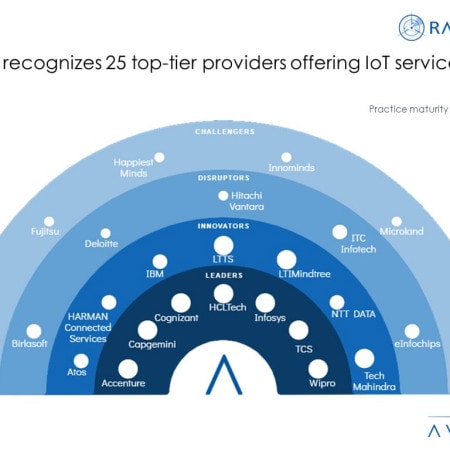

IoT technology has become mainstream, as evidenced by the steady rise in the adoption of connected devices. The share of production-grade projects increased from 68% in 2021 to 73% in 2022. Across three key segments—Industrial Internet of Things (IIoT), connected infrastructure, and Consumer IoT—IIoT continues to lead in adoption driven by smart manufacturing and Industry 4.0 use cases, including digital twins. The connected infrastructure segment saw significant growth pushed by smart city initiatives, including urban mobility, energy management, and waste management. Sustainability has emerged as a new growth lever in IoT services. These and other trends focused on the demand-side and supply-side are covered in our Internet of Things Services 2023 Market Insights™ and Internet of Things Services 2023 RadarView™, respectively.

May, 2023

-

Business Continuity Fears Favor Growth in Data Center Outsourcing

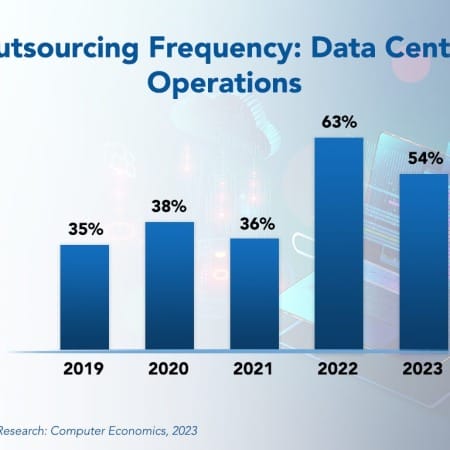

As IT organizations try to “get out of the data center business,” companies are turning to service providers to make up the difference. However, the amount of the data center workload that companies are outsourcing has been volatile, with rather large swings over the past few years. Why is this so? The COVID-19 pandemic led to an inflection in data center outsourcing. However, those swings should lessen over the next couple of years with the growth of infrastructure as a service (IaaS) and the cloud. In 2023, it is likely that areas where businesses increased their outsourcing in the last three years will return to pre-pandemic levels. This Research Byte discusses the changes in data center outsourcing over the last five years.

July, 2023

-

Combining Technology and Domain Expertise to Deliver Touchless Claims Experience

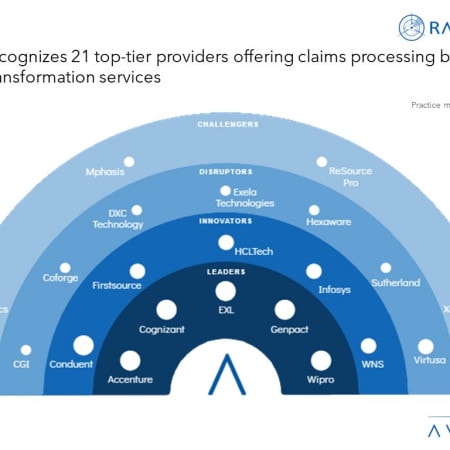

With uncertain macroeconomic conditions, an increasing number of natural calamities, and rising inflation, insurers are dealing with a huge volume of claims. Insurers must find new ways to continue innovating through this challenging period. For property and casualty (P&C) insurance providers, this translates to a significant impact on nearly every category of insurance due to the rising claims expenses and costs. Even though they are losing money, they need to invest continuously to offer better quality and customer experience. With the emergence of technologies such as IoT, AI, and telematics, insurers can adopt a more proactive strategy for forecasting, identifying, and mitigating risks, and to support these, they rely on outsourcing claims processing to service providers. This is evident from a 15%–20% increase in the revenue of claims processing outsourcing service providers between March 2022 and March 2023. Demand-side and supply-side trends are covered in our Claims Processing Business Process Transformation 2023 Market Insights™ and Claims Processing Business Process Transformation 2023 RadarView™, respectively.

September, 2023

-

IT Security Outsourcing is Burgeoning but Facing Service and Cost Challenges

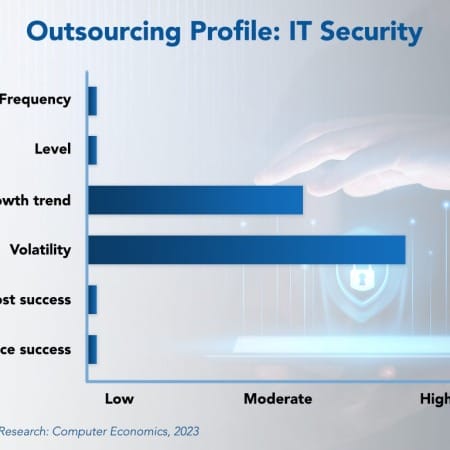

IT security is a major focus for IT leaders, and that is unlikely to change in the near future. The threat landscape continues to evolve with greater diversity in the IT service portfolio, more employees working from home, and a more burdensome regulatory environment. To combat these threats, organizations are turning to IT security outsourcing firms to handle higher-value security tasks. This Research Byte summarizes our full report on IT security outsourcing trends.

November, 2023

-

Dare to Compare: Getting Value from IT Spending Benchmarks

Benchmarking is the key to measuring an organization’s IT budget against industry peers. Whether the goal is to compare the organization’s IT spending levels, defend current spending levels, justify new spending requests, or find opportunities for cost reduction, benchmarking is an effective way for IT executives to optimize their IT budgets and better focus their efforts to achieve a state of continuous improvement. This Research Byte summarizes the full report, Best Practices for Benchmarking Your IT Budget Ratios.

December, 2023

-

Microsoft Revs Up Copilot in Dynamics 365: Will it Fly with Customers?

To capitalize on the generative AI frenzy sweeping the business world, Microsoft has been rapidly launching versions of its Copilot solutions throughout its various products. The software giant has also announced many new use cases for Copilots in individual Dynamics 365 modules. But are customers ready and willing to let Gen AI play such an important role in their core ERP processes? And are they willing to pay for it? We examine the Copilot state of play.

February, 2024

-

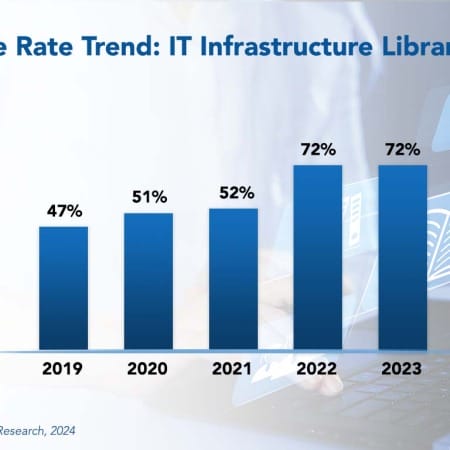

ITIL Adoption Unlikely to Show Further Significant Growth

Organizations have embraced IT Infrastructure Library (ITIL) to some degree. It is crucial to keep in mind, though, that following the 2022 spike, data from 2023 points to a plateau in adoption. The initial enthusiasm surrounding the adoption of ITIL 4 may have subsided because the framework’s intimidating depth and scope requires a substantial investment of time and expertise. This Research Byte summarizes the full report, IT Infrastructure Library Best Practices.

March, 2024

Grid View

Grid View List View

List View