-

IT Vendor Governance Best Practices

IT vendor management is a function and set of practices that guide the selection, management, and assessment of IT suppliers to ensure that all parties comply with the terms of their contracts. IT supplier management has been a best practice for many years, but the disciplines have evolved. Traditional IT vendor governance practices are now inadequate to navigate the changing business ecosystem. The upshot is that most organizations need to transform their vendor governance programs. This Research Byte summarizes our full report on IT Vendor Governance Best Practices.

August, 2022

-

Compliance Requirements Driving the Move to Government Clouds

The dramatic shift towards smart cities and a new digital economy is increasing the need for governments to upgrade their IT infrastructure. Cloud environments are the best way to ensure government systems are highly available and data is securely accessible. But until recently, cloud was not always an option for government entities due to strict compliance requirements. Now providers are catering to this need by setting up government clouds—sovereign data centers to employ local workers in the countries they intend to serve.

November, 2021

-

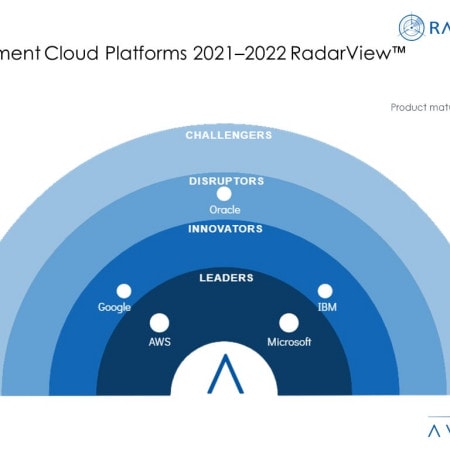

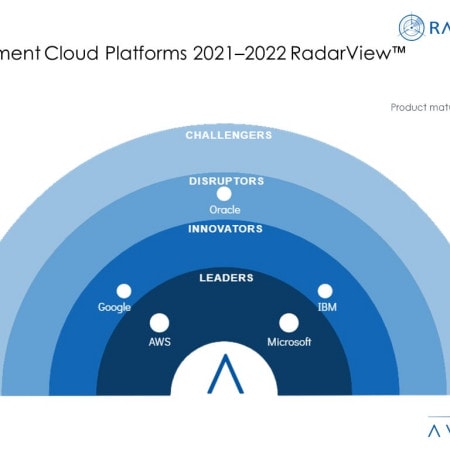

Government Cloud Platforms 2021–2022 RadarView™

The Government Cloud Platforms 2021–2022 RadarView™ addresses the need for government departments and agencies to leverage cloud platforms to accelerate their digital journeys, embrace the cloud, and identify the right cloud platform providers to partner with. The 33-page report also provides our point of view on how government cloud platform providers are catering to the changing needs of public sector agencies through a wide portfolio of products and services. Avasant delivers a general ranking for these providers based on the key dimensions of product maturity, enterprise adaptability, and future readiness.

November, 2021

-

IT Spending and Staffing Benchmarks 2021/2022: Chapter 16: Government Sector Benchmarks

Chapter 16 provides benchmarks for government organizations. The 45 respondents in the sample range in size from about $50 million to $68 billion in annual revenue. The category includes city and county governments, federal and state agencies, law enforcement agencies, organizations that provide IT services to government agencies, and other government organizations.

July, 2021

-

IT Spending and Staffing Benchmarks 2021/2022: Chapter 28: City and County Government Subsector Benchmarks

Chapter 28 provides benchmarks for city and county governments. This chapter is concerned with the IT workings of city or county governments and not individual agencies within larger governments (which can be found in Chapter 29). The 25 respondents in this subsector have annual operating budgets ranging from $50 million to $68 billion.

July, 2021

-

IT Spending and Staffing Benchmarks 2021/2022: Chapter 29: Government Agencies Subsector Benchmarks

Chapter 29 provides benchmarks for federal, state, and regional government agencies. The category includes public health agencies, courts and law enforcement agencies, organizations that provide IT services to government agencies, social service agencies, state parks, lotteries, and other federal, state, and regional government units. The 24 respondents in the sample have operating budgets that range in size from $62 million to about $40 billion.

July, 2021

-

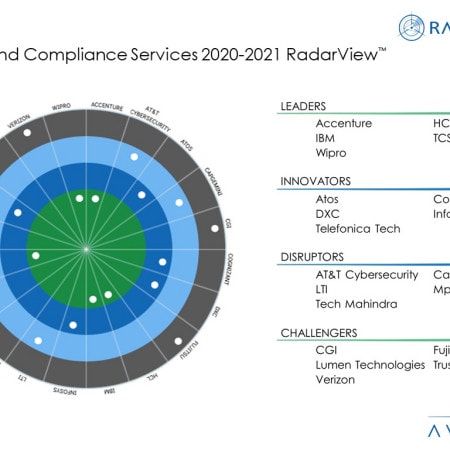

Business Agility and Resilience Drive Demand for Risk and Compliance Services

COVID-19 has emphasized the need for regulatory compliance, internal compliance controls, and the use of security frameworks and tools. Meanwhile, the regulatory environment is increasingly complex, particularly for multinational companies, as they struggle to comply with sometimes conflicting regulations across regions. Risks have changed with a growing cloud environment and increasingly diverse IT service portfolio. The need for a strong governance, risk, and compliance (GRC) partner has grown. These emerging trends are covered in Avasant's Risk and Compliance Services 2020-2021 RadarView™ report.

April, 2021

-

Risk and Compliance Services 2020-2021 RadarView™

The Risk and Compliance Services 2021 RadarView™ report provides information to assist enterprises in charting out their action plan for developing a robust governance, risk, and compliance (GRC) program. It identifies key global service providers and system integrators that can help organizations expedite their GRC tool adoption journey. It also brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying strategic partners for their digital transformation journeys. The 90-page report also highlights key industry trends in the risk and compliance sector and Avasant’s viewpoint on them.

April, 2021

Grid View

Grid View List View

List View