-

Data Center Managed Services 2023–2024 RadarView™

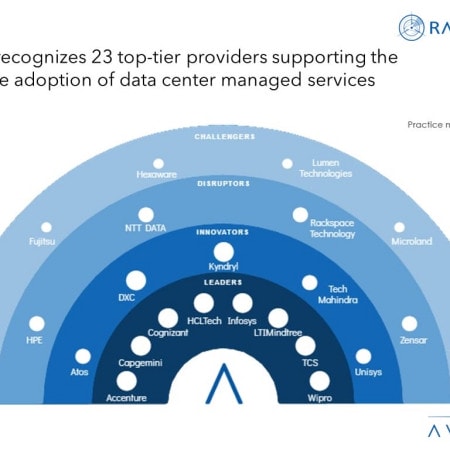

The Data Center Managed Services 2023–2024 RadarView™ assists organizations in identifying strategic partners for data center managed services by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key data center managed service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right services partner. The 68-page report highlights top supply-side trends in the data center managed services space and Avasant’s viewpoint on them.

November, 2023

-

Data Center Managed Services 2023–2024 Market Insights™

The Data Center Managed Services 2023–2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any data center management projects. The report also highlights key data center management challenges that enterprises face today.

November, 2023

-

Data Center Managed Services: Revolutionizing Data Center Operations with Generative AI

Managing a data center involves a complex interplay of hardware, software, security, and scalability considerations, presenting challenges that organizations may struggle to address internally. Service providers harness AI and predictive algorithms to anticipate potential issues, enabling proactive maintenance and minimizing downtime. Generative AI takes this narrative forward and empowers organizations in resource optimization and allocation by predicting workloads and dynamically adjusting the resource provisioning on demand, enabling efficient data center management. Both demand-side and supply-side trends are covered in Avasant’s Data Center Managed Services 2023–2024 Market Insights™ and Data Center Managed Services 2023–2024 RadarView™, respectively.

November, 2023

-

Data Center Spending Benchmarks and the Case for Consolidation

Now that IT operational budgets are on the mend, IT organizations are once again assessing their data center strategies. In this study, we start with an assessment of data center spending and provide benchmarks that enable IT organizations to answer the question: Is our data center spending in line with our peers? Benchmarks include data center spending as a percentage of total IT spending and data center spending per physical server. We also provide benchmarks on virtualization rates and operating system mix. Finally, we demonstrate the potential cost-savings from consolidating data centers and servers to help IT executives make the case for data center consolidation. (26 pp., 16 fig.) [Research Byte]

January, 2014

-

DBA Outsourcing Not Widely Embraced but May Become Strategic

Although the DBA function is not often a target for outsourcing, it may become more popular in the future as databases grow and DBA skills are increasingly in short supply. This Research Byte, an extract from our full report, analyzes current trends in database administration outsourcing.

July, 2010

-

Data Center Automation: Adoption Trends

Data center automation is a high-priority investment for IT organizations today. In this study, we assess the overall adoption trend for data center automation (DCA) projects, the percentage of companies that have deployed the technology, and the current level of investment activity. The study also investigates how organizational size affects adoption trends and investment activity. A final look at how investment activity differs by industry sector completes the statistical picture. We conclude with recommendations for measuring return on investment and scoping data center automation projects, as well as considerations for selecting solutions. (4 pp., 6 figs.)[Executive Summary]

August, 2008

-

Data Center Consolidation: Business Case Metrics

The study quantifies the benefits of data center consolidation and provides recommendations to ensure the success of the effort. It tracks the three-year trend in increasing data center consolidation activity and reports current consolidation trends by organization size. The business case for consolidation is then presented in two ways: first, we analyze total data center costs per server for Windows, Unix, Linux, and mainframe data centers, showing substantially lower per-server costs as data center size increases. Second, we find a reduction in total IT spending per user for organizations with single data centers versus those with multiple data centers. The study concludes with a summary of the return on investment (ROI) and total cost of ownership (TCO) experiences of organizations undergoing data center consolidation and recommended best practices for mitigating risks in the migration effort. (8 pp., 9 figs.)[Executive Summary]

August, 2008

-

Minimizing Data Center Job Failure Rates

The successful completion of batch and online processing is crucial to meeting service level objectives in any data center, yet a surprising percentage of data centers do not routinely collect metrics concerning job failures. This article presents statistics concerning the average rate of job failure in IBM mainframe (z/OS) data centers along with the typical rate of failure experienced by organizations that implement best practices. We also break down failure rates by type of failure and provide recommendations for attaining best-practice status. (3 pp., 3 figs.)

December, 2007

-

The Shifting Mix of Data Center Costs

Understanding trends in data center costs is key to managing data center spending. For example, IT executives know that hardware costs are declining. But by how much? And what about other costs, such as software, personnel, and facilities? Is the long-term trend up or down? This article examines the major categories of data center cost for Unix and Windows servers on a per-unit basis for the years 2002 through 2006. It also analyzes how these costs have been changing and makes recommendations based on these trends. (3 pp., 4 figs.) [Executive Summary]

October, 2007

-

Data Center Consolidation Reduces Costs and Improves Performance

This article investigates the benefits of data center consolidation and provides recommendations based on our findings. Based on our survey of over 200 IT organizations, we find that organizations with single data centers generally spend less per user than organizations with multiple data centers. We report adoption rates for data center consolidation by size of organization. We also provide a summary of the return on investment (ROI) experienced by organizations undergoing data center consolidation as well as their experiences with actual consolidation costs versus budgets. Our analysis concludes with guidelines for best practices that mitigate risk in the consolidation effort. (5 pp., 4 figs.)[Executive Summary]

September, 2007

-

Windows and Linux Data Centers Lag Behind Unix in Realizing Economies of Scale

In this article, we examine total data center spending per server OS instance across data centers of varying sizes. We break down these metrics for Windows, Linux, and Unix systems. Interestingly, Unix data centers experience significantly better economies of scale than Windows or Linux shops. We report the metrics and examine the reasons for the greater efficiencies in large Unix shops compared to other operating systems. (3 pp., 1 fig.)[Executive Summary]

September, 2007

-

2006 IT Spending Trends: Implications for the Data Center

Every year since 1990, Computer Economics has surveyed companies in the U.S. and Canada concerning their plans for IT spending, staffing, and technology adoption. This year's survey contains important insights for the data center executive. This article highlights the most important of these trends, including the dominance of Microsoft Windows in the data center; the resulting push toward server consolidation; and the growing interest in SANs, ITIL, and IT asset management systems. We also document the reluctance of many organizations to add data center staff in favor of outsourcing of data center operations. (7 pp., 7 figs.)

October, 2006

-

Data Center Recovery Site Planning: Geographic Considerations

The U.S. federal government and private industry have developed new guidelines that can be helpful in deciding the optimal distance between the data center and its recovery site. Based on various studies conducted over the past few years, it is clear that the placement of a recovery site too far away from the main data center can be as much of a problem as placing it too close. This research report provides recommendations for the optimal distance, based on U.S. Federal Government guidelines, industry best practices, and the need to balance risk with speed of recovery. (5 pp. with footnotes of sources.)[Executive Summary]

March, 2005

Grid View

Grid View List View

List View