Latest Reports

-

![IT Management Staffing Levels in Long-Term Decline IT Management Staffing - IT Management Staffing Levels in Long-Term Decline]()

IT Management Staffing Levels in Long-Term Decline

Generally, the ratio of IT managers to the total IT staff has been decreasing over recent years. In fact, the 2022 percentage stands at the lowest this metric has been in more than a decade. While increasing cloud transformation is a major reason for this drop, there are other factors at work. This Research Byte examines the possible causes.

June, 2023

-

![Cybersecurity Services: Shifting from Horizontal to Industry Vertical-Specific Approach MoneyShot Cybersecurity Services 2023 - Cybersecurity Services: Shifting from Horizontal to Industry Vertical-Specific Approach]()

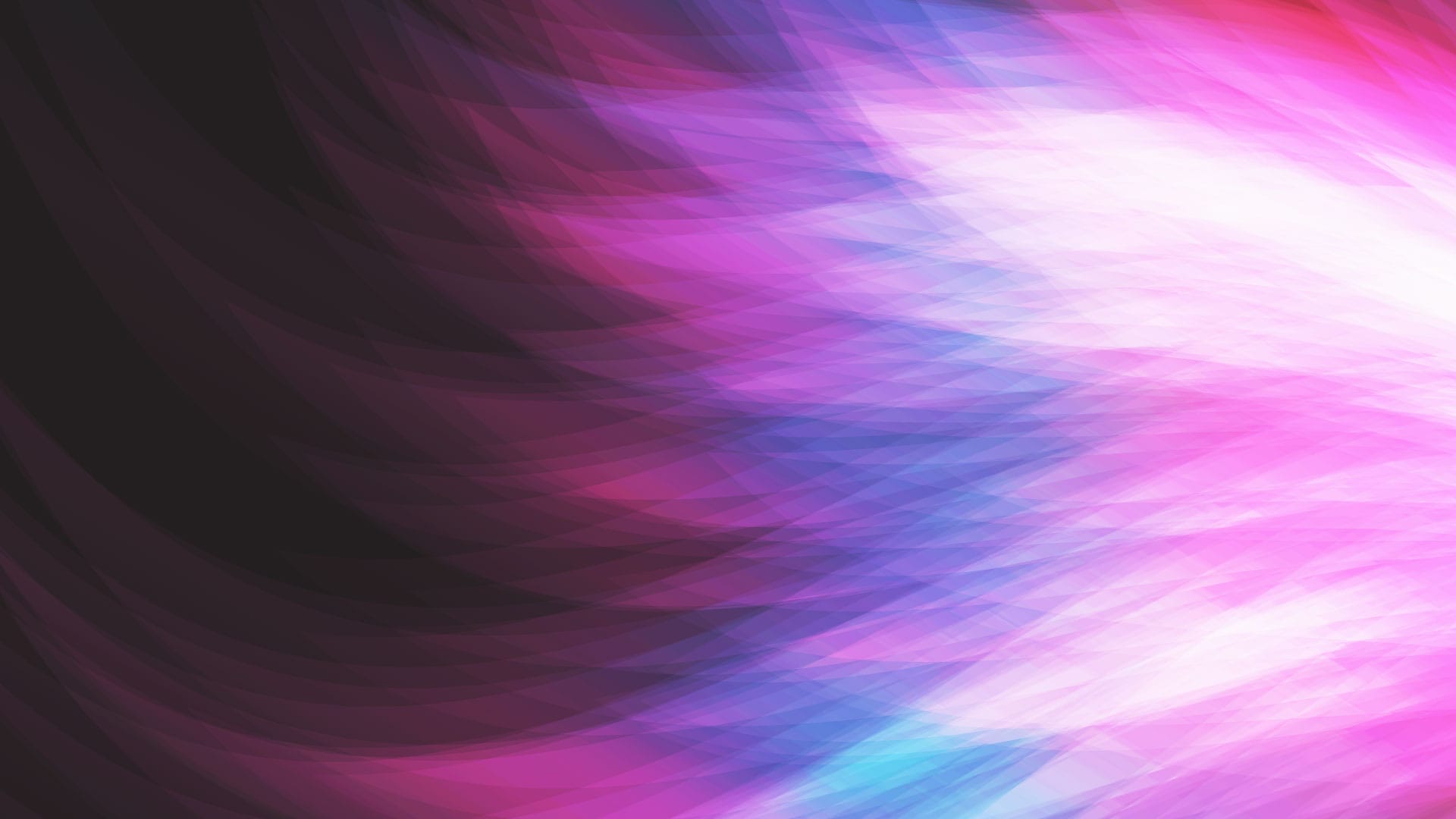

Cybersecurity Services: Shifting from Horizontal to Industry Vertical-Specific Approach

As cyber threats rise, organizations continue to secure their hybrid environments by refreshing, enabling, and standardizing security controls deployment to address trends emerging around cloudification, Industry 4.0, the convergence of 5G, and software-defined networking. This has fundamentally shifted how cybersecurity services are viewed from a general-use horizontal solution to industry vertical-specific offerings. Both demand-side and supply-side trends are covered in our Cybersecurity Services 2023 Market Insights™ and Cybersecurity Services 2023 RadarView™, respectively.

June, 2023

-

![Transforming HR Operations to Improve Productivity and Accountability MoneyShot SAP SuccessFactors Services 2023 - Transforming HR Operations to Improve Productivity and Accountability]()

Transforming HR Operations to Improve Productivity and Accountability

Enterprises are replacing their discrete HR solutions with a unified people management platform as it helps address multiple business challenges such as workflow redundancy, data visibility issues, and process inefficiencies. Organizations leverage digital tools and accelerators with modular designs to accelerate their transition to SAP SuccessFactors and address additional use cases such as automated data migration, compliance management, and industry-specific workflow creation. Additionally, enterprises focus on improving scalability and offering employee self-service options. Companies leverage automation solutions and interactive design interfaces to optimize HR functions and improve user adoption. Both demand-side and supply-side trends are covered in our SAP SuccessFactors Services 2023 Market Insights™ and SAP SuccessFactors Services 2023 RadarView™, respectively.

May, 2023

-

![Manufacturing Smart Industry Services: Empowering ER&D Through Digitalization MoneyShot Manufacturing Smart Industry Services 2023 - Manufacturing Smart Industry Services: Empowering ER&D Through Digitalization]()

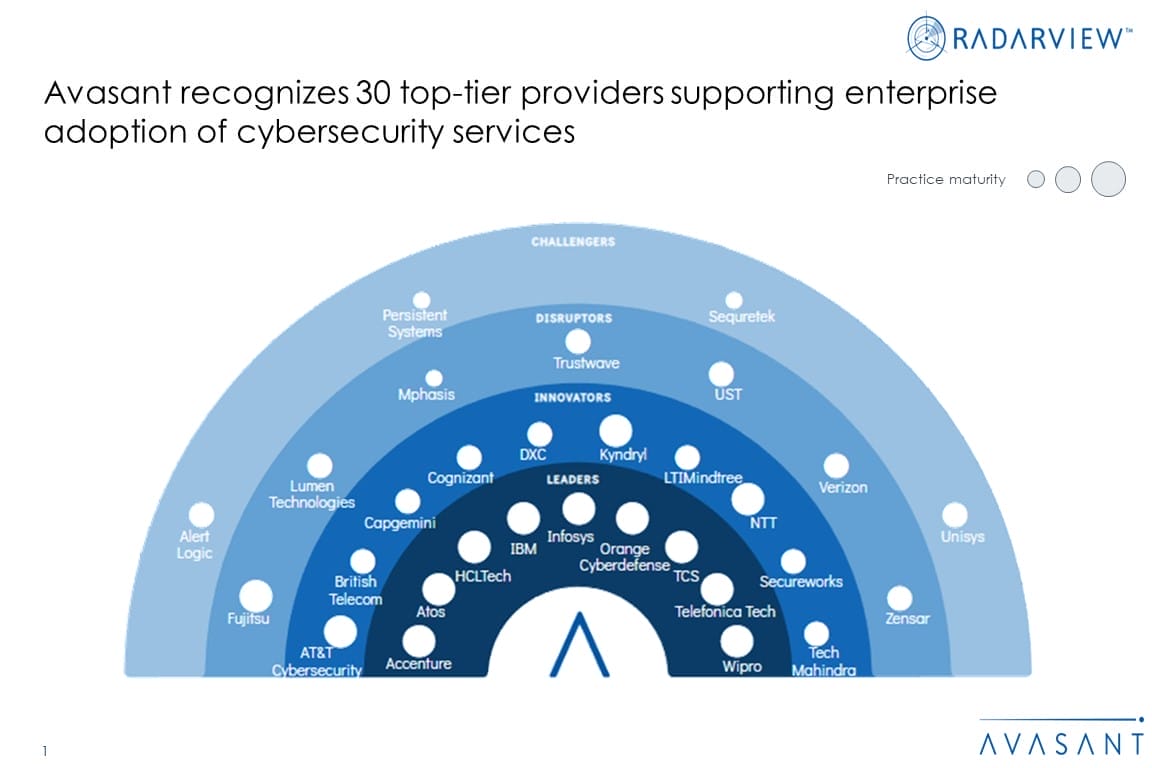

Manufacturing Smart Industry Services: Empowering ER&D Through Digitalization

Engineering and manufacturing enterprises have always had complex IT and OT environments and faced integration challenges. Concerns about security, connectivity, and customization hindered their digitalization efforts. However, due to cost pressures, changing customer demands, and rising product complexity, companies are now actively transforming their processes. This requires digitalizing IT and OT operations and investing in product and software engineering skills. To accelerate their digital transformation, enterprises are engaging with digital engineering service providers, leading to a 15% growth in manufacturing smart industry deals between December 2021 and December 2022. Both demand- and supply-side trends are covered in Avasant’s Manufacturing Smart Industry Services 2023 Market Insights™ and Manufacturing Smart Industry Services 2023 RadarView™, respectively.

May, 2023

-

![Boosting Banking Through Digitally Enabled Operations MoneyShot Banking Process Transformation 2023 - Boosting Banking Through Digitally Enabled Operations]()

Boosting Banking Through Digitally Enabled Operations

The volatile macroeconomic environment and rising interest rates have put pressure on banks, impacting their liquidity and raising the cost of funding. Rising competition due to neobanks and fintechs that offer personalized products and add-on services have upended customer expectations. Stringent regulatory requirements are driving banks to revamp their processes and operations. Banks seek support from service providers to transform their operations, drive higher margins and process efficiency, and enhance customer experience. This has led to a 23% growth in banking process transformation revenue for service providers in the past 12 months. Both demand-side and supply-side trends are covered in our Banking Process Transformation 2023 Market Insights™ and Banking Process Transformation 2023 RadarView™, respectively.

May, 2023

-

![Driving Innovation in Investment Avenues and Optimizing Costs MoneyShot Financial Services 2023 2024 - Driving Innovation in Investment Avenues and Optimizing Costs]()

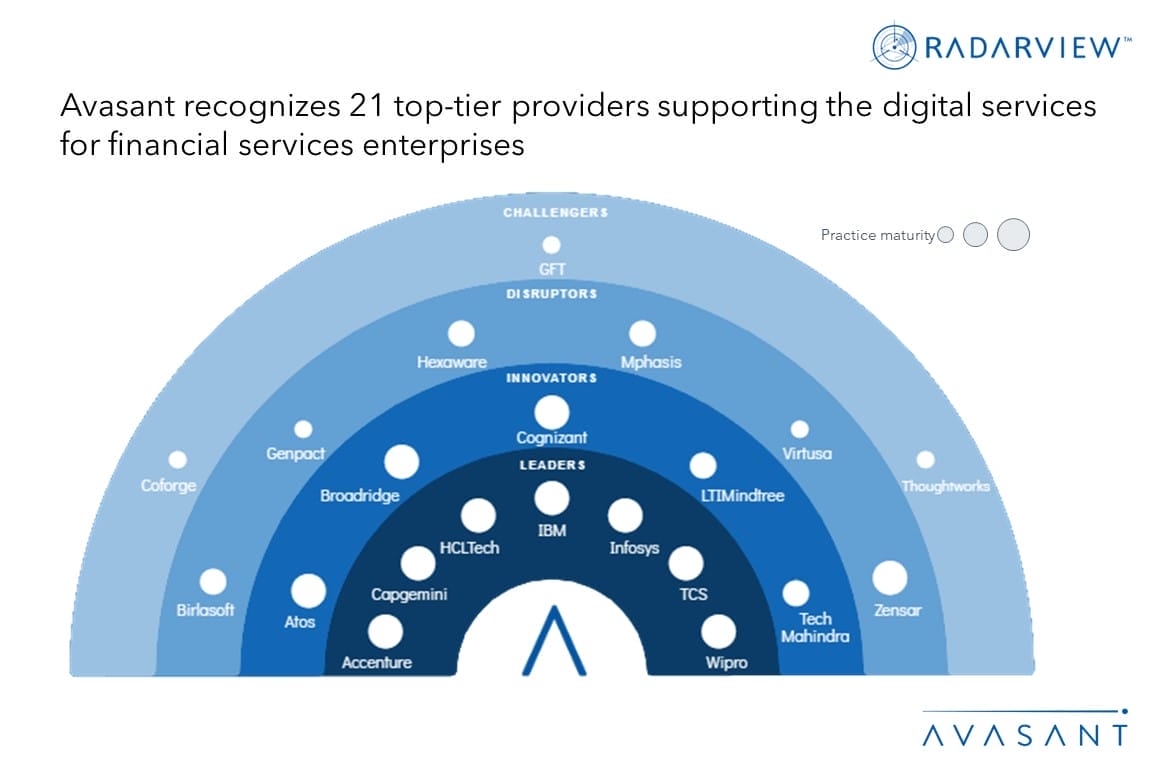

Driving Innovation in Investment Avenues and Optimizing Costs

Despite a challenging business environment, financial services firms are investing in digital technologies to improve cost efficiency and capabilities. Digital assets have become an increasingly popular alternative investment avenue amongst the customers of private and wealth managers. Financial services firms are also allocating significant resources to cybersecurity measures due to growing cyber threats. Stringent financial regulations mandate ESG investment scrutiny to avoid greenwashing of the tagged investments. To address these issues, financial institutions are leveraging digital technologies to optimize operations, deliver efficient investment services, and enhance customer experience while mitigating risks. Both demand-side and supply-side trends are covered in our Financial Services Digital Services 2023–2024 Market Insights™ and Financial Services Digital Services 2023–2024 RadarView™, respectively.

May, 2023

-

![Creating a Connected Ecosystem to Speed Innovation and Growth MoneyShot Internet of Things Services 2023 RadarView Updated - Creating a Connected Ecosystem to Speed Innovation and Growth]()

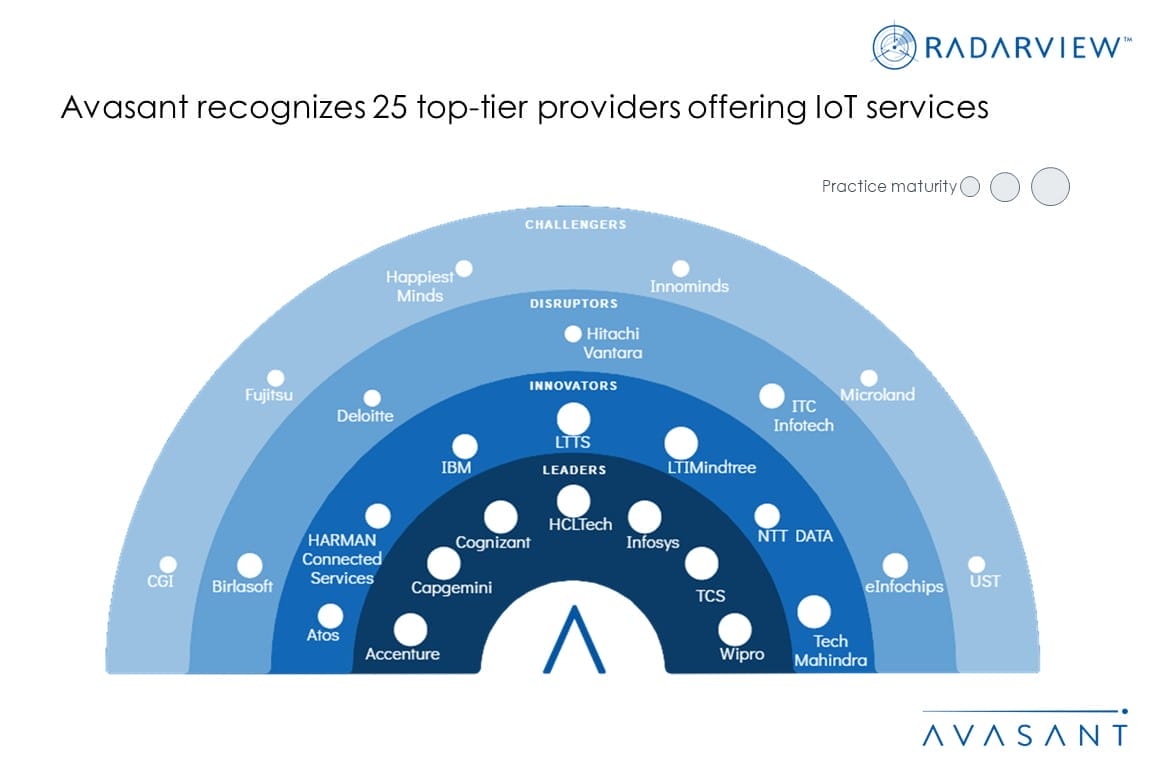

Creating a Connected Ecosystem to Speed Innovation and Growth

IoT technology has become mainstream, as evidenced by the steady rise in the adoption of connected devices. The share of production-grade projects increased from 68% in 2021 to 73% in 2022. Across three key segments—Industrial Internet of Things (IIoT), connected infrastructure, and Consumer IoT—IIoT continues to lead in adoption driven by smart manufacturing and Industry 4.0 use cases, including digital twins. The connected infrastructure segment saw significant growth pushed by smart city initiatives, including urban mobility, energy management, and waste management. Sustainability has emerged as a new growth lever in IoT services. These and other trends focused on the demand-side and supply-side are covered in our Internet of Things Services 2023 Market Insights™ and Internet of Things Services 2023 RadarView™, respectively.

May, 2023

-

![Driving Patient-Centricity Through Digitalization and Health Data Analytics MoneyShot Clinical Services BPT 2023 Market Insights - Driving Patient-Centricity Through Digitalization and Health Data Analytics]()

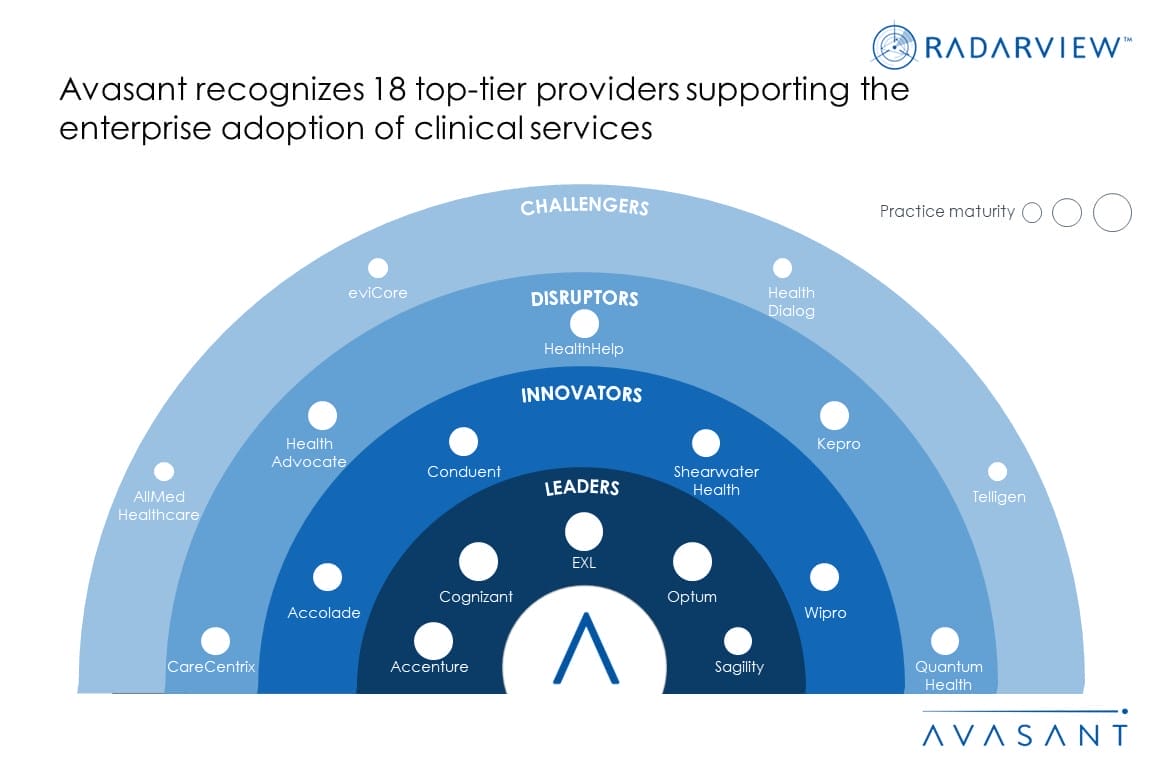

Driving Patient-Centricity Through Digitalization and Health Data Analytics

Innovation in clinical and care management services during the pandemic has permanently impacted how care is delivered. Remote care support and productivity improvement solutions are key to better clinical services and care management outcomes. Service providers are enhancing their care management capabilities and incorporating various services, such as remote delivery, preventive care, and clinical decision support, to address the growing enterprise demand for clinical services in utilization management (UM), care coordination (CC), and population health management (PHM). Also, organizations are focusing on developing and investing in the capabilities that help them deliver value-based care, reduce costs, and deliver high-quality services. Therefore, they increasingly rely on clinical service providers’ expertise through outsourcing. This is evident from a 28% increase in the number of enterprises outsourcing. Both demand-side and supply-side trends are covered in our Clinical Services Business Process Transformation 2023 Market Insights™ and Clinical Services Business Process Transformation 2023 RadarView™, respectively.

May, 2023

-

![ChatGPT to Lead More Companies to Say Aye-Aye to AI Ai Adoption Invetsment - ChatGPT to Lead More Companies to Say Aye-Aye to AI]()

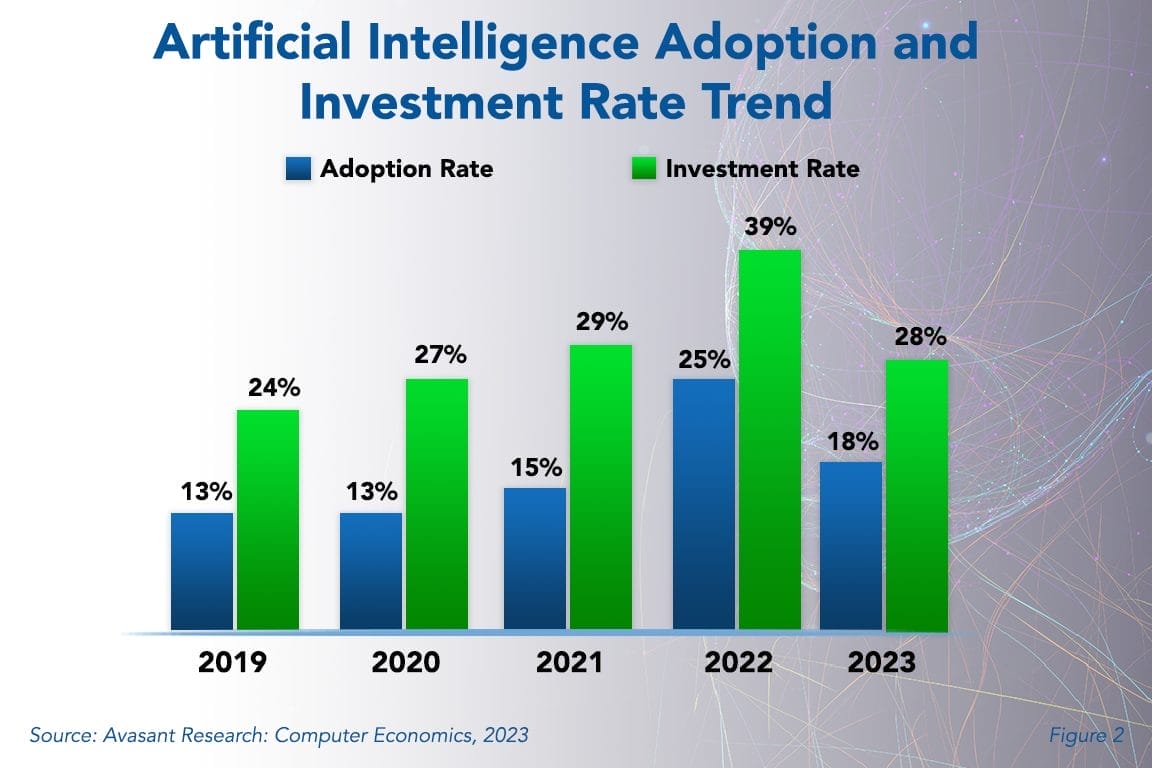

ChatGPT to Lead More Companies to Say Aye-Aye to AI

The recent frenzy of interest in generative AI has changed the perception of artificial intelligence. Once locked inside other processes, AI was often forgotten as it powered everything from IoT devices, automation, and security. Although most companies have not been investing heavily in AI, we see that changing in the coming months and years. This Research Byte summarizes our full report on AI technology trends.

May, 2023

-

![Network Support Staffing Seeing Net Loss Trend in Network Support copy - Network Support Staffing Seeing Net Loss]()

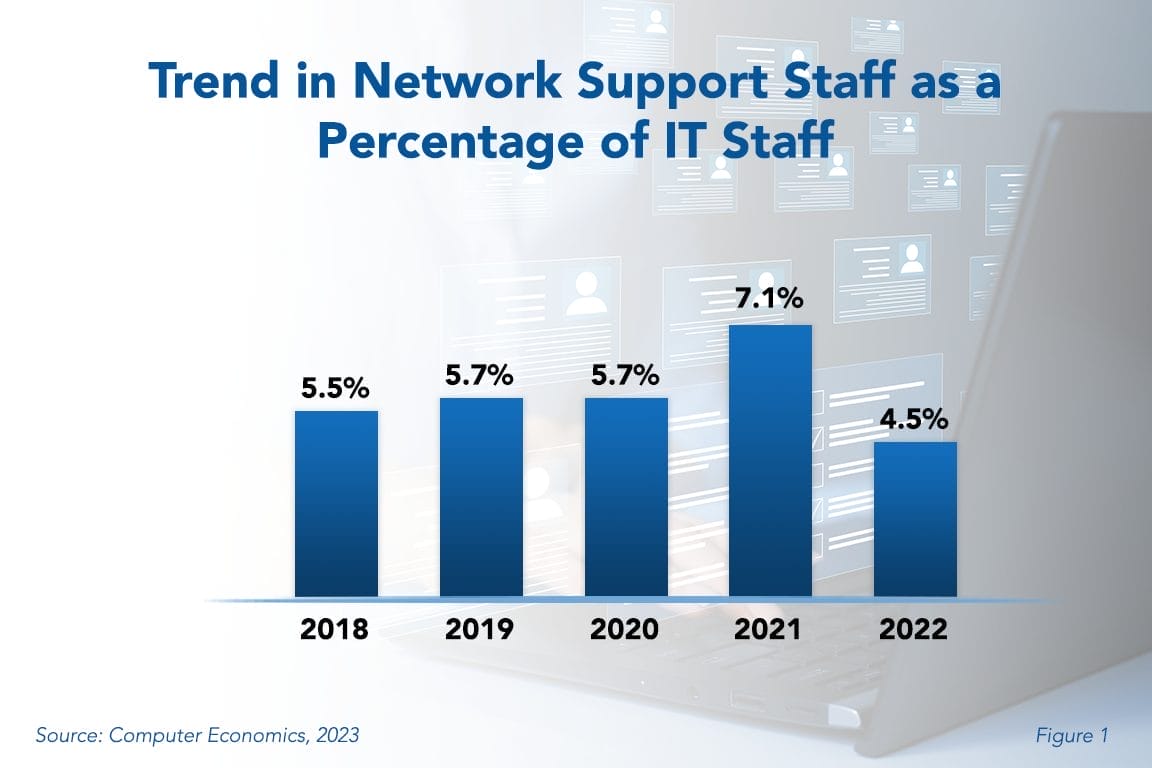

Network Support Staffing Seeing Net Loss

The last couple of years have been volatile in terms of IT staffing for network support. This is representative of a larger shift in IT services and staffing overall, driven by digital transformation and the pandemic. As such, there has been growth in IT roles that work more closely with the business including IT finance, project management, data management, and business analysts. This Research Byte highlights the causes of this notable decrease and suggests how businesses can continue to adapt to changes in IT services and staffing requirements.

May, 2023

-

![Applied AI Services: Building the AI Ecosystem for the Future MoneyShot2 Applied AI Services 2022–2023 - Applied AI Services: Building the AI Ecosystem for the Future]()

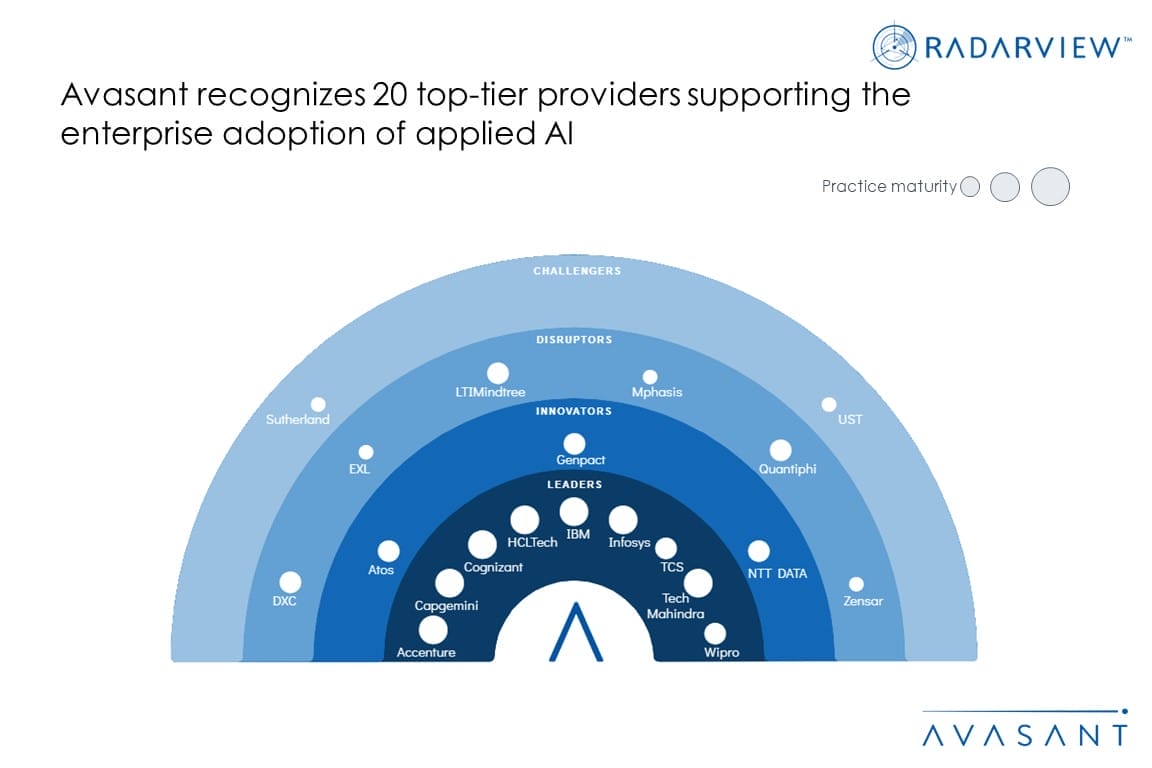

Applied AI Services: Building the AI Ecosystem for the Future

With advancements in the current AI landscape, enterprises are increasing their investments in new technologies such as generative AI, computer vision, and edge AI. Businesses across industries have realized the tremendous optimization opportunities AI brings and how it aids them in improving operational efficiency while ensuring sustainability. In addition, increasing regulation and compliance around AI systems and data use is helping companies use AI systems more ethically. Both demand- and supply-side trends are covered in Avasant’s Applied AI Services 2022–2023 Market Insights™ and Applied AI Services 2022–2023 RadarView™, respectively.

May, 2023

-

![Supply Chain Disruptions Disrupt SCM Investments Supply Chain Disruptions Disrupt SCM Investments RB copy - Supply Chain Disruptions Disrupt SCM Investments]()

Supply Chain Disruptions Disrupt SCM Investments

Global supply chain disruptions are disrupting supply chain management (SCM) investments. Unable to keep up with the pace of change, SCM systems have the lowest satisfaction rating of all the technologies in our study. This Research Byte provides a look at the customer satisfaction rating for SCM systems, as well as an overview of our Technology Trends 2023.

May, 2023