This RadarView™ aims to help engineering and construction (E&C) enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 12 providers offering digital services in the E&C industry. Each profile provides an overview of the service provider, its industry-specific solutions, a list of representative clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovation, and partner ecosystem.

Why read this RadarView?

Facing rising material costs, labor shortages, supply chain disruptions, and stricter ESG demands, E&C enterprises are accelerating their digital transformation. Companies are turning to modular construction, AI-powered procurement, and robotics to boost efficiency and strengthen operational control. Fragmented systems are being replaced by integrated platforms that improve data coordination and support more informed decisions. As sustainability moves from optional to essential, firms are deploying carbon tracking tools, digital twins, and life cycle assessments to meet regulatory and investor expectations. To scale these initiatives effectively, industry leaders are partnering with digital service providers to drive innovation across the value chain.

The Engineering and Construction Digital Services 2025 RadarView™ highlights key supply-side trends in the E&C industry and Avasant’s viewpoint. It aids companies in identifying top service providers to assist them in the digital transformation of their offerings for this sector. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to identify the right strategic partners.

Featured providers

This RadarView includes a detailed analysis of the following service providers: Accenture, Capgemini, CGI, IBM, Infosys, Kyndryl, LTIMindtree, NTT DATA, SAP, TCS, Tech Mahindra, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–7)

-

- Scope of coverage

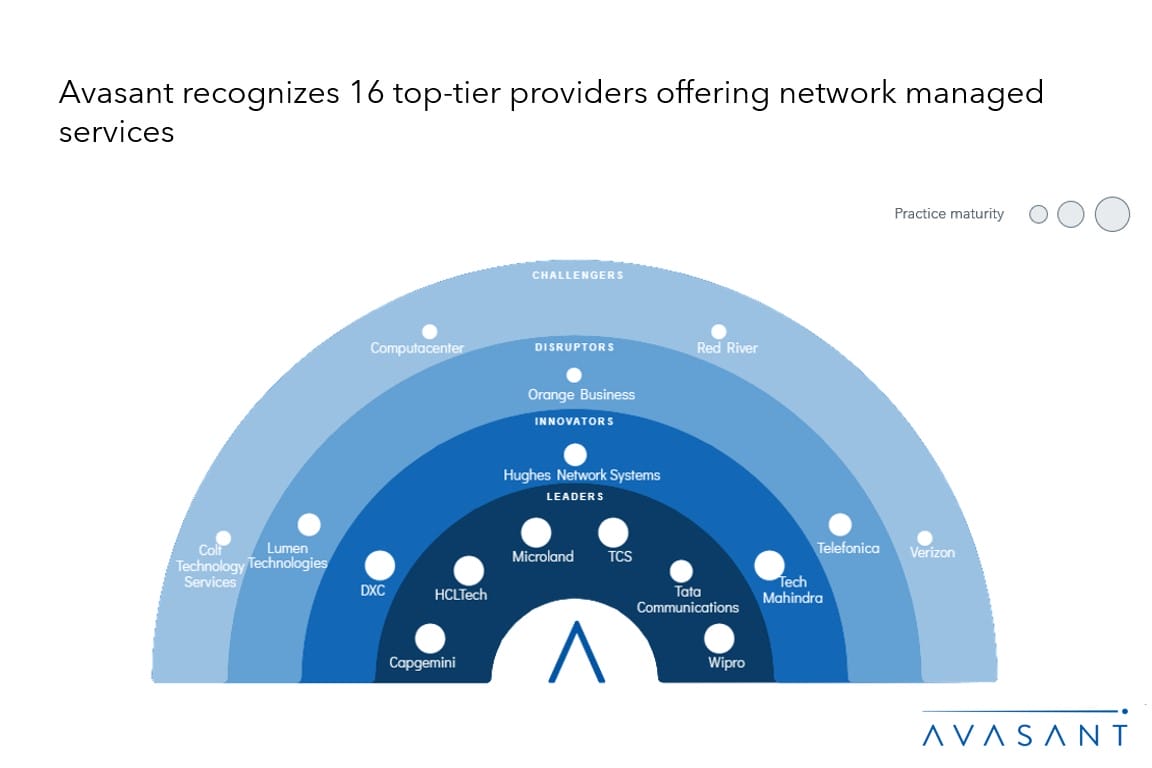

- Avasant recognizes 12 top-tier providers supporting the engineering and construction industry in digital transformation

- Provider comparison

Supply-side trends (Pages 8–9)

-

- Service providers are adopting digital-first, industry-tailored platforms to replace outdated systems, transforming the construction value chain

Service provider profiles (Pages 10–46)

-

- Detailed profiles for Accenture, Capgemini, CGI, IBM, Infosys, Kyndryl, LTIMindtree, NTT DATA, SAP, TCS, Tech Mahindra, and Wipro

Appendix (Pages 47–50)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 51)

Read the Research Byte based on this report. Please refer to Avasant’s Engineering and Construction Digital Services 2025 Market Insights™ for demand-side trends.