This RadarView™ helps enterprises define their approach for transforming payroll processes and identifying the right outsourcing partner to support them. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 24 service providers offering payroll business process transformation services. Each profile gives an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovation.

Why read this RadarView?

Enterprises are moving toward managed payroll services that unify technology, analytics, and compliance into a single, flexible delivery model. Driven by talent shortages, rapid technological change, regulatory complexity, and cost pressures, buyers are prioritizing scalable solutions that enhance operational efficiency and minimize fragmentation. They expect predictive compliance, automated statutory updates, localized tax feeds, proactive alerts, and embedded audit trails to lower risk and simplify governance. At the same time, organizations are embedding AI across payroll, automation, anomaly detection, copilots, and orchestration layers to boost accuracy, speed, employee query resolution, and end-to-end visibility.

The Payroll Business Process Transformation 2025–2026 RadarView™ highlights key supply-side trends in this space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in payroll business process transformation. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for their payroll function.

Featured providers

This RadarView includes a detailed analysis of the following payroll business process transformation service providers: activpayroll, ADP, CloudPay, Dayforce, Deel, EY, Genpact, IBM, Infosys, KPMG, Mercans, Neeyamo, Papaya Global, Paybix, PwC, Ramco, SD Worx, Strada, TCS, TMF Group, UKG, Vistra, Wipro, and Zalaris.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–10)

-

- Definition and scope of payroll business process transformation

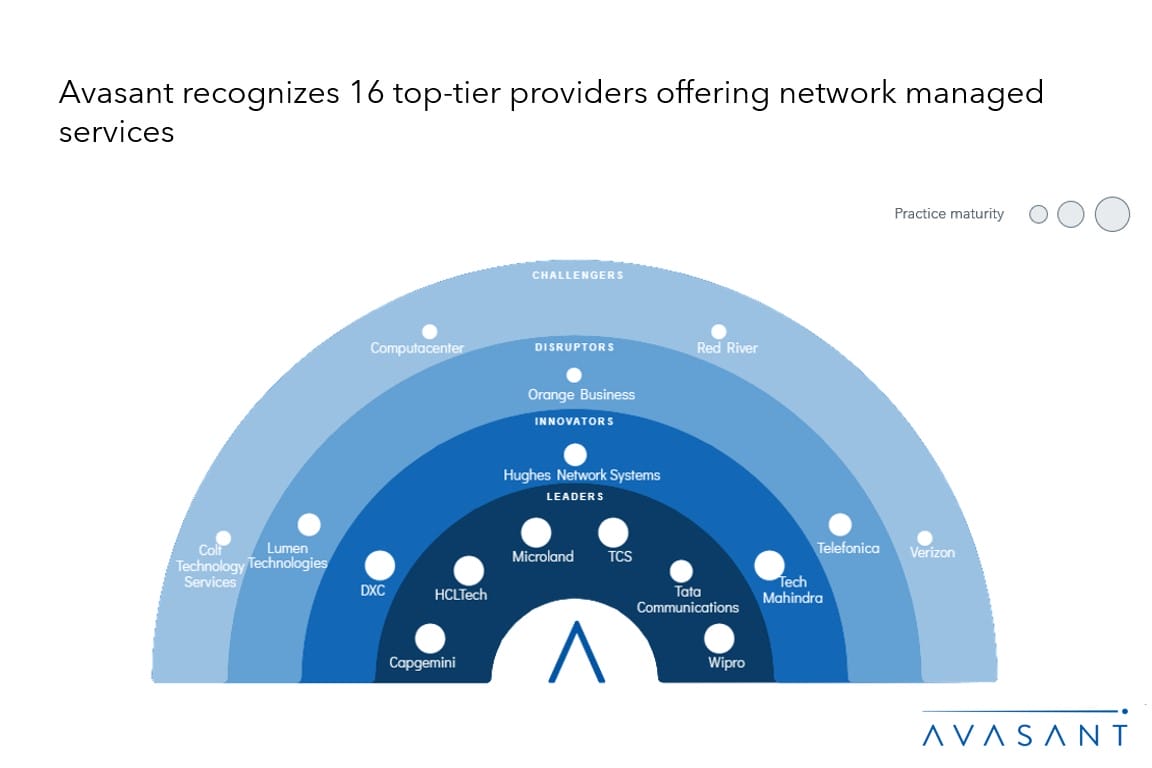

- Avasant recognizes 24 top-tier providers offering payroll business process transformation services

- Provider comparison

Supply-side trends (Pages 11–16)

-

- Compliance and automation dominate payroll priorities, driving regulatory assurance, efficiency, and employee experience.

- Very large enterprises dominate payroll BPT, while Europe leads in revenue share across regions.

- Transactional processes dominate the resource split, but tech-driven payroll models gain momentum amid workforce shifts.

- Output-based pricing remains dominant, but hybrid and KPI-linked models gain momentum in payroll BPT deals.

- Service providers accelerate growth through strategic investments in talent and technology.

Service provider profiles (Pages 17–65)

-

- Detailed profiles for activpayroll, ADP, CloudPay, Dayforce, Deel, EY, Genpact, IBM, Infosys, KPMG, Mercans, Neeyamo, Papaya Global, Paybix, PwC, Ramco, SD Worx, Strada, TCS, TMF Group, UKG, Vistra, Wipro, and Zalaris.

Appendix (Pages 66–69)

-

- Research methodology and coverage

- Interpretation of classification

- RadarView assessment

Key contacts (Page 70)

Read the Research Byte based on this report. Please refer to Avasant’s Payroll Business Process Transformation 2025–2026 Market Insights™ for demand-side trends.