The aerospace and defense industry is facing pressure in two directions. The commercial side of aerospace is struggling with decreased demand from the impacts of COVID-19 while the defense and space segments are seeing growth as new technologies emerge. Regardless of the segment, however, the prescriptions are similar. Digital transformation and the adoption of technologies such as 3D printing, artificial intelligence, digital twin, and augmented/virtual reality (AR/VR) are an imperative.

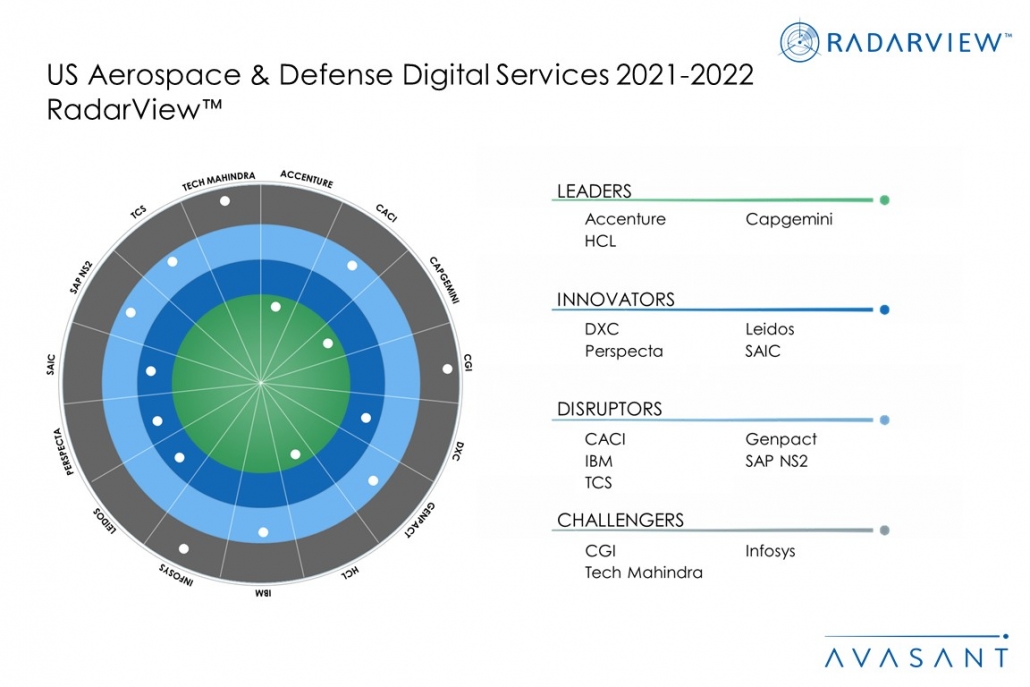

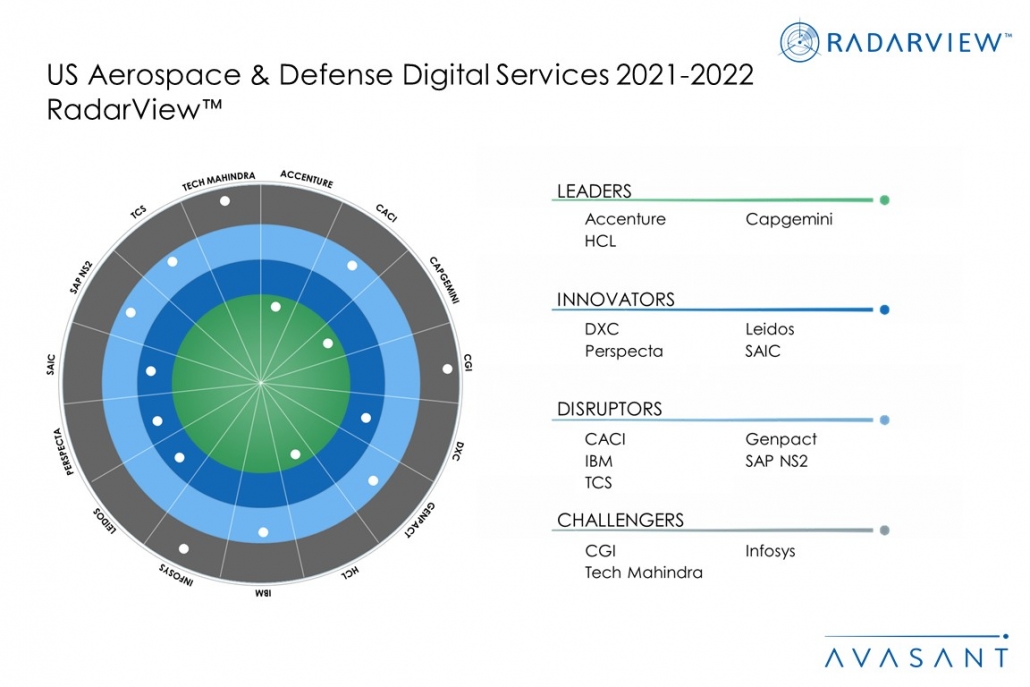

These emerging trends are covered in Avasant’s new US Aerospace & Defense Digital Services 2021-2022 RadarView™ report. The report is a comprehensive study of digital service providers in the US aerospace and defense space, including top trends, analysis, recommendations, and a close look at the leaders, innovators, disruptors, and challengers in this market.

We evaluated 20 providers using three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of those 20 providers, we recognize 15 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, and HCL

- Innovators: DXC, Leidos, Perspecta, and SAIC

- Disruptors: CACI, Genpact, IBM, SAP NS2, and TCS

- Challengers: CGI, Infosys, and Tech Mahindra

Figure 1 from the full report illustrates these categories:

Naresh Lachmandas, Aerospace and Defense Vertical Head at Avasant , congratulated the winners noting, “With increased confidence in enterprise-grade, secure cloud platforms and services, aerospace and defense industry leaders have started their journey to accelerate their digital transformation initiatives with a focus on Industry 4.0, supply chain, MRO, and cost reductions.”

Some of the findings from the full report include the following:

- Explore different business sectors and models to drive revenue growth.

- Consider making the long-term investments necessary to enter the defense and space segment to minimize exposure from a future financial crisis.

- Invest in emerging business models, such as advanced air mobility (AAM) and zero-emission aircraft, to set a course for the industry’s future, leveraging strong product design and engineering capabilities.

- Accelerate digitalization of manufacturing processes to become agile and expedite delivery.

- Scale up the adoption of emerging digital technologies like robotic process automation to reduce dependency on the human workforce, 3D printing to design lightweight aircraft, and analytics to integrate real-time applications in the supply chain, reducing time to market.

- Build smart manufacturing facilities by expediting the journey to Industry 4.0, integrating next-gen technologies like digital twin that can virtually simulate the impact of production changes.

Defense segment companies should:

- Accelerate digitization with the maturity of ITAR-compliant cloud platforms.

- Align the strategy to leverage modernization initiatives, replacing aging processes and systems by deploying industry-leading solutions on International Traffic in Arms Regulations-compliant platforms.

- Assess, prioritize, and invest in Industry 4.0 across the value chain. Leverage technologies like 3D printing for product design, AI-led military drones for surveillance, AR/VR for medical aid training, and blockchain for supply chain communication to stay ahead of the competition.

- Evaluate enterprise-level cybersecurity strategy to combat rising cyber threats.

- Invest or partner with cybersecurity companies to transition from the old-school, preventive mode to a cyber-resilient mode of operation, enhancing the enterprise’s cybersecurity capabilities.

- Define a road map, aligning and complying with the Cybersecurity Maturing Model Certification (CMMC) as defined by the DOD. Develop cybersecurity capabilities, focusing on identity and access management, zero trust, threat hunting, detection and response, and cloud workload protection.

“Service providers are tightly integrated across their customers’ value chain,” said Avasant’s Principal Analyst, Parinita Singh. “A&D enterprises are leveraging service providers’ digital transformation capabilities in engineering and product design, manufacturing, and cybersecurity to help them achieve their business objectives.”

The full report also features detailed RadarView profiles of the 15 service providers, along with their solutions, offerings, and experience in assisting aerospace and defense companies in digital transformation.

This Research Byte is a brief overview of the US Aerospace & Defense Digital Services 2021-2022 RadarView™ report (click for pricing).