This RadarView™ provides a view into the leading service providers offering revenue cycle management (RCM) services. It begins by summarizing key trends shaping the market’s supply side. It continues with a detailed assessment of 24 providers offering RCM services. Each profile provides an overview of the service provider, its key IP assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovation.

Why read this RadarView?

Escalating healthcare costs, shrinking margins, and workforce shortages are increasing the demand for RCM outsourcing. Service providers are utilizing generative AI-based solutions to improve efficiency across routine processes in the RCM operations, including denial management, appeal generation, prior authorization, and medical coding. There is also a focus on strengthening their existing RCM offerings by integrating AI and partnering with technology vendors to open labs/research centers to develop intelligent automation solutions for RCM operations.

The Revenue Cycle Management (RCM) Business Process Transformation 2025 RadarView™ highlights key supply-side trends in the RCM services space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in outsourcing RCM services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for RCM services.

Featured providers

This RadarView includes a detailed analysis of the following clinical service providers: Access Healthcare, AGS Health, Atos, Cognizant, Conifer Health, CorroHealth, Datavant, Firstsource, GeBBS Healthcare Solutions, Genpact, Guidehouse, HCLTech, NextGen Healthcare, Omega Healthcare, Optum, R1 RCM, Sagility, Savista RCM, Shearwater Health, Sutherland, TP, Vee Healthtek, WNS, and XBP Global.

Methodology

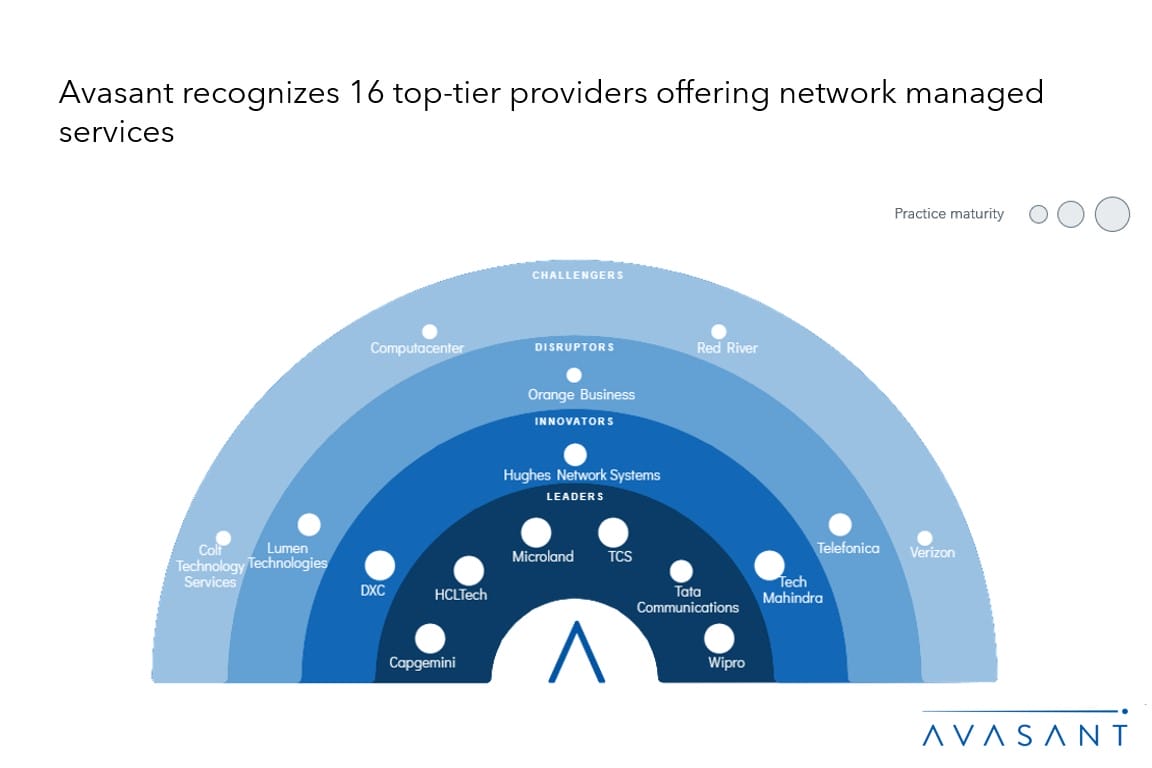

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

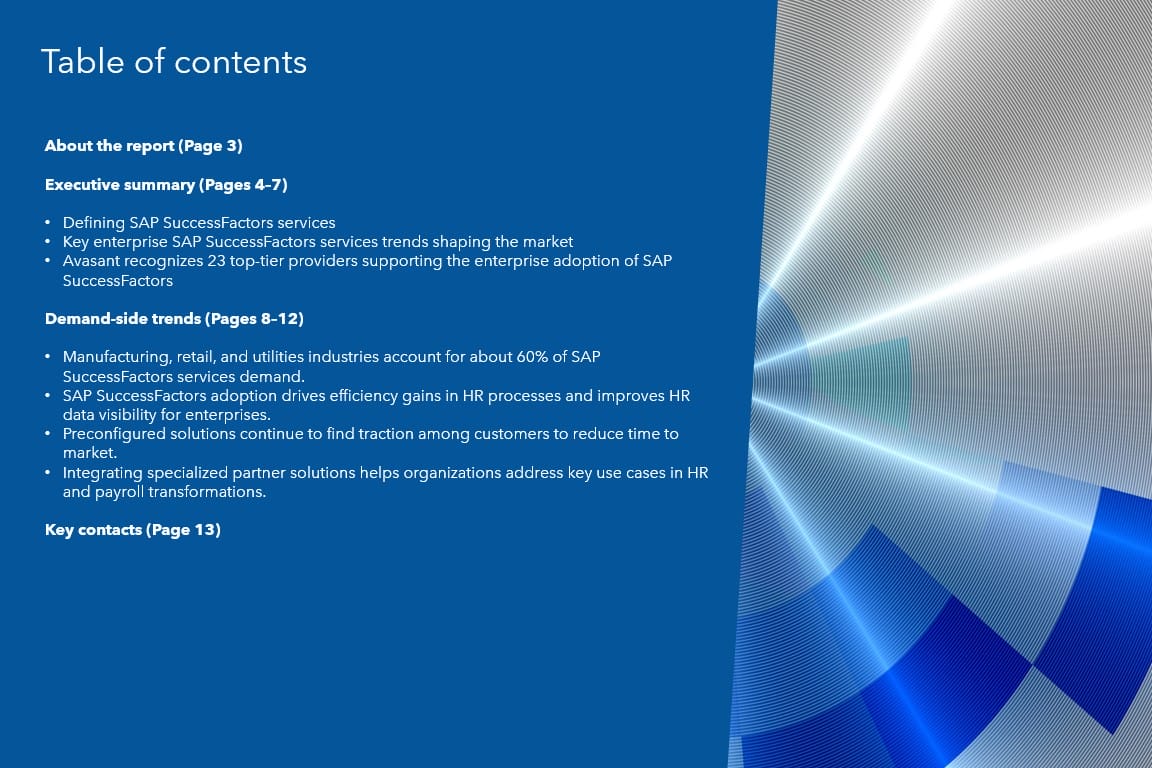

About the report (Page 3)

Executive summary (Pages 4–9)

-

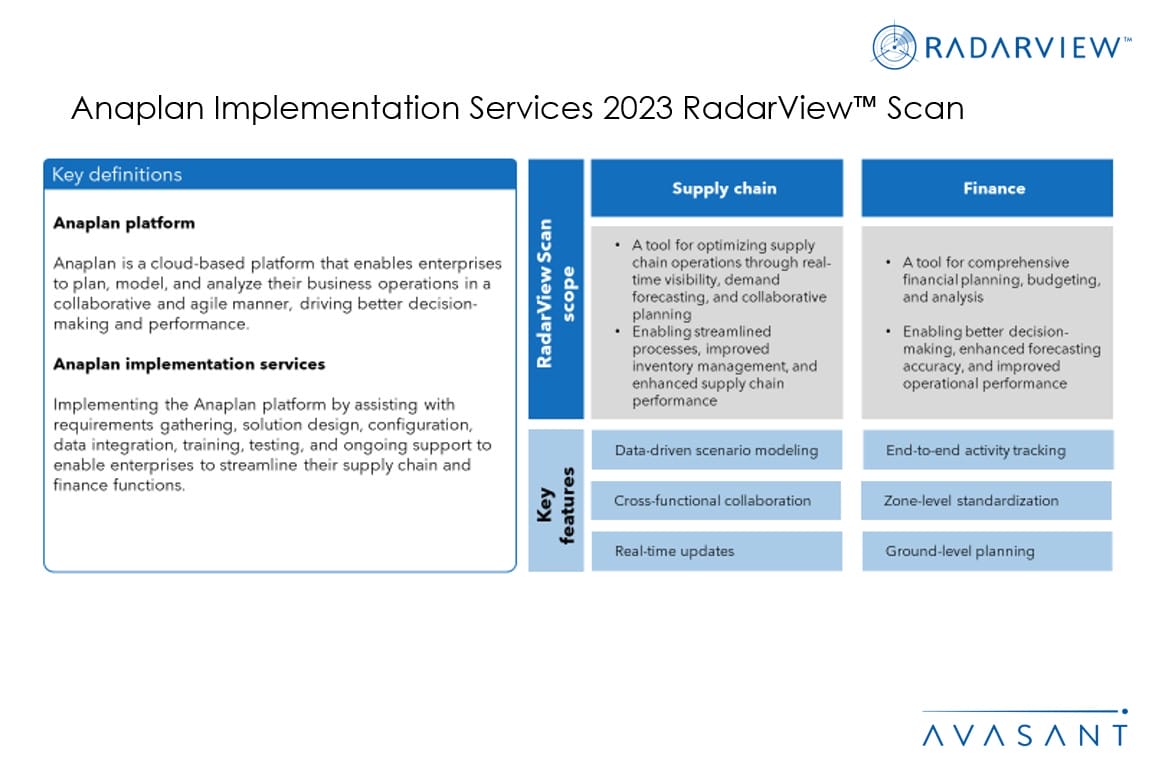

- Definition and scope of revenue cycle management business process transformation, functionality, and features

- Avasant recognizes 24 top-tier service providers offering revenue cycle management business process transformation services

- Provider comparison

Supply-side trends (Pages 10–15)

- Enterprises continue to prefer outcome-linked pricing, but time-based pricing model adoption is rising to combat increasing operational expenses.

- Growth across large clients’ distribution is helping tackle intense financial pressure and operational complexity.

- The majority of RCM outsourcing FTEs are allocated to backend processes.

- Providers are focusing on product growth, R&D, and human capital to maximize their RCM investments.

- Service providers are utilizing generative AI to improve efficiency across routine processes in the RCM value chain.

Service provider profiles (Pages 16–64)

- Detailed profiles for Access Healthcare, AGS Health, Atos, Cognizant, Conifer Health, CorroHealth, Datavant, Firstsource, GeBBS Healthcare Solutions, Genpact, Guidehouse, HCLTech, NextGen Healthcare, Omega Healthcare, Optum, R1 RCM, Sagility, Savista RCM, Shearwater Health, Sutherland, TP, Vee Healthtek, WNS, and XBP Global.

Appendix (Pages 65–68)

- Research methodology and coverage

- Interpretation of classification

- RadarView assessment

Key contacts (Page 69)

Read the Research Byte based on this report. Please refer to Avasant’s Revenue Cycle Management (RCM) Business Process Transformation 2025 Market Insights™ for demand-side trends.