The mortgage BPO industry is undergoing a transformation driven by high interest rates, affordability pressures, and evolving borrower expectations. US mortgage originations reached $1.8 trillion in 2024, while first-time buyers now account for approximately 50% of purchase loans. These factors have increased demand for mortgage business process transformation services, reflected in an 8% growth in active clients of service providers during FY 2024–2025. However, subdued origination volumes and affordability challenges have kept overall revenue growth between 6% and 11%, highlighting the continued need for operational efficiency and digital adoption.

Both demand- and supply-side trends are covered in Avasant’s Mortgage Business Process Transformation 2025 Market Insights™ and Mortgage Business Process Transformation 2025 RadarView™, respectively. These reports present a comprehensive study of the mortgage process services industry and closely examine the market leaders, innovators, disruptors, and challengers. They also provide a view into key market trends and developments impacting the mortgage services space.

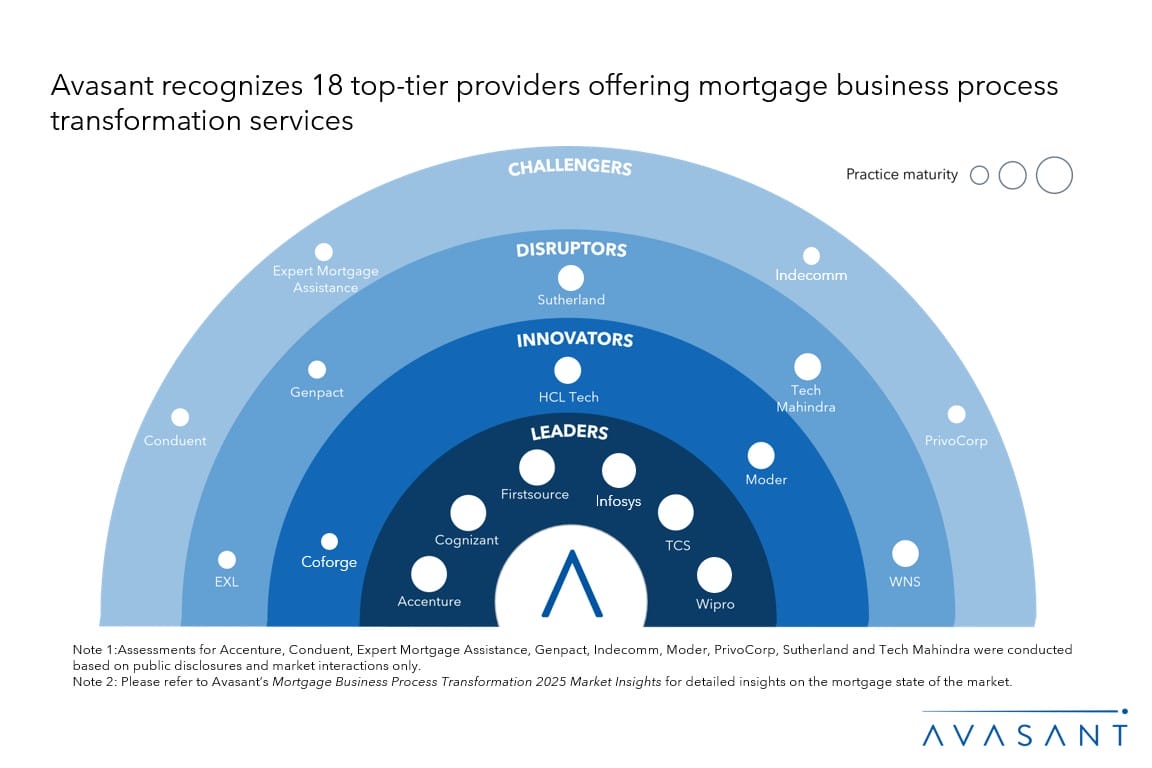

Avasant evaluated 70 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of the 70 providers, we recognized 18 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Cognizant, Firstsource, Infosys, TCS, and Wipro

- Innovators: Coforge, HCLTech, and Moder

- Disruptors: EXL, Genpact, Sutherland, Tech Mahindra, and WNS

- Challengers: Conduent, Expert Mortgage Assistance, Indecomm, and PrivoCorp

Figure 1 below from the full report illustrates these categories:

“Digital automation and cloud adoption are central to modern mortgage operations. They ensure scalability and reduce manual errors,” said Praveen Kona, associate research director at Avasant. “Service providers integrating AI and analytics into their processes can better manage risk and extract insights across the mortgage life cycle.”

The reports provide a number of findings, including the following:

-

- High-interest US mortgage originations hit $1.8 trillion in 2024, representing a decline of approximately 60% from the peaks observed in 2020–2021. The market was primarily driven by purchase loans, while refinancing activity remained limited as a result of elevated interest rates.

- Over 80% of US borrowers are locked into below-market mortgages, constraining supply and slowing market turnover.

- Digital notarization, AI, automation, and e-verification are accelerating mortgage processing, reducing approval and closing times, and enhancing borrower experience.

- Service providers are leveraging domain expertise to ensure multi-jurisdictional compliance, optimize workflows, and integrate legacy systems with AI-enabled platforms.

“Rising interest rates and housing affordability challenges are forcing mortgage service providers to rethink capacity and cost structures,” said Aditya Jain, research leader with Avasant. “Providers that can quickly adapt to fluctuating origination volumes and changing borrower profiles gain a clear operational and competitive advantage.”

This RadarView features detailed profiles of 18 service providers, along with their solutions, offerings, and experience in assisting enterprises and individuals in their mortgage journey.

This Research Byte is a brief overview of Avasant’s Mortgage Business Process Transformation 2025 Market Insights™ and Mortgage Business Process Transformation 2025 RadarView™. (Click for pricing.)