This RadarView™ helps media and entertainment enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 24 providers offering digital services to the media and entertainment industry. Each profile gives an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity and future-proofing capabilities.

Why read this RadarView?

The media and entertainment industry is being reshaped as AI becomes embedded across core operations, powering content creation, editing, recommendations, advertising, and compliance, while unified models enable real-time personalization across platforms. As privacy regulations tighten and third-party cookies decline, enterprises are prioritizing first-party data, secure data architectures, and strong consent frameworks to maintain trust and compliance. Monetization is shifting toward ad-supported streaming, free ad-supported streaming television (FAST) channels, and retail media, driving the convergence of content, commerce, and advertising through shoppable formats and retail partnerships. At the same time, rising competition and costs are accelerating the bundling, aggregation, and consolidation of services, with alliances and mergers enhancing scale, resilience, customer experience, and retention. Interactive engagement through gaming, esports, AR/VR, and phygital experiences is becoming central to strategy, supported by stronger verification, content provenance, IP protection, and fraud controls to ensure sustainable, brand-safe growth.

The Media and Entertainment Digital Services 2025–2026 RadarView™ highlights key supply-side trends in the media and entertainment space and Avasant’s viewpoint on them. It aids companies in this industry in identifying top service providers to assist them in the digital transformation of their services. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for the media and entertainment industry.

Featured providers

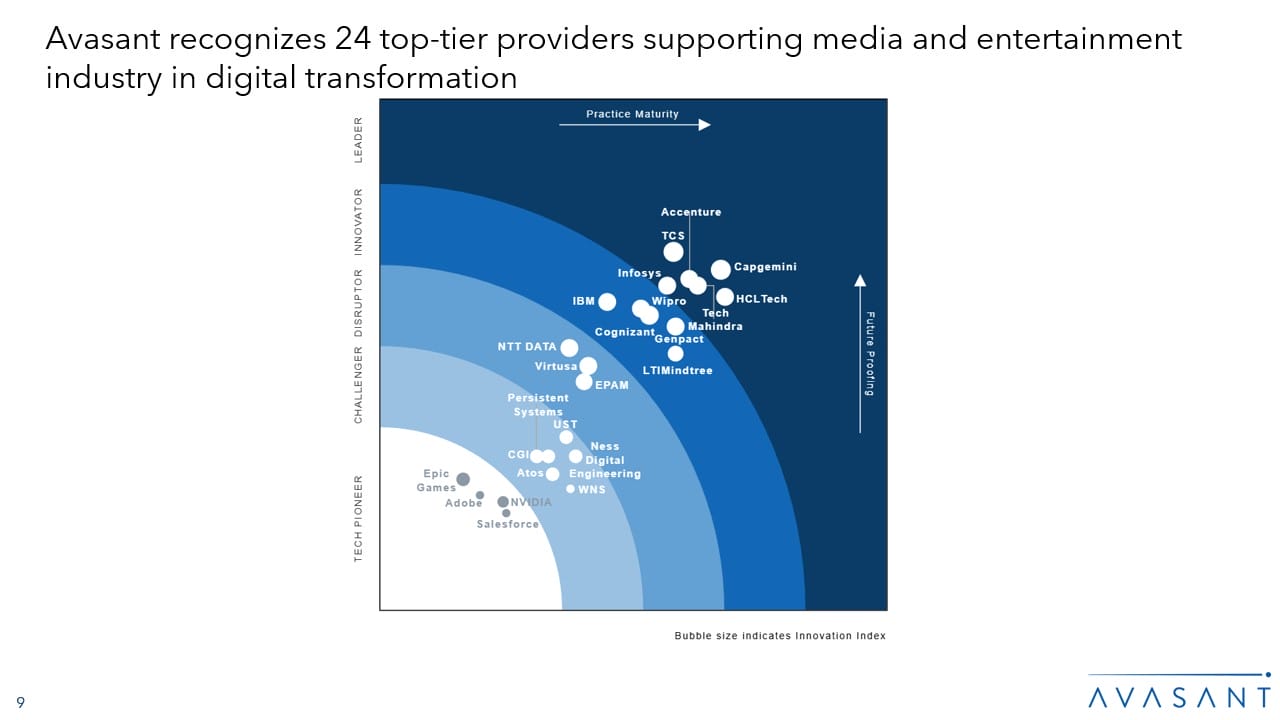

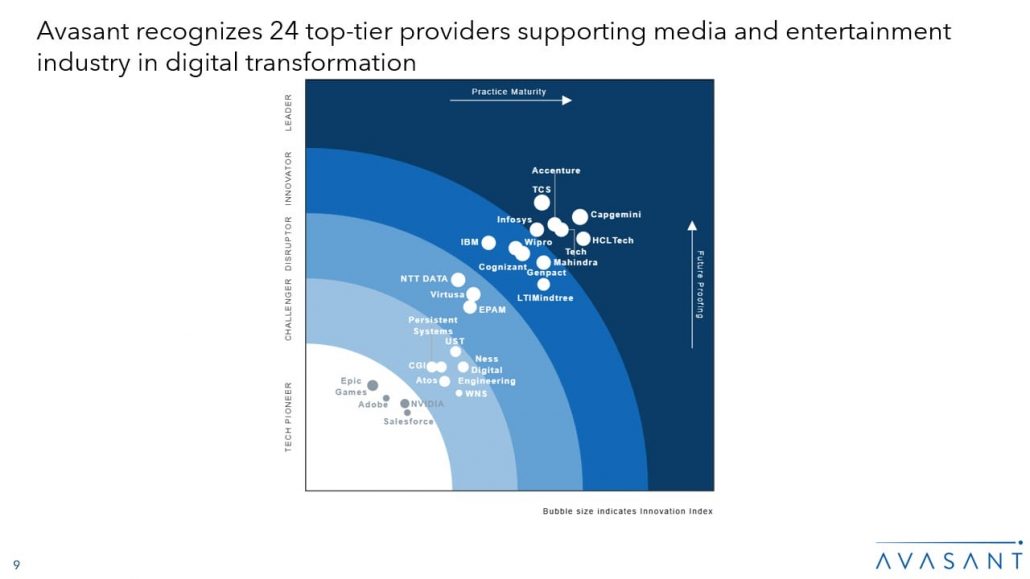

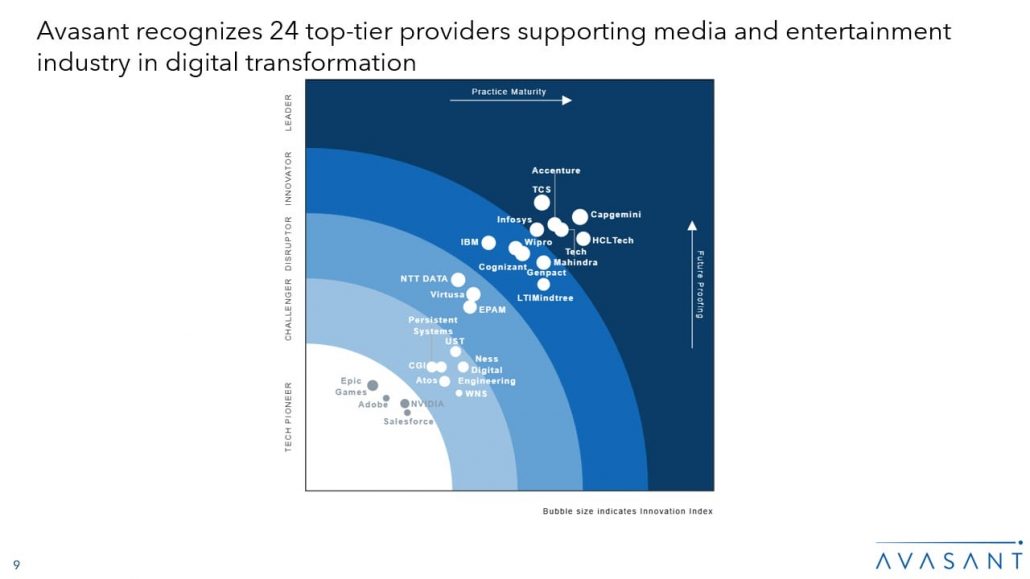

This RadarView includes a detailed analysis of the following service providers: Accenture, Adobe, Atos, Capgemini, CGI, Cognizant, EPAM, Epic Games, Genpact, HCLTech, IBM, Infosys, LTIMindtree, Ness Digital Engineering, NTT DATA, NVIDIA, Persistent Systems, Salesforce, TCS, Tech Mahindra, UST, Virtusa, Wipro, and WNS

Methodology

Our evaluation of service providers is based on primary inputs from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the dimensions of practice maturity and future proofing, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 4–5)

Executive summary (Pages 6–14)

-

- Media and entertainment: Definition and scope

- Media and entertainment digital services: Value chain

- Avasant recognizes 24 top-tier providers offering media and entertainment digital services.

- Provider comparison

- Tech pioneer comparison

Supply-side trends (Pages 15–19)

-

- Providers are growing audiences with Gen AI, XR, and data‑driven subscriptions.

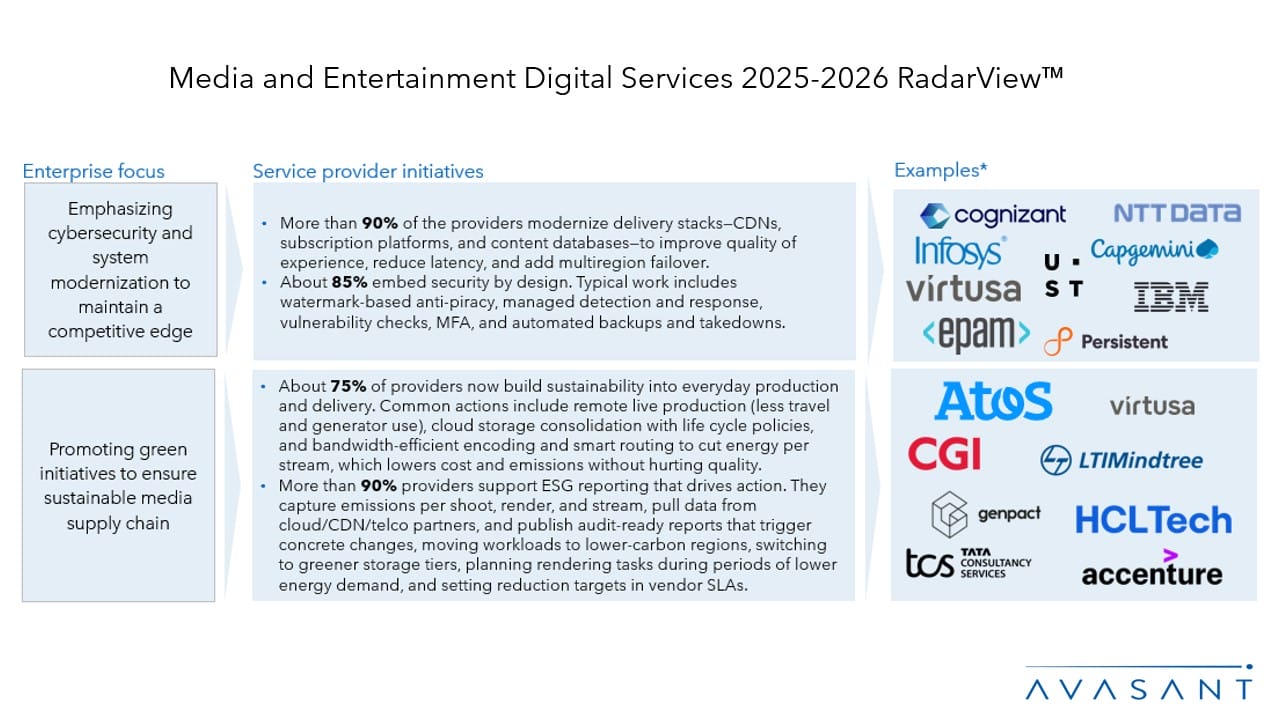

- Service providers are modernizing delivery with cloud, built‑in security, and sustainability.

- Service providers are pivoting portfolios toward digital-first TV, OTT, and new media services while scaling back legacy entertainment and advertising offerings.

- Geographic demand is moving toward Europe and emerging regions as North America’s dominance tapers.

Service provider profiles (Pages 20–84)

-

- Detailed profiles for Accenture, Adobe, Atos, Capgemini, CGI, Cognizant, EPAM, Epic Games, Genpact, HCLTech, IBM, Infosys, LTIMindtree, Ness Digital Engineering, NTT DATA, NVIDIA, Persistent Systems, Salesforce, TCS, Tech Mahindra, UST, Virtusa, Wipro, and WNS.

Appendix (Pages 85–88)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 89)

Read the Research Byte based on this report. Please refer to Avasant’s Media and Entertainment Digital Services 2025–2026 Market Insights™ for demand-side trends.