Regulatory complexities and governance hurdles have long slowed technology adoption in healthcare. Today, however, organizations are gaining momentum in their digital transformation efforts. This acceleration is driven by mounting pressures that demand greater efficiency, better outcomes, and stronger competitiveness. About a third of hospitals in the US are operating at a loss, and new technologies such as AI, wearables, and telehealth are rapidly changing the care landscape. The traditional time-and-materials model is giving way to value-based care, and hospitals are under more pressure now than ever to transform.

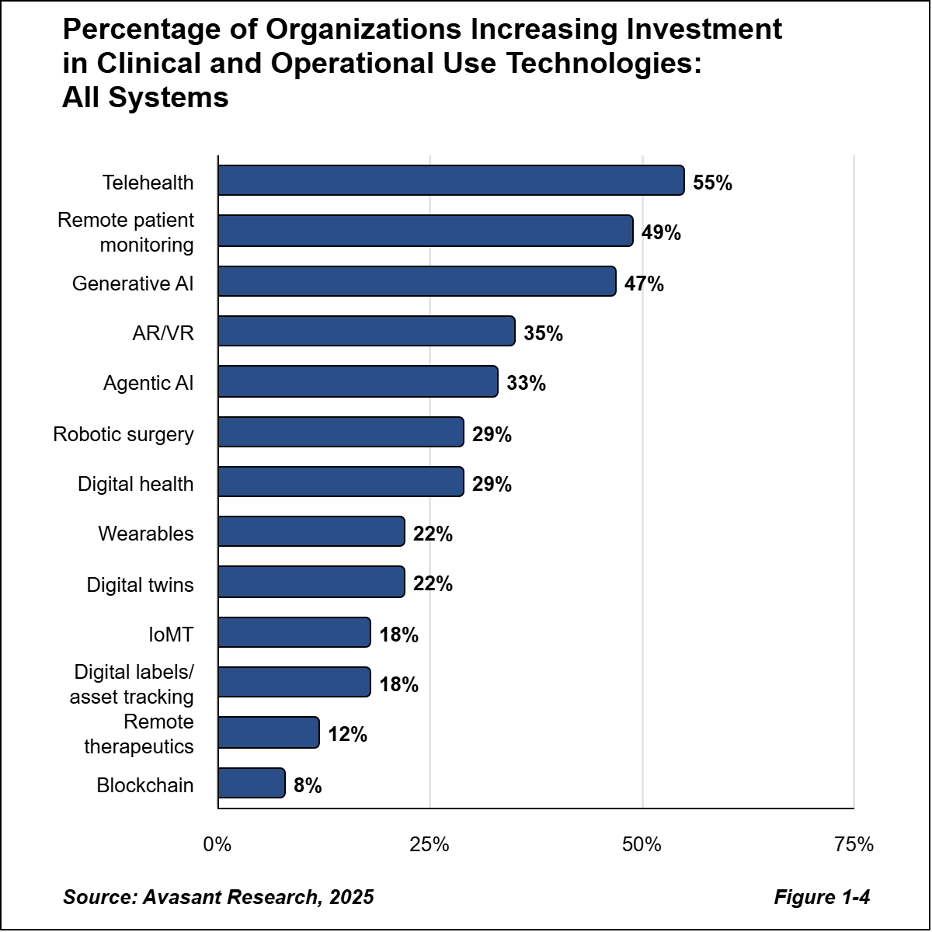

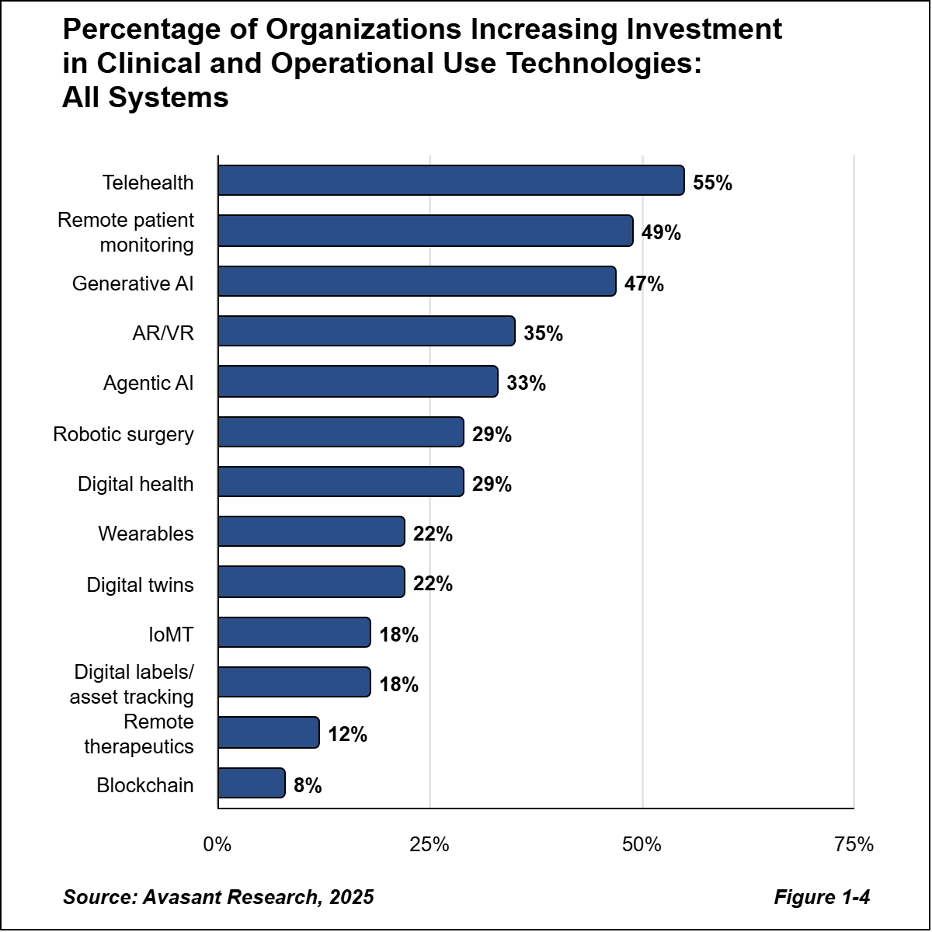

As shown in Figure 1-4 from the free executive summary of our inaugural Healthcare Provider Performance Benchmarks 2025/2026 study, the top technologies where organizations are increasing investment include telehealth, remote patient monitoring, and generative AI. This signals a strong push toward virtual care models. Emerging technologies, such as AR/VR and agentic AI, are gaining traction, while blockchain remains a low priority.

This data comes from a larger study of over 50 hospitals and health networks designed to create a number of KPIs and metrics to improve hospital operations. Figure 1-4 shows that generative AI is assuming a growing role in clinical and operational workflows, with nearly half of respondents reporting increased investment in this area. This suggests a significant shift toward advanced automation and intelligent systems in healthcare operations.

Other growth areas, including telehealth, wearables, and digital health, highlight the need to manage chronic diseases and follow value-based care models. Chronic diseases are a major component of healthcare costs. Hospital readmissions, emergency room visits, and other costly events related to chronic diseases can often be reduced or prevented with more access to healthcare resources. Telemedicine extends access, especially to patients with limited mobility or who live far from standard care. Wearables can monitor patient conditions for warning signs, eliminating the need for scarce medical resources to observe those patients. All of this can improve patient outcomes, reduce costs, and serve as new lines of revenue for hospitals.

“The convergence of technology and patient care marks a pivotal moment for healthcare,” said Waynelle John, research analyst for Avasant, based in Los Angeles. “But technology adoptions must be scaled, standardized, and integrated across all levels of care to have a meaningful impact on the wider US healthcare system.”

Avasant’s Industry Economics: Healthcare Provider Performance Benchmarks 2025/2026 study draws on an in-depth survey of more than 50 hospitals and healthcare networks across the US. It examines organizational spending and staffing plans for 2025/2026, as well as emerging industry trends. The study delivers performance benchmarks tailored to single hospitals, hospital systems, and integrated healthcare networks. It includes over 50 metrics, organized into seven sections. These sections include basic performance metrics, financial metrics, staffing (medical and nonmedical), revenue cycle management, compliance, and technology adoption. A comprehensive overview of the study’s metrics, design, demographics, and methodology is available in the free executive summary .

This Research Byte provides a brief overview of the findings from Avasant’s report, Healthcare Provider Performance Benchmarks 2025/2026. The full five-chapter report is available at no charge for Avasant Research clients.