This RadarView™ helps life and annuity (L&A) insurance companies craft a robust strategy based on industry outlook, best practices, and digital transformation. It begins with a summary of key trends shaping the supply side of the L&A insurance market. It continues with a detailed assessment of 25 leading service providers. Each profile provides an overview of the service provider, its industry-specific solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, investments and innovation, and partner ecosystem. The report can aid businesses in identifying the right partners and service providers to support their digital transformation journeys.

Why read this RadarView?

The life and annuities (L&A) insurance industry is adapting to rising demand for life insurance and annuity products by accelerating digital transformation. Insurers are introducing tools to empower advisors, enhance engagement, and deliver personalized experiences. To meet evolving expectations, firms are embedding retirement planning and holistic financial wellness features into digital platforms. While digital maturity varies globally, insurers are modernizing systems, consolidating vendors, and leveraging AI-driven capabilities to strengthen underwriting and advisory processes. At the same time, L&A insurers are forging strategic partnerships with service providers to fast-track digital transformation, ensuring innovation and customer-centricity remain central to growth strategies.

The Life and Annuity Insurance Digital Services 2025 RadarView™ highlights key supply-side trends in the L&A insurance space and Avasant’s viewpoint on them. It aids L&A insurance companies in identifying top service providers to assist them in digitalizing their services. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for the L&A insurance industry.

Featured providers

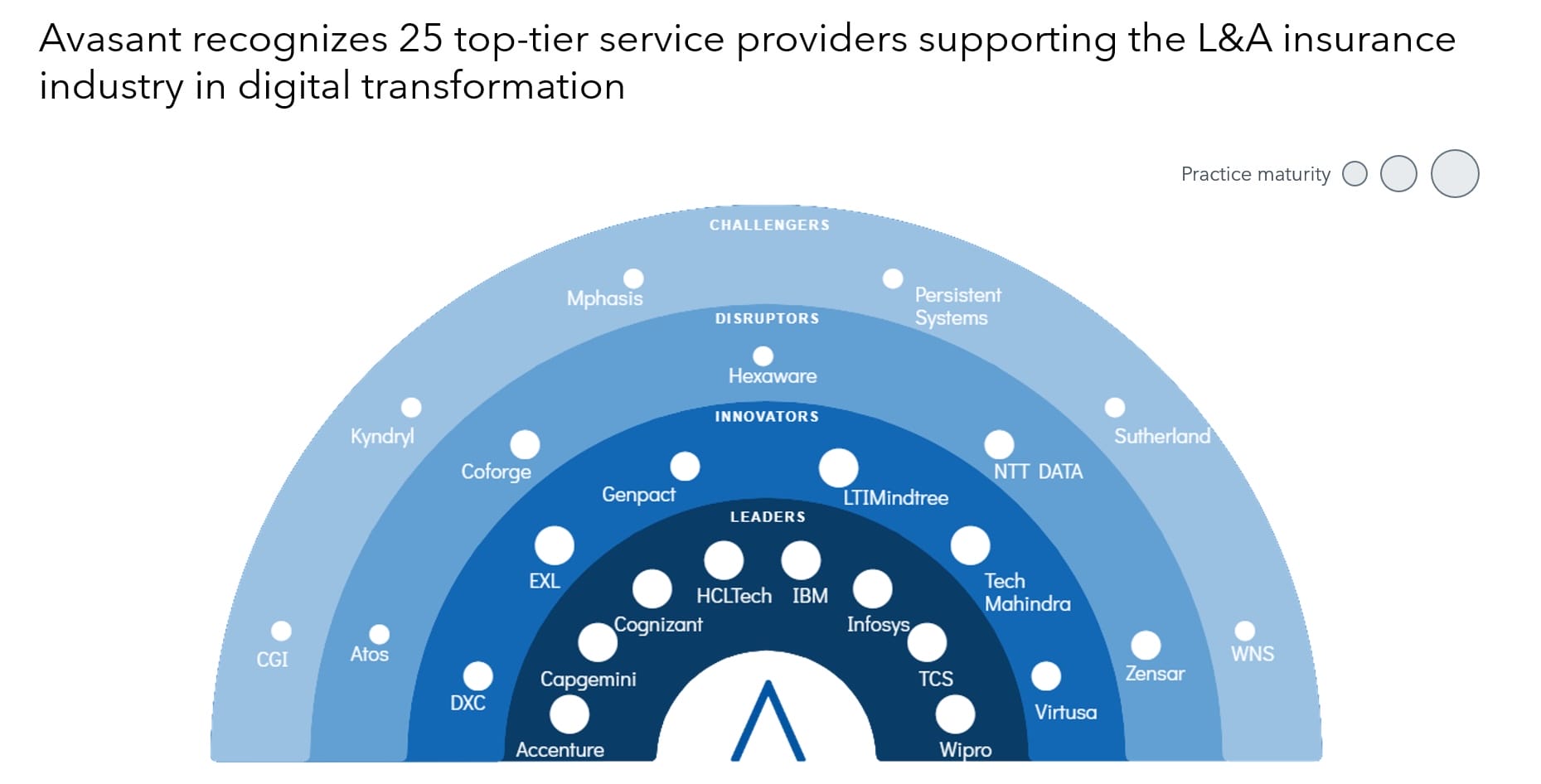

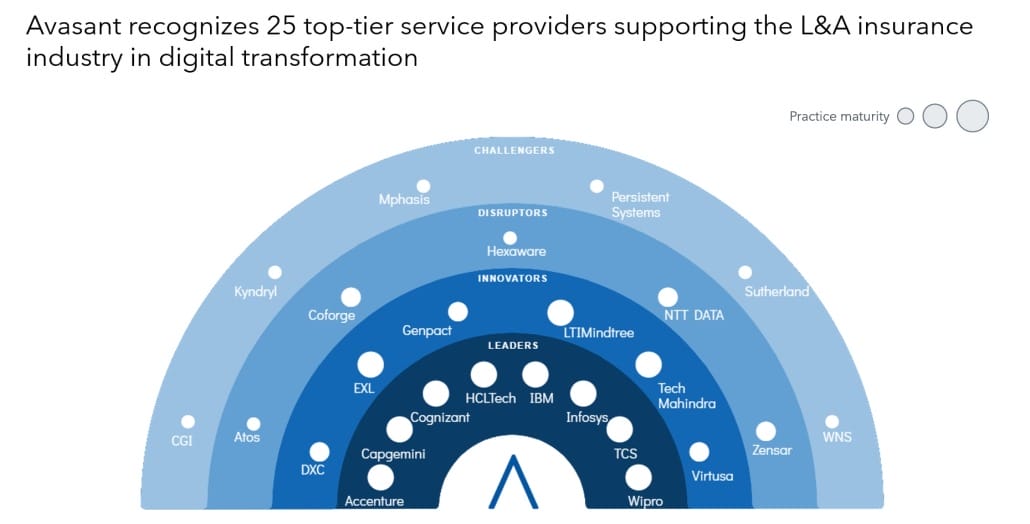

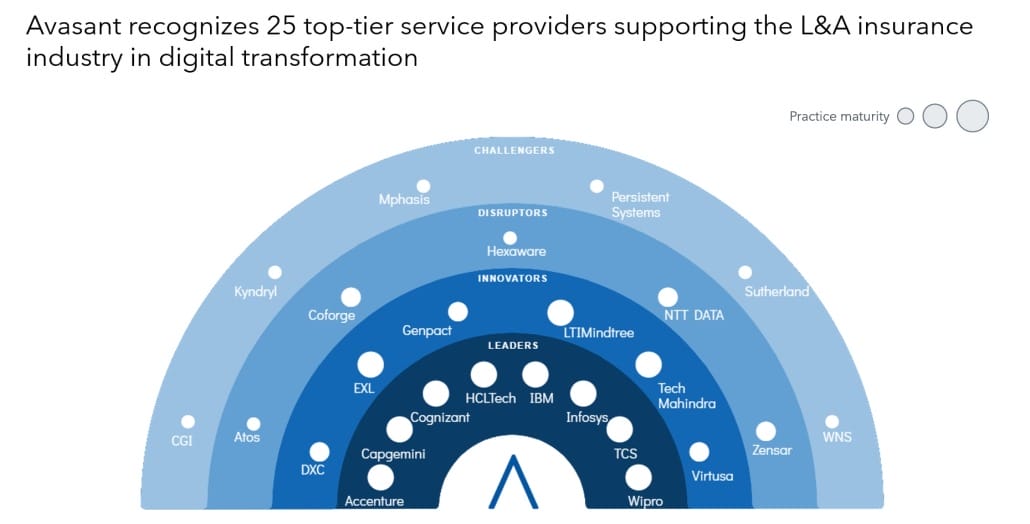

This RadarView includes an analysis of the following service providers in the L&A insurance digital services space: Accenture, Atos, Capgemini, CGI, Coforge, Cognizant, DXC, EXL, Genpact, HCLTech, Hexaware, IBM, Infosys, Kyndryl, LTIMindtree, Mphasis, NTT DATA, Persistent Systems, Sutherland, TCS, Tech Mahindra, Virtusa, Wipro, WNS, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across three dimensions of practice maturity, investments and innovation, and partner ecosystem, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

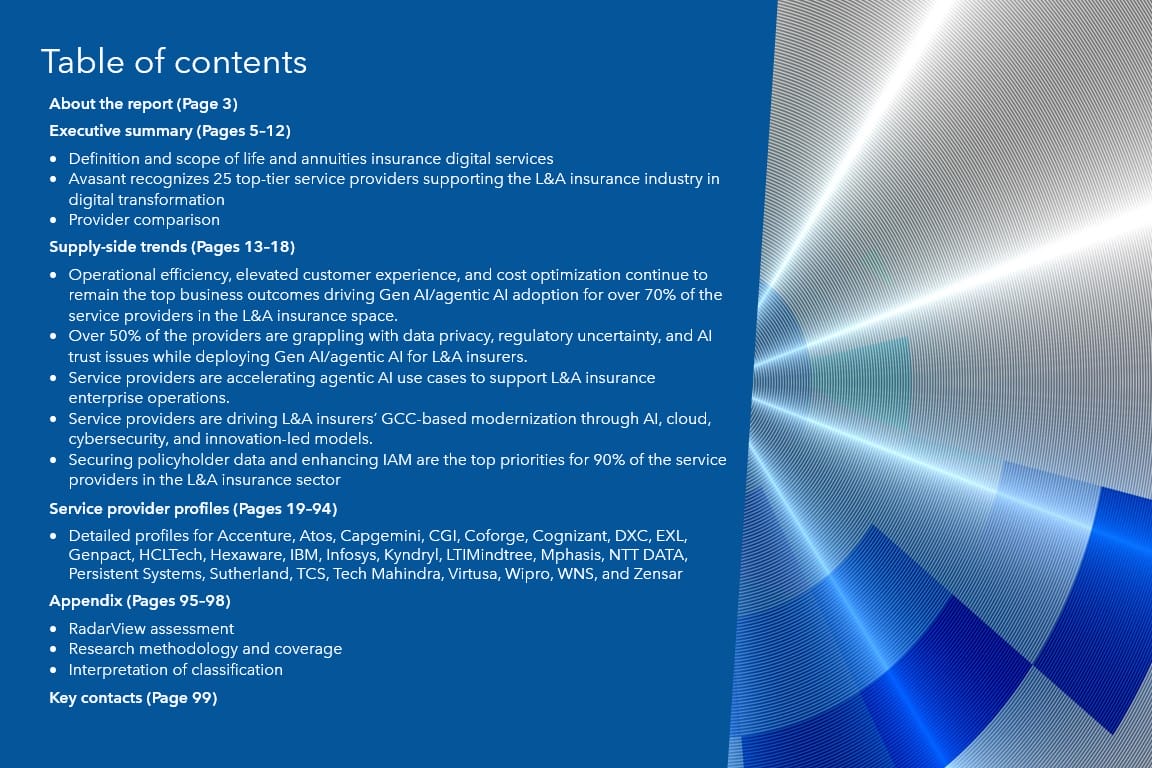

About the report (Page 3)

Executive summary (Pages 5–12)

-

- Definition and scope of life and annuities insurance digital services

- Avasant recognizes 25 top-tier service providers supporting the L&A insurance industry in digital transformation

- Provider comparison

Supply-side trends (Pages 13–18)

-

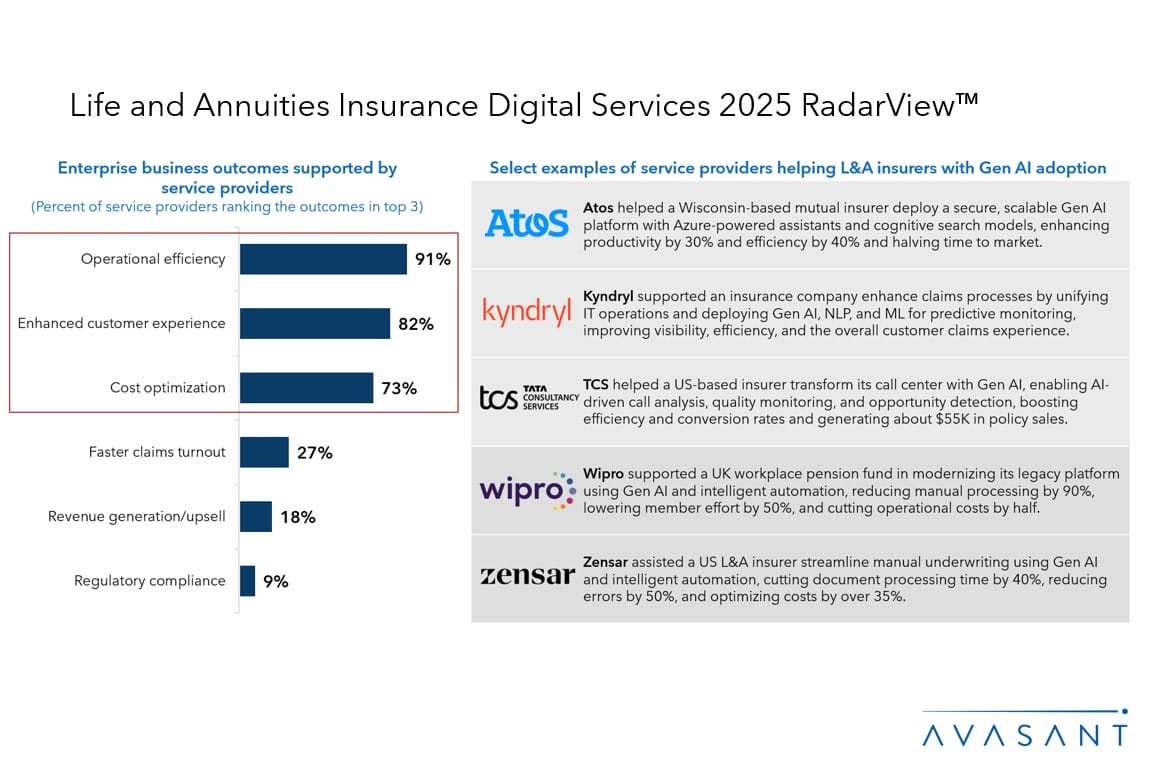

- Operational efficiency, elevated customer experience, and cost optimization continue to remain the top business outcomes driving Gen AI/agentic AI adoption for over 70% of the service providers in the L&A insurance space.

- Over 50% of the providers are grappling with data privacy, regulatory uncertainty, and AI trust issues while deploying Gen AI/agentic AI for L&A insurers.

- Service providers are accelerating agentic AI use cases to support L&A insurance enterprise operations.

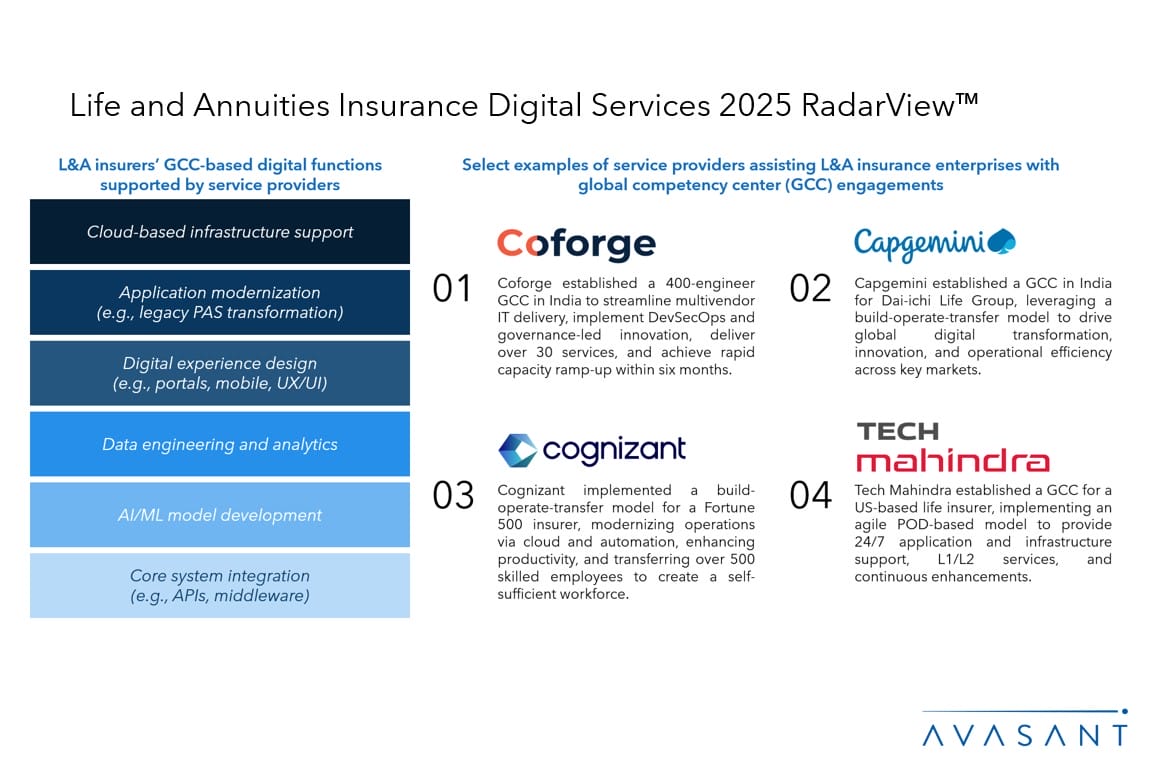

- Service providers are driving L&A insurers’ GCC-based modernization through AI, cloud, cybersecurity, and innovation-led models.

- Securing policyholder data and enhancing IAM are the top priorities for 90% of the service providers in the L&A insurance sector.

Service provider profiles (Pages 19–94)

-

- Detailed profiles for Accenture, Atos, Capgemini, CGI, Coforge, Cognizant, DXC, EXL, Genpact, HCLTech, Hexaware, IBM, Infosys, Kyndryl, LTIMindtree, Mphasis, NTT DATA, Persistent Systems, Sutherland, TCS, Tech Mahindra, Virtusa, Wipro, WNS, and Zensar

Appendix (Pages 95–98)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 99)

Read the Research Byte based on this report. Please refer to Avasant’s Life and Annuities Insurance Digital Services 2025 Market Insights™ for demand-side trends.