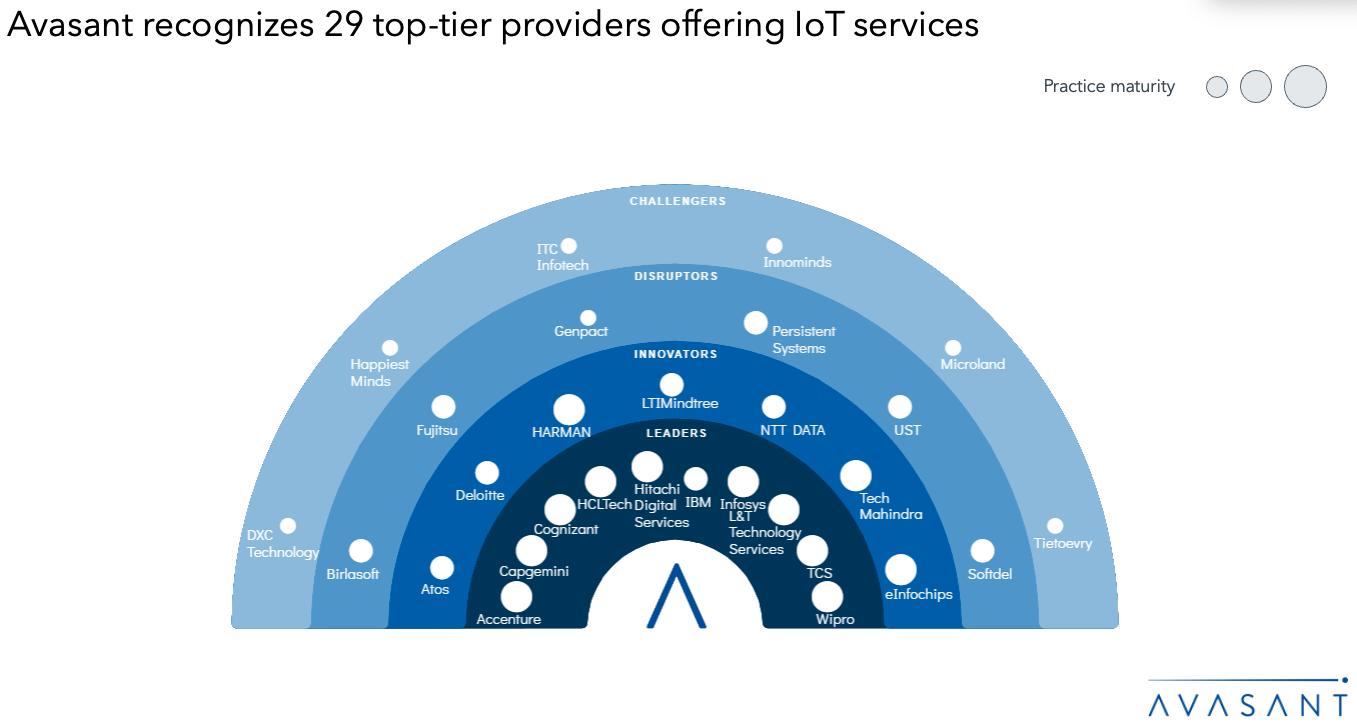

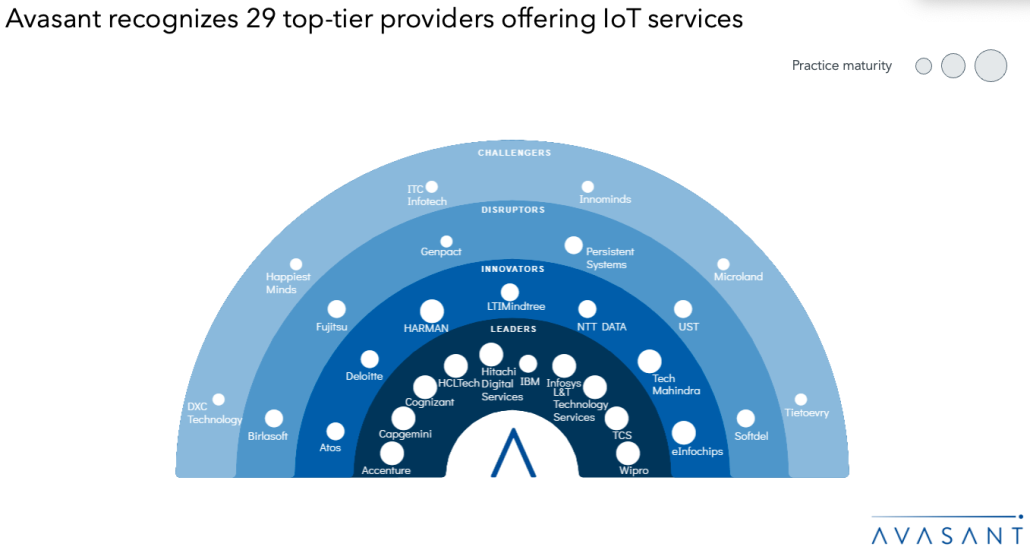

The report helps enterprises identify key service providers to design and implement IoT platforms and services. We present a detailed assessment of 29 providers offering IoT services. Each profile provides an overview of the service provider, their key IP assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations.

Why read this RadarView?

Industrial IoT adoption is accelerating as enterprises transition from Industry 4.0 to Industry 5.0, integrating connected machinery, robotics, and AI-driven automation to enhance efficiency, safety, and sustainability. AIoT convergence with edge and 5G is powering real-time insights, autonomous actions, and early use of agentic AI pilots. As deployments scale, IT–OT cybersecurity has become a critical priority, with providers embedding zero-trust frameworks and AI-driven monitoring. Digital twins are gaining momentum for simulation, disruption testing, and decarbonization modeling. At the same time, IoT is becoming more human-centric, enabling adaptive, personalized experiences through multimodal sensing and emotion-aware analytics.

The Internet of Things Services 2025 RadarView™ highlights key supply-side trends in the IoT services space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in their digital transformation by implementing IoT services. It also offers an analysis of each service provider’s capabilities in technology and delivery support, enabling organizations to identify the right strategic partners in implementing and managing IoT systems.

Featured providers

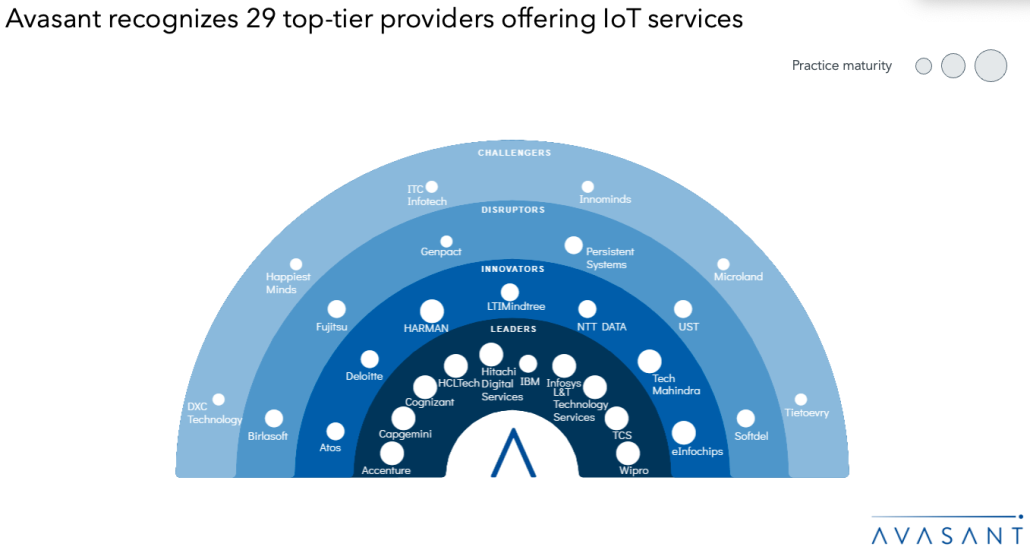

This RadarView includes a detailed analysis of the following IoT services providers: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Deloitte, DXC Technology, eInfochips, Fujitsu, Genpact, Happiest Minds, HARMAN Digital Transformation Solutions, HCLTech, Hitachi Digital Services, IBM, Infosys, Innominds, ITC Infotech, L&T Technology Services, LTIMindtree, Microland, NTT DATA, Persistent Systems, Softdel, TCS, Tech Mahindra, Tietoevry, UST, and Wipro.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 5–11)

-

- Defining the Internet of Things services

- Avasant recognizes 29 top-tier providers offering IoT services

- Provider comparison

Supply-side trends (Pages 12–16)

-

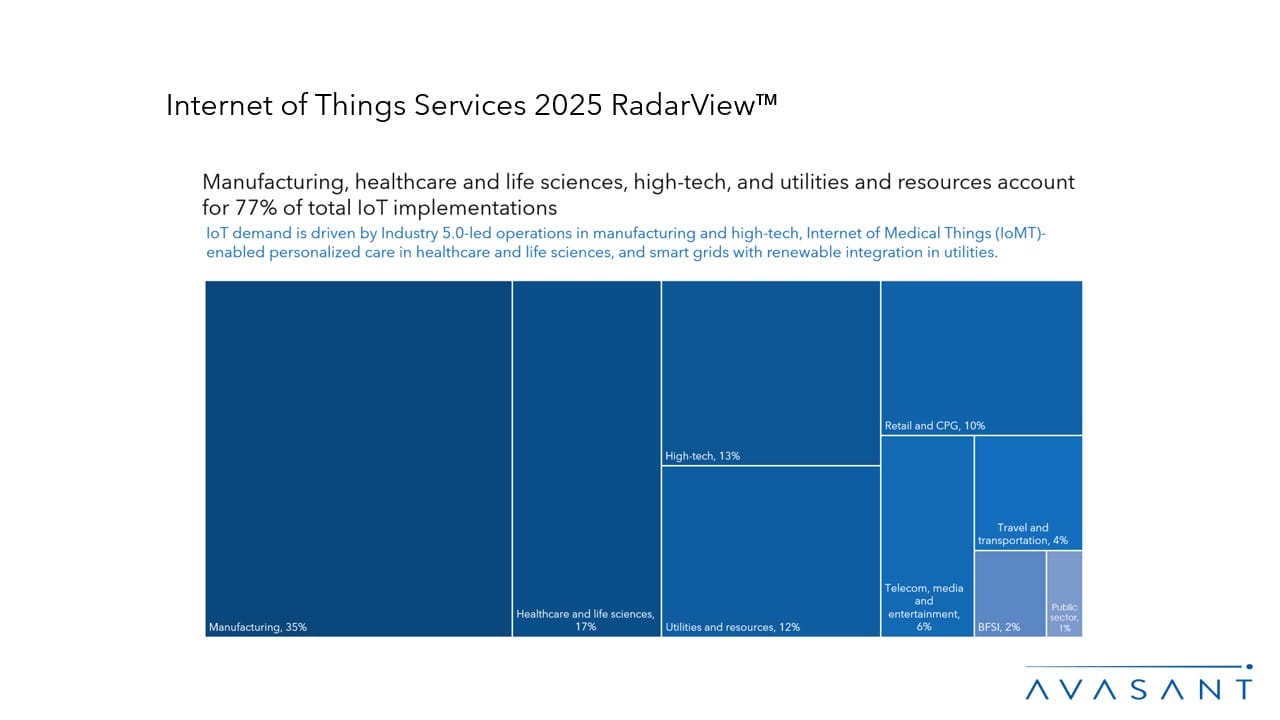

- Manufacturing, healthcare and life sciences, high-tech, and utilities and resources account for 77% of total IoT implementations.

- Large and very large enterprise clients are leading the revenue split; North America is the highest contributor among the geographies, followed by Europe.

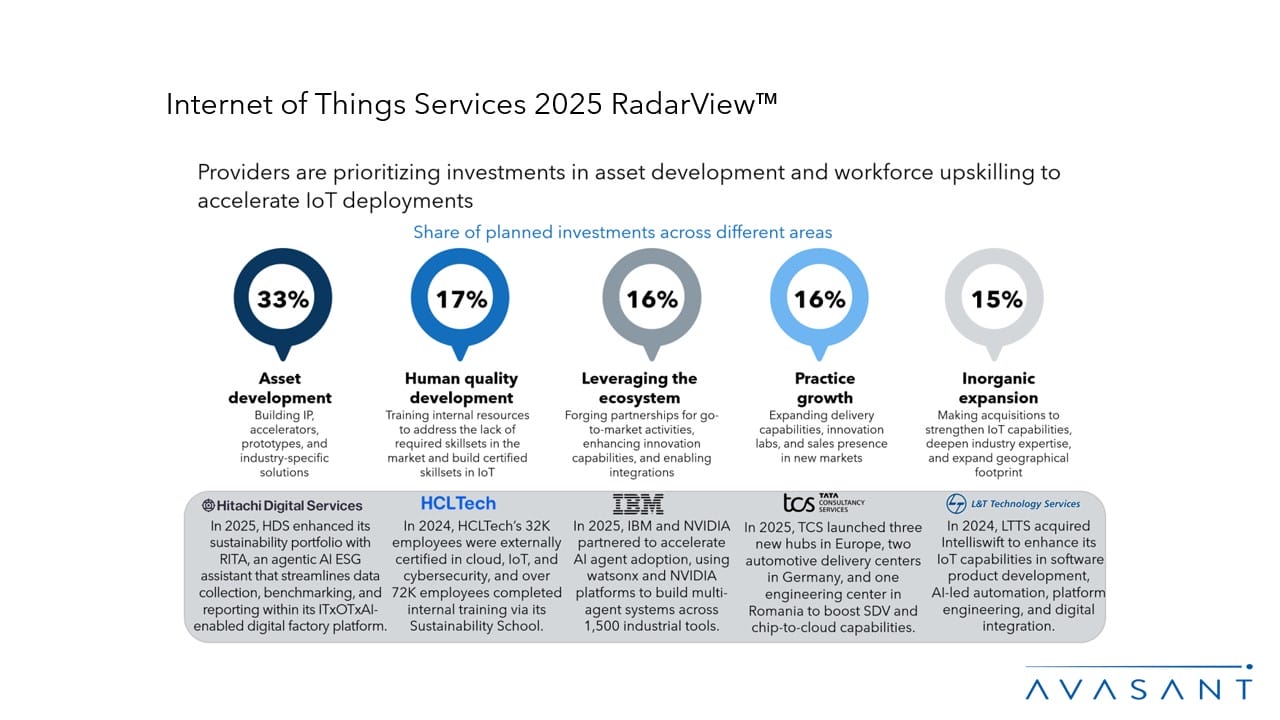

- Providers are prioritizing investments in asset development and workforce upskilling to accelerate IoT deployments.

- Service providers are advancing IoT adoption by scaling Industry 4.0, enabling AIoT with edge, and securing IT–OT environments.

Service provider profiles (Pages 17–104)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Cognizant, Deloitte, DXC Technology, eInfochips, Fujitsu, Genpact, Happiest Minds, HARMAN Digital Transformation Solutions, HCLTech, Hitachi Digital Services, IBM, Infosys, Innominds, ITC Infotech, L&T Technology Services, LTIMindtree, Microland, NTT DATA, Persistent Systems, Softdel, TCS, Tech Mahindra, Tietoevry, UST, and Wipro.

Appendix (Pages 105–108)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 109)

Read the Research Byte based on this report. Please refer to Avasant’s Internet of Things Services 2025 Market Insights™ for demand-side trends.