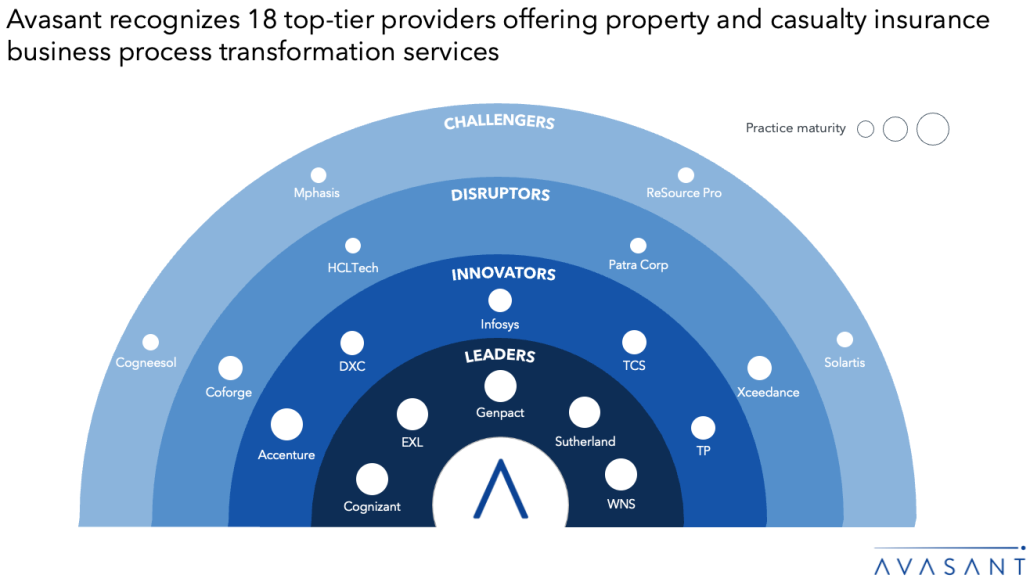

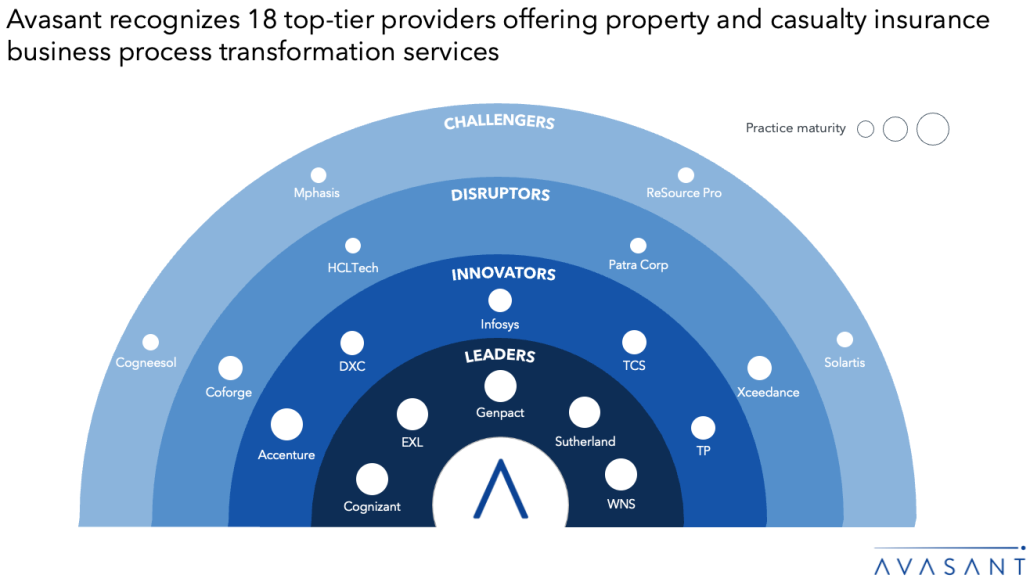

This report provides businesses with a view of the P&C insurance process transformation services landscape. It begins with a summary of key enterprise and outsourcing trends and identifies the right service providers that companies can engage with to reshape the P&C insurance outsourcing services. We continue with a detailed assessment of 18 service providers offering P&C insurance process transformation services. Each profile overviews a service provider, its key IPs and assets, a list of representative clients and partnerships, and brief case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovation.

Why read this RadarView?

P&C insurers are broadening their outsourcing strategies beyond traditional claims and policy administration to include functions such as climate risk modeling, cyber threat monitoring, and parametric product servicing—areas where service providers offer deep domain expertise and scalable AI solutions. There is a rising emphasis on intelligent automation and real-time data integration to streamline underwriting, accelerate claims resolution, and enhance customer experience. With service providers now embedding AI copilots into insurance operations, tasks such as fraud detection, compliance validation, and customer sentiment analysis are seeing measurable improvements.

The Property and Casualty Insurance Business Process Transformation 2025 RadarView™ aids companies in identifying top service providers to transform their P&C insurance services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for their P&C insurance process transformation.

Featured providers

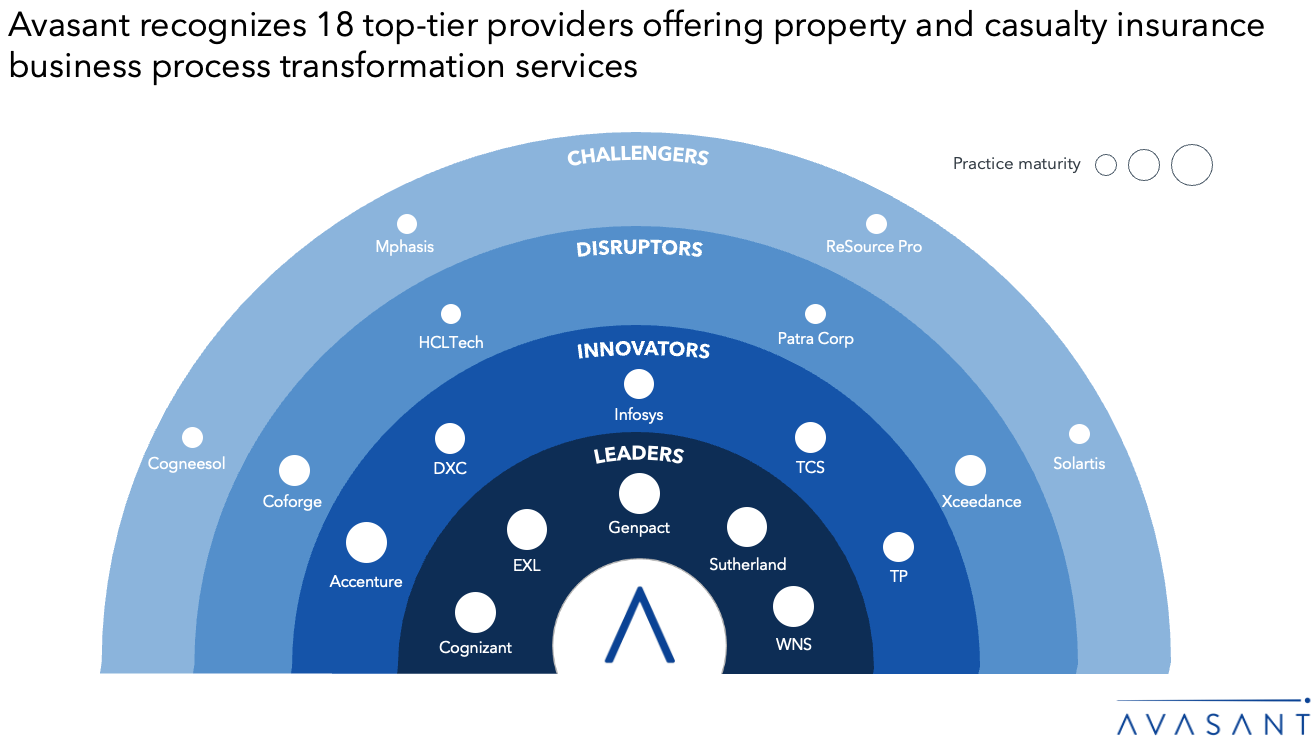

This RadarView includes a detailed analysis of the following service providers offering P&C insurance business process transformation services: Accenture, Coforge, Cogneesol, Cognizant, DXC Technology, EXL, Genpact, HCLTech, Infosys, Mphasis, Patra Corporation, ReSource Pro, Solartis, Sutherland, TCS, TP, WNS, and Xceedance.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Definition and scope of property and casualty insurance business process transformation

- Avasant recognizes 18 top-tier service providers offering property and casualty insurance process transformation services

- Provider comparison

Supply-side trends (Pages 9–13)

-

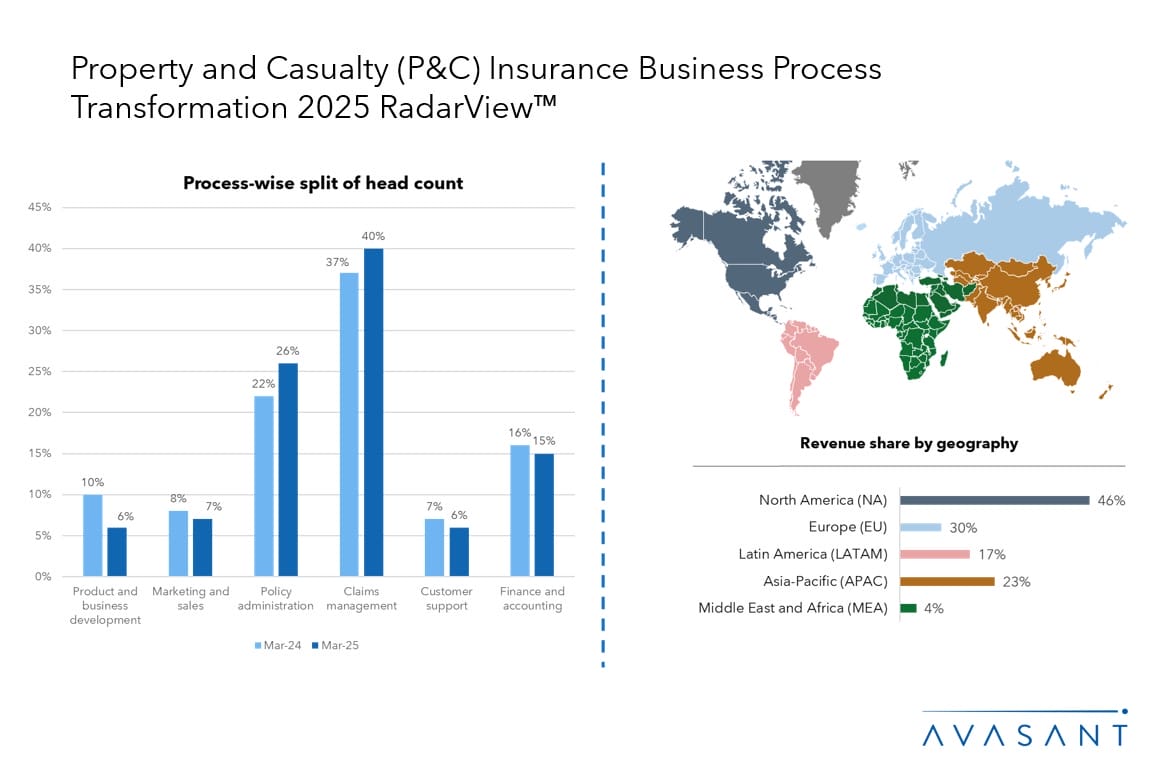

- Claims management remains the most resource-intensive function, and North America leads all geographies in contribution.

- Hybrid models are preferred for their flexibility, while outcome-based models are losing traction amid market volatility and regulatory uncertainty.

- Providers are differentiating themselves by strengthening their offerings and delivering greater value to clients through technology adoption.

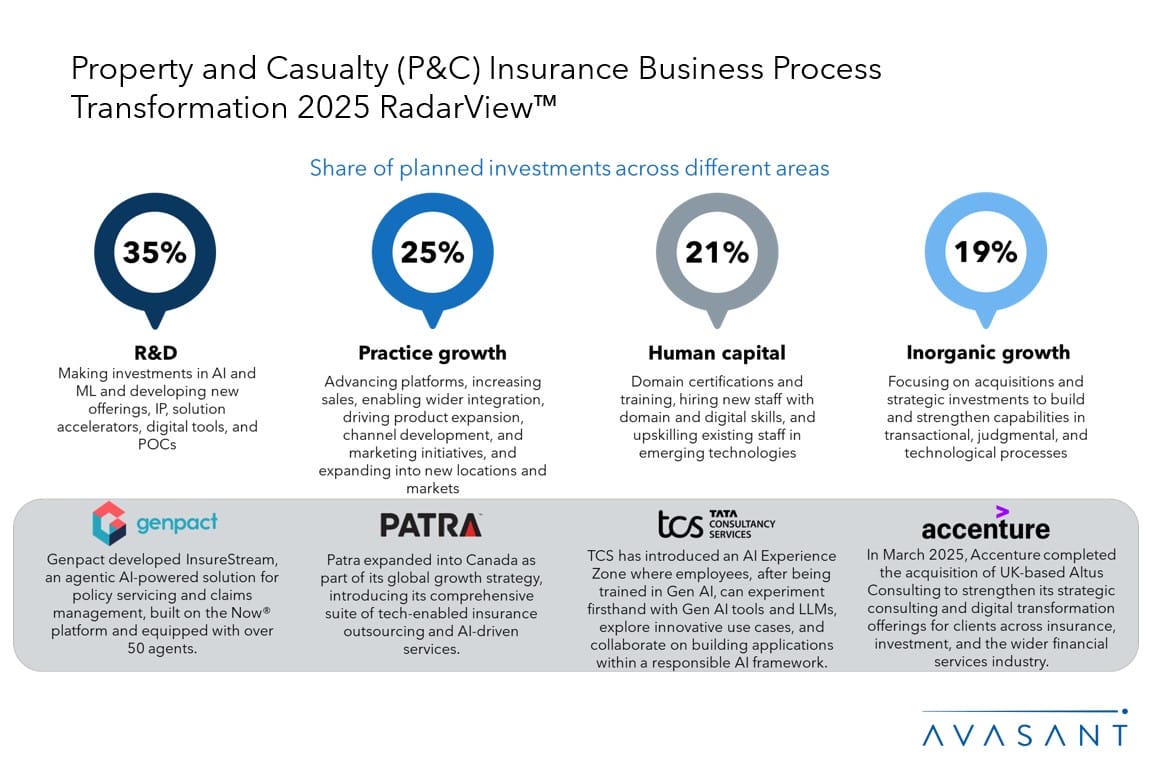

- Focus on R&D has increased due to rapid innovation driven by emerging technologies such as Gen AI.

Service provider profiles (Pages 14–50)

-

- Detailed profiles for Accenture, Coforge, Cogneesol, Cognizant, DXC Technology, EXL, Genpact, HCLTech, Infosys, Mphasis, Patra Corporation, ReSource Pro, Solartis, Sutherland, TCS, TP, WNS, and Xceedance.

Appendix (Pages 51–54)

-

- RadarView assessment

- Methodology and coverage

- Interpretation of classification

Key contacts (Page 55)

Read the Research Byte based on this report. Please refer to Avasant’s Property and Casualty Insurance Business Process Transformation 2025 Market Insights™ for detailed insights on demand-side trends.