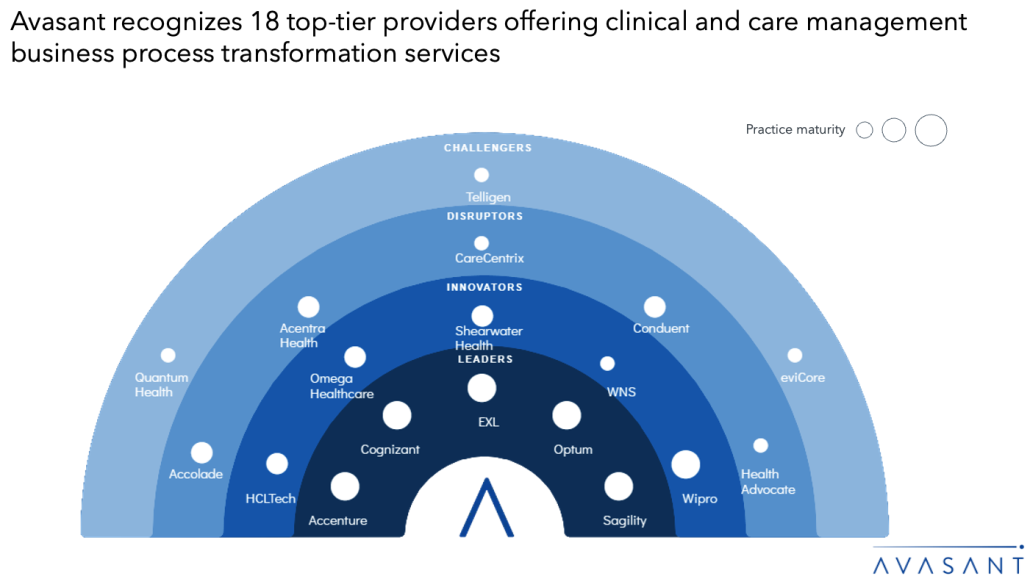

The report offers a comprehensive analysis of how service providers are transforming healthcare operations, with a particular focus on clinical and care management functions. It defines the scope of transformation services and evaluates 18 top-tier providers across various dimensions such as virtual care, utilization management, and population health. Key supply-side trends include a workforce shift from traditional utilization management to integrated, multispecialty care teams; growing investments in training and certifications; and broader service offerings through strategic partnerships. The report also highlights the increasing adoption of generative AI in core care management workflows. It features detailed profiles of major vendors, including Accenture, EviCore, EXL, Cognizant, HCLTech, and others. Supporting sections provide an overview of RadarView methodology, classification criteria, and key contacts.

Why read this RadarView?

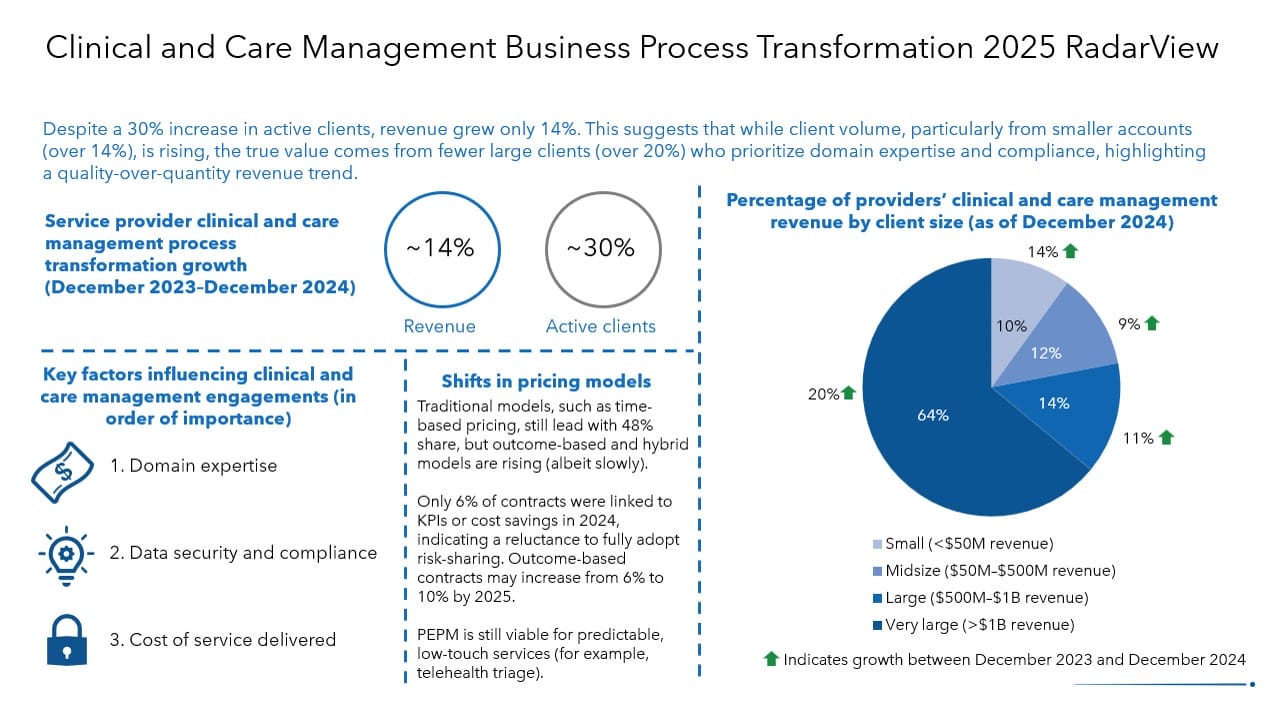

Providers are moving away from traditional utilization management-heavy models. Instead, they are adopting multispecialty teams centered on virtual, preventive, and behavioral care. To tackle workforce shortages, many are investing in training academies, fast-track certifications, and academic collaborations. A significant portion of revenue—64%—is now generated from very large clients, indicating robust demand across market segments. Additionally, service providers are expanding into integrated healthcare ecosystems through partnerships and diversified capabilities. Generative AI is being actively deployed across core functions such as utilization management, case management, and population health, enhancing both efficiency and outcomes.

The Clinical and Care Management Business Process Transformation 2025 RadarView™ aids companies in identifying top service providers to transform their clinical and care management services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for their clinical and care management services transformation.

Featured providers

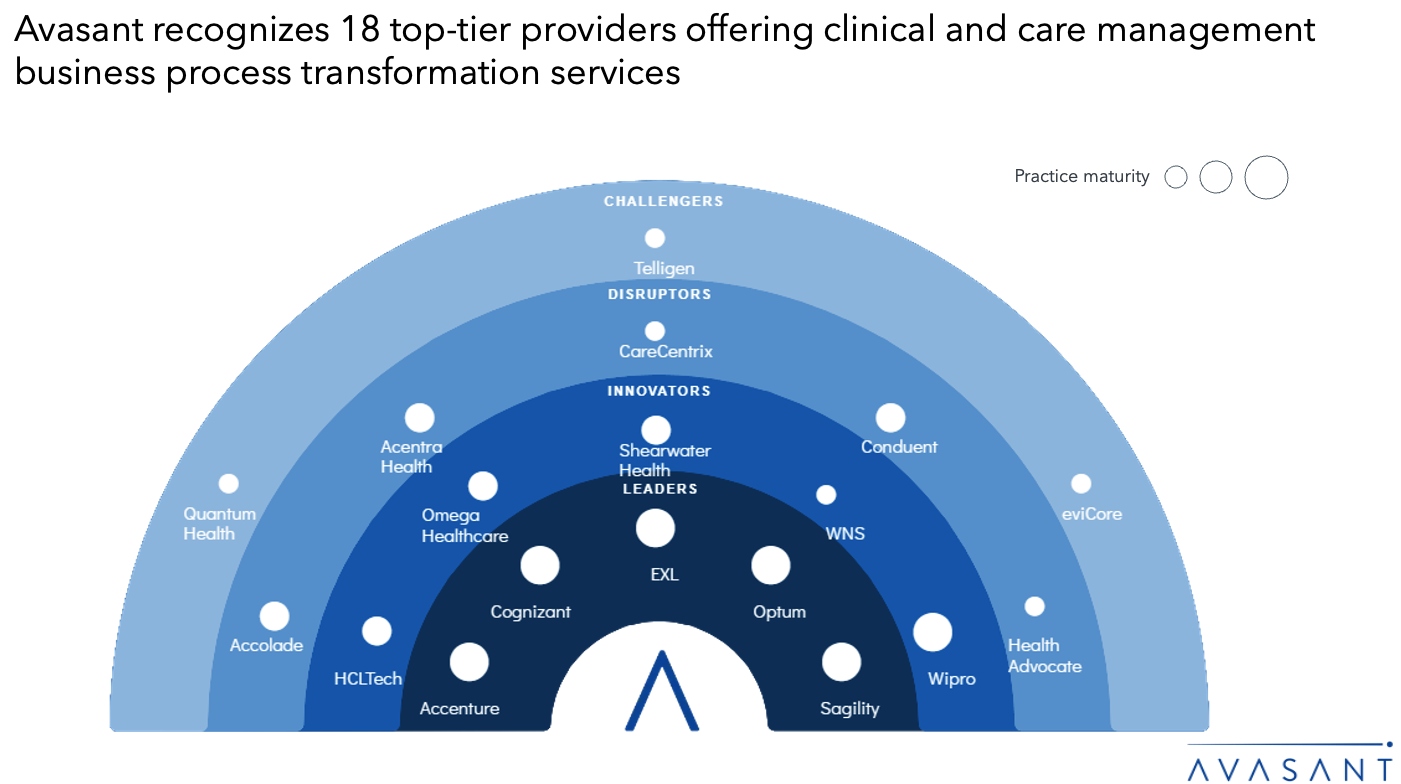

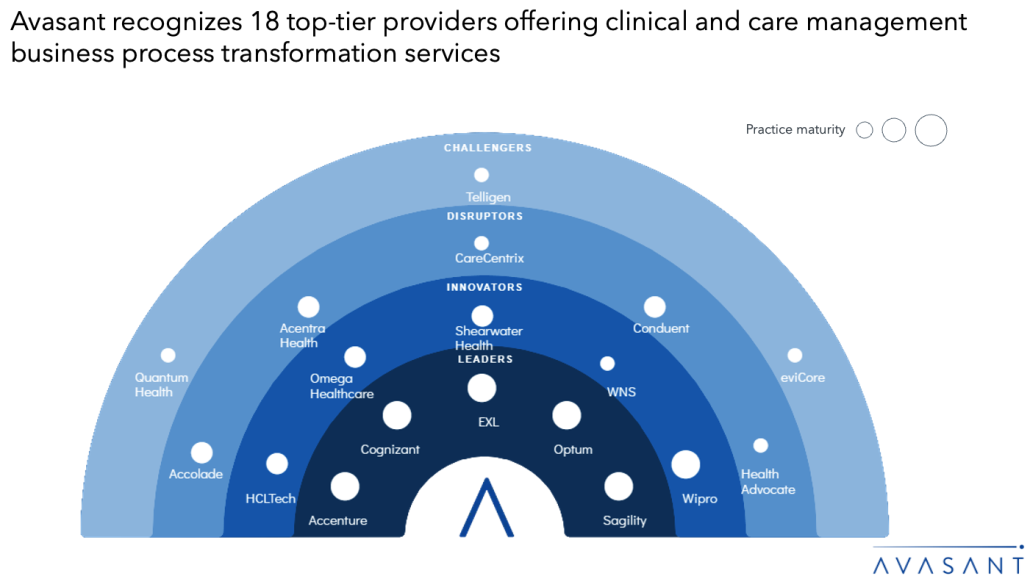

This RadarView includes a detailed analysis of the following service providers offering clinical and care management services: Accenture, Accolade, Acentra Health, CareCentrix, Cognizant, Conduent, , EXL, HCLTech, Health Advocate, Omega Healthcare, Optum, Quantum Health, Sagility, Shearwater Health, Telligen, Wipro, and WNS.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the Clinical and Care Management Services Business Process Transformation 2025 RadarView (Page 3)

Executive summary (Pages 4–8)

-

- Definition and scope of clinical and care management services

- Avasant recognizes 18 top-tier service providers offering clinical and care management business process transformation services

- Provider comparison

Supply-side trends (Pages 9–15)

-

- Workforce realignment reflects a shift from traditional UM-heavy models toward multispecialty teams focused on virtual, preventive, and behavioral care services.

- Providers utilize training academies, accelerated certifications, and institutional partnerships to address critical clinical workforce shortages.

- Revenue is increasingly concentrated among very large clients (64%), with all segments posting positive growth, signaling broad-based demand.

- Providers are expanding beyond traditional offerings into integrated healthcare ecosystems through strategic partnerships and enhanced service capabilities.

- Service providers are implementing generative AI solutions across utilization management, case management, and population health functions.

Service provider profiles (Pages 16–52)

-

- Detailed profiles for Accenture, Accolade, Acentra Health, CareCentrix, Cognizant, Conduent, EviCore, EXL, HCLTech, Health Advocate, Omega Healthcare, Optum, Quantum Health, Sagility, Shearwater Health, Telligen, Wipro, and WNS

RadarView overview (Pages 53–56)

-

- RadarView assessment

- Methodology and coverage

- Interpretation of classification

Key contacts (Page 57)

Read the Research Byte based on this report. Please refer to Avasant’s Clinical and Care Management Business Process Transformation 2025 Market Insights™ for detailed insights on demand-side trends.