Introduction

For decades, the economies of the Gulf Cooperation Council (GCC) countries, Saudi Arabia, Bahrain, Kuwait, Oman, Qatar, and the United Arab Emirates, have been profoundly anchored in hydrocarbon wealth. Historically, oil revenues have constituted a significant portion of these nations’ government incomes. For instance, in 2023, hydrocarbons accounted for 87.1% of Kuwait’s government revenue and 71.9% of Oman’s. Moreover, 64.0% was the weighted average across the GCC bloc. This heavy dependence did not stem from choice alone but from circumstances: arid landscapes limiting agricultural prospects, sparse freshwater resources, and an early comparative advantage in energy exports that hindered economic diversification. With few viable alternatives at the time, oil became both the backbone and the barrier to diversification.

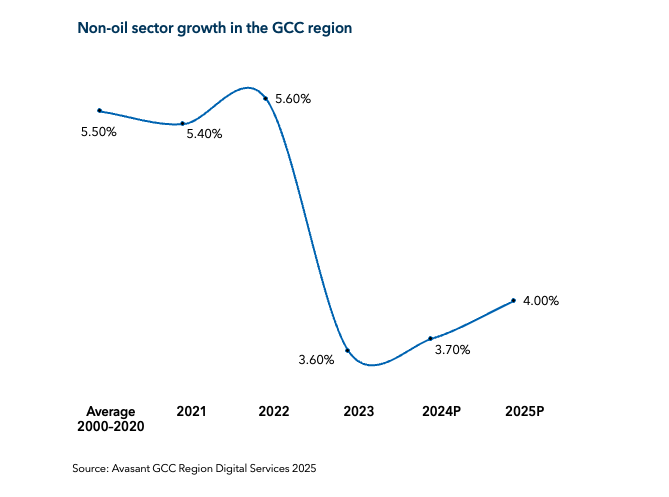

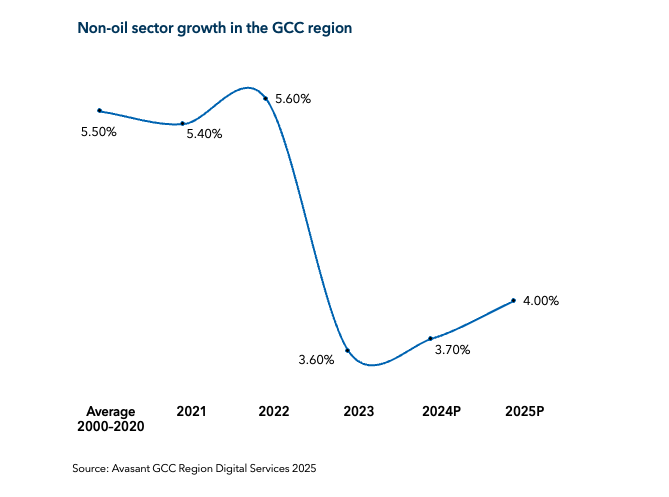

However, in the past few years, things have started to change noticeably and quickly. The GCC region is projected to witness a post-COVID U-shaped recovery in the non-oil sector, complemented by digital transformation initiatives.

Several factors are driving this shift:

-

- Oil market volatility: Brent crude prices fluctuated between $75 and $120 per barrel from 2021 to 2023, challenging fiscal planning and exposing economic fragility.

- Global climate commitments and energy transition: Over 140 countries have pledged net-zero targets, and with fossil fuel demand projected to peak by 2030, the pressure to future-proof economies is intensifying. This is driving a global pivot toward renewables, such as hydrogen, solar, wind, and sustainable fuels, as strategic alternatives to hydrocarbons.

- Digital infrastructure readiness: With large-scale 5G rollouts, sovereign cloud initiatives, and smart city pilots, the GCC has quietly laid the foundation to accelerate AI at scale.

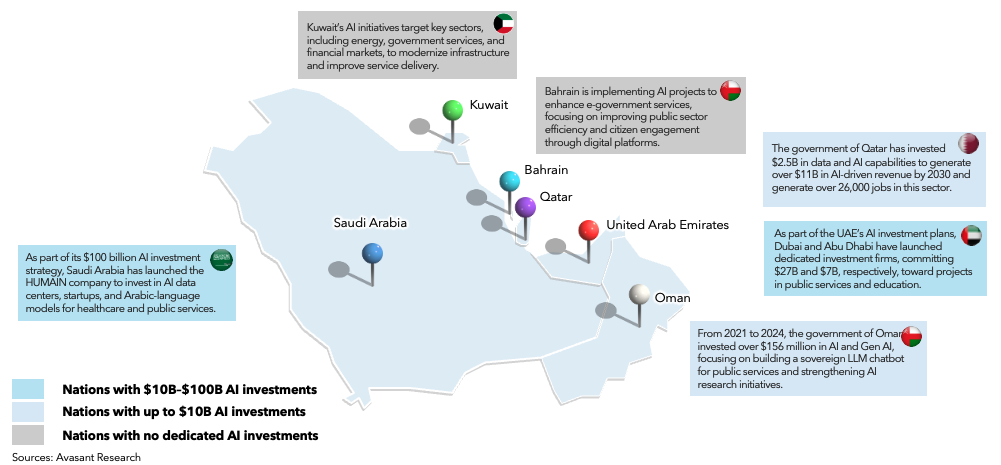

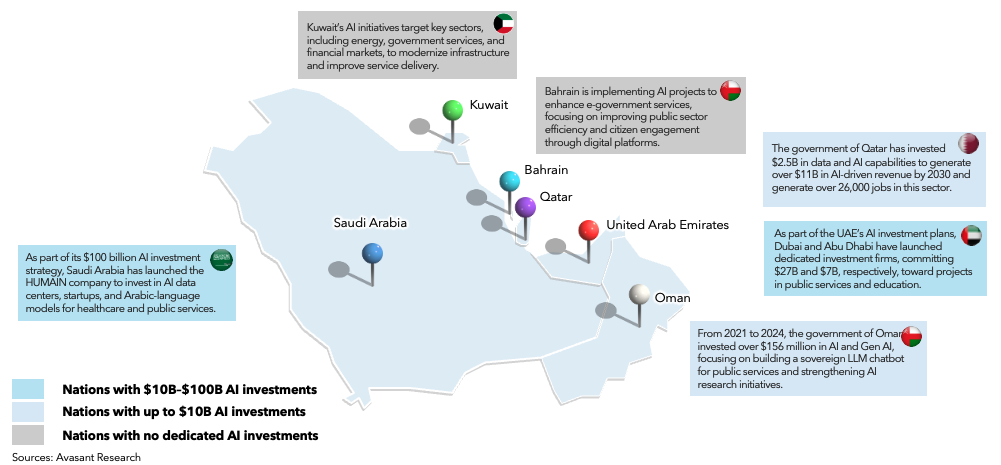

This convergence of fiscal, technological, and environmental urgency has set the stage for a new strategic focus. The global boom in AI, especially generative AI (Gen AI), has offered these nations a fast-moving, capital-intensive frontier where early movers can shape the global narrative. For example, Qatar (Fanar), Saudi Arabia (ALLaM and HUMAIN), and the UAE (Falcon and Jais) have all developed sovereign Arabic-language LLMs to reduce reliance on models trained predominantly on Western data. These initiatives aim to preserve regional culture, language, dialects, and local context in AI systems. The map below highlights major AI investments made across the region over the past year, underscoring the pace and strategic breadth of this shift.

Across the GCC, there is a definitive ambition to evolve into AI-first economies by investing heavily in digital transformation that aligns with national priorities, which include enhancing citizen services and healthcare and boosting human productivity. The UAE and Saudi Arabia are leading the charge. The UAE is deploying AI in unprecedented ways, including drafting legislation with AI assistance. Saudi Arabia is rapidly scaling its AI infrastructure; for instance, it is developing 500MW data centers in partnership with NVIDIA. Meanwhile, countries such as Qatar and Oman are emerging as complementary ecosystems, contributing to a more integrated regional AI landscape.

Enterprises Echo the Same Sentiment

The push toward AI is not confined to governments; leading enterprises across the Gulf region echo the same urgency. With oil revenues historically dominating their balance sheets, many actively seek digital avenues to diversify income and future-proof operations.

With some companies operating for over 50 years, they possess vast archives of proprietary domain data, spanning energy systems, logistics networks, and financial infrastructures. Today, that data is being reevaluated through the lens of Gen AI, transforming it into a strategic asset. The intent is no longer limited to internal productivity and process efficiency. It is also about building IP, commercializing AI platforms, and unlocking non-oil revenue at scale. Reflecting this shift, 85% of enterprises in the GCC plan to increase Gen AI investments in the coming months, signaling a strong alignment with national transformation agendas. Mentioned below are three notable examples:

-

- Saudi Aramco: It is creating a proprietary LLM focused on predictive maintenance and reservoir simulation. The goal is to improve operations and eventually offer AI services to industry clients.

- ADNOC (Abu Dhabi National Oil Company): ADNOC’s ENERGYai Lab uses AI for real-time well optimization, emissions tracking, and equipment failure prediction. The company is also exploring ways to productize its AI capabilities for regional utilities and energy startups.

- e& (formerly Etisalat Group): The UAE-based telecom company is building a consumer-facing Gen AI suite integrated into its digital services, which include personalized content, customer support automation, and a regional language model for fintech and retail sectors. It has also launched partnerships to commercialize AI tools for regional SMEs.

Breaking the Bottlenecks: Addressing Structural Gaps in the GCC’s AI Shift

The GCC’s move from oil dependence to AI-powered economies is not merely a narrative shift; it demands structural transformation across governance, data, talent, and commercialization. The following lays down key roadblocks hindering this transition and the targeted imperatives to resolve them.

Challenges Hindering the Transition

-

- Fragmented AI governance

Unlike the EU, the GCC lacks a unified regulatory framework for responsible AI. Inconsistent national guidelines and fragmented policy efforts across the region result in uncertainty around ethical standards, data privacy, and long-term oversight mechanisms. These impact enterprises operating in regulated domains such as banking, healthcare, and public services, where responsible data use and algorithmic transparency are critical for adoption.

- Siloed data ecosystems

Data localization laws, institutional silos, and limited trust between public-private stakeholders prevent the aggregation of diverse datasets. Without unified data pools, Gen AI models, especially in Arabic and regional contexts, lack the scale and relevance to power city-wide, industry-wide, or cross-border applications.

- Disconnect between national AI visions and enterprise execution

While nations have AI blueprints, they often do not cascade into structured incentives or road maps for private sector adoption. Enterprises, in turn, lack clarity on how to contribute, what regulatory guardrails apply, and how to align internal AI initiatives with long-term national objectives.

- Lack of commercial constructs for homegrown Gen AI assets

As GCC firms develop proprietary LLMs, Arabic-first Gen AI platforms, and embedded tools for regulated domains (for example, compliance copilots and KYC engines), they face a structural gap: no standardized IP protection, licensing models, or validation mechanisms. Without this, high-value assets remain locked in internal use or stalled in legal uncertainty.

- Scarcity of skilled local AI talent

The GCC faces a significant shortage of local AI professionals, with over 95% of employers in the UAE relying on foreign talent due to gaps in advanced AI/ML expertise. This dependency limits regional self-sufficiency and slows innovation.

Strategic Priorities to Accelerate AI Leadership

-

- Institutionalize AI governance

Governments must establish national AI oversight councils that include regulators, technical experts, and industry leaders. These bodies should define risk-based compliance standards, enforceable audit protocols, and ethical thresholds, ensuring that national AI ambitions are grounded in responsible, scalable implementations.

- Launch sovereign data exchanges to unlock public value

They must build regulated, state-backed platforms for secure and anonymized data sharing across ministries, enterprises, and academia. These exchanges will accelerate Gen AI innovation in critical sectors such as energy, healthcare, and government while maintaining compliance and public trust.

- Embed AI strategy into industrial and sectoral policy

They must embed AI targets into economic diversification plans and offer aligned incentives such as AI adoption tax credits, public procurement for enterprise AI tools, and national sandboxes for regulated experimentation. This will translate vision into measurable enterprise outcomes.

- Establish AI commercialization sandboxes and licensing pathways

They should build national AI testbeds for product validation, fast-track certification for enterprise-built solutions, and introduce standardized IP protection and licensing models. This will enable enterprises to scale Arabic-first Gen AI platforms through APIs, marketplaces, and regional distribution agreements.

-

- Emphasize AI education and knowledge transfer The UAE has taken a bold step by making AI education mandatory across all public school grades from the 2025–2026 academic year, setting a regional precedent. However, developing an effective curriculum and delivering complex AI concepts to young learners remains a significant challenge. If the UAE succeeds, it could create a replicable playbook for other GCC nations. Meanwhile, the broader region can complement such efforts by introducing targeted incentives to attract global AI talent, emphasizing knowledge transfer, and upskilling the local workforce.

By Chandrika Dutt, Research Director, Avasant, and Abhisekh Satapathy, Principal Analyst, Avasant