The finance and accounting (F&A) BPO industry is navigating a dynamic phase marked by rapid technological advancements, evolving regulatory landscapes, and shifting client expectations. Service providers are adopting advanced technologies such as AI, ML, and RPA to automate routine tasks, improve compliance accuracy, and deliver financial insights. Meanwhile, regulatory changes are pushing for more stringent reporting and data transparency, compelling providers to innovate in governance and risk management practices. These developments are fueling the demand for F&A BPO services that enable organizations to achieve cost optimization, scalability, and strategic decision-making, evidenced by about a 13% growth in service providers’ revenue.

Both demand- and supply-side trends are covered in Avasant’s Finance and Accounting Business Process Transformation 2024–2025 Market Insights™ and Finance and Accounting Business Process Transformation 2024–2025 RadarView™, respectively. These reports present a comprehensive study of the F&A process services industry and closely examine the market leaders, innovators, disruptors, and challengers. They also provide a view into key market trends and developments impacting the F&A services space.

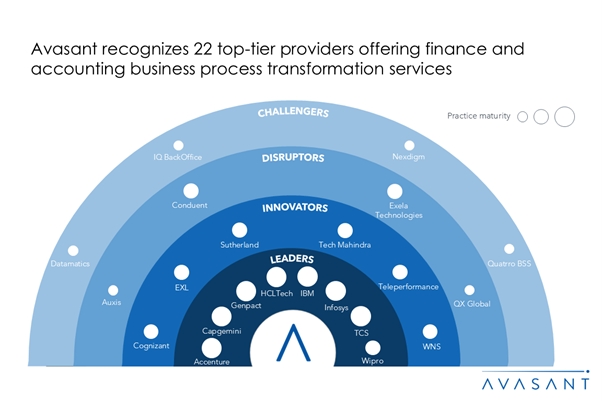

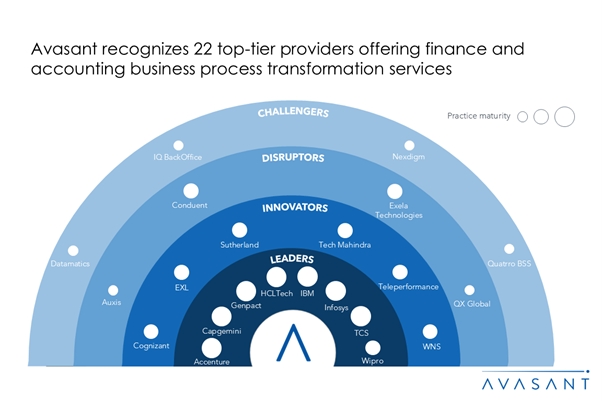

Avasant evaluated 45 service providers across three dimensions: practice maturity, domain ecosystem, and investments and innovation. Of the 45 providers, we recognized 22 that brought the most value to the market during the past 12 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, Genpact, HCLTech, IBM, Infosys, TCS, and Wipro

- Innovators: Cognizant, EXL, Sutherland, Tech Mahindra, Teleperformance, and WNS

- Disruptors: Auxis, Conduent, Exela Technologies, QX Global

- Challengers: Datamatics, IQ BackOffice, Nexdigm, Quatrro BSS

Figure 1 below from the full report illustrates these categories:

“The emergence of advanced technologies, such as generative AI & ML, is leading to fundamental changes in the way F&A services are delivered,” said Shobhit Patnaik, partner at Avasant. “Increased importance of domain understanding coupled with the ability to understand and implement technology at the operating levels has become paramount to delivering incremental value to the client’s business.”

The reports provide a number of findings, including the following:

-

- Generative AI is driving automation, scalability, ROI, compliance, and employee upskilling. Due to shifting market dynamics, demand is rising for services such as financial planning, ESG reporting, and risk management.

- Transaction-heavy industries are driving F&A outsourcing demand, prioritizing industry-specific solutions that deliver business value over transactional efficiency.

- Service providers saw a 13% revenue growth, driven largely by transactional processes. Over 70% came from large clients (over $1B revenue), with North America leading contributions.

- Transaction-based pricing is the most popular model but output-based and hybrid models are growing. To stay competitive, providers focus on acquisitions, new solutions, training, and scaling practices.

“Economic volatility and increasing pressure to enhance operational efficiency have driven organizations to seek innovative solutions in F&A outsourcing,” said Aditya Jain, research leader with Avasant. “This has led to an increase in industry-specific solutions that can meet the specific requirements of clients.”

The Finance and Accounting Business Process Transformation 2024–2025 RadarView™ features detailed profiles of 22 service providers, along with their solutions, offerings, and experience in assisting enterprises and individuals in their F&A journey.

This Research Byte is a brief overview of the Finance and Accounting Business Process Transformation 2024–2025 Market Insights™ and Finance and Accounting Business Process Transformation 2024–2025 RadarView™. (Click for pricing.)