The finance and accounting (F&A) outsourcing industry is now in a phase defined by the widespread operational deployment of advanced technologies, with providers moving beyond early-stage pilots to embed AI, Gen AI, ML, and intelligent automation into live delivery environments, driving measurable impact in efficiency, accuracy, and insights. This shift toward AI-native automation and analytics is reducing manual effort, accelerating reporting, and supporting more informed and strategic decision-making. Talent shortages and skills gaps are prompting organizations to partner with service providers for access to both technology and specialized finance expertise, while nearshoring and diversified delivery models are gaining traction, enabling enterprises to balance cost, agility, and collaboration.

Both state of the market and supply-side trends are covered in Avasant’s Finance and Accounting Business Process Transformation 2025–2026 Market Insights™ and Finance and Accounting Business Process Transformation 2025–2026 RadarView™, respectively. These reports present a comprehensive study of the F&A services industry and closely examine the market leaders, innovators, disruptors, challengers, and tech pioneers. They also provide a view into key market trends and developments impacting the F&A services space.

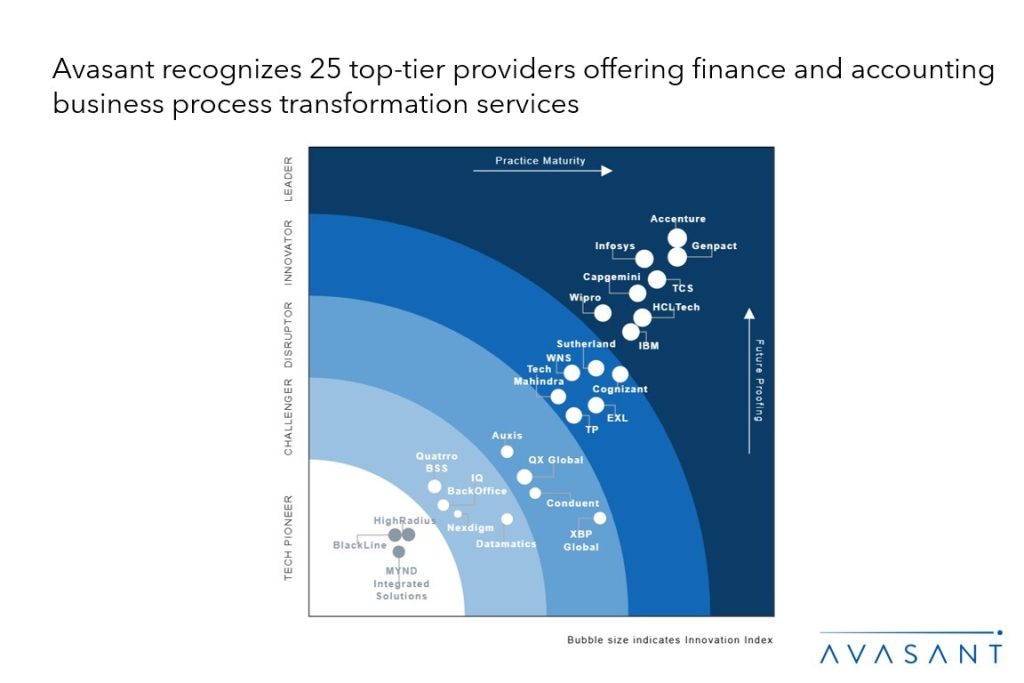

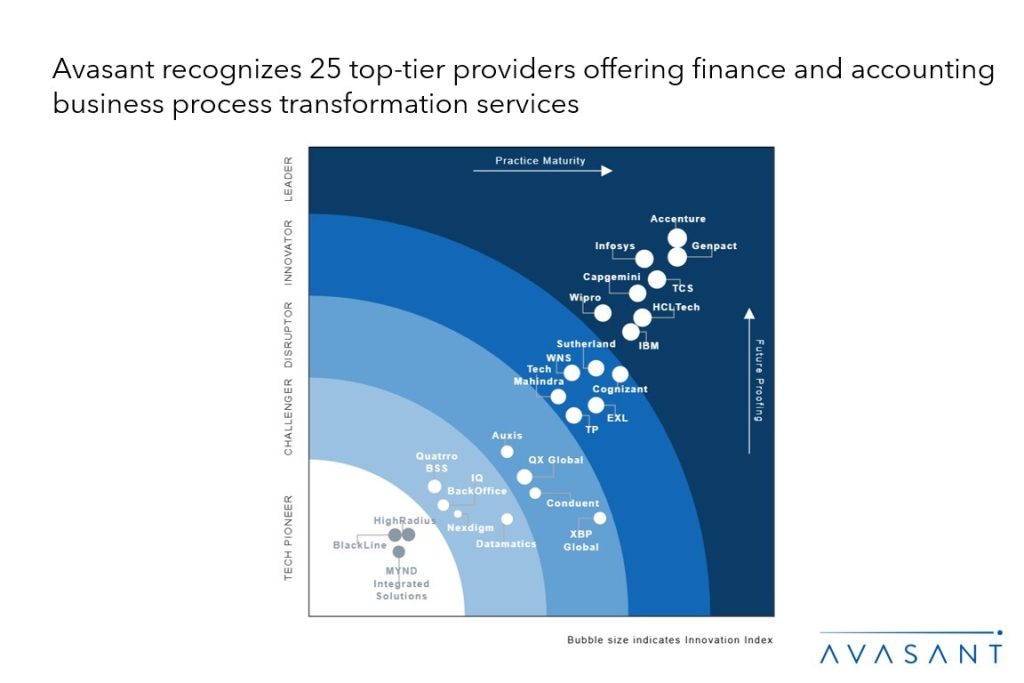

Avasant evaluated over 50 service providers across two dimensions: practice maturity and future proofing. Of the 50 providers, we recognized 25 that brought the most value to the market over the past 12 months.

The report recognizes service providers in five categories:

-

- Leaders: Accenture, Capgemini, Genpact, HCLTech, IBM, Infosys, TCS, and Wipro

- Innovators: Cognizant, EXL, Sutherland, Tech Mahindra, TP, and WNS

- Disruptors: Auxis, Conduent, Exela Technologies, and QX Global

- Challengers: Datamatics, IQ BackOffice, Nexdigm, and Quatrro BSS

- Tech pioneers: BlackLine, HighRadius, and MYND Integrated Solutions

Figure 1 below from the full report illustrates these categories:

“The rapid integration of generative AI, agentic AI, and automation is reshaping how F&A services are executed and valued,” said Shobhit Patnaik, partner at Avasant. “Clients now expect not just efficiency and accuracy, but proactive insights, predictive decision support, and measurable business outcomes from service providers.”

The reports provide a number of findings, including the following:

-

- Clients are seeking greater predictability in outcomes, leading to gradual growth in outcome- and KPI-based pricing, while hybrid and transaction-based models remain the backbone of F&A engagements.

- GCCs are rapidly gaining share as enterprises shift budgets away from internal F&A teams to improve cost flexibility, scalability, and retain strategic control.

- A shrinking finance talent pipeline is accelerating offshoring, automation, and demand for specialized, technology-enabled F&A providers over labor-centric models.

- Providers are prioritizing productivity over head count growth, keeping workforce growth low (3%) while increasing digital FTEs by 17% as automation and AI take on more work.

“Amid economic uncertainty and rising efficiency demands, F&A providers are delivering tailored solutions beyond traditional outsourcing,” said Aditya Jain, research leader with Avasant. “Those combining AI-driven platforms with industry-specific expertise are delivering more outcome-oriented, value-focused F&A engagements.”

This RadarView features detailed profiles of 25 service providers, along with their solutions, offerings, and experience in assisting enterprises and individuals in their F&A journey.

This Research Byte is a brief overview of Avasant’s Finance and Accounting Business Process Transformation 2025–2026 Market Insights™ and Finance and Accounting Business Process Transformation 2025–2026 RadarView™.(Click for pricing.)