The global IT services industry is evolving beyond traditional scale-based competition toward a capability-centric paradigm where private equity (PE)-backed midtier digital service firms are emerging as strategic contenders. The tech services industry has, over the last couple of decades, grown on the back of labor scale-up and global presence.

As the landscape shifts with AI infusion across enterprises, midtier firms with better operational control, access to capital, and the ability to align sales and delivery incentives are better positioned to deliver value to enterprises. Once overshadowed by global IT service providers, these firms are now emerging as strategic consolidators, with PE firms’ help, and leveraging acquisitions to rapidly build advanced digital engineering, AI, cloud, and analytics capabilities.

Before the Pivot: When Midtier IT Services Firms Were Executors, Not Innovators

Back in the day, enterprises across industries viewed midtier IT services firms largely as tactical partners rather than strategic ones. They were often seen through a narrow lens, operating in fragmented market pockets, struggling to keep pace with emerging technologies, facing shortages of skilled talent, and carrying technical debt. Most midtier firms were engaged for scoped programs such as application maintenance, incremental cloud migrations, testing, or staff augmentation—where predictability and cost efficiency outweighed strategic depth.

Today, that perception is changing fundamentally. With private equity entering the equation, midtier firms are being reengineered for a digital-first economy. Through consolidation via M&A, acquisition of scarce talent, and modernization of their core, these firms are repositioning themselves as strategic digital partners in next-generation technologies, rather than merely cost-effective alternatives. At Avasant, we have been proactively identifying and highlighting these firms as Tech Innovators and Tech Pioneers. As we have observed, hyperscalers are developing domain-specific capabilities, while industry and business players are simultaneously building technology platforms to serve cross-enterprise needs.

Drivers of Midtier Digital Engineering Consolidation

As digital demand accelerates across industries, enterprises are moving away from traditional delivery models and seeking partners that offer deep engineering expertise. Hence, building these capabilities in-house is often slow, expensive, and uncertain, prompting these enterprises to partner with specialist firms to obtain niche skills and deep domain expertise.

At the same time, private equity firms are evolving from passive financiers into active value architects. Therefore, rather than backing scale alone, they are shaping differentiated, next-generation IT service providers by investing in digital engineering and AI-first capabilities, enabling midtier IT services firms to break through growth ceilings, move up the value chain, and become strategic partners for enterprises.

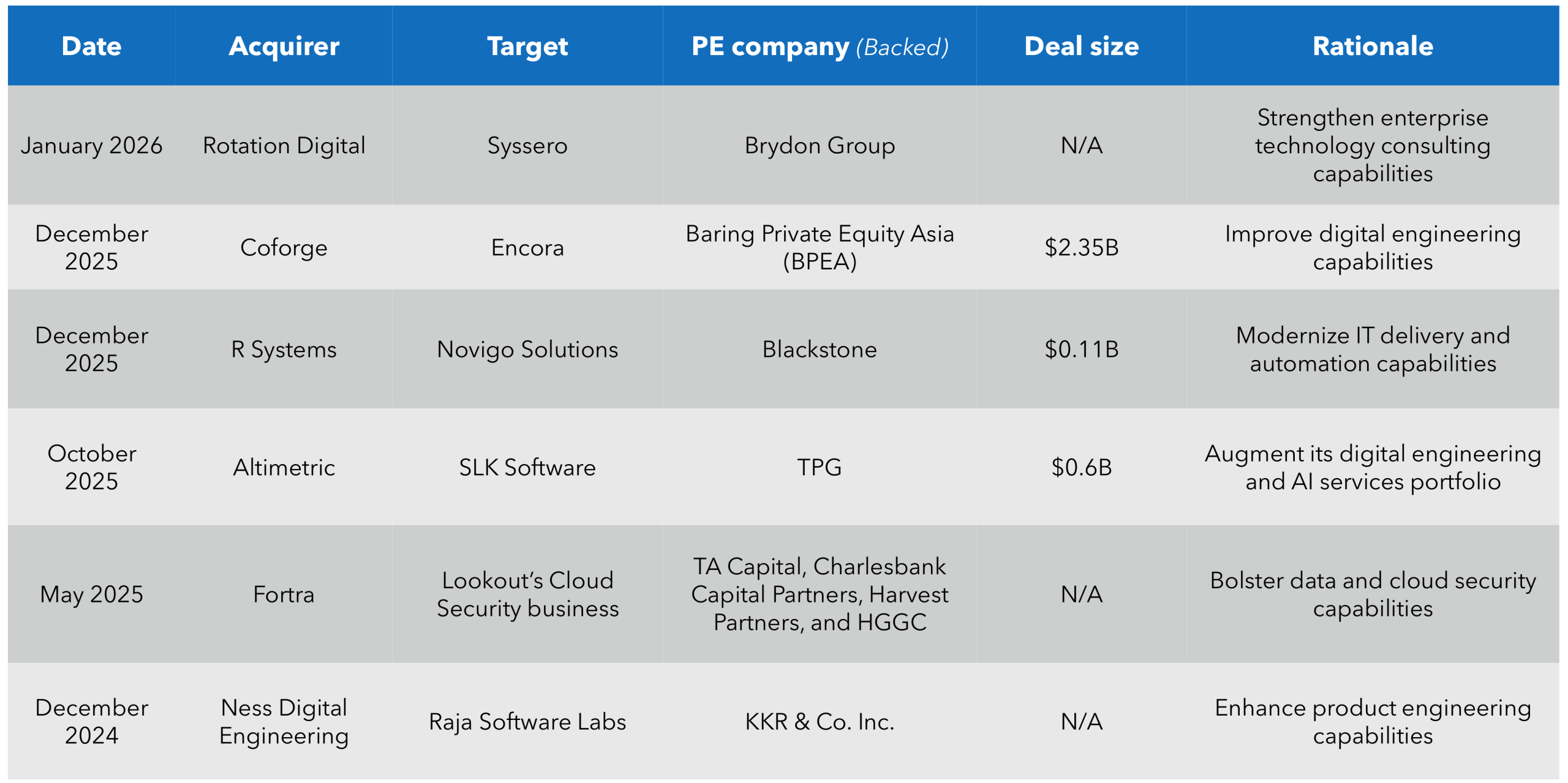

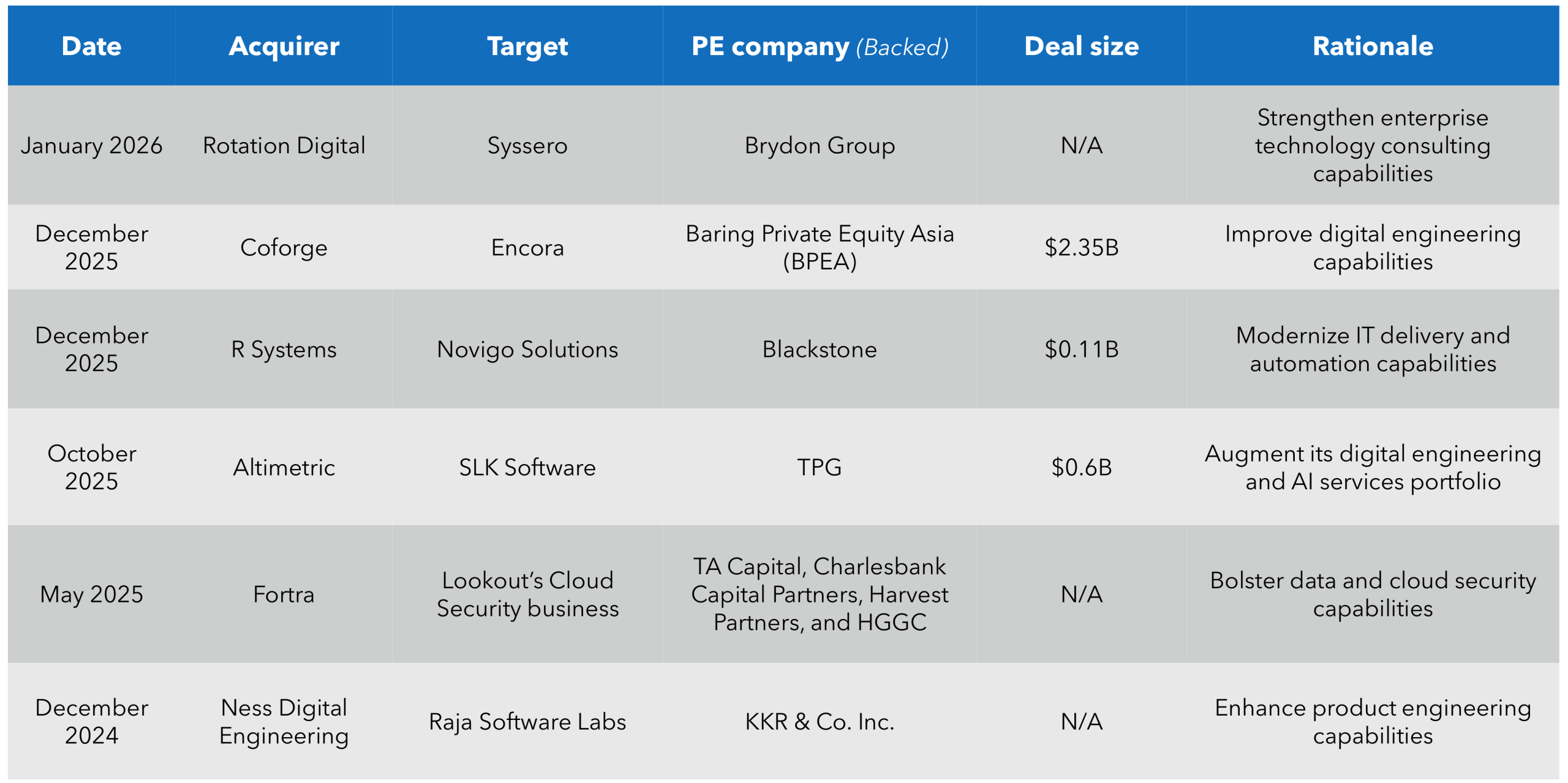

Recent examples:

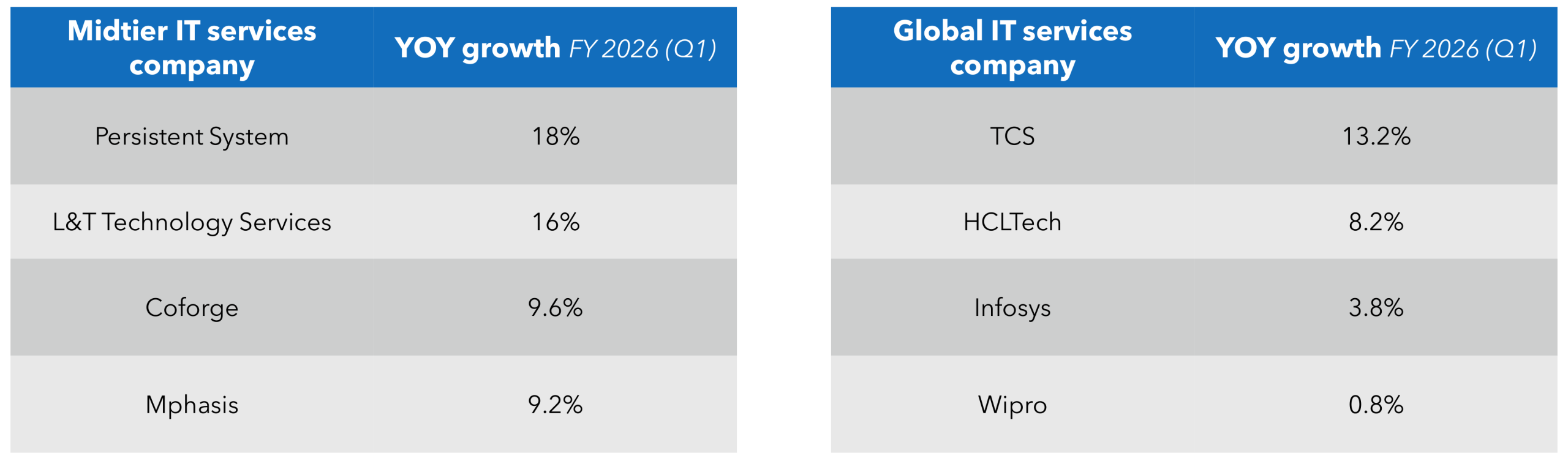

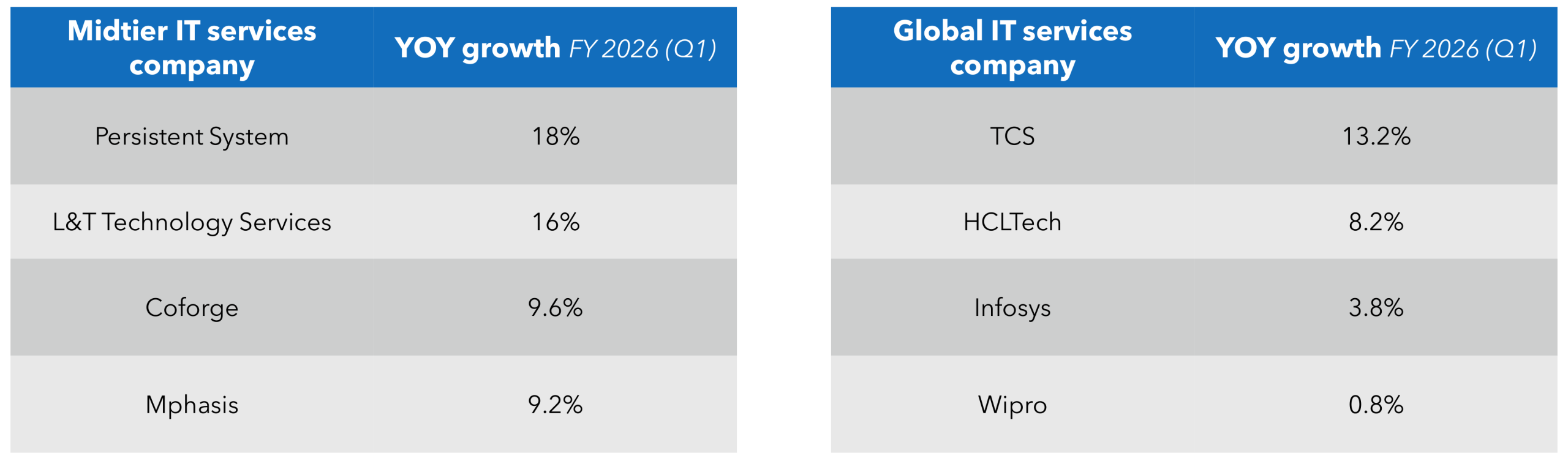

How Is This Shift Being Observed in Contrast to a Global IT Services Company?

With growth capital and a focus on building differentiated IT capabilities through M&A, these midtier firms are moving vertically (rather than growing horizontally) into domains such as cloud-native engineering, data engineering platforms, AI-led modernization, cybersecurity, and industry-specific SaaS. This has enabled them to become domain-led digital specialists, with sharper value propositions and faster go-to-market cycles.

Whereas global IT services companies are transforming from a position of scale and incumbency, they continue to dominate large, enterprise-wide transformation mandates, and their size and portfolio breadth make them inherently more measured in their approach to change. Therefore, midtier firms are becoming “digital-first and AI-first by design,” assembling capability stacks through focused acquisitions and niche leadership, while global players are “digitizing at scale,” embedding new technologies across vast legacy portfolios.

For enterprises, this creates a new buying dynamic. Global firms anchor complex, multiyear transformations, while PE-backed midtier firms increasingly win high-impact, domain-specific deals that demand speed, agility, specialization, and outcome orientation.

Conclusion: The Age of Depth and Specialists and Not Generalists

From Avasant’s perspective, PE-backed midtier IT services firms are growing through acquisitions that add industry knowledge and drive innovation. This trend points to market consolidation, stronger industry focus, and better operational efficiency—a key change in the IT services sector. It helps these firms build digital skills with emerging technologies. PE funding supports the development of agentic and generative AI solutions for enterprises. The growth of these midtier players will reshape the IT landscape in several ways, including the following:

-

- Increased competition as PE-backed midtier firms acquire complementary businesses to compete with global IT services firms.

- Focus on specialization is driving high-value offerings rather than one-size-fits-all, as midtier firms strengthen their digital capabilities in specialized technologies such as cloud, AI, SaaS, digital engineering, and cybersecurity.

- PE firms are infusing operational rigor in midtier IT firms, enhancing professional management, data-led decisions, and scalable models often anchored in GCCs for cost and talent advantage.

- Accelerating the technology adoption across the portfolio, creating lean, and competing on capability, not just cost.

At Avasant, we expect this shift to help enterprises in various industries by speeding up time-to-market with better operations, building stronger long-term technology plans using advanced capabilities from midtier IT specialists, and cutting costs by avoiding trial-and-error approaches. It reduces risks in transformations while producing better results and more innovation for the money spent, thanks to the specialists’ deep industry knowledge. At the same time, more competition among IT service providers raises service quality and tightens pricing. This gives enterprises better value and stronger strategic benefits from each project.

By Amar Verma, Lead Analyst, and Sahaj Kumar, Research Director, Avasant