The pandemic has accelerated the need for digitization to achieve growth in every market segment. With paper-based workflows reducing overall workforce productivity, enterprises are leveraging cognitive technologies to streamline document processing across various departments. Platform providers are transitioning beyond traditional optical character recognition-based data extraction to generate new insights from complex, unstructured data.

These trends, and others, are covered in our Intelligent Document Processing Platforms 2021-2022 RadarView™ . The report is a comprehensive study of intelligent document processing platform providers, including the top trends, analysis, and a close look at the market’s leaders, innovators, disruptors, and challengers.

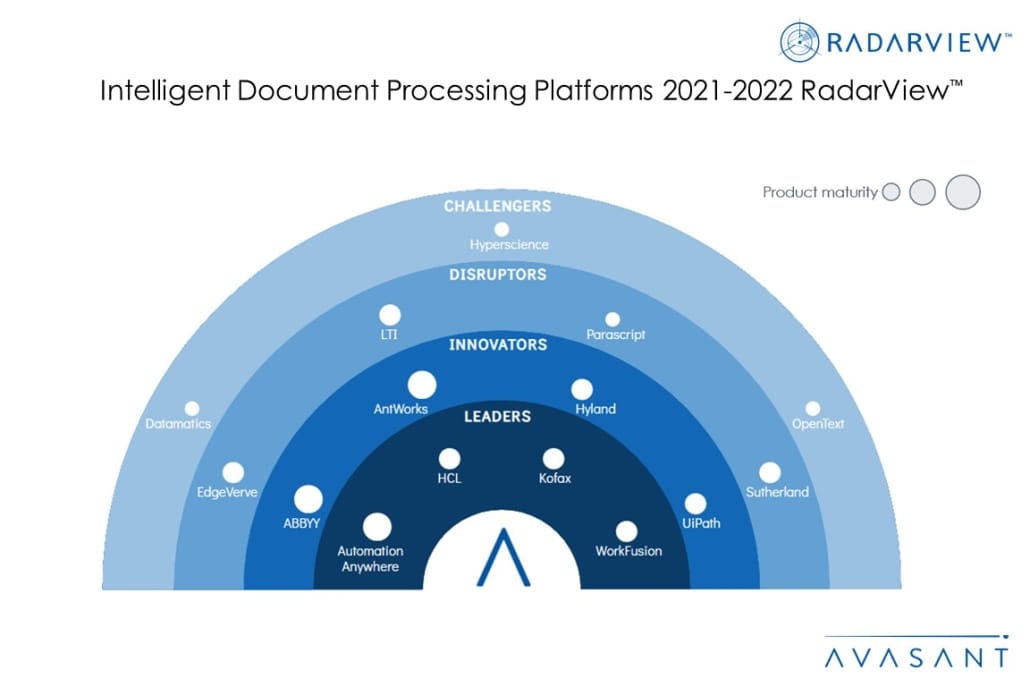

We evaluated 27 platform providers across three dimensions: product maturity, enterprise adaptability, and future readiness. Of those 27 providers, we recognized 15 that have brought the most value to the market during the past 12 months.

The report recognizes platform providers in four categories:

-

- Leaders: Automation Anywhere, HCL, Kofax, and WorkFusion

- Innovators: ABBYY, AntWorks, Hyland, and UiPath

- Disruptors: EdgeVerve, LTI, Parascript, and Sutherland

- Challengers: Datamatics, Hyperscience, and OpenText

Figure 1 from the full report illustrates these categories:

Anupam Govil, partner and digital practice lead at Avasant, congratulated the winners noting, “The role of IDP has expanded from data extraction to insights generation, increasing the scope of automation initiatives. This is a vital cog in the hyperautomation wheel. An intelligent automation platform with natively integrated IDP can deliver faster processing and end-to-end automation.”

Some of the findings from the full report include the following:

-

- Rapid digitization accelerated by the pandemic is driving growth in every market segment.

- The IDP industry saw nearly 11% annual growth in client engagements in 2021. While unstructured data extraction is the single largest use case, it still comprises less than 30% of total IDP workflows.

- Owing to paper-intensive workflows, banking and financial services are the biggest consumer of IDP platforms with nearly 26% market share, followed by healthcare and life sciences and insurance.

- North America continues to be the largest market for IDP. However, an increasing demand for multilingual document processing is driving growth in Europe, Asia, and Latin America.

- Complex data type extraction is emerging as the key differentiator in IDP platforms.

- Advances in cognitive technologies are enabling enterprises to gain insights from niche datasets, including barcodes/QR codes, watermarks, checkboxes, illustrations, crossed-out fields, borderless tables, signatures, and cursive text.

- Over the next 12–18 months, extraction of more complex data types is on the horizon, including audiovisual elements, faces from IDs, weather data, engineering drawings, and geospatial data.

- Providers are enriching the IDP value chain with cognitive elements.

- Robotic process automation (RPA) providers and service providers are integrating IDP capabilities with their suite of solutions to gain competitive advantage in the industry.

- To enhance complex data extraction, providers are augmenting platform features through cognitive capabilities across the IDP value chain. This includes scanned PDF detection, intelligent document clustering, image baselining, label-less extraction, cognitive searching, anomaly detection, and knowledge generation.

- Cloud enablement and low-code capabilities drive higher enterprise adoption.

- Cloud-based application development for data extraction and processing, model training, and SaaS-based delivery is becoming table stakes as enterprise adoption of IDP platforms is accelerating.

- Sophisticated features such as self-service process designing, multidevice data ingestion, bring-your-own-models, analytical dashboarding, and low-code-based data labeling and model training are enhancing user experience.

- Rapid digitization accelerated by the pandemic is driving growth in every market segment.

“Next-gen IDP platforms have evolved from old school OCR/ICR offerings to deep learning tools to decipher content from low quality documents,” said Abhijeet Pattnaik, senior analyst at Avasant. “Their ability to extract insights from niche data types such as audio and video will be the biggest differentiator in the next 18–24 months.”

The full report also features detailed RadarView profiles of the 15 platform providers, along with their solutions, offerings, and experience in assisting enterprises in their document processing journeys.

This Research Byte is a brief overview of the Intelligent Document Processing Platforms 2021-2022 RadarView™ (click for pricing).