- Management Consulting

- Strategic Sourcing Consulting

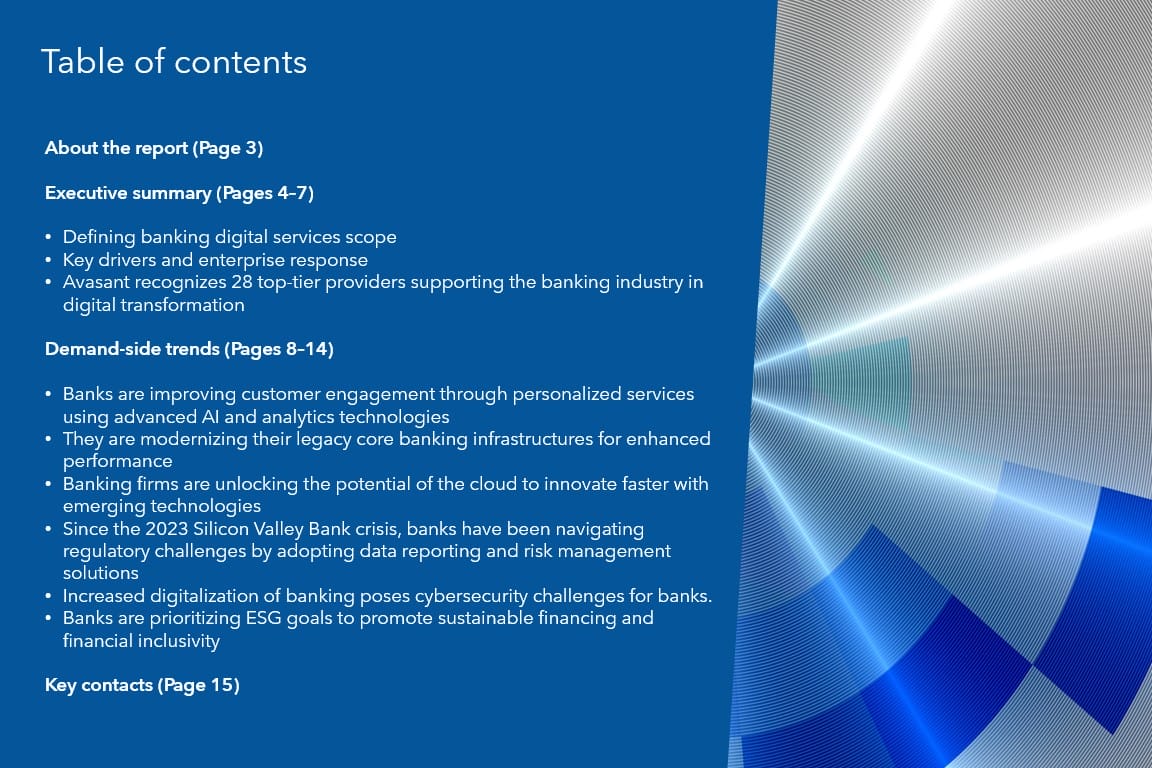

- IT & Digital Transformation Consulting Services

- Business & Process Transformation Consulting Services

- AI Strategy Consulting

- Software Selection Consulting and Vendor Evaluation

- Legal & Transactional Services

- GCC Consulting and Operations

- Vendor Management

- Supply Chain Consulting Services

- Digital Public Infrastructure Consulting

- Procurement Services

- Non-Profit Support Services

- Industries

- Research & Data

- All Reports

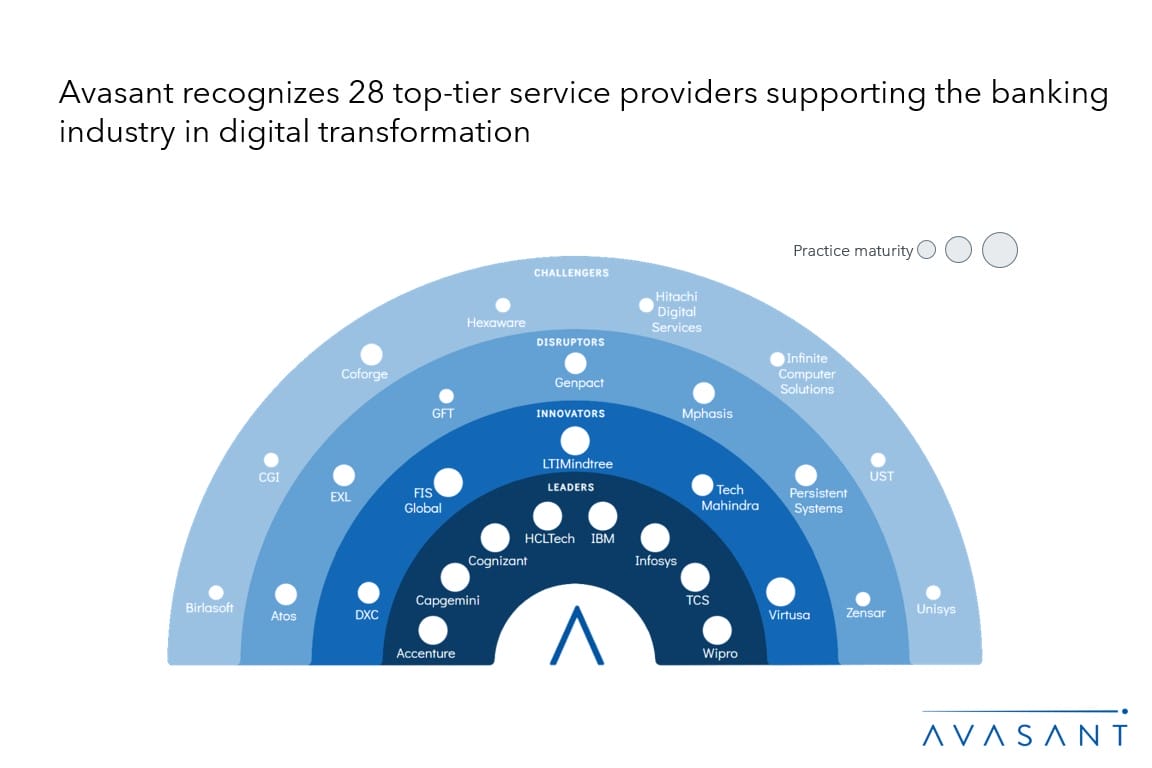

- RadarView™ – Market Assessments

- Business Economics – Human Resources | Finance & Accounting | Procurement Metrics

- Emerging Trends & Predictions

- Avasant Labs

- AvaSense™

- Avasant Copilot

- Global Equations™ Location Intelligence

- IT Spending, Staffing, and Salary Reports

- Computer Economics™ – IT Metrics

- Avasant Tech Innovators

- Industry Economics

- AvaMark™

- Strativa Edge™

- GCC Intelligence

- Benchmarking

- Avasant AI

- Events

- Event Calendar

- Avasant Empowering Beyond Summit 2026

- Avasant Empowering Beyond Executive Roundtable Dubai

- Empowering Beyond Events

- Partner With Avasant Events

- Partner Connect 2025

- Avasant Empowering Beyond Symposium, Bengaluru

- Avasant Foundation Golf Event: Impact the Future 2025

- Executive Spotlight

- About Us

- Contact Us