This RadarView helps banks and financial companies to identify key service providers that can help them digitally transform their banking operations. It begins with a summary of key trends that are shaping the banking process transformation space. We continue with a detailed assessment of 22 providers offering services in the banking process transformation market. Each profile provides an overview of the service provider, its key IP assets for banking processes, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

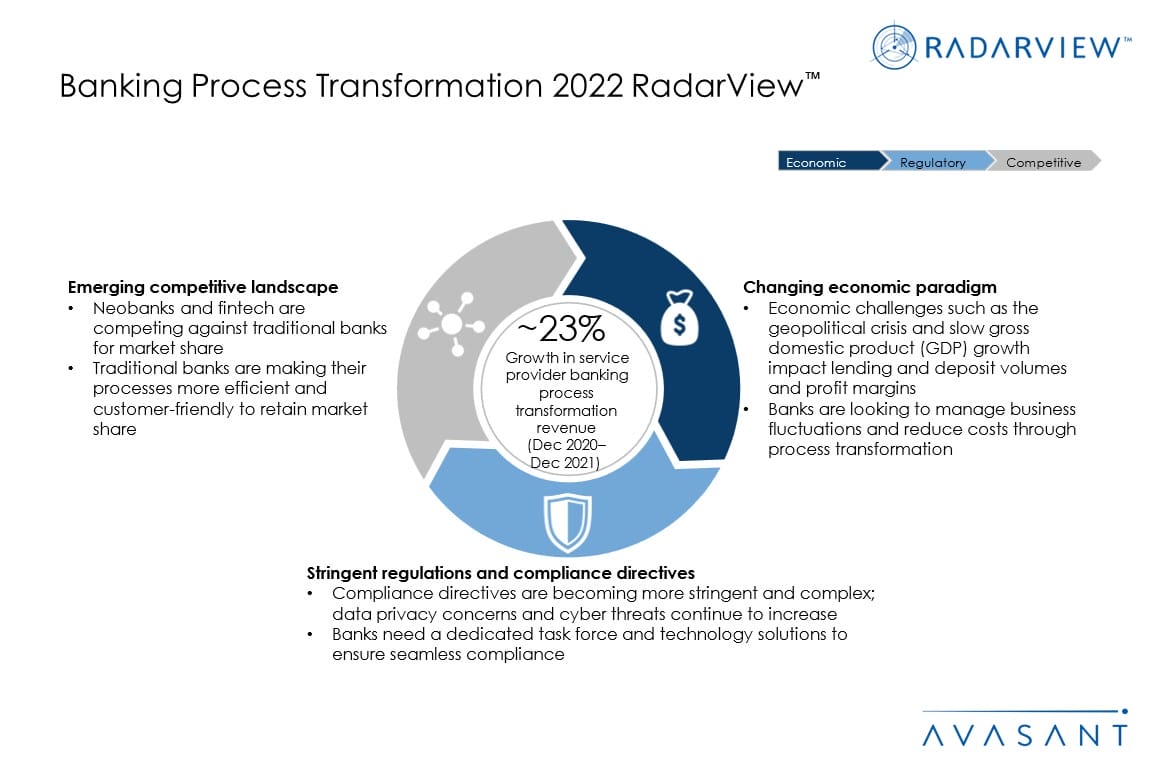

With banking regulations becoming more stringent, banks are struggling with managing complex processes and delivering a seamless customer experience. Further, rising competition in the banking industry is necessitating traditional banks to reimagine their operations for sustaining their market share. Hence, banks are increasingly looking to partner with service providers who bring technology expertise and specialized talent to simplify and standardize their processes for a seamless customer experience.

The Banking Process Transformation 2022 RadarView highlights key banking and service provider trends in the banking process transformation space and Avasant’s viewpoint on them. It aids banks and financial companies in identifying top service providers that can assist them in the digital transformation of their banking operations. It also offers an analysis of each service provider’s capabilities in technology and delivery expertise, enabling organizations to identify the right strategic partners for banking process transformation.

Featured providers

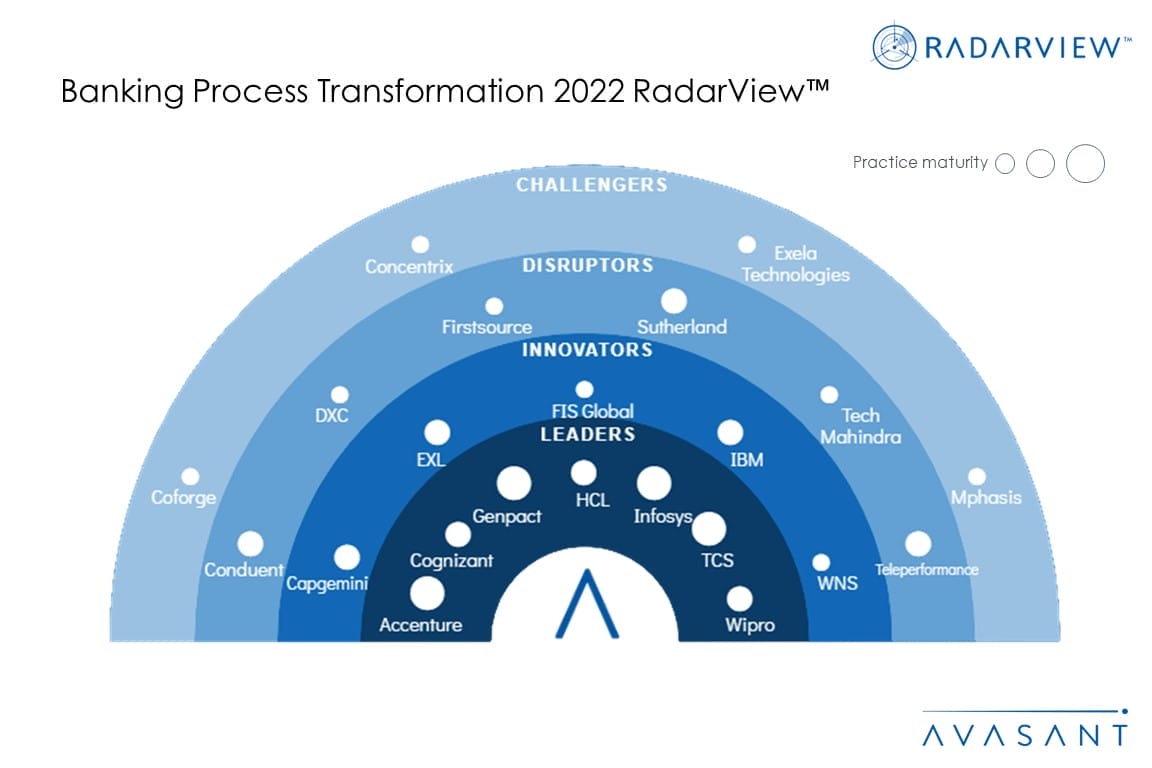

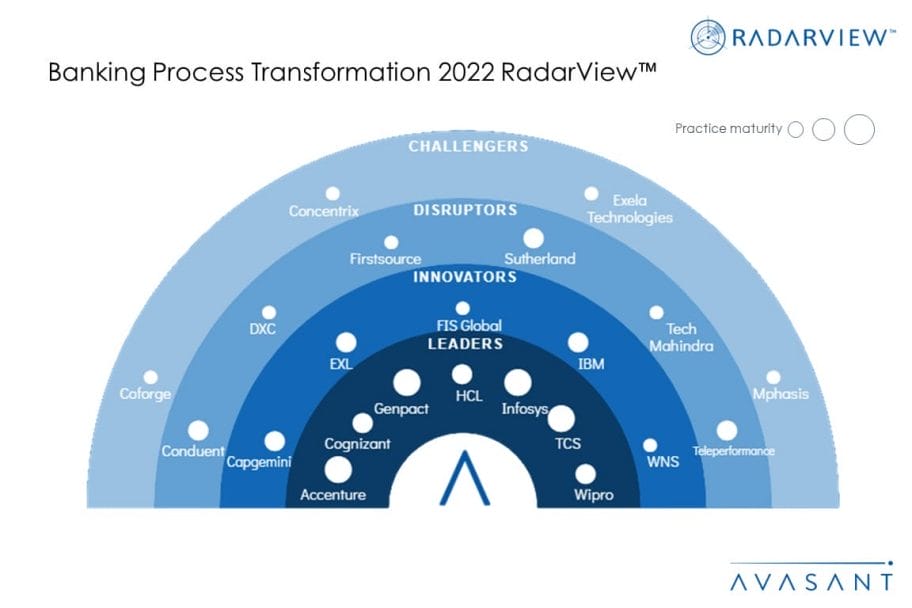

This RadarView includes a detailed analysis of the following banking service providers: Accenture, Capgemini, Coforge, Cognizant, Concentrix, Conduent, DXC Technologies, Exela Technologies, EXL, Firstsource, FIS Global, Genpact, HCL, IBM, Infosys, Mphasis, Sutherland, TCS, Tech Mahindra, Teleperformance, Wipro, and WNS.

Methodology

The industry insights and recommendations are based on our ongoing interactions with enterprise CXOs and other key executives, targeted discussions with service providers, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and our ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 5–8)

-

- Key process transformation trends shaping the banking industry

- Service provider future road map

- Avasant recognizes 22 service providers offering banking process transformation services

Key banking process transformation trends (Pages 9–19)

-

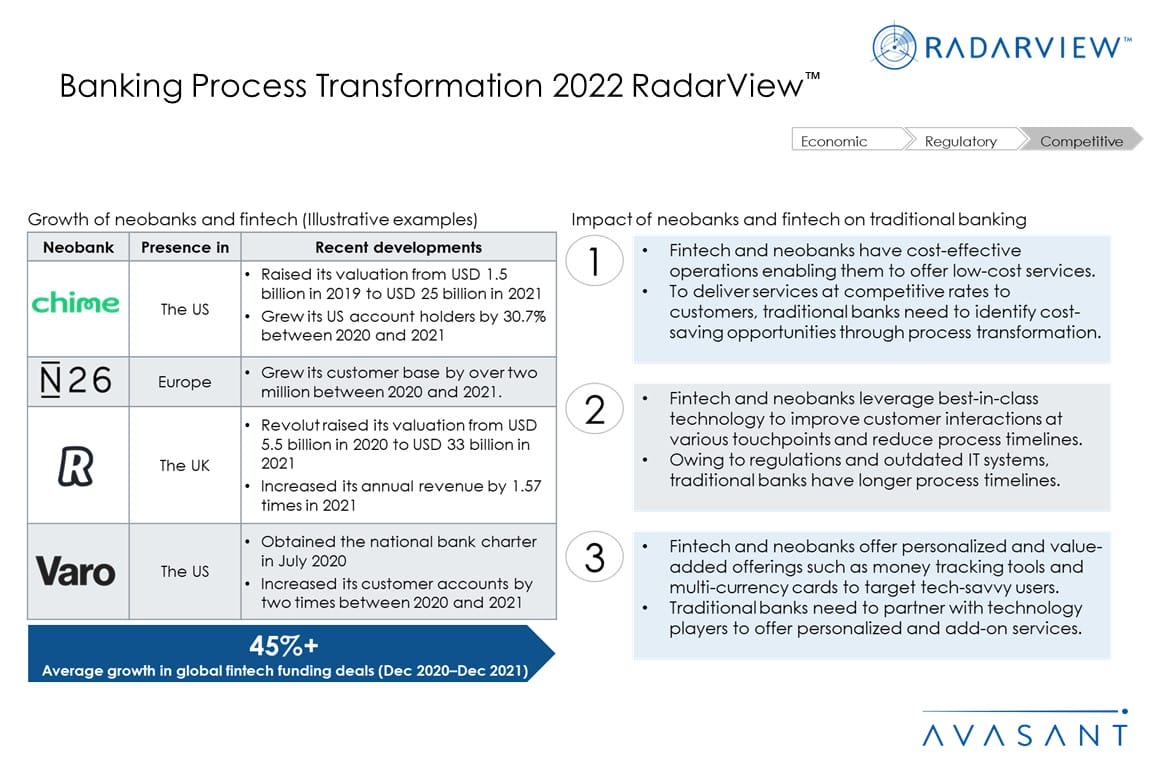

- Growth of banking process transformation is driven by economic, regulatory, and competitive factors

- Difference between outsourcing engagements of traditional banks and neobanks

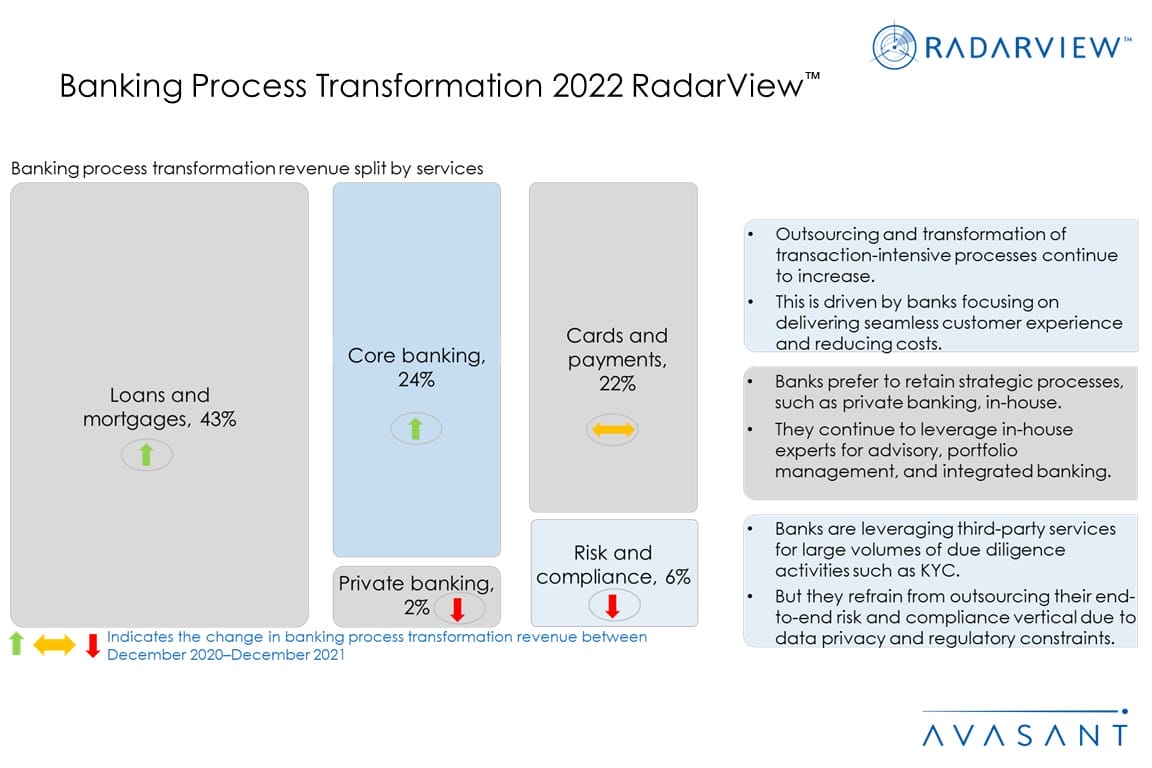

- Loans and mortgage services are leading process transformation demand

- Banks are transforming their core banking processes for improving customer service

- Banks are witnessing growth of instant payments and new-age financing schemes

- Emerging technologies have become a crucial part of banking process transformation deals

Service provider road map (Pages 20–24)

-

- Investments in BPaaS-led delivery models

- Focus on emerging pricing models

- Expansion of delivery footprint

- Focus on domain and digital training

RadarView overview (Pages 25–30)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 31–75)

Detailed profiles for Accenture, Capgemini, Coforge, Cognizant, Concentrix, Conduent, DXC Technologies, Exela Technologies, EXL, Firstsource, FIS Global, Genpact, HCL, IBM, Infosys, Mphasis, Sutherland, TCS, Tech Mahindra, Teleperformance, Wipro, and WNS.

Key contacts (Page 77)

Read the Research Byte based on this report.