This report provides a view into the emerging landscape of blockchain technology and highlights key developments and best practices in this space. It also aids in identifying the right service providers that enterprises can partner with to enable digital transformation for their blockchain initiatives.

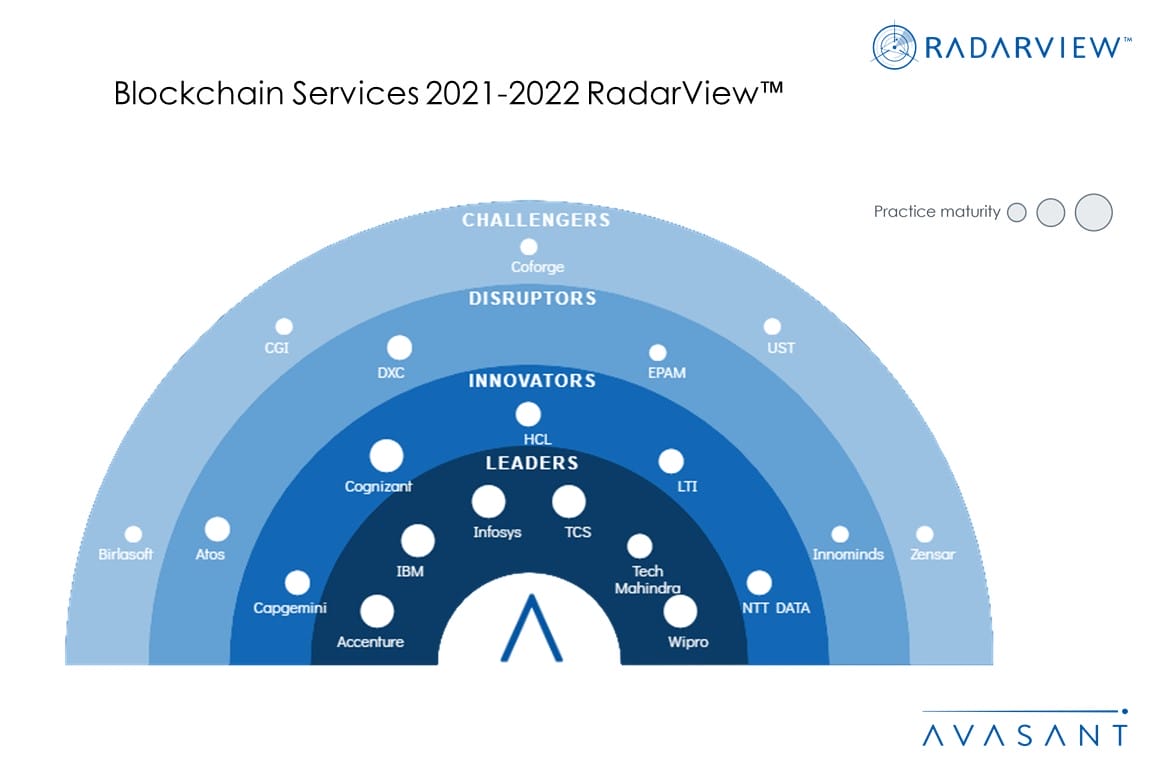

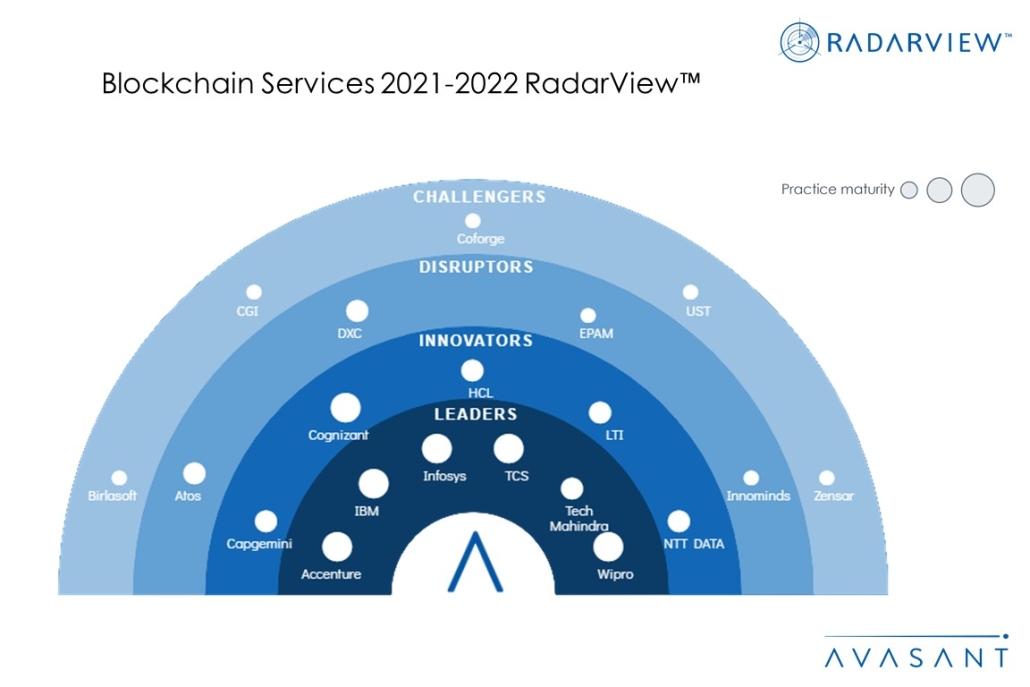

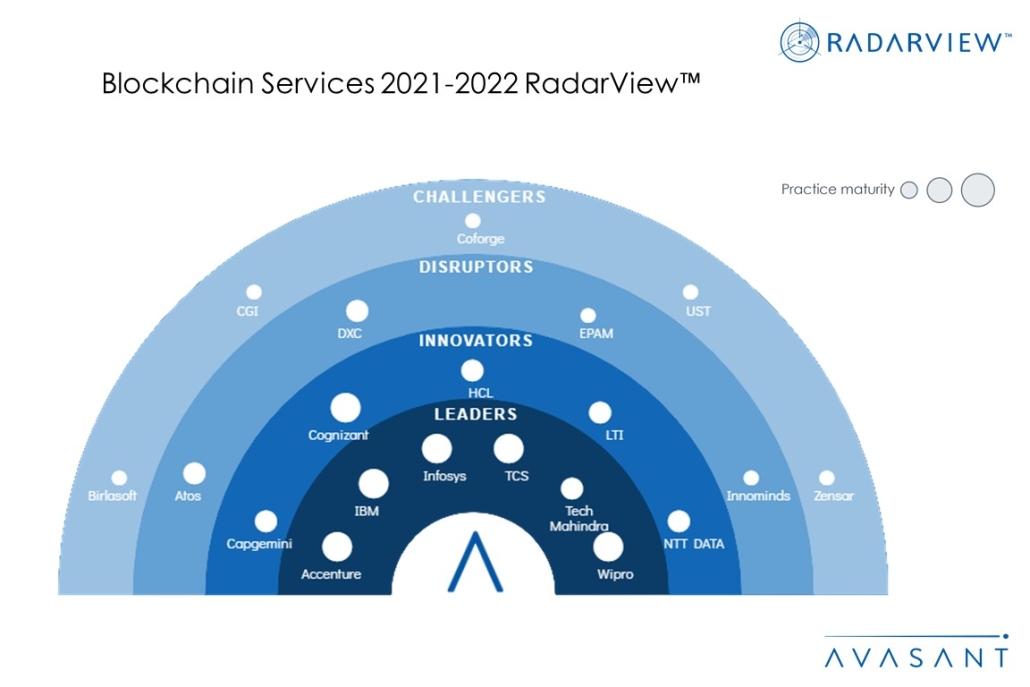

We continue with a detailed assessment of 20 service providers offering blockchain services. Each profile provides an overview of the service provider, their blockchain services capabilities and solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

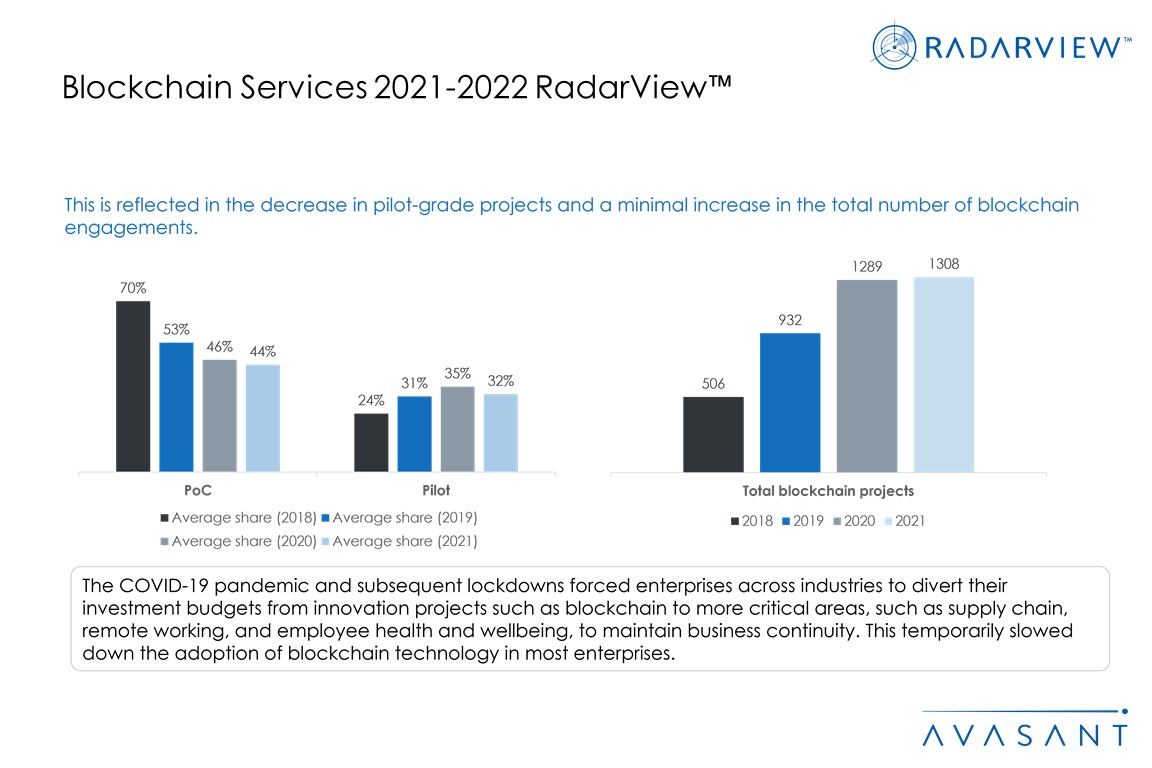

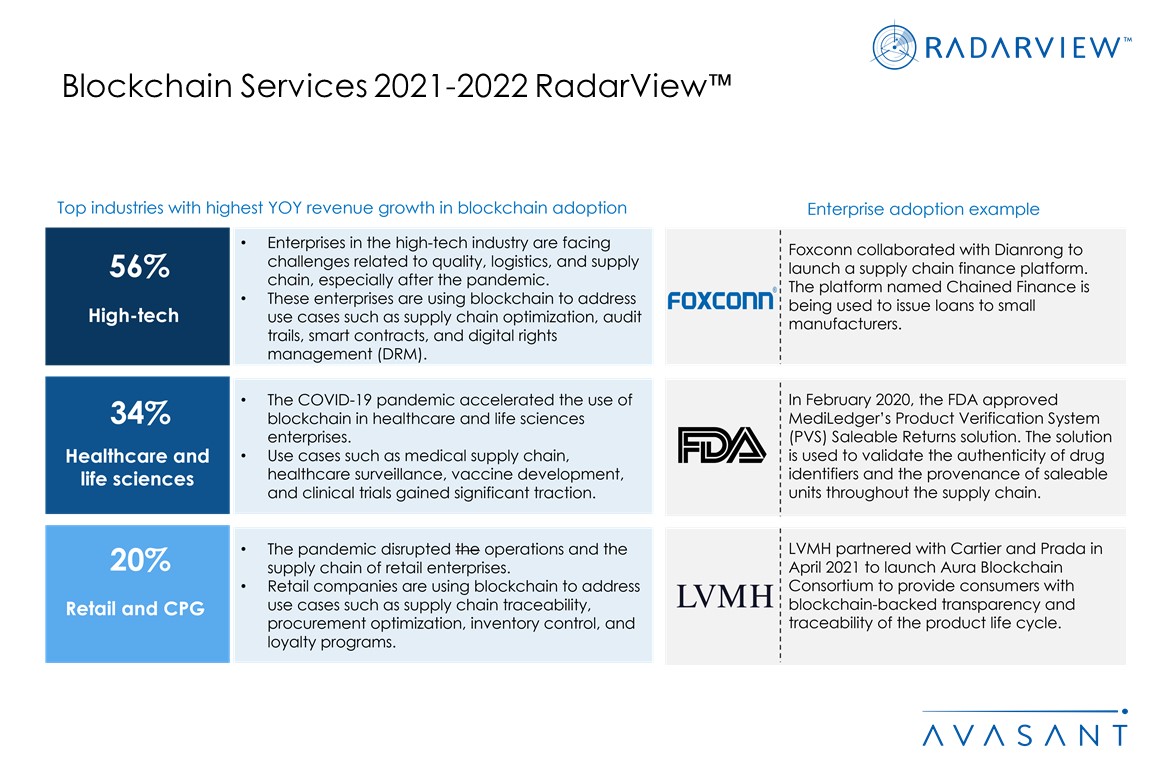

The pandemic temporarily halted new enterprise blockchain investments, as companies reprioritized technology budgets for maintaining business continuity, enabling hybrid work, and adopting cloud. While adoption paused, the pandemic spurred renewed interest in blockchain. Use cases such as medical supply chain, healthcare surveillance, and procurement optimization gained significant traction. Enterprises are determining their next course of action in leveraging blockchain to enable trust and transparency and focusing on practical use cases that can create a positive impact for their business.

This RadarView helps companies get a detailed view of the blockchain services landscape, key enterprise and provider trends, and market developments. It also provides information to assist businesses in choosing the right blockchain service provider.

Featured providers

This RadarView includes an analysis of the following service providers in the blockchain services space: Accenture, Atos, Birlasoft, Capgemini, CGI, Coforge, Cognizant, DXC, EPAM, HCL, IBM, Infosys, Innominds, LTI, NTT DATA, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Defining blockchain services

- Key enterprise blockchain trends shaping the market

- Key recommendations for enterprise blockchain adoption

- Avasant recognizes 20 top-tier service providers offering blockchain services

Lay of the land (Pages 9–23)

-

- COVID-19 halting new enterprise blockchain investments

- Revenue share of industries adopting blockchain services

- Industries seeing the highest growth and use cases

- Industry verticals converting proof of concept (POC) to production

- Blockchain platforms being adopted

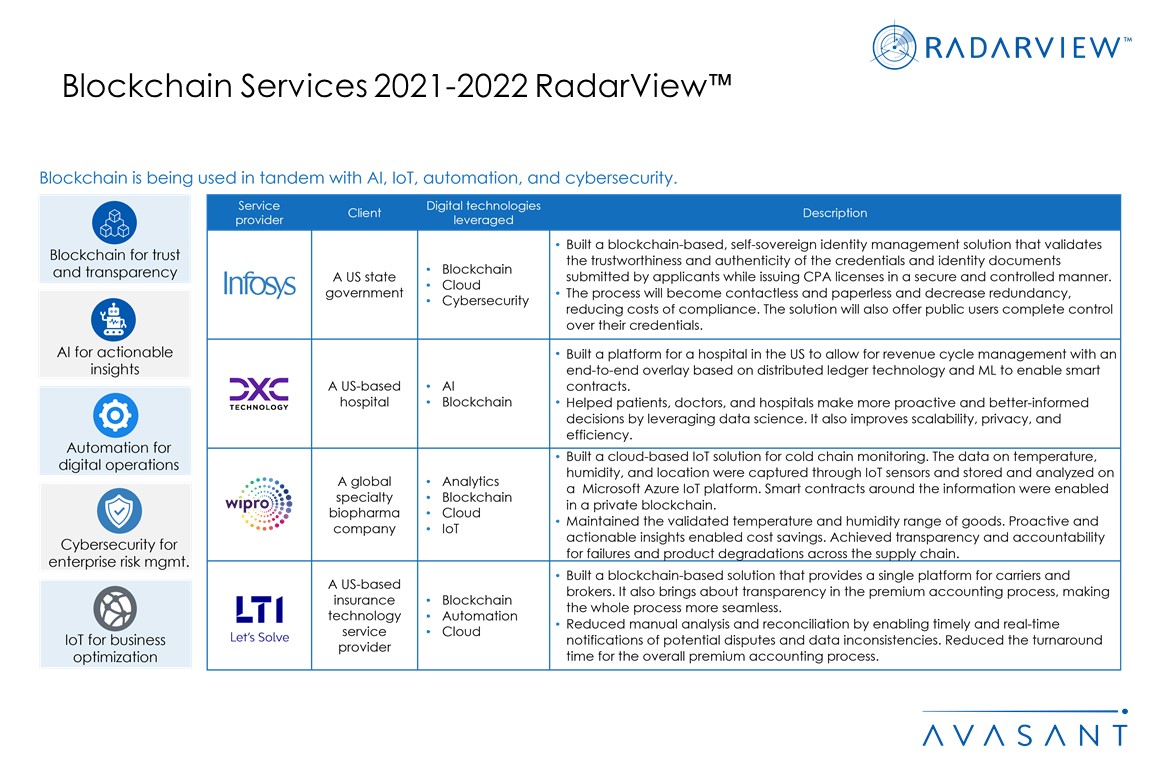

- Blockchain being integrated with other digital technologies

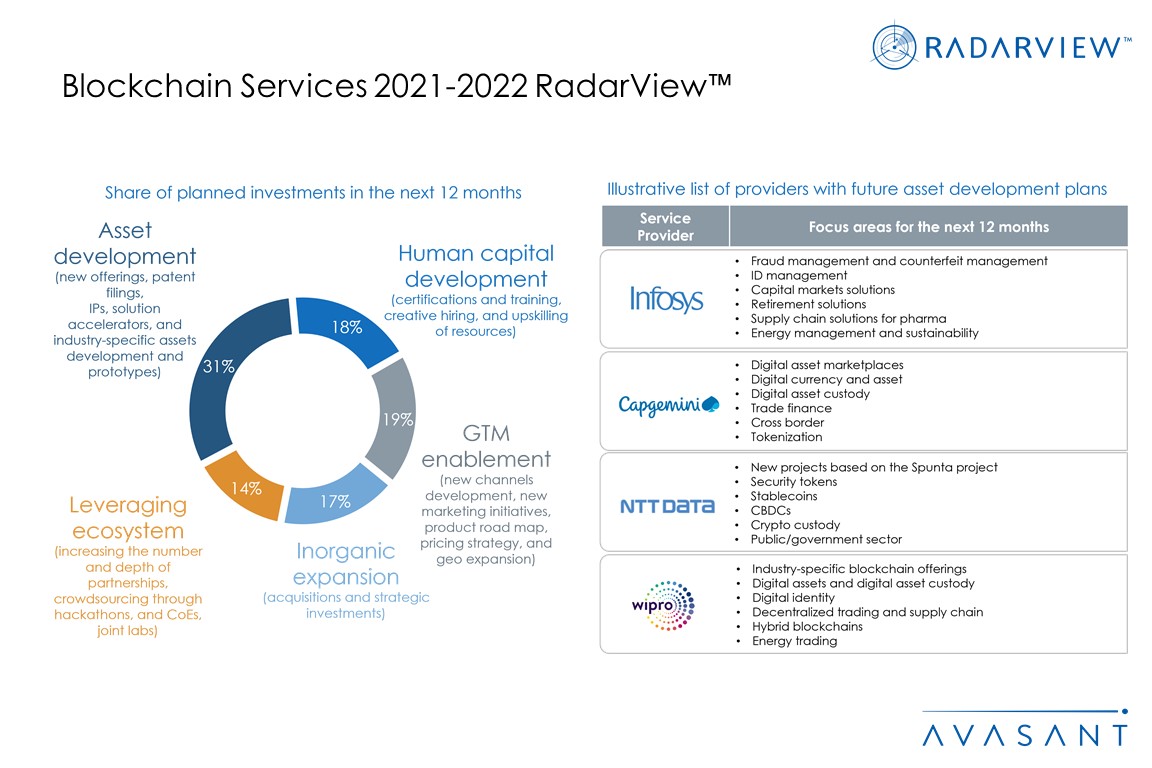

- Service providers focusing on investments in blockchain

RadarView overview (Pages 24–29)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 30–70)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, CGI, Coforge, Cognizant, DXC, EPAM, HCL, IBM, Infosys, Innominds, LTI, NTT DATA, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Read the Research Byte based on this report.