Artificial Intelligence (AI) is no longer a futuristic concept—it is the cornerstone of transformation in the finance and insurance sectors. As digital capabilities become baseline expectations, AI is emerging as the strategic lever that empowers organizations to not only optimize operations, but to fundamentally rearchitect them. Why this change, as AI has evolved from being a competitive advantage to foundational expectations in the finance and insurance industry as it is now deeply embedded in core processes and customer interactions, impacting everything from risk management to personalized service delivery. AI is reshaping how institutions operate, make decisions, and serve customers.

For C-level executives, the imperative is clear: embrace AI or risk obsolescence. The pace of change is accelerating, and legacy systems, siloed data, and outdated governance models are no longer sustainable. AI offers a path to resilience, agility, and growth—but only if leaders are willing to rethink traditional processes and invest in the infrastructure, talent, and governance needed to support it. This article outlines a real-world roadmap for integrating AI into finance and insurance, drawing on practical insights from industry leaders who are navigating this transformation today.

Voices In The Industry

Broader industry challenges discussed at the Empowering Beyond Summit 2025, where Robert Joslin, Managing Partner at Avasant, led a panel titled “Becoming Digital First: Winning Customer Loyalty in Banking and Insurance.” The panel featured Suzanne Brown of NYSC, Christopher Campbell of Ensono, Vipul Nagrath of ADP, and Rohan Ranadive of WisdomTree. Together, they explored how financial, and insurance institutions are overcoming legacy constraints and embracing AI to drive customer-centric innovation and operational agility.

Pressing challenges as discussed at the Empowering Beyond Summit facing finance and insurance organizations today is not technological—it’s generational. As AI becomes central to operational transformation, a significant barrier to progress lies in the boardroom. The average board member is 64 years old, with many coming from traditional CEO or CFO backgrounds. While these leaders bring deep business acumen, they often lack the technical fluency required to fully grasp the implications and potential of AI. This knowledge gap fuels skepticism about AI investments, as board members often report unclear ROI . This disconnect creates a strategic bottleneck: executives are eager to innovate but struggle to secure the board-level buy-in and funding necessary to move forward.

Several factors contribute to delayed AI adoption at the board level. Many directors, primarily Baby Boomers, are unfamiliar with emerging technologies and associated risks, such as deepfakes. Oversight responsibilities often fall to audit or risk committees, typically led by ex-CFOs focused on compliance rather than innovation. Moreover, AI’s benefits, like improved customer experience or risk detection—are often intangible, making ROI difficult to quantify. Additionally, with CEOs averaging 4.8 years in tenure and board members serving over a decade, misalignment in vision can stall or derail AI initiatives during leadership transitions.

Equating AI with ROI: A C-Level Imperative

One of the most persistent challenges for C-level executives is justifying AI investments in terms of ROI. Unlike traditional capital expenditures, AI’s value often lies in intangible yet critical outcomes such as efficiency gains, risk reduction, and improved customer experience. While these benefits are harder to quantify, they are essential to long-term competitiveness.

Executives must shift their mindset from short-term cost savings to long-term value creation. As one panelist noted, “You have to take the soft values you get out of it and put a number on top of that.” For example, faster claims processing not only reduces operational costs but also improves customer retention. AI-driven fraud detection may not show immediate revenue gains, but it significantly reduces financial exposure.

Here are real-world examples of how AI delivers measurable ROI in finance and insurance:

-

- JPMorgan Chase implemented an AI-powered platform called COIN (Contract Intelligence) to automate the review of commercial loan agreements. This system saved the bank an estimated 360,000 hours of legal and loan officer time, significantly reducing operational costs and improving efficiency. While this represented only 0.07% of total hours worked at the time, it marked a pivotal shift in how AI could streamline high-volume, repetitive tasks in financial services[1].

- According to the U.S. Government Accountability Office (GAO), financial institutions—including credit unions—are using AI to enhance customer service and automate credit decisions. AI applications have led to reduced costs, improved efficiency, and more personalized investment advice. However, the GAO also notes that oversight challenges remain, particularly for regulators like the National Credit Union Administration (NCUA), which lacks authority to examine third-party AI service providers[2].

- AXA Switzerland implemented Shift Claims Fraud Detection, an AI-powered solution, to analyze claims in real time from the first notice of loss (FNOL). This system enabled faster claims handling, improved customer satisfaction, and significantly enhanced fraud detection capabilities. AXA analyzed over 1 million claims and prevented more than €12 million in fraud using this AI system[3] [4]

Efficiency at a Cost: The Fragile Balance of AI in Finance

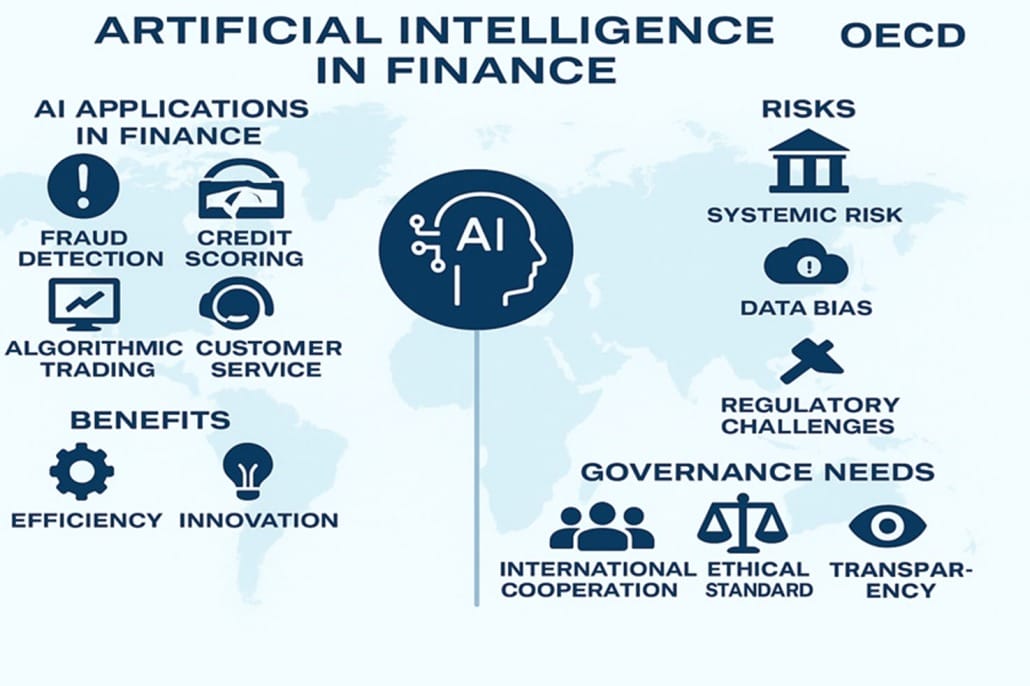

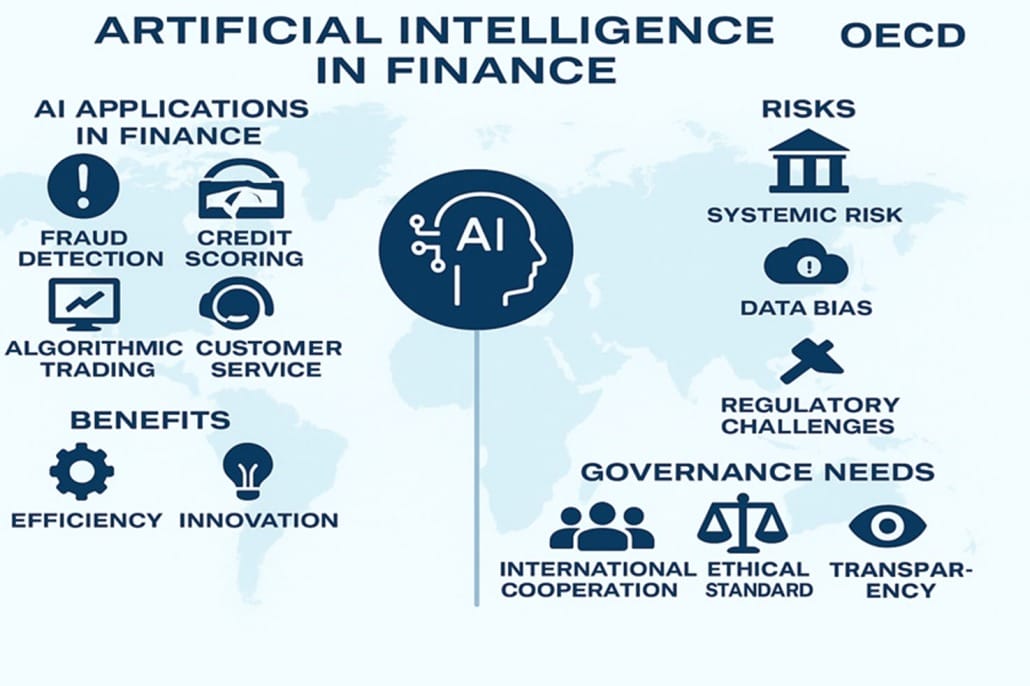

AI is rapidly transforming finance by enhancing efficiency, enabling innovation, and introducing new risks. Key applications include fraud detection, credit scoring, algorithmic trading, and customer service automation. However, AI can amplify systemic risks, create data biases, and challenge regulatory frameworks. It emphasizes the need for international cooperation, ethical standards, and robust governance to ensure AI in finance is transparent, fair, and resilient.[5]

C-Level Playbook for AI Integration

For C-level executives, the message is clear: AI is not a plug-and-play solution, it is a strategic enabler that requires vision, investment, and leadership. To successfully integrate AI organizations must take a deliberate, outcome-driven approach:

-

- Start with High-Impact Areas: Focus on functions like claims, underwriting, and compliance where AI can deliver quick wins.

- Invest in Infrastructure and Talent: Build the technical foundation and upskill your workforce to support AI adoption.

- Educate the Board: Bridge the knowledge gap with clear, ROI-focused communication that aligns AI initiatives with governance priorities.

- Time-Box Transformation: Limit projects to 15–18 months to maintain focus and deliver measurable results.

- Foster a Culture of Innovation: Redesign incentive systems to reward experimentation, collaboration, and continuous learning.

AI is not just about doing things better; it’s about doing better things. By reimagining processes through the lens of AI, organizations can unlock new value, adapt to market shifts, and build lasting resilience.

Conclusion

AI is no longer a future consideration—it is actively reshaping finance and insurance landscape from the inside out. It enhances resilience, strengthens governance, and empowers organizations to navigate complexity with agility and confidence. But transformation doesn’t happen by default. It requires bold leadership, strategic alignment, and a willingness to challenge the status quo.

C-level executives must act now. The tools are available, the use cases are proven, and the risks of inaction are growing. By embracing AI today, leaders can position their organizations for long-term success, earning the trust of customers, regulators, and shareholders in an unpredictable world.

By Lu Esan, Director, Supply Chain & Procurement