This report provides businesses with a view of the customer experience (CX) center services landscape. It begins with a summary of key enterprise and outsourcing trends and identifies the right service providers companies can engage with to reshape the customer service function. We continue with a detailed assessment of 35 service providers offering CX center services. Each profile provides an overview of the service provider, its CX center services capabilities and solutions, a list of representative clients and partnerships, and brief case studies. Each profile concludes with analyst insights on the provider’s practice maturity and future proofing.

Why read this RadarView?

CX center services providers are rapidly evolving into AI‑powered experience partners, embedding intelligence across every layer of delivery to industrialize operations and reduce reliance on human variability. They are standardizing AI‑augmented agent support, automated quality and compliance, and cross‑channel workflow orchestration as foundational capabilities, enabling faster, more consistent, and insight‑driven outcomes. Alongside this, providers are building enterprise‑grade AI platforms, shared data models, and reusable accelerators that make transformation scalable while shifting toward cloud‑native, hybrid human‑AI operating models. Collectively, these shifts reflect a supply side that is becoming more technologically unified, operationally predictable, and equipped to deliver high‑quality CX at scale.

The CX Center Business Process Transformation 2025–2026 RadarView™ aids companies in identifying top service providers to reinvent their customer service. It also analyzes each service provider’s technology and delivery capabilities, thus enabling organizations to identify the right strategic partners for their CX center transformation.

Featured providers

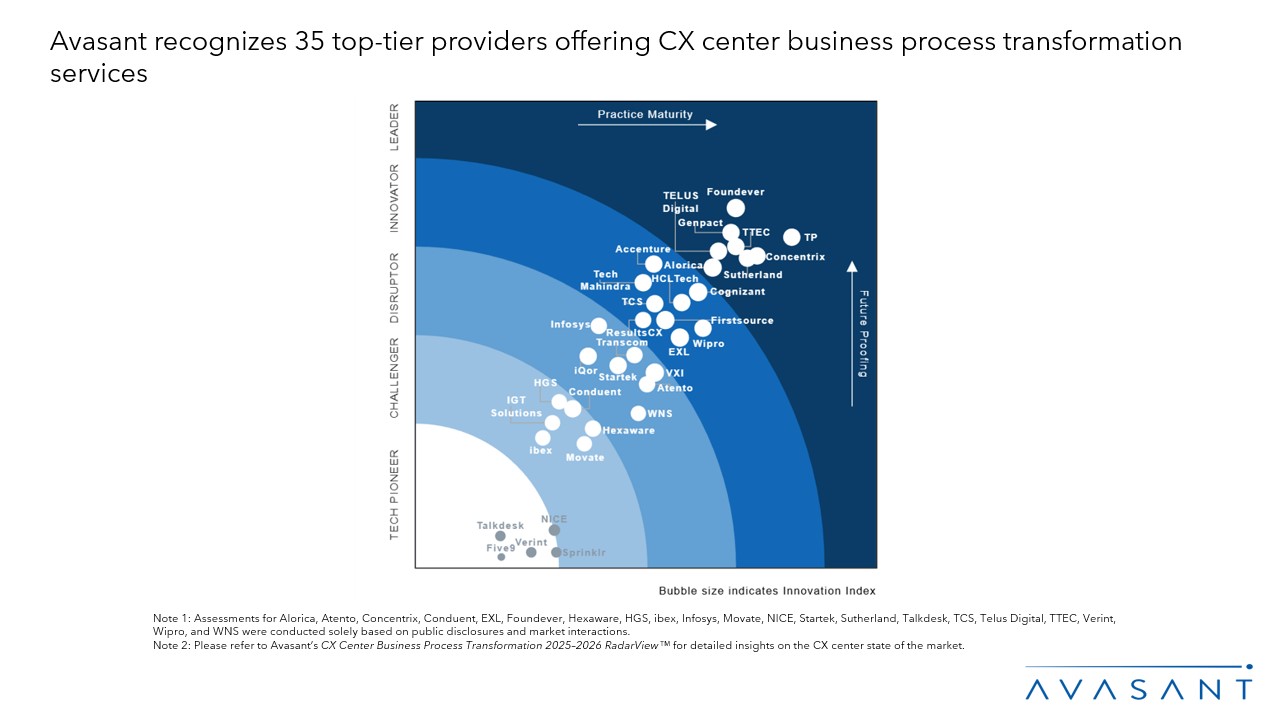

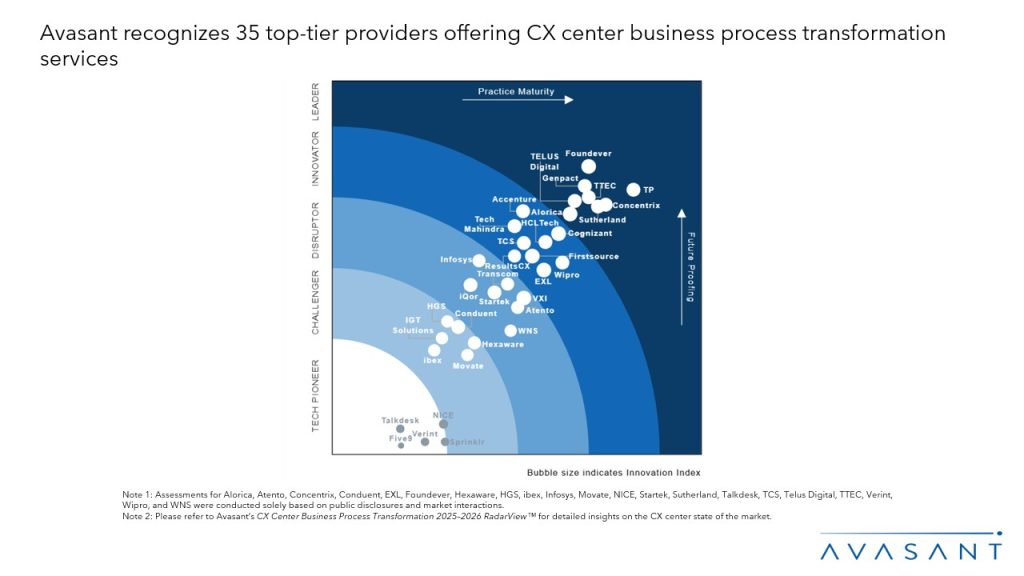

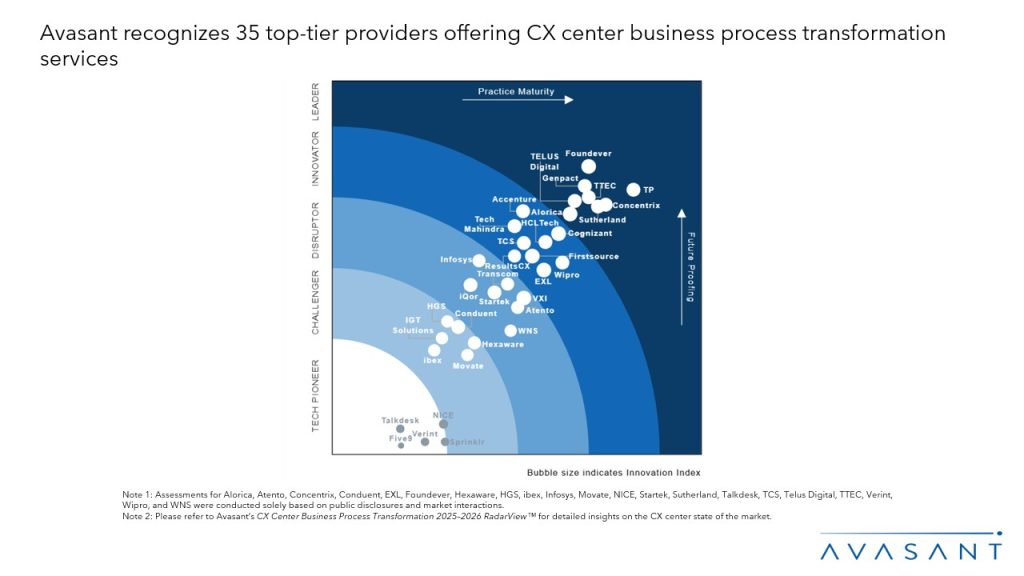

This RadarView analyzes the following service providers in the CX center business process transformation space: Accenture, Alorica, Atento, Cognizant, Concentrix, Conduent, EXL, Firstsource, Five9, Foundever, Genpact, HCL, Hexaware, HGS, Ibex, IGT Solutions, Infosys, iQor, Movate, NICE, ResultsCX, Sprinklr, Startek, Sutherland, Talkdesk, TCS, Tech Mahindra, TP, TELUS Digital, Transcom, TTEC, Verint, VXI, Wipro, and WNS.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the two dimensions of practice maturity and future proofing, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 6–14)

-

- Definition and scope

- Avasant recognizes 35 top-tier service providers offering CX center business process transformation services.

- Provider comparison

Supply-side trends (Pages 15–20)

-

- CX service providers are embedding AI across the value chain to scale quality, reduce dependency on human variability, and industrialize CX delivery.

- Voice remains the leading channel even as it declines, while email and self-service grow, indicating a shift toward cloud-native, AI-orchestrated omnichannel delivery.

- Despite the outcome-based pricing rhetoric, providers are shifting incrementally at the portfolio level, not exiting effort-led revenue models.

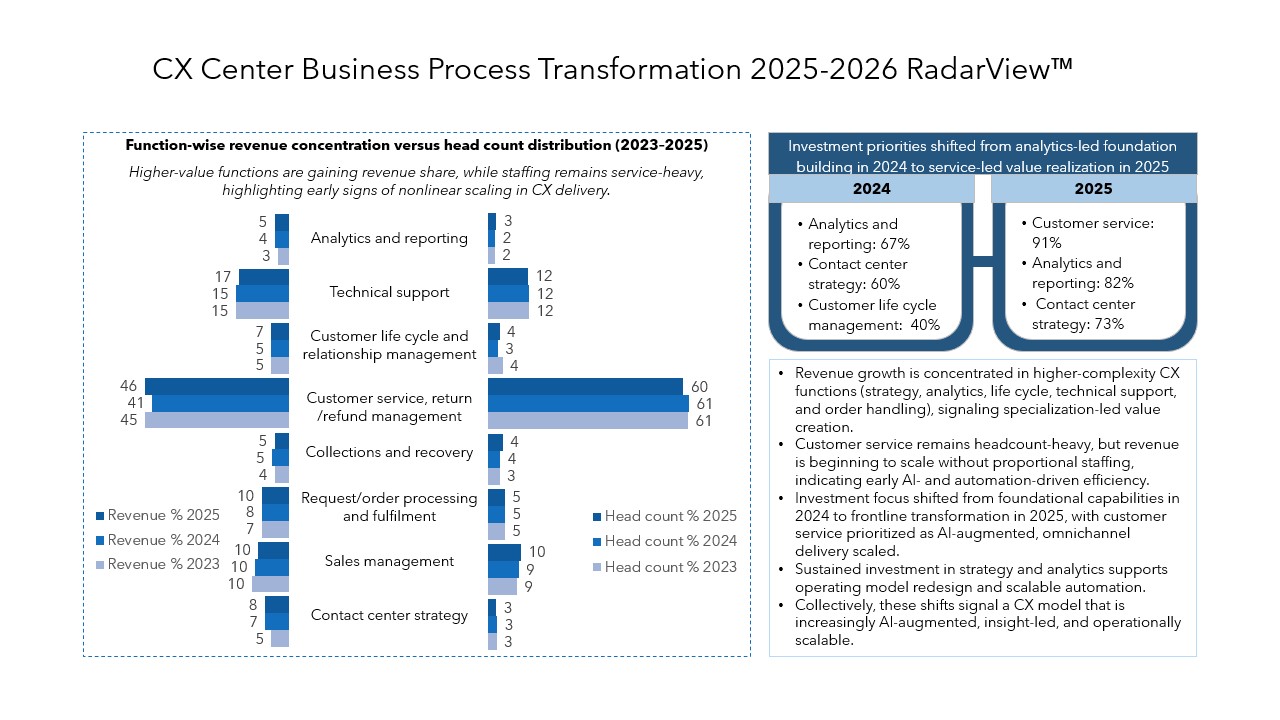

- Revenue is concentrating in high-complexity CX functions, while head count stays service-heavy, signaling early nonlinear, AI-enabled scaling.

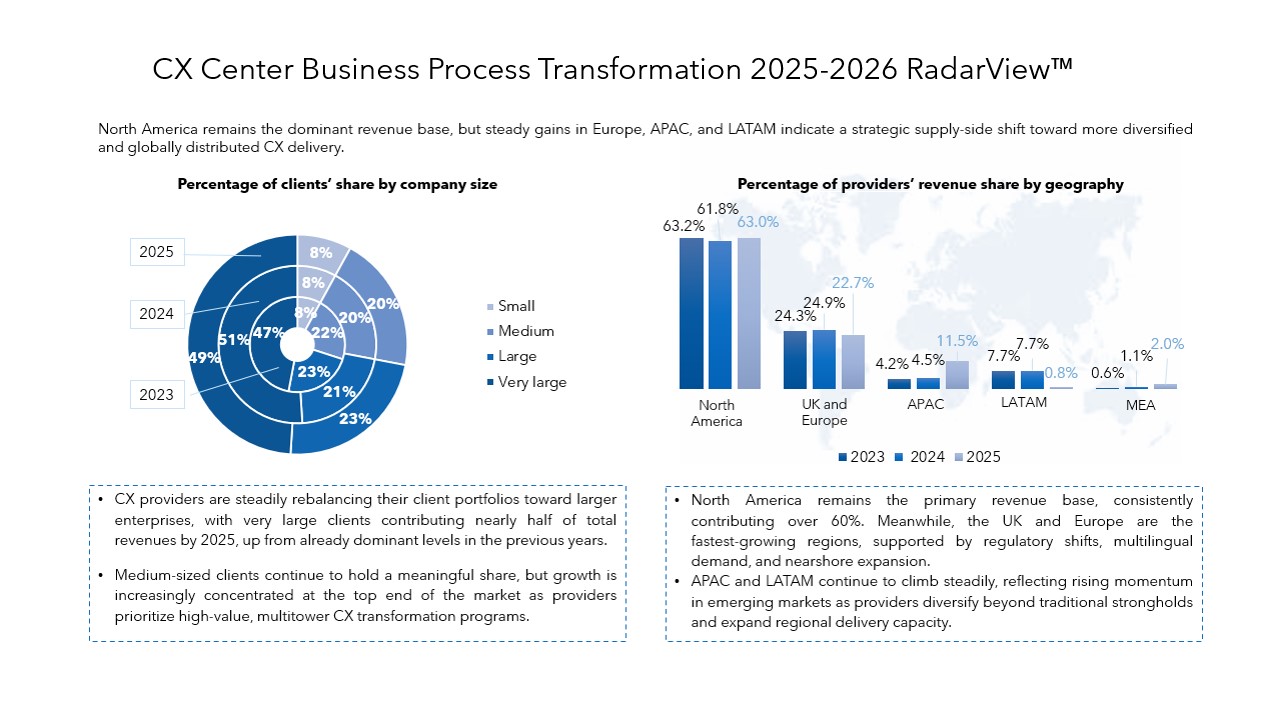

- CX providers are consolidating around very large clients while gradually expanding their geographic footprint beyond North America.

Service provider profiles (Pages 21–86)

Detailed profiles for Accenture, Alorica, Atento, Cognizant, Concentrix, Conduent, EXL, Firstsource, Five9, Foundever, Genpact, HCL, Hexaware, HGS, Ibex, IGT Solutions, Infosys, iQor, Movate, NICE, ResultsCX, Sprinklr, Startek, Sutherland, Talkdesk, TCS, Tech Mahindra, Teleperformance, TELUS Digital, Transcom, TTEC, Verint, VXI, Wipro, and WNS.

RadarView overview (Pages 87–90)

-

- RadarView assessment

- Methodology and coverage

- Interpretation of classification

Key contacts (Page 91)

Read the Research Byte based on this report. Please refer to Avasant’s CX Center Business Process Transformation 2025–2026 Market Insights™ for detailed insights on the demand-side trends.