This RadarView is designed to inform enterprises about cybersecurity best practices and provide a relatively granular understanding of key service providers. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 30 providers offering cybersecurity services. Each profile provides an overview of the service provider, its key IP assets, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations.

Why read this RadarView?

Market leaders are transitioning from generalized cybersecurity solutions to industry-specific offerings tailored to vertical markets. This now includes the establishment of vehicle security operations centers (vSOCs) for securing connected cars. Furthermore, they are harnessing the power of generative AI (Gen AI) to enhance security observability and enable proactive threat detection.

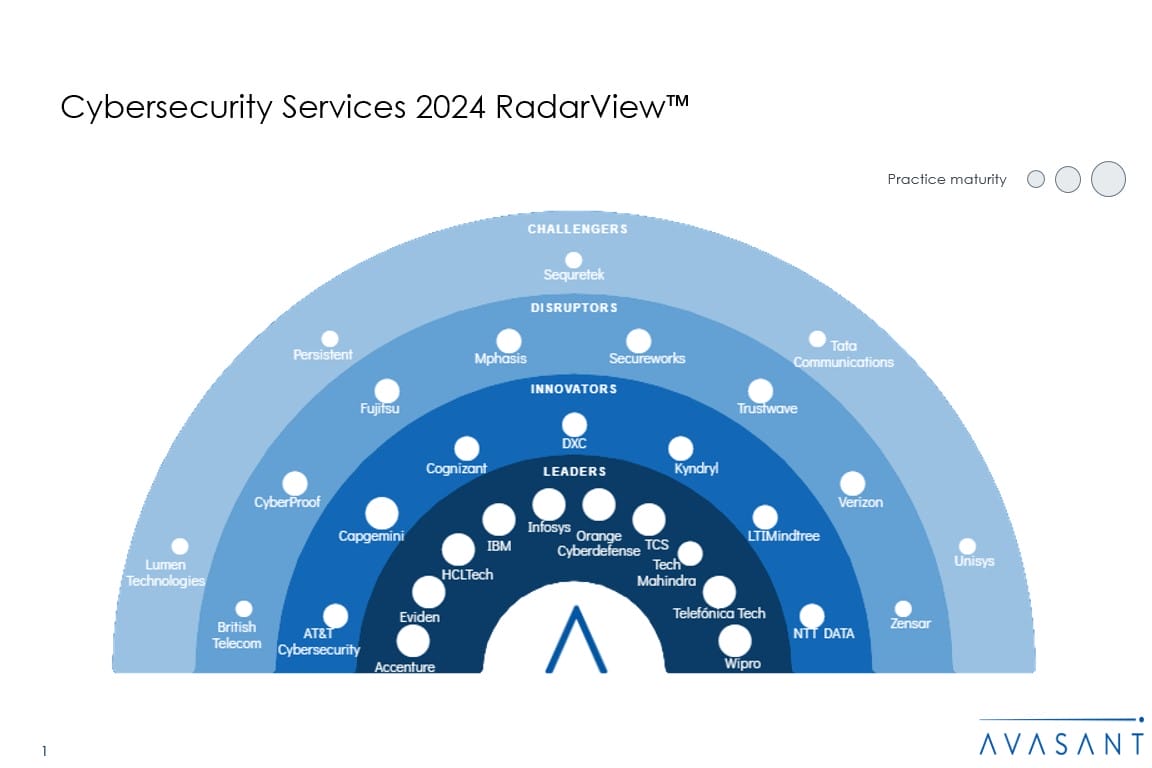

The Cybersecurity Services 2024 RadarView highlights key supply-side trends in the cybersecurity space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in adopting cybersecurity solutions. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to identify the right strategic partners for cybersecurity.

Featured providers

This RadarView includes a detailed analysis of the following Cybersecurity service providers: Accenture, AT&T Cybersecurity, British Telecom, Capgemini, Cognizant, CyberProof, DXC, Eviden, Fujitsu, HCLTech, IBM, Infosys, Kyndryl, LTIMindtree, Lumen, Mphasis, NTT DATA, Orange Cyberdefense, Persistent, Secureworks, Sequretek, Tata Communications, TCS, Tech Mahindra, Telefónica Tech, Trustwave, Unisys, Verizon, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

- Defining cybersecurity

- Avasant recognizes 30 top-tier providers supporting enterprise adoption of cybersecurity services

- Provider comparison

Supply-side trends (Pages 10–15)

- Phishing continues to account for the largest percentage of cyberattacks, followed by DDoS.

- Banking and manufacturing continue to lead the cybersecurity revenue chart for service providers.

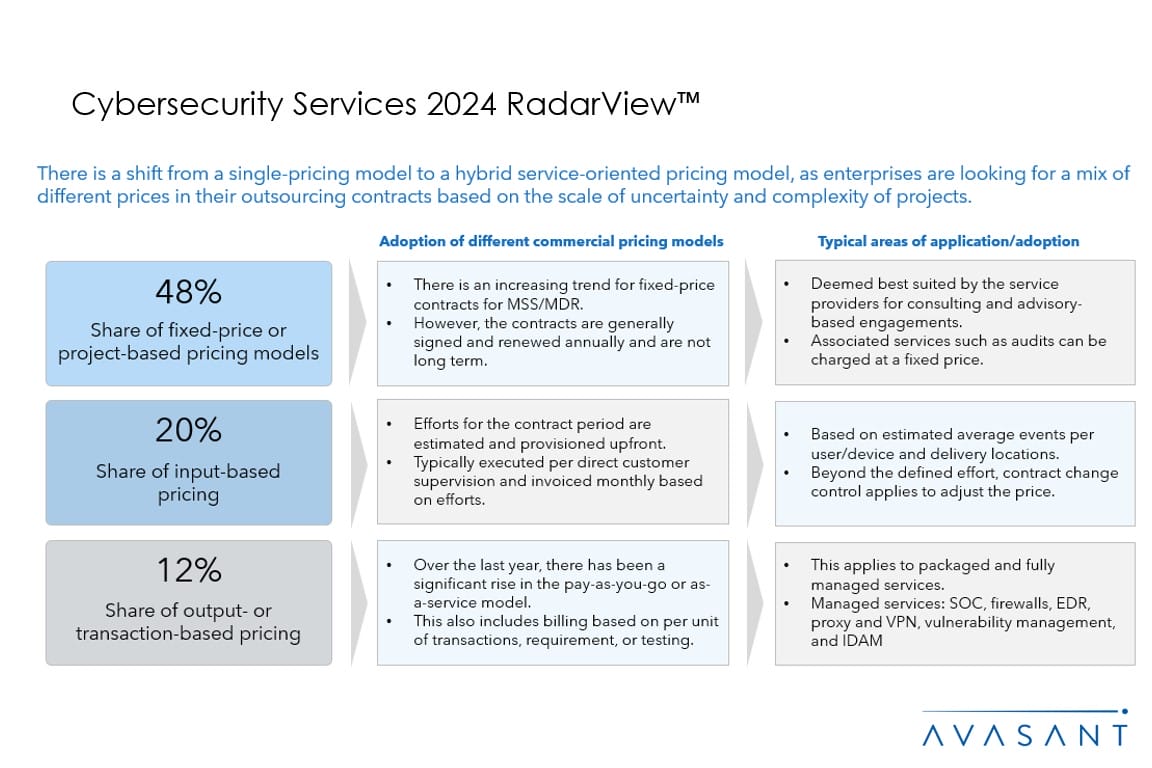

- Though project-based pricing continues to be the preferred model, there is a huge uptake in the as-a-service model.

- Transitioning from broad, general-purpose cybersecurity solutions to industry-specific offerings tailored to vertical markets.

- Service providers are leveraging Gen AI to enhance security observability and enable proactive threat detections.

Service provider profiles (Pages 16–76)

- Detailed profiles for Accenture, AT&T Cybersecurity, British Telecom, Capgemini, Cognizant, CyberProof, DXC, Eviden, Fujitsu, HCLTech, IBM, Infosys, Kyndryl, LTIMindtree, Lumen, Mphasis, NTT DATA, Orange Cyberdefense, Persistent, Secureworks, Sequretek, Tata Communications, TCS, Tech Mahindra, Telefónica Tech, Trustwave, Unisys, Verizon, Wipro, and Zensar.

Appendix (Pages 77–80)

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 81)

Read the Research Byte based on this report.

Please refer to Avasant’s Cybersecurity Services 2024 Market Insights™ for demand-side trends.