This RadarView offers enterprises a view into the changing landscape of digital and traditional commerce. It begins with a summary of key trends in the market shaping the enterprise commerce function.

We continue with a detailed assessment of 16 leading service providers offering digital commerce services. Each profile provides an overview of the service provider, its digital commerce services capabilities and solutions, a list of representative clients and partnerships, and brief case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovations. The report can assist companies in identifying the right service providers they can partner with to reshape and implement their digital commerce strategies.

Why read this RadarView?

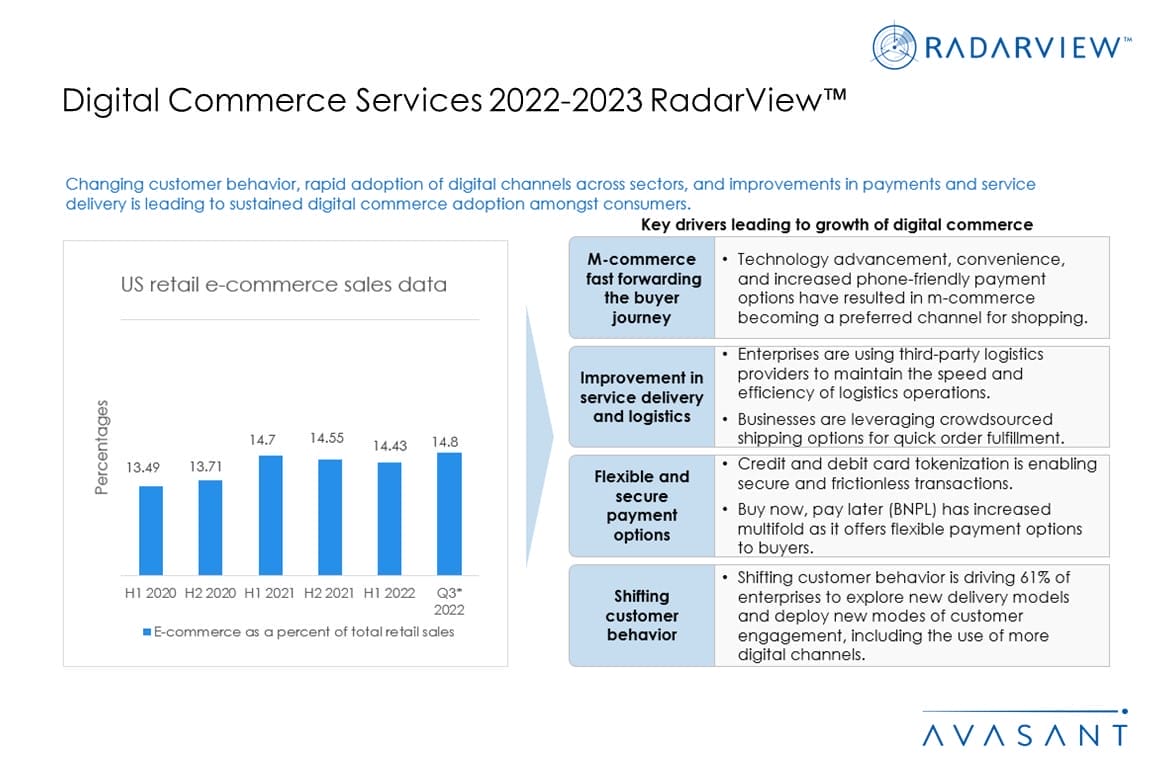

Digital commerce remains attractive to consumers due in a large part to the growth of digital channels and improvements in payment and service delivery. Enterprises would like to expand that success to B2B. For B2C and B2B customers, personalization has become a major differentiator, and service providers are helping enterprises deploy integrated digital commerce solutions. This resulted in an increase of 31% in service providers’ revenue for digital commerce services in 2021–2022.

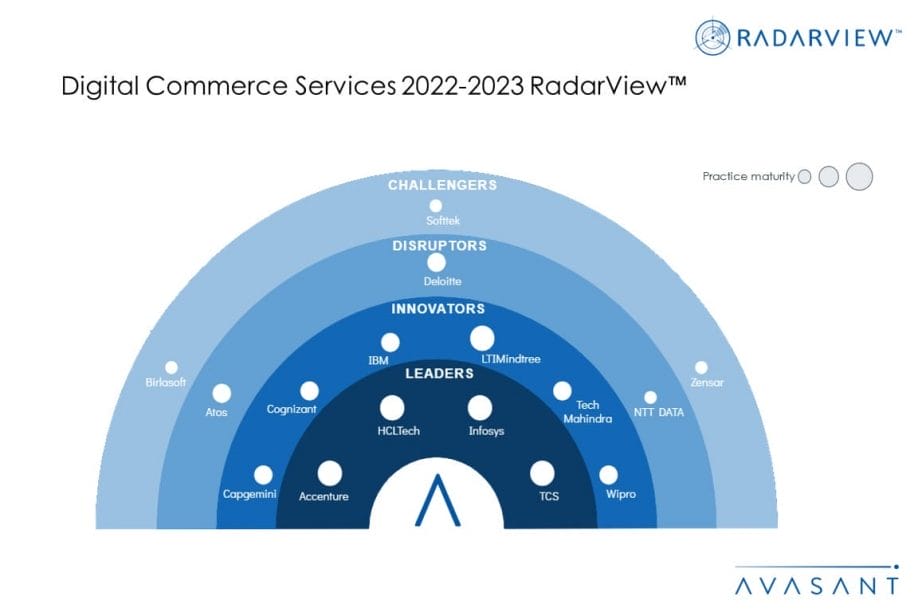

Featured Providers

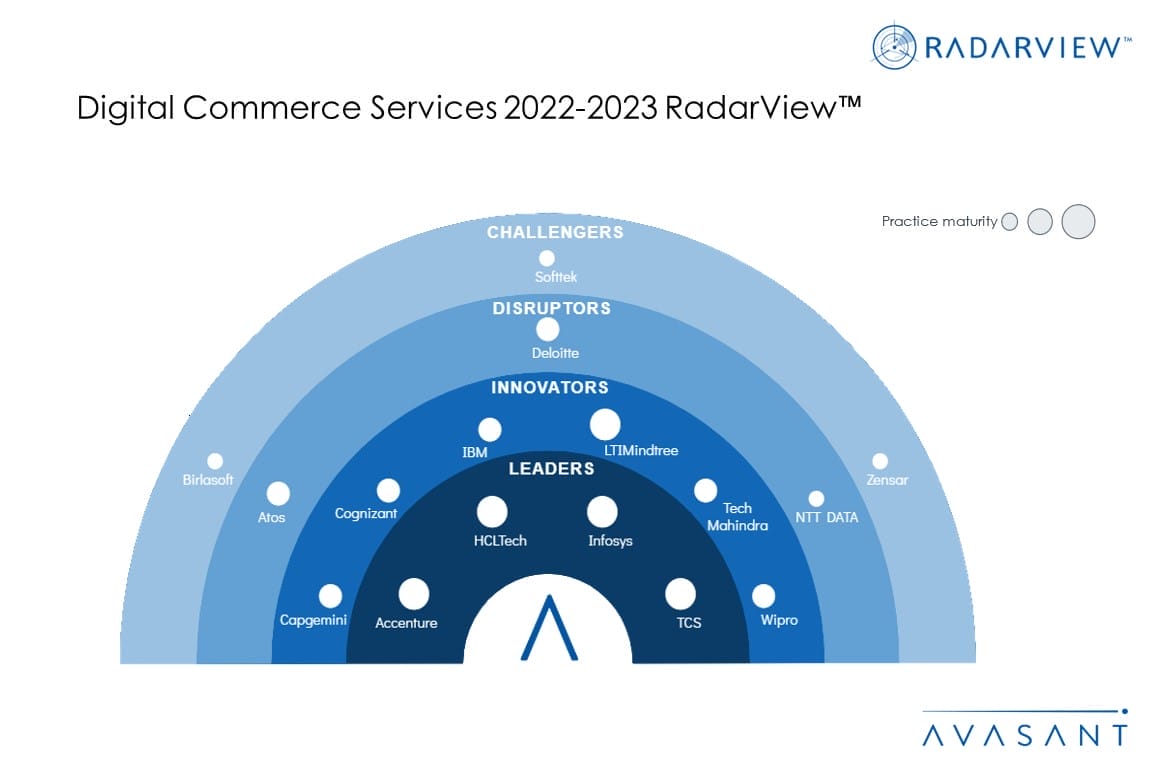

This RadarView includes an analysis of the following service providers in the digital commerce services space: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Deloitte, HCLTech, IBM, Infosys, LTIMindtree, NTT DATA, Softtek, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8):

-

- Defining digital commerce services

- Key digital commerce trends shaping the market

- Key recommendations for enterprises

- Avasant recognizes 16 top-tier vendors offering digital commerce services

Lay of the land (Pages 9–19)

-

- Growth in digital commerce fueled by the pandemic has now stabilized.

- Enterprise push for digital channels, self-service, and online marketplaces expands digital commerce in B2B.

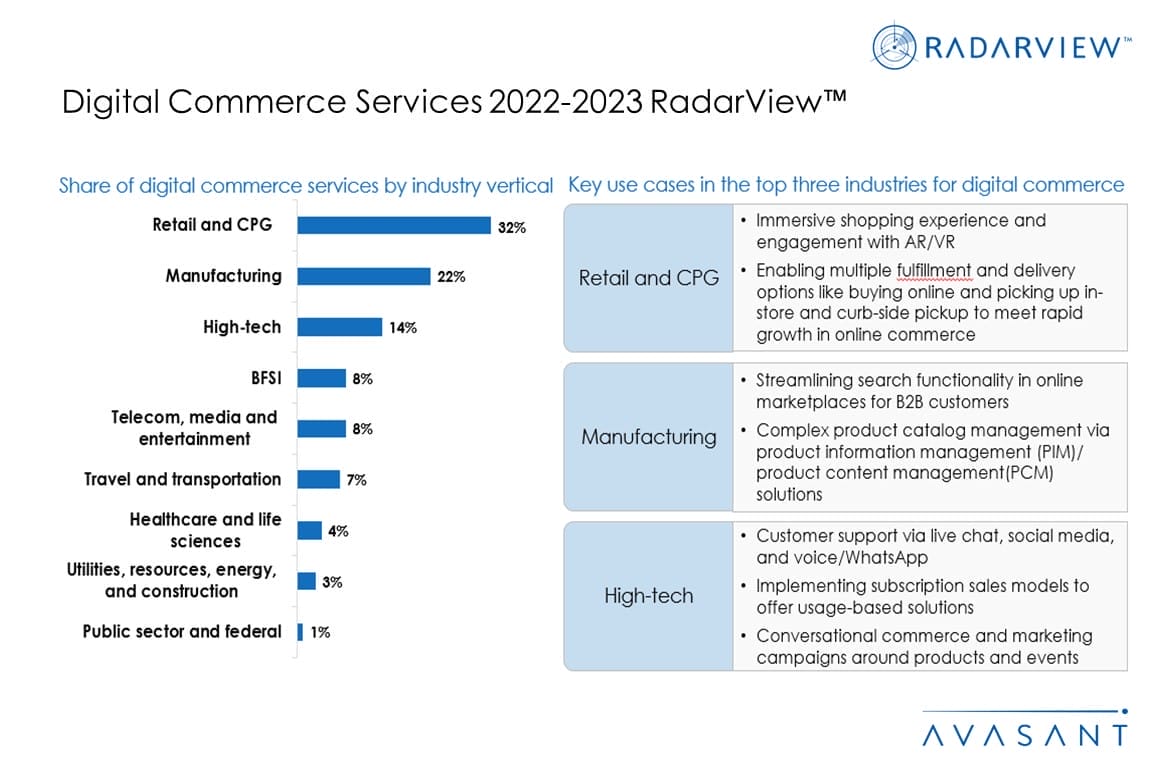

- Retail and CPG, manufacturing, and high-tech are the top contributors to digital commerce services revenue.

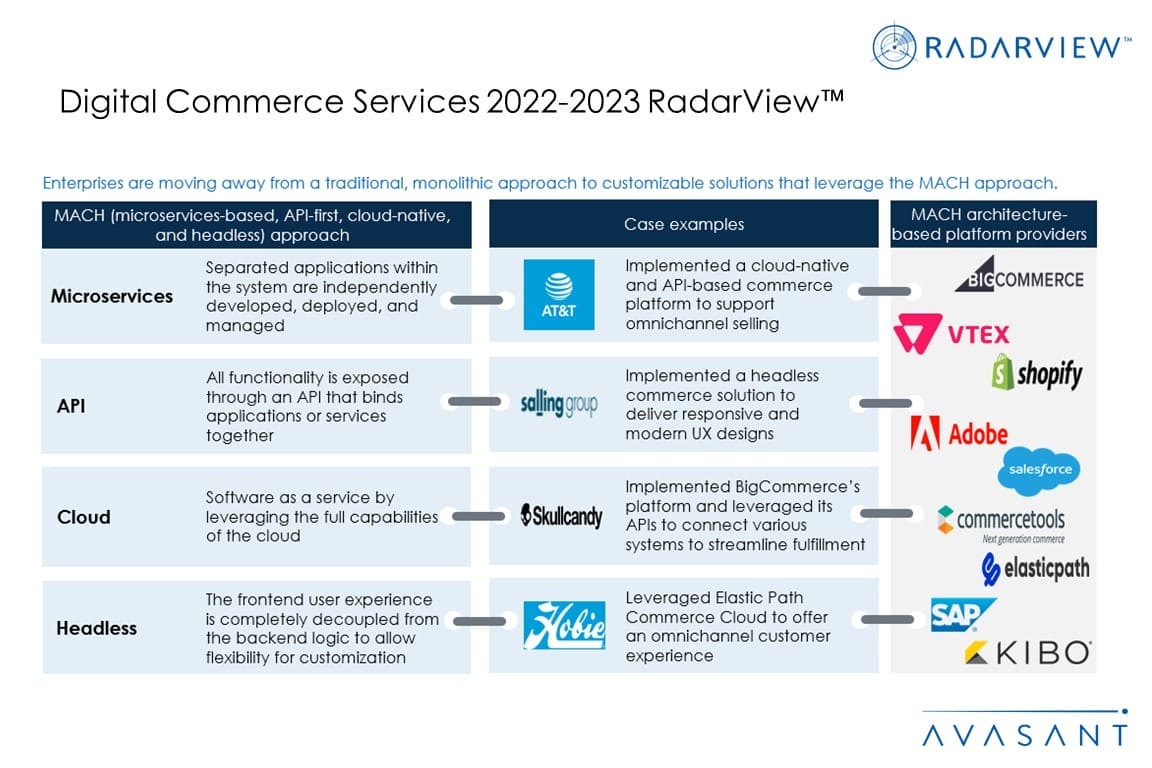

- Enterprises have a composable approach for building custom commerce applications for specific business needs.

- Digital technologies and platform investments help create an interactive online shopping experience.

RadarView overview (Pages 20–25)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 26–58)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Cognizant, Deloitte, HCLTech, IBM, Infosys, LTIMindtree, NTT DATA, Softtek, TCS, Tech Mahindra, Wipro, and Zensar.

Read the Research Byte based on this report.