Macroeconomic factors such as volatile interest rates, financial and geopolitical crises, and lower GDP growth forecasts among advanced economies are putting significant pressure on banks. With the growth of fintech and digital-only banks, traditional banks are being challenged to reinvent themselves. Banks need to invest in artificial intelligence (AI) and data analytics in order to look at new business models and hyperpersonalized customer experience.

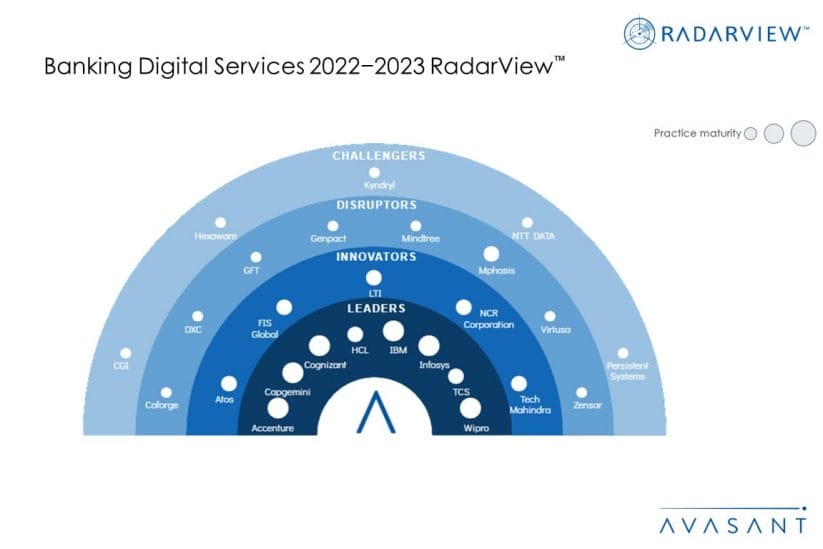

These emerging trends are covered in Avasant’s Banking Digital Services 2022–2023 RadarView™. The report is a comprehensive study of banking digital service providers, including top trends, analysis, and recommendations, taking a close look at the leaders, innovators, disruptors, and challengers in this industry.

Avasant evaluated 38 digital service providers with a presence in the banking industry, using a rigorous methodology against the dimensions of practice maturity, investments and innovation, and partner ecosystem. Of these, Avasant recognized 26 providers who brought the most value to the market during the past 18 months.

The report recognizes service providers in four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCL, IBM, Infosys, TCS, and Wipro

- Innovators: Atos, FIS Global, LTI, NCR Corporation, and Tech Mahindra

- Disruptors: Coforge, DXC, GFT, Genpact, Mindtree, Mphasis, Virtusa, and Zensar

- Challengers: CGI, Hexaware, Kyndryl, NTT DATA, and Persistent Systems

Figure 1 from the full report illustrates these categories:

“Banks are under constant pressure to maintain profitability and explore differentiated business models,” said Anupam Govil, Avasant partner. “They need to adopt a customer-centric strategy and offer product innovation by leveraging technologies to enable seamless digital banking.”

The full report includes a number of recommendations for banks, including the following.

- Adopt non-linear business models to create disruptive value.

-

- Identify viable capital/cost-lite models such as B2B2X (selling products through B2C firms) and Packager (embedding others’ products into the bank’s own offerings) by selecting your strengths in the value chain. Evaluate and select sizeable companies for product bundling and indirect distribution.

- Align these business models with your operating model to manage value architecting.

- Adopt a customer-centric strategy by focusing on product innovation and hyperpersonalization.

-

- Set up a comprehensive data infrastructure for widespread capture of data and invest in behavioral science and ethnographic research to create the foundation of the hyperpersonalization journey.

- Ensure data privacy by collecting and using only the data that is relevant to the current and future products/services and informing customers about benefits that they can get from this data.

- Make AI central to the core strategy and operations to enhance customer experiences and efficiencies.

-

- Improve customer experiences and back-office processes by adopting AI-led use cases such as conversational bots for basic servicing requests, humanoid robots to serve customers in branches, intelligent document processing, fraud analytics, fraud detection, and risk modelling.

- Embed AI in four layers—engagement, decisioning, core tech and data, and operating model.

“Digital reinvention is the catalyst for banks to unlock new growth opportunities, identify new revenue streams, and meet evolving customer expectations,” said Amrita Keswani, lead analyst with Avasant. “Collaboration with service providers and fintech can provide them with a broad set of innovative capabilities and domain expertise.”

The full report also features detailed RadarView profiles of 26 service providers, along with their solutions, offerings, and experience in assisting banks in digital transformation.

This Research Byte is a brief overview of the Banking Digital Services 2022–2023 RadarView™ (click for pricing).