This RadarView offers enterprises a view into the evolving technology and outsourcing trends changing the digital talent landscape. It also provides recommendations on how to cope with the “new normal” and prioritize digital talent. It begins by identifying the right service providers that enterprises can partner with to address digital talent gaps, enabling digital transformation. We continue with a detailed assessment of 20 leading service providers. Each profile provides an overview of the service provider, their digital talent capabilities, and talent acquisition and development initiatives, along with brief client case studies. Each profile concludes with analyst insights on the provider’s digital strategy and talent capabilities, talent transformation, and talent investments and innovations.

Why read this RadarView?

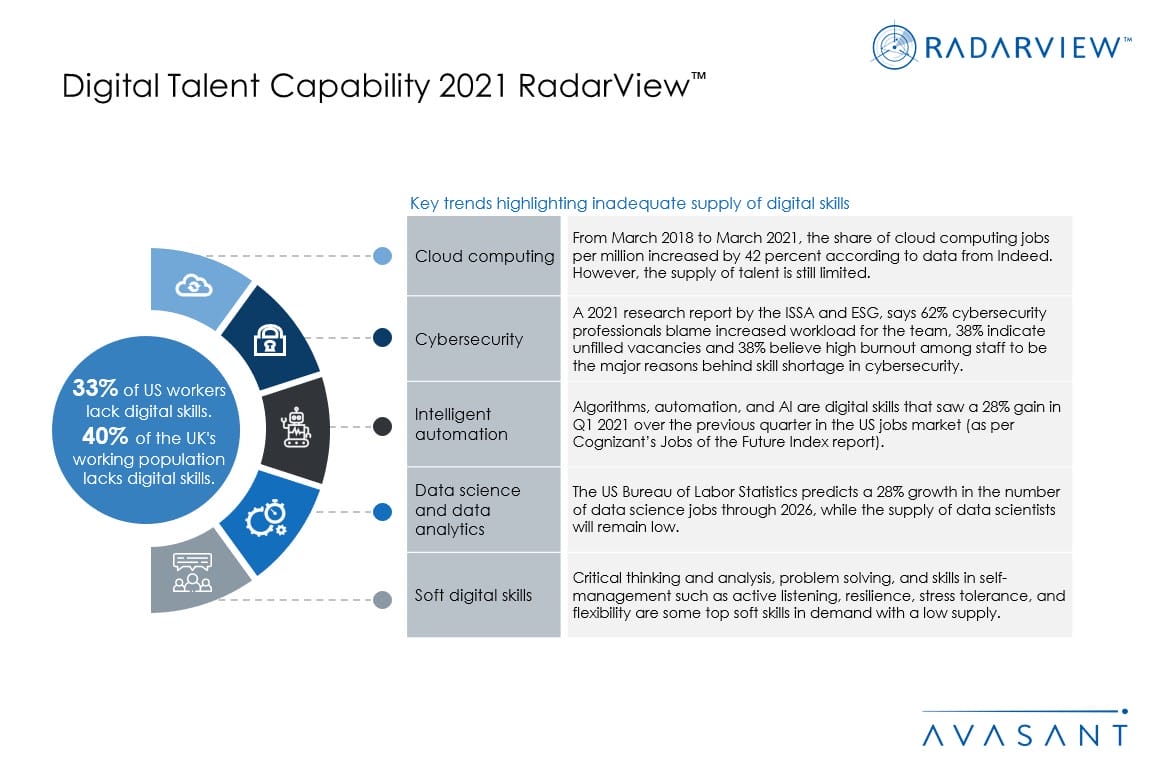

With a new wave of digitalization hitting businesses, and companies pivoting to hybrid ways of working, the digital talent gap is widening. Organizations are facing multiple challenges in implementing their digital transformation agenda. Thus, enterprises are figuring out the right approach to bridge the digital talent gap.

This RadarView helps companies determine the digital skills in demand and provides insight into how service providers are building a digital talent pool. It also affords detailed information to assist businesses in identifying the right services provider that can drive digital transformation.

Featured Providers

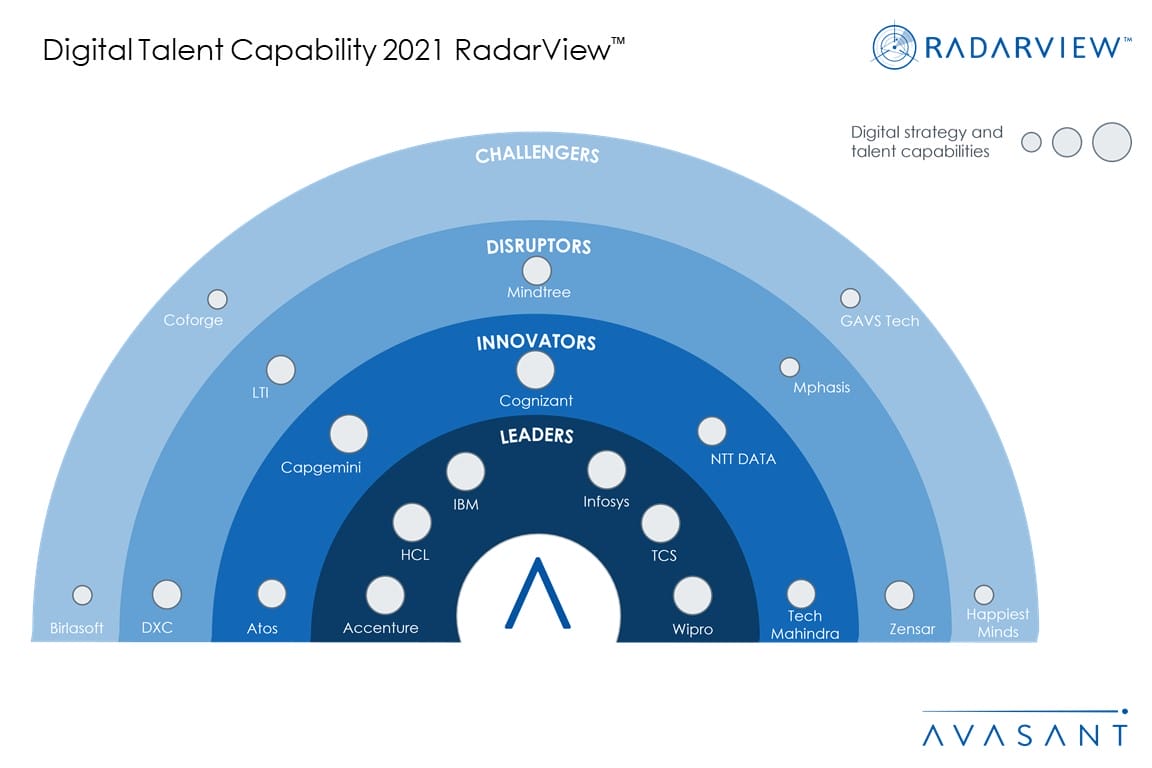

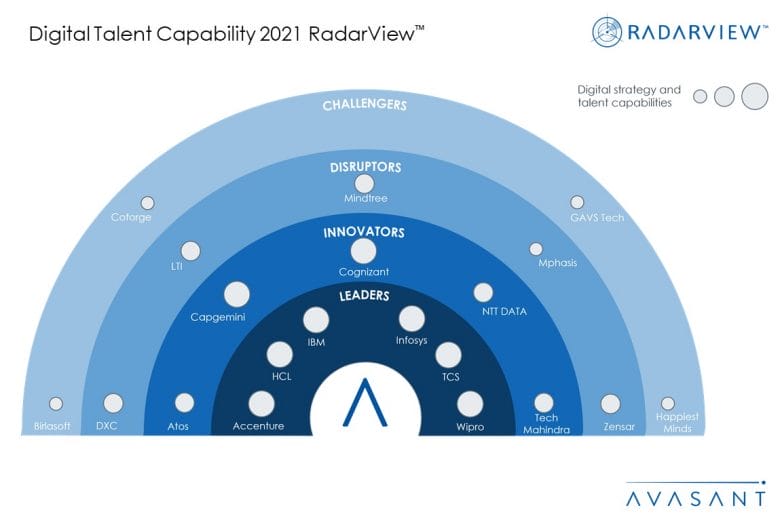

This RadarView includes an analysis of the following service providers in the digital talent capability space: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Coforge, DXC, GAVS Tech, Happiest Minds, HCL, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, TCS, Tech Mahindra, Wipro, and Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of digital strategy and talent capabilities, talent transformation, and talent investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4-8):

-

- Defining digital talent capability

- Key enterprise digital talent capability trends

- Building digital talent capability: The road ahead

- Avasant recognizes 20 top-tier vendors building digital talent capabilities

Lay of the land (Pages 9-22)

-

- Enterprises witnessing rapid digital adoption

- Key technology and outsourcing trends

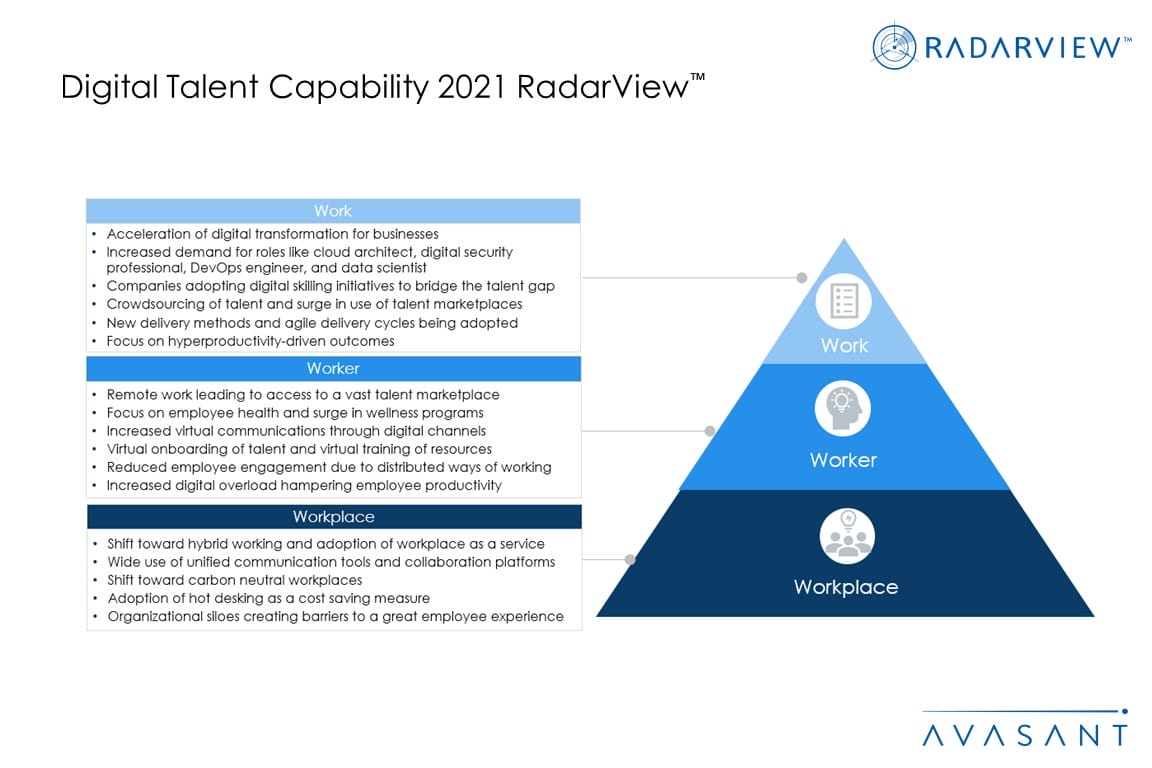

- Nature of work, worker, and workplace changing

- Digital talent segments facing supply demand imbalance

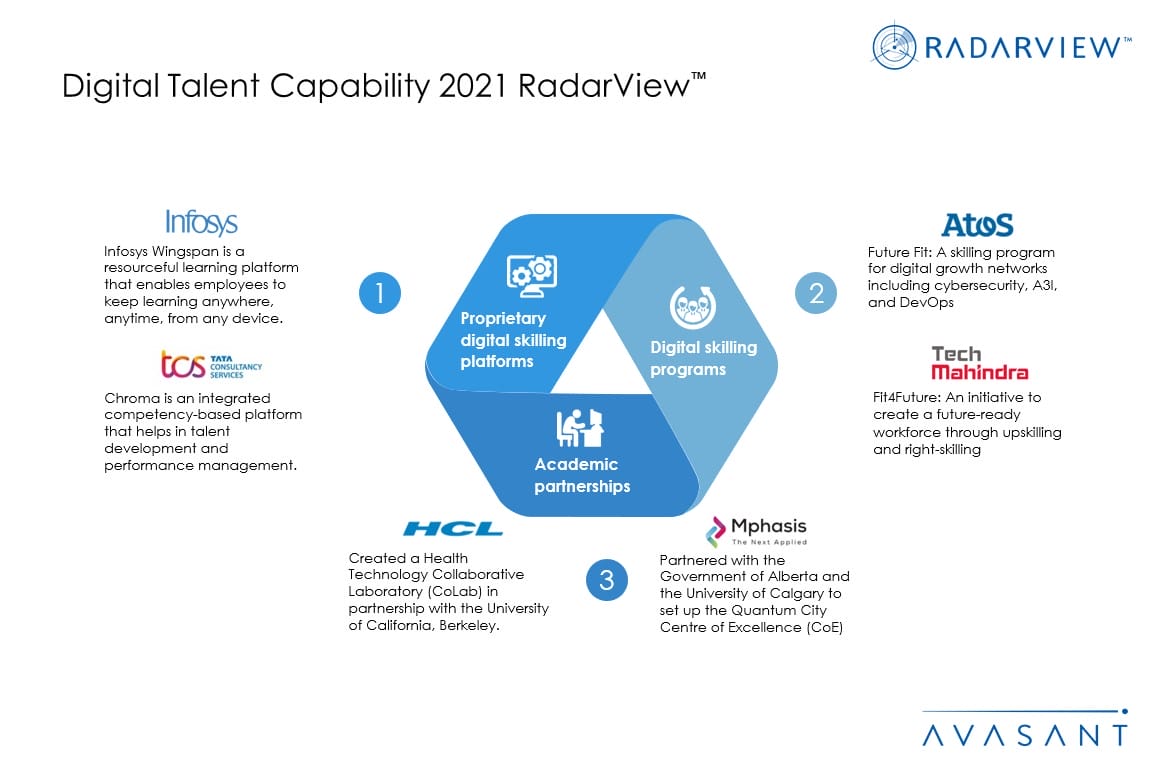

- Service providers building digital talent to meet surge in outsourcing

- Talent localization and digital skilling becoming top priority

- Proprietary tools and platforms improving talent management

Getting ready for the road ahead (Pages 23-30)

-

- Assess current state of technology adoption

- Recognize cloud and cybersecurity as key pillars of transformation

- Rethink IT workforce strategies to enable new business models

RadarView assessment (Pages 31-36)

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 37-77)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Cognizant, Coforge, DXC, GAVS Tech, Happiest Minds, HCL, IBM, Infosys, LTI, Mindtree, Mphasis, NTT DATA, TCS, Tech Mahindra, Wipro, and Zensar.

Read the Research Byte based on this report.