Despite a challenging business environment, financial services firms are investing in digital technologies to improve cost efficiency and capabilities. Digital assets have become an increasingly popular alternative investment avenue amongst the customers of private and wealth managers. Financial services firms are also allocating significant resources to cybersecurity measures due to growing cyber threats. Stringent financial regulations mandate environmental, social, and governance investment scrutiny to avoid greenwashing of the tagged investments. To address these issues, financial institutions are leveraging digital technologies to optimize operations, deliver efficient investment services, and enhance customer experience while mitigating risks.

Both demand-side and supply-side trends are covered in our Financial Services Digital Services 2023–2024 Market Insights™ and Financial Services Digital Services 2023–2024 RadarView™, respectively. These reports present a comprehensive study of digital service providers in the financial services industry, including top trends, analysis, and recommendations. It takes a close look at the leaders, innovators, disruptors, and challengers in this market.

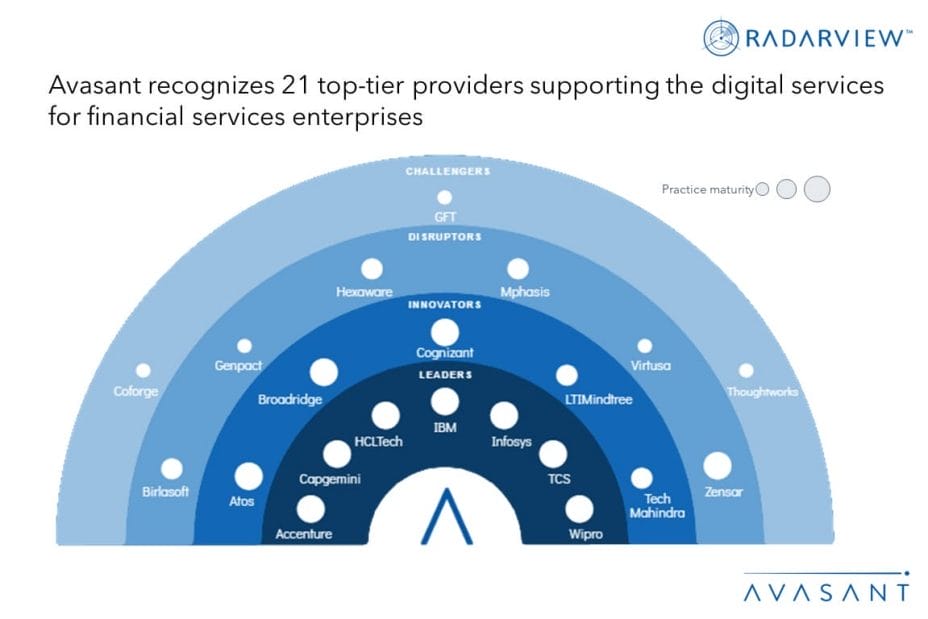

We evaluated 42 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of the 42 providers, we recognized 21 that brought the most value to the market during the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Capgemini, IBM, Infosys, HCLTech, TCS, and Wipro

- Innovators: Atos, Broadridge, Cognizant, LTIMindtree, and Tech Mahindra

- Disruptors: Birlasoft, Genpact, Hexaware, Mphasis, Virtusa, and Zensar

- Challengers: Coforge, GFT, and Thoughtworks

Figure 1 below from the full report illustrates these categories:

“Financial institutions are being pushed to enhance customer experience while driving down costs in these turbulent times,” said Anupam Govil, Avasant partner. “Enterprises need to embrace new-age technologies to innovate and offer solutions around digital assets and safer investment advisory, as well as to ensure cost optimization.”

The reports provide several findings, including the following:

-

- The impact of rate hikes during 2022–2023 and stress on US SME banks are some factors compelling large banks to offer safer investment services and enhanced customer experience leveraging digital innovation.

- Amid a slowdown in deals and IPOs, global investment banking revenue shrinkage is enabling cost optimization driven by emerging technologies.

- Digital assets have become a popular investment option due to their potential for high returns and portfolio diversification.

- Increased adoption of digital technologies and hybrid work environments in financial services firms has led to a rise in cyber vulnerabilities, necessitating the implementation of advanced cybersecurity measures to safeguard against cyber threats.

- Financial services firms are leveraging digital technologies to enhance ESG reporting and combat greenwashing activities.

“Service providers are developing digital solutions to meet evolving customer demands,” said Praveen Kona, associate research director with Avasant. “By leveraging emerging technologies such as blockchain and AI/ML, providers are offering solutions around digital asset exchange, portfolio risk tracking, and management, along with cloud-driven cost optimization.”

The RadarView also features detailed profiles of 21 service providers, along with their solutions, offerings, and experience in assisting financial services enterprises in their digital transformation journeys.

This Research Byte is a brief overview of the Financial Services Digital Services 2023–2024 Market Insights™ and Financial Services Digital Services 2023–2024 RadarView™. (click for pricing).