Despite the maturity of intelligent automation (IA) services, enterprise investment in advanced technologies such as AI, NLP, and generative AI continues to reshape this space. Sectors such as manufacturing, retail and CPG, and healthcare and life sciences lead in IA adoption to analyze unstructured data, optimize operations, and enhance customer experiences. The rise of Gen AI has further amplified AI integration throughout the automation value chain, particularly in process mapping, AIOps, knowledge management, and back-office automation.

Both demand- and supply-side trends are covered in Avasant’s Intelligent Automation Services 2023–2024 Market Insights™ and Intelligent Automation Services 2023–2024 RadarView™, respectively. These reports present a comprehensive study of IA service providers and closely examine the market leaders, innovators, disruptors, and challengers in this space. They also provide a view of key market trends and developments impacting the IA services space.

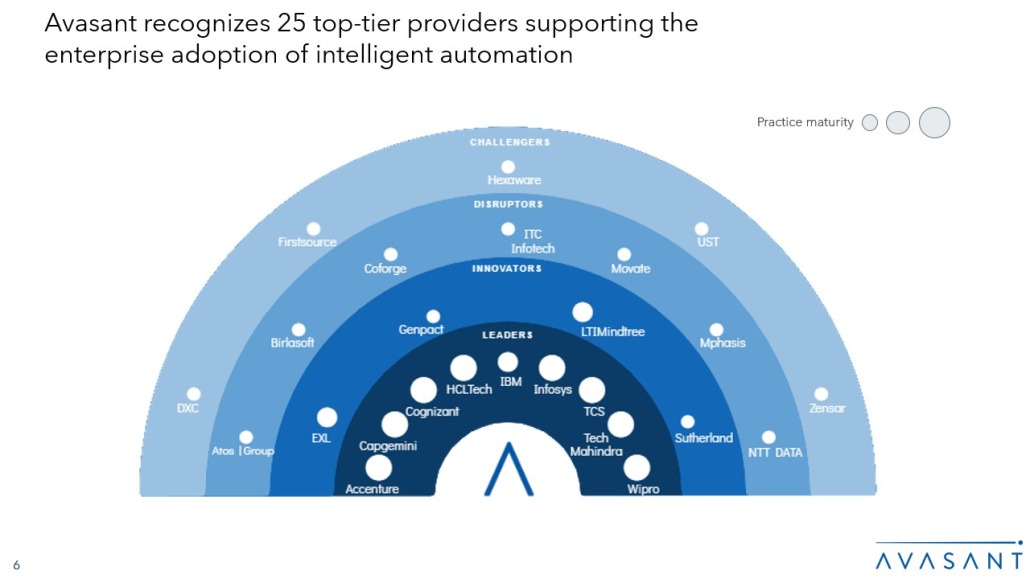

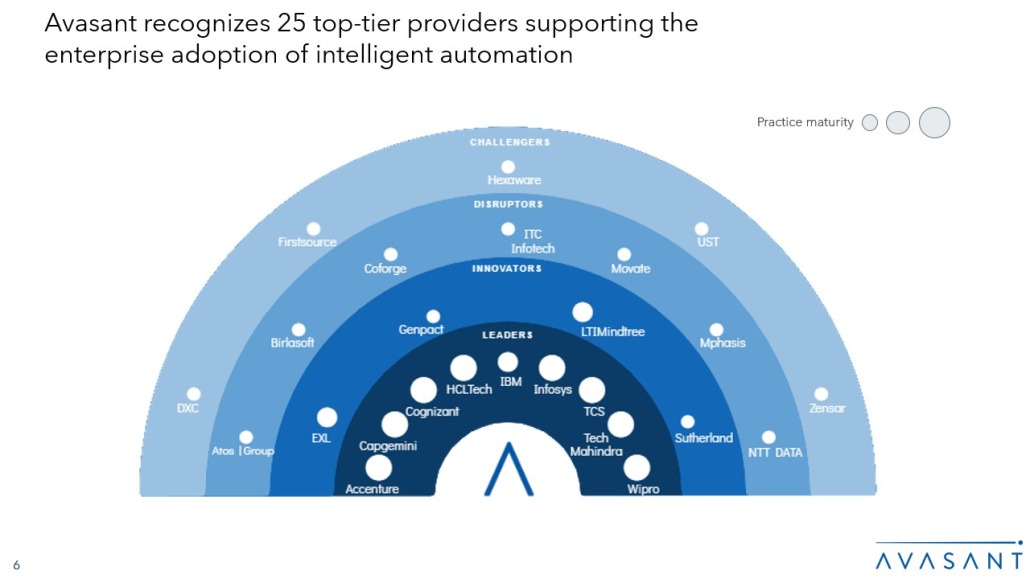

Avasant evaluated 35 service providers across three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these 35 providers, we recognized 25 that brought the most value to the market over the past 12 months.

The reports recognize service providers across four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCLTech, IBM, Infosys, TCS, Tech Mahindra, and Wipro

- Innovators: EXL, Genpact, LTIMindtree, and Sutherland

- Disruptors: Atos | Group, Birlasoft, Coforge, ITC Infotech, Movate, Mphasis, and NTT DATA

- Challengers: DXC, Firstsource, Hexaware, UST, and Zensar

Figure 1 below from the full report illustrates these categories:

“The rise of generative AI has significantly influenced enterprise demand for AI integration throughout the automation value chain, leading service providers to redesign workflows accordingly,” said Anupam Govil, managing partner and digital practice lead at Avasant. “This entails embracing advancements like multimodal data processing and intuitive digital interactions.”

The reports provide a number of findings, including the following:

- More than 85% of enterprises plan to increase digital spending in intelligent automation over the next 12–18 months. This surge is geared towards expanding IA initiatives, often integrating advanced cognitive automation features such as AI, ML, NLP, and generative AI.

- Since 2021, there has been a declining trend in standalone automation projects, dropping from 55% in 2021 to 44% in 2022 and further to 29% in 2023. This reflects an enterprise-wide shift from task-based automation towards process transformation.

- In 2023, low-code automation projects experienced a year-on-year increase of 43%, driven largely by growing enterprise interest in empowering employees to create their own automation workflows. To scale automation efforts, many enterprises are implementing citizen developer programs.

- Generative AI is reshaping workflows throughout the automation value chain, improving operational efficiency and accuracy.

“Enterprises are redirecting their focus from task-based automation to broader process- and enterprise-wide automation initiatives,” said Chandrika Dutt, associate research director with Avasant. “As part of this shift, they are investing in centers of excellence and implementing citizen developer programs to empower automation even at the grassroots level.”

The Intelligent Automation Services 2023–2024 RadarView™ features detailed profiles of 25 service providers, along with an overview of their solutions, offerings, and experience in assisting enterprises in their IA journeys.

This Research Byte is a brief overview of the Intelligent Automation Services 2023–2024 Market Insights™ and Intelligent Automation Services 2023–2024 RadarView™ (click for pricing).