This RadarView™ helps enterprises identify key service providers to implement and manage end-user computing services. It begins with a summary of key market trends and Avasant’s viewpoint on end-user computing services for the next 12 to 18 months. It continues with a detailed assessment of 25 providers offering end-user computing services. Each profile provides an overview of the service provider, its key IP and assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

Enterprises focus on improving user experience, enhancing productivity, reducing costs, and providing flexibility in their IT strategies. Service providers are responding by offering as-a-service models that align costs with actual usage, enabling faster adaptation to market changes and technological advancements without significant upfront investments. Additionally, they are introducing experience-level agreement (XLA)-based pricing models that emphasize continuous feedback and performance tracking, optimizing user experience and driving operational efficiency.

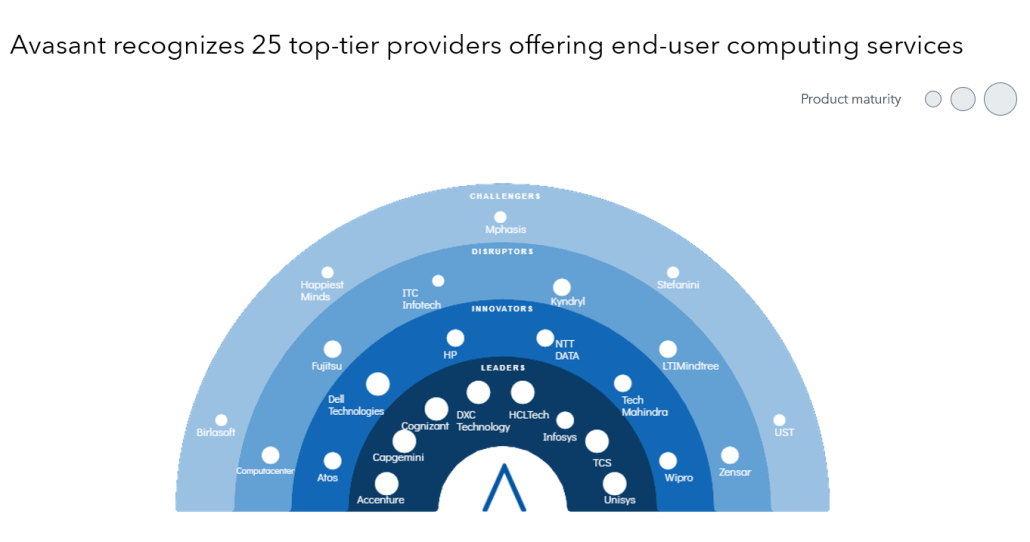

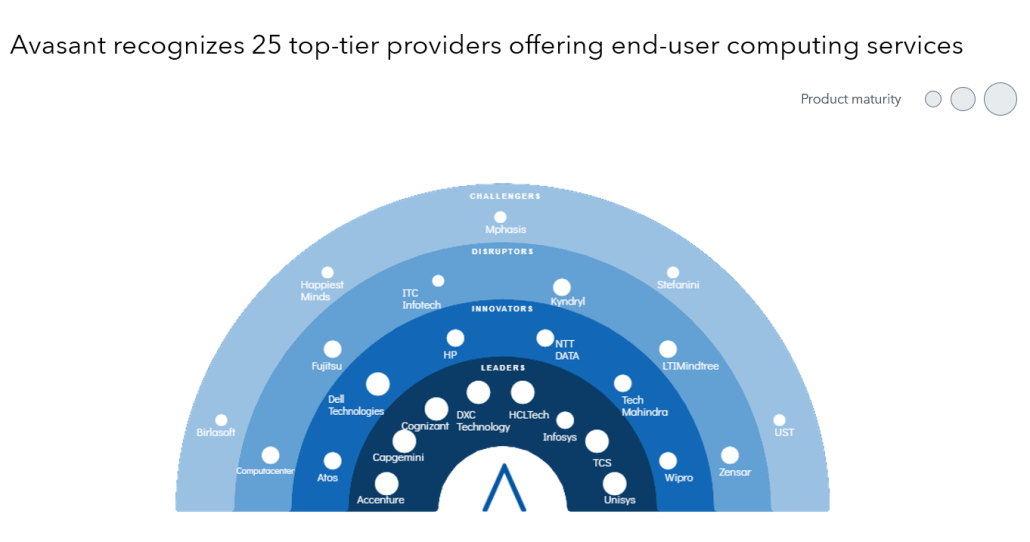

The End-user Computing Services 2024–2025 RadarView™ highlights key supply-side trends in the end-user computing space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in adopting end-user computing services. It also analyzes each service provider’s technology and delivery support capabilities, enabling organizations to identify the right strategic partners for managing their end-user computing environment.

Featured providers

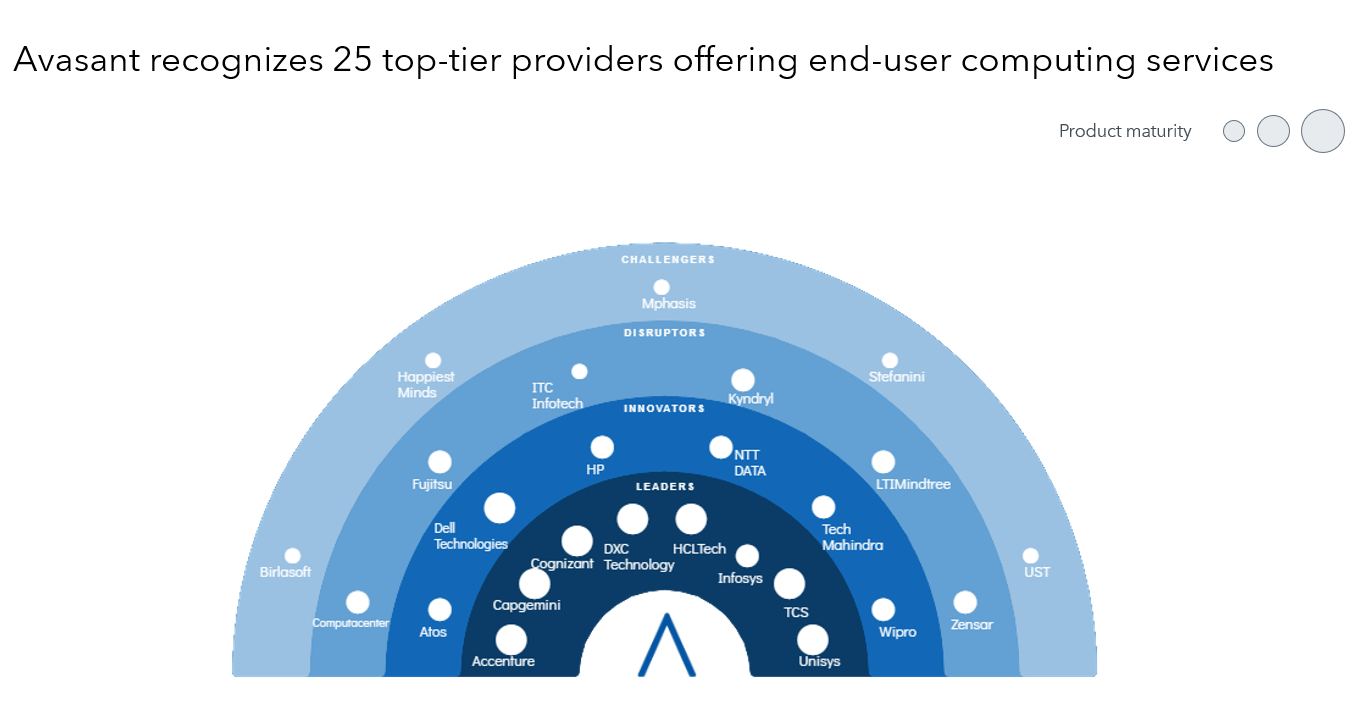

This RadarView includes a detailed analysis of the following end-user computing service providers: Accenture, Atos, Birlasoft, Capgemini, Cognizant, Computacenter, Dell Technologies, DXC Technology, Fujitsu, Happiest Minds, HCLTech, HP, Infosys, ITC Infotech, Kyndryl, LTIMindtree, Mphasis, NTT DATA, Stefanini, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

Table of contents

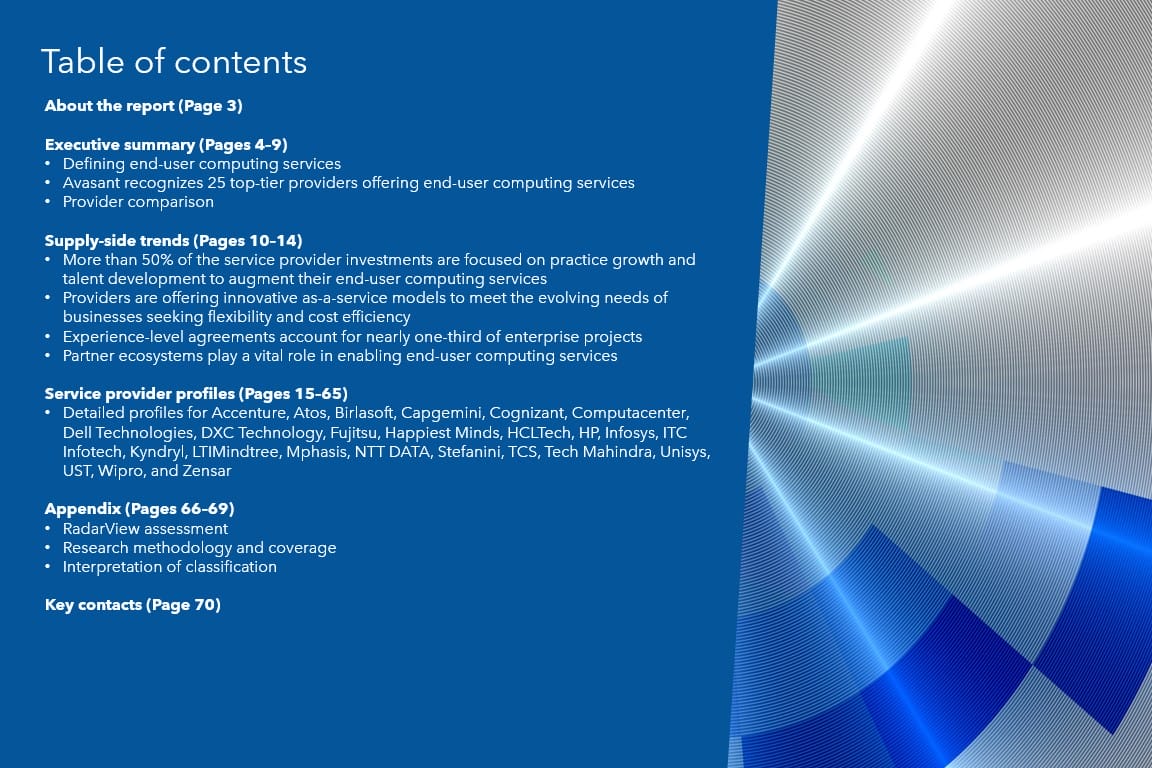

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Defining end-user computing services

- Avasant recognizes 25 top-tier providers offering end-user computing services

- Provider comparison

Supply-side trends (Pages 10–14)

-

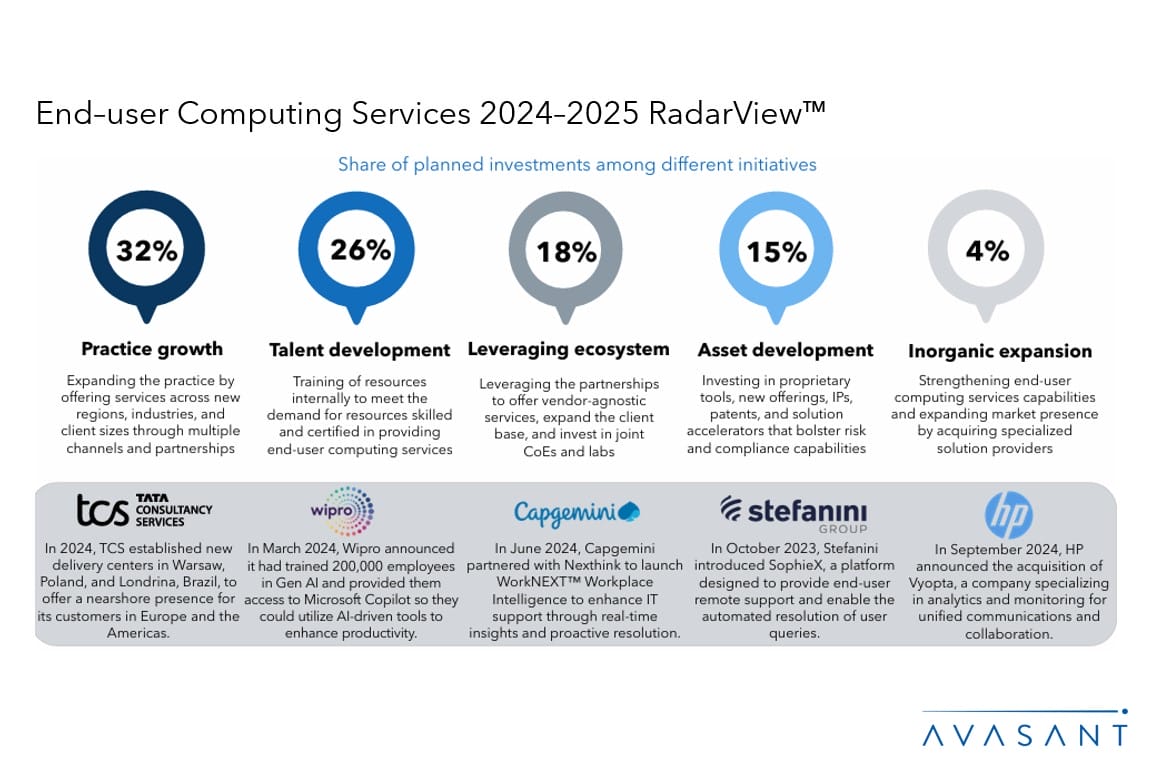

- More than 50% of the service provider investments are focused on practice growth and talent development to augment their end-user computing services.

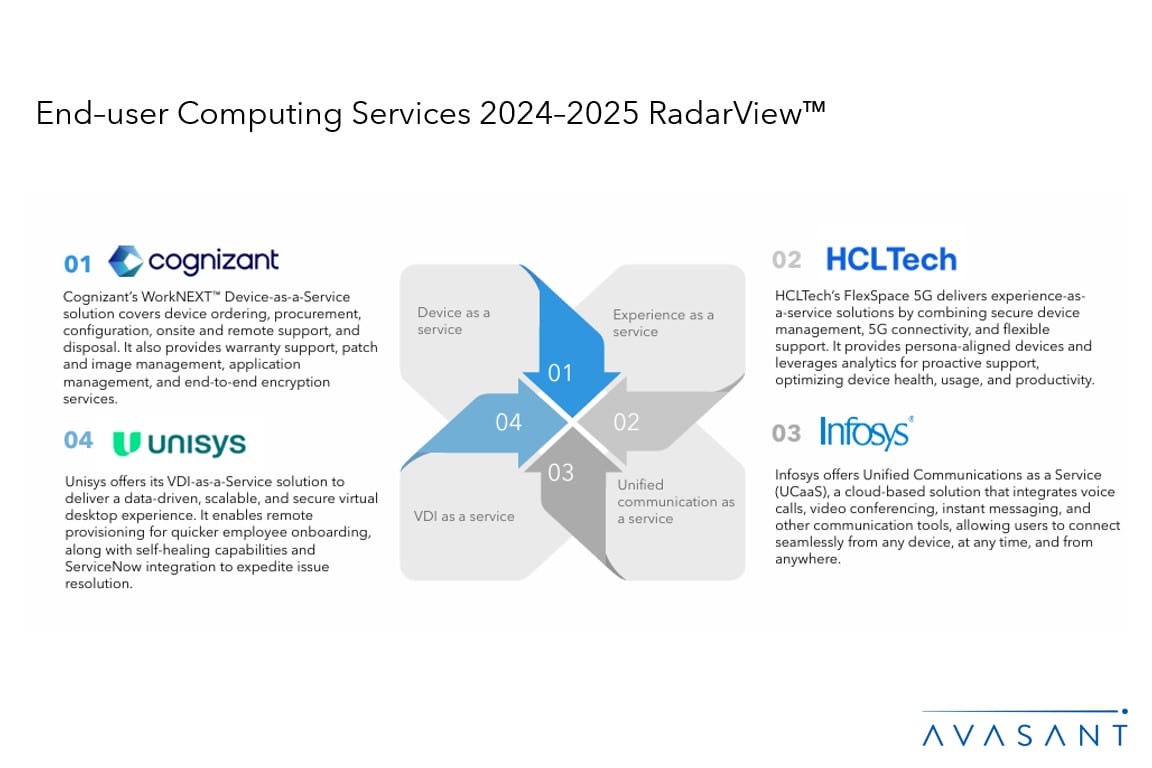

- Providers are offering innovative as-a-service models to meet the evolving needs of businesses seeking flexibility and cost efficiency.

- Experience-level agreements account for nearly one-third of enterprise projects.

- Partner ecosystems play a vital role in enabling end-user computing services.

Service provider profiles (Pages 15–65)

-

- Detailed profiles for Accenture, Atos, Birlasoft, Capgemini, Cognizant, Computacenter, Dell Technologies, DXC Technology, Fujitsu, Happiest Minds, HCLTech, HP, Infosys, ITC Infotech, Kyndryl, LTIMindtree, Mphasis, NTT DATA, Stefanini, TCS, Tech Mahindra, Unisys, UST, Wipro, and Zensar.

Appendix (Pages 66–69)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 70)

Read the Research Byte based on this report. Please refer to Avasant’s End-user Computing Services 2024–2025 Market Insights™ for detailed insights on the demand-side trends.