A major transition in the ERP market is underway, from traditional sales of perpetual licenses for applications deployed on-premises to subscription services deployed in the cloud. But not all buyers are ready to make the switch, particularly in more conservative sectors such as manufacturing. Some prefer to stick with the traditional model, while others are rapidly migrating to the new model. Others still are somewhere in the middle, choosing a traditional vendor offering but having the system hosted by the vendor or a third-party partner.

Customer preferences are complicated by what is offered by their chosen vendor. When a new customer selects a cloud ERP provider such as NetSuite, Plex, or Rootstock, are they doing so because of the cloud subscription model or in spite of it? Moreover, when a customer selects a traditional vendor with on-premises or hosted deployment, is it because they are opposed to the cloud model or because the functionality of the traditional vendor’s application is a better fit?

Acumatica as a Test Bed

As it turns out, there is one vendor’s experience that can help answer these questions: Acumatica. Acumatica has some interesting characteristics that make it a good laboratory for testing customer preferences.

-

It is a fairly new provider, founded in 2008, and it built its product from the ground up as a multi-tenant cloud system. It now has about 1,000 customers–a good sized sample–in manufacturing, professional services, and a variety of other industries. Moreover, there is no legacy installed base to influence the numbers.

-

The system is sold exclusively by partners, and partners have flexibility in how they deploy the system. This is the key point: partners can deploy it as a multi-tenant cloud system, with multiple customers on the same system instance, or they can deploy as a single-tenant system in the customer’s data center or a hosting data center.

- The licensing model is also flexible: customers can buy Acumatica as a subscription service, or they can buy it as a perpetual license.

The combination of deployment flexibility and licensing flexibility yield three main groups of customers as follows:

-

Perpetual License Customers: these are customers choosing the traditional license model with on-premises deployment or hosting by a partner. (Acumatica refers to these as “private cloud.” This term is confusing, however, as when deployed for a single customer, the system loses its cloud characteristics, such as pooled resources and elasticity.)

-

SaaS Customers: these are customers choosing cloud deployment along with a subscription agreement.

- Subscription On-Premises Customers: these are customers that choose traditional on-premises or hosted deployment but pay according to a subscription agreement.

In theory, according to Acumatica, there could be a fourth category: a customer could choose cloud deployment with a perpetual license. In practice, however, no customer has asked for this. If a customer were to choose this option, they would pay the license fee up-front, plus traditional maintenance fees, plus a hosting or cloud services charge on a monthly basis.

What Deployment and Licensing Options Do Customers Prefer?

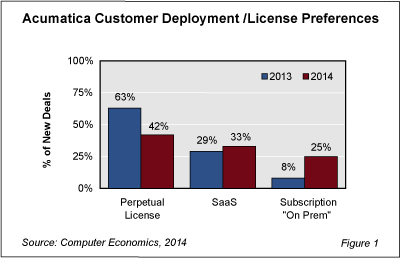

Acumatica made available to Computer Economics the customer counts for each of these three categories for the years 2013 and 2014. This allowed us to calculate on a percentage basis what options customers are choosing and—just as importantly—how those preferences are changing.

As shown in Figure 1, perpetual licenses (either on-premises or hosted) form the largest category of customers. This group accounted for 63% of new Acumatica sales in 2013, but it is falling dramatically to 42% of new customers in 2014. The SaaS customer group is picking up some of the difference: 29% in 2013 and rising to 33% in 2014. But the largest increase is coming from the so-called “Subscription On-Premises” group, which accounted for only 8% of sales in 2013, rising to 25% this year.

A Trend to Cloud, But Even More to Subscription

These results indicate that—at least for some customers today—the attraction of cloud ERP is more in the subscription option than it is in cloud deployment itself. Acumatica’s experience shows from 2013 to 2014, the majority of Acumatica’s sales shifted from perpetual licenses to subscription agreements. But a significant percentage of those did not deploy in the cloud: they chose the subscription agreement with on-premises (or hosted) deployment.

Acumatica executives are quick to point out that the choice of licensing and deployment options are influenced by Acumatica’s partners. Some are accustomed to selling perpetual licenses and appreciate the up-front cash that comes from license sales. Others are accustomed to on-premises deployments or hosting in their own data centers and, unless challenged by the customer, may steer them toward those options. But if this is the case, the trend in Figure 1 is conservative. Without partner bias toward perpetual licenses and on-premises/hosted deployment, the trend toward subscription and cloud would be even greater.

What Does This Mean for Buyers and Vendors?

As outlined in other research from Computer Economics, the benefits of cloud ERP are clear: speed of implementation, ease of upgrades and support, agility, and scalability. But do not underestimate the benefits that come from subscription pricing—whether or not it comes with cloud deployment:

-

Up-front cash savings. Unlike perpetual licenses, subscription agreements give customers pay-as-you-go pricing. Some vendors may require customers to commit to an initial contract term (e.g. one year) and pay for that up front. But even so, this is significantly less than customers would pay up-front under a perpetual license.

-

Risk mitigation. Under a perpetual license, if the implementation fails, or the customer decides to switch systems after two or three years, the customer loses its entire investment in the software. With a subscription agreement, the customer only loses subscription fees paid prior to cancellation.

- Alignment of vendor’s interest with customer’s. Closely following the previous point, under a perpetual license, a failed implementation does not cost the vendor anything (assuming there is no legal action requiring vendor concessions). With a subscription agreement, in contrast, vendors must continually satisfy customers, lest they lose the ongoing subscription fees. This tends to focus the vendor’s attention more closely on customer success.

The combination of cloud deployment and subscription agreements is, no doubt, a powerful combination. But notice that the three benefits outlined above are the same, regardless of whether the system is deployed as a cloud system.

Does this mean that all customers should go for subscription pricing? Based on interviews with some Acumatica customers that chose perpetual licenses, it seems the answer is no. Some customers do not like the idea that they will be paying subscription fees for as long as they use the system. They like the thought that, if they implement successfully, they have lower out-of-pocket costs for the long run.

It may be that customers are underestimating their ongoing costs, including maintenance fees and the cost of money. They also may be under-appreciating the risk mitigation and alignment benefits of subscription agreements.

Nevertheless, Acumatica’s experience shows where customer preferences are today and where they are heading. Cloud deployment is the future of ERP, and subscription agreements are attractive, even without cloud deployment.

These findings also suggest that traditional vendors that are slow to adapt to cloud deployment may be able to benefit in the short term simply by offering and promoting subscription agreements.