The best way to describe the European recovery from the COVID-19 pandemic is cautiously optimistic. Maybe with a little extra emphasis on optimistic. But it is nothing quite like the miracle recovery we described a little over a month ago for IT organizations in the US and Canada. Still, it is not all bad.

Sixty-five percent of European organizations are planning to increase their IT operational budgets. Half are planning to modestly increase IT head count. We continue to see expected increases in spending on digital transformation, software as a service (SaaS), and cloud, indicating that IT organizations are not holding back on new investments, and they see a clear path toward a digital future.

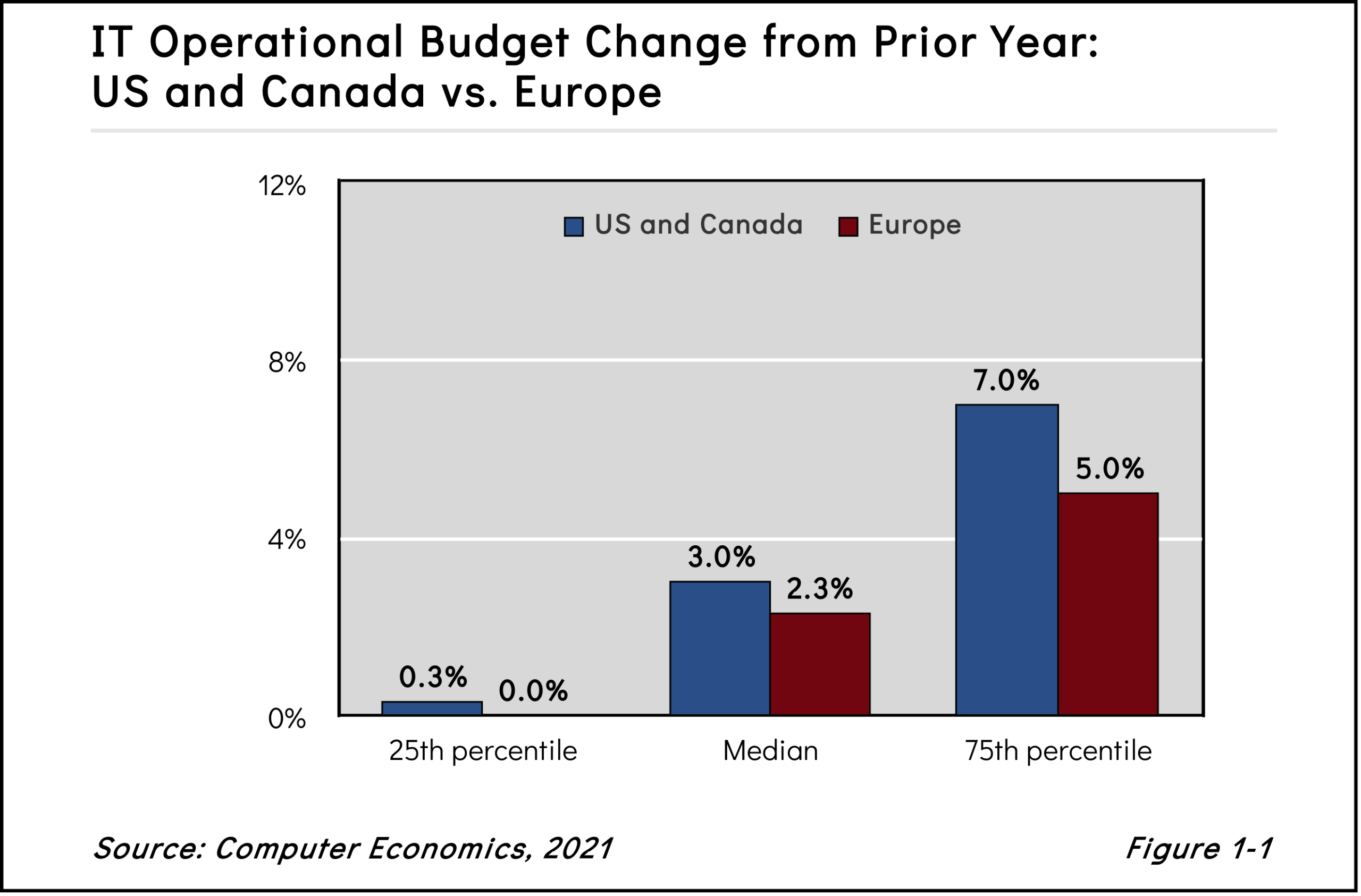

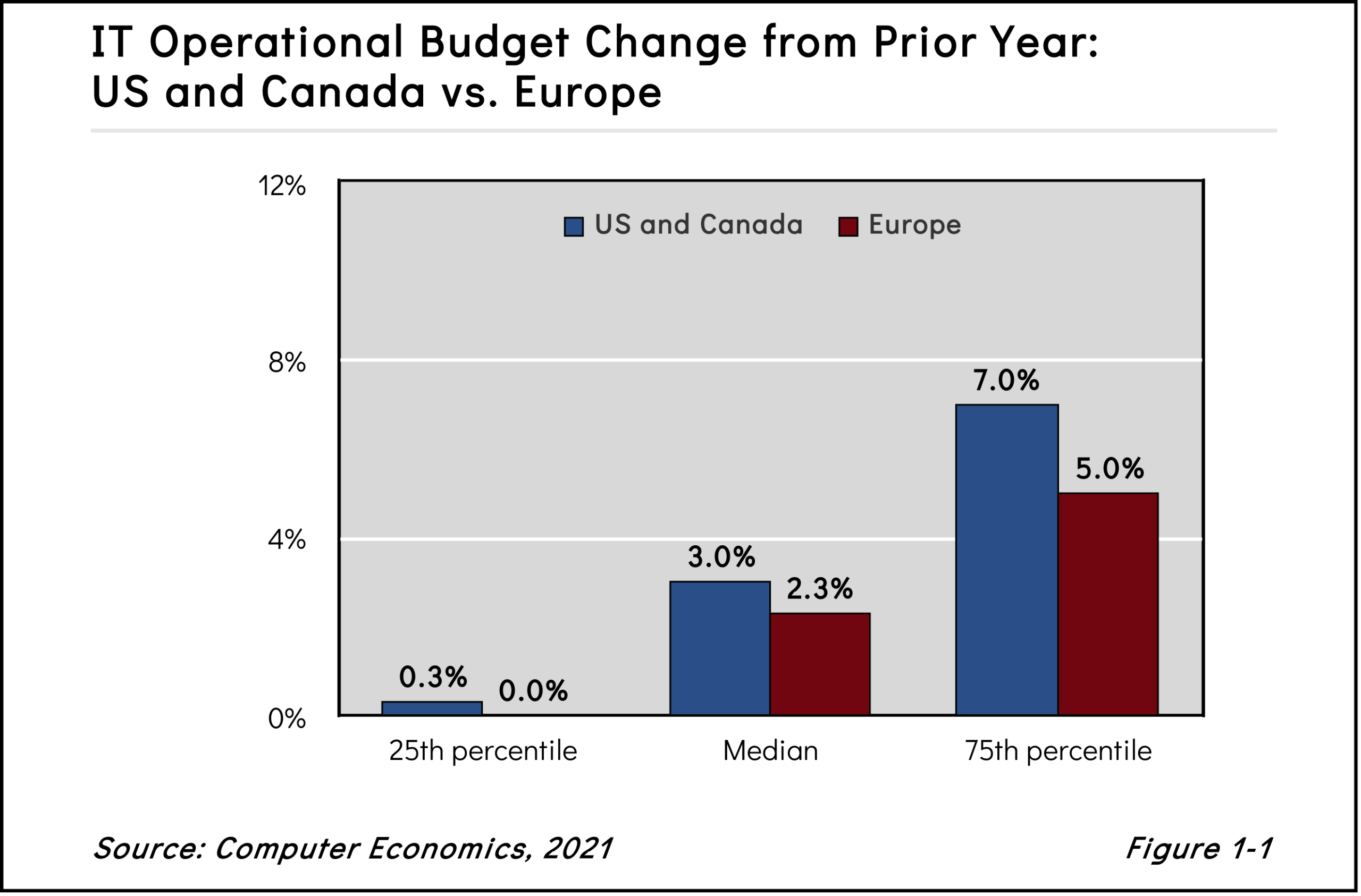

But as shown in Figure 1-1 from the our European IT Spending and Staffing Benchmarks 2021/2022 study, at the median US and Canadian companies are planning budget increases of 3.0%, compared to 2.3% at the median for European companies. A record 75% of US and Canadian companies are planning IT operational budget increases. The vibe across the pond is just a bit more subdued.

Part of the hesitancy to raise IT budgets in Europe to match North American increases can likely be traced to our survey period, which was from January until July 2021. In the earliest parts of the year, the US was ahead of most of Europe in vaccine distribution. Cases of COVID-19 were on a sharp decline in the US. The US had skyrocketing GDP growth of 6.4%. In contrast, GDP actually contracted slightly in the euro zone in the first quarter of 2021. Now, the executive arm of the EU is predicting growth of 4.8% for the rest of the year. And, vaccination rates are currently exceeding the US in some areas of Europe.

The good news is that regardless of the reason, IT organizations have an increasingly strategic role in the recovery. This is why we see most European companies increasing their spending on IT even if individual sectors are still being tested by the virus.

We continue to see rising spending on both cloud software and infrastructure, as well as an increase in spending on digital transformation and automation. While 2020 was disruptive in many ways, it also accelerated many of the projects already under way. Once many companies got over the shock of suddenly having all (or nearly all) of their employees work from home and the associated security risks, the trend toward digital transformation accelerated. More cloud. More SaaS.

“The economy transformed during the COVID lockdowns,” said David Wagner, senior research director at Computer Economics, a service of Avasant Research, based in Los Angeles. “New channels emerged. Customers are accustomed to everything arriving on their doorstep. There is no doubt we will see increases in IT budgets to pay for this new omnichannel, seamless customer experience. It is only a matter of when.”

We predict even stronger growth in the next few years as European economies grow and vaccines and therapeutics allow for recovery. It is unlikely that the growth will allow IT budget increases to persist between 2.0% and 2.3% as they did the last two years. We are now in the stage of digital transformation where we are not just replacing existing tools—we are now enhancing them.

The next few years will be about taking existing digital tools and changing how we interact with customers. We will be reinventing rather than replacing. This will require more investment in both technology and people. How much, of course, will be difficult to predict. But it feels safe to predict strong growth in IT spending over the next few years.

The Computer Economics European IT Spending and Staffing Benchmarks 2021/2022 study is based on a detailed survey of more than 234 IT executives in Europe on their IT spending and staffing plans for 2021/2022. The study provides IT spending and staffing benchmarks for small, midsize, and large organizations and for nine sectors and subsectors. A description of the study’s metrics, design, demographics, and methodology can be found in the free executive summary.

This Research Byte is a brief overview of the findings in our report, European IT Spending and Staffing Benchmarks 2021/2022. The full 12-chapter report is available at no charge for subscribers. Individual chapters may be purchased by non-subscribers directly from our website (click for pricing).