The report helps enterprises identify key providers to transform their finance and accounting (F&A) operations. It begins with a summary of key trends that are shaping the F&A space. We then continue with detailed assessments of 21 providers offering their services in the F&A outsourcing domain. Each profile provides an overview of the service provider, its key intellectual property (IP) assets for F&A, and a list of clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on each provider’s practice maturity, domain ecosystem, and investments and innovation.

Why read this RadarView?

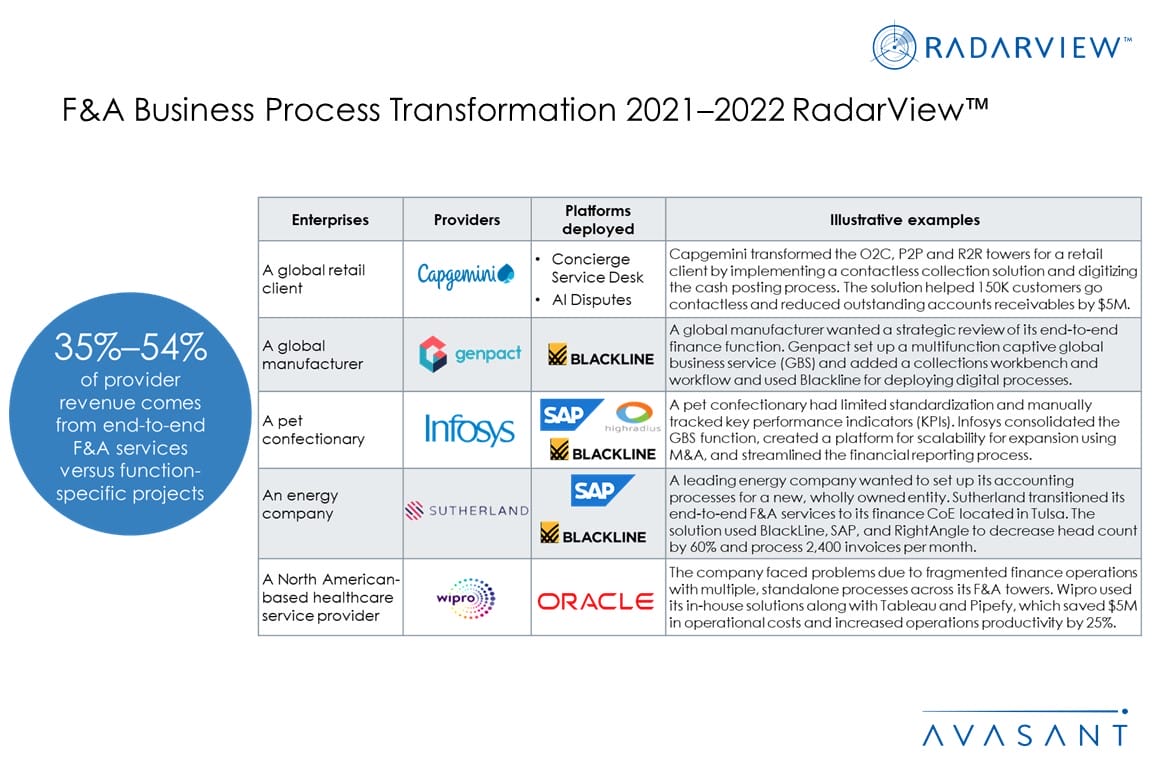

With the COVID-19 pandemic continuing to impact several industries, enterprises are looking to form strategic partnerships with F&A providers and pursue multitower F&A outsourcing deals to ensure business continuity. Providers are responding by developing industry-specific solutions, bringing in platform capabilities, hiring extensively in judgmental processes, and developing joint solutions with their key partners.

The F&A Business Process Transformation 2021–2022 RadarView™ highlights key outsourcing trends in the F&A space and Avasant’s viewpoint on them. It aims to aid companies in identifying the top service providers to transform their F&A operations. It also offers an analysis of service providers’ capabilities in technology, domain expertise, and delivery-related support for enabling enterprises to identify strategic partners for their F&A transformation.

Featured providers

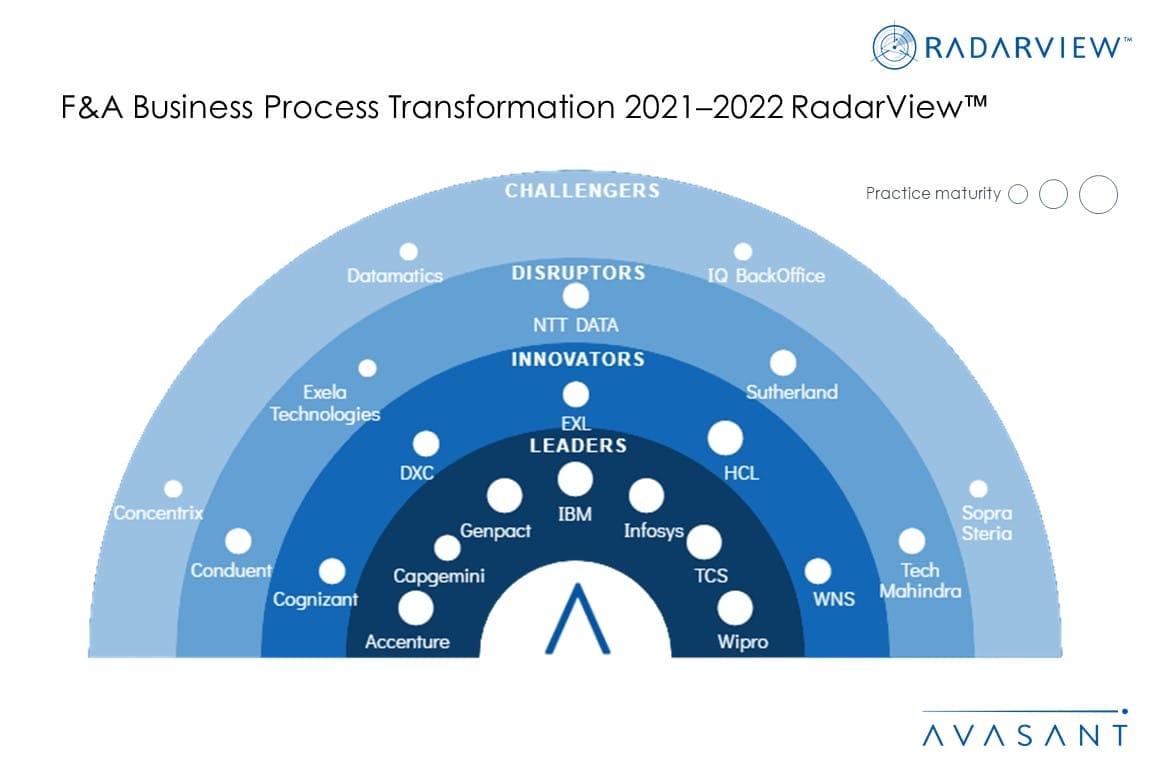

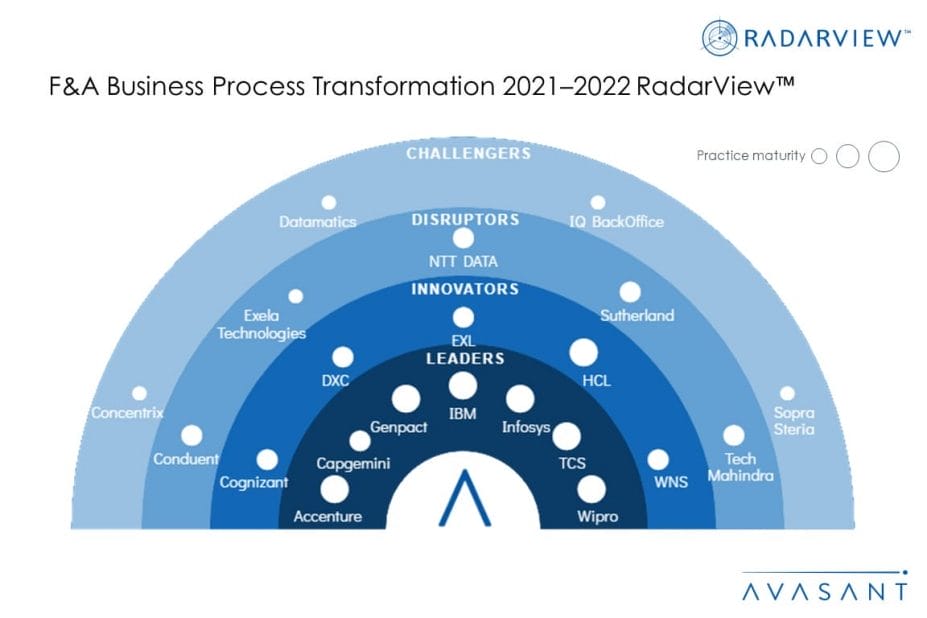

This RadarView includes a detailed analysis of the following F&A service providers: Accenture, Capgemini, Cognizant, Concentrix, Conduent, Datamatics, DXC, Exela Technologies, EXL, Genpact, HCL, IBM, Infosys, IQ BackOffice, NTT DATA, Sopra Steria, Sutherland, TCS, Tech Mahindra, Wipro, and WNS.

Methodology

The industry insights and recommendations are based on our ongoing interactions with enterprise chief experience officers and other key executives, targeted discussions with service providers, subject matter experts, and Avasant fellows, and lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and our ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

Table of contents

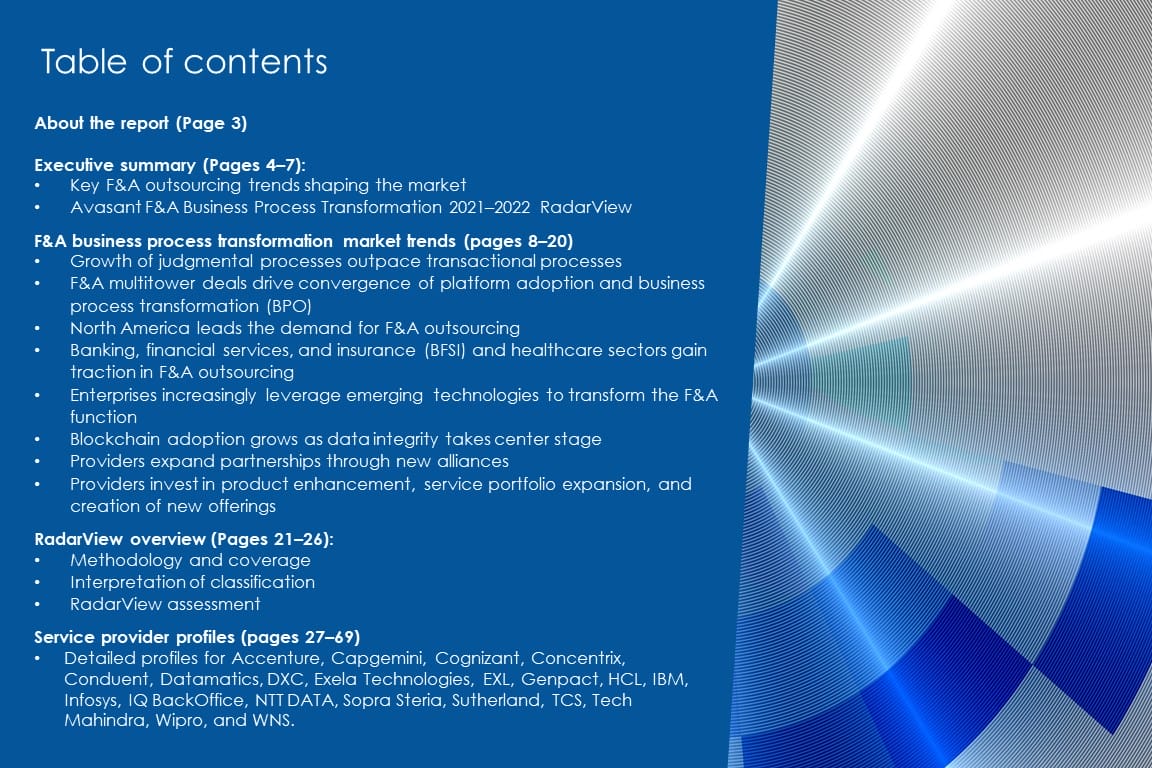

About the report (Page 3)

Executive summary (Pages 4–7):

-

- Key F&A outsourcing trends shaping the market

- Avasant F&A Business Process Transformation 2021–2022 RadarView

F&A business process transformation market trends (Pages 8–20):

-

- Growth of judgmental processes outpace transactional processes

- F&A multitower deals drive convergence of platform adoption and business process transformation (BPO)

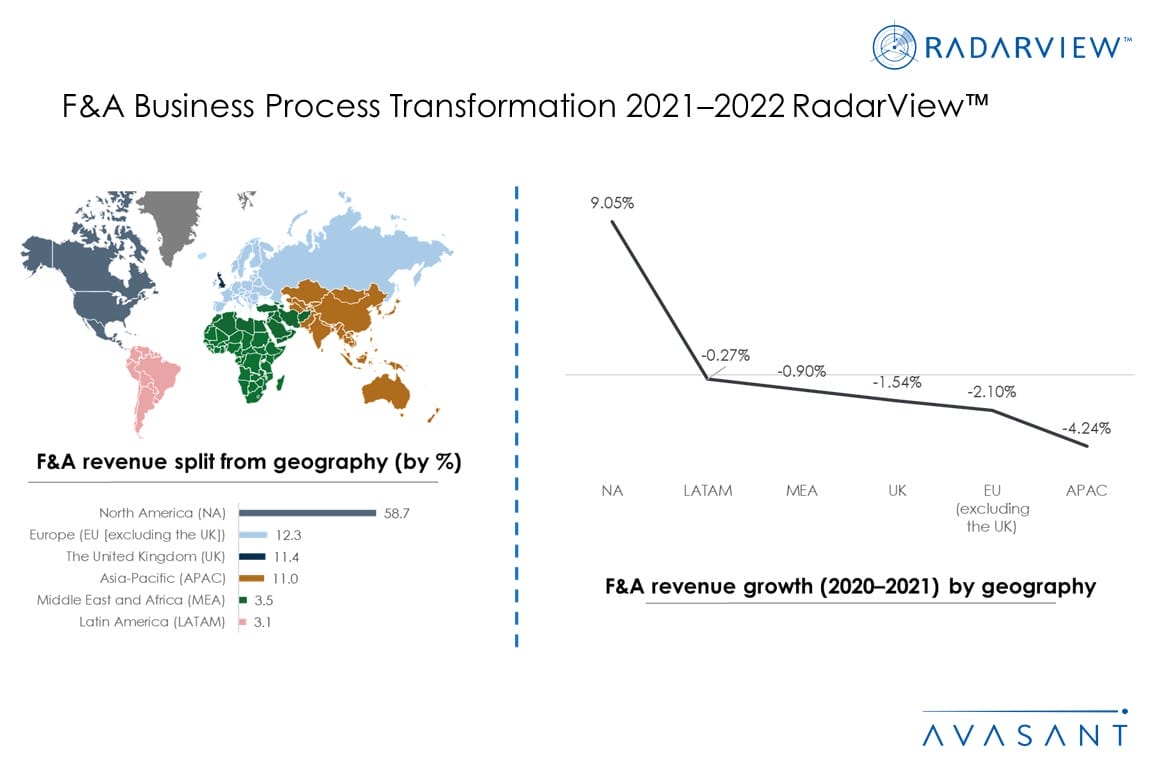

- North America leads the demand for F&A outsourcing

- Banking, financial services, and insurance (BFSI) and healthcare sectors gain traction in F&A outsourcing

- Enterprises increasingly leverage emerging technologies to transform the F&A function

- Blockchain adoption grows as data integrity takes center stage

- Providers expand partnerships through new alliances

- Providers invest in product enhancement, service portfolio expansion, and creation of new offerings

RadarView overview (Pages 21–26):

-

- Methodology and coverage

- Interpretation of classification

- RadarView assessment

Service provider profiles (Pages 27–69):

-

- Detailed profiles for Accenture, Capgemini, Cognizant, Concentrix, Conduent, Datamatics, DXC, Exela Technologies, EXL, Genpact, HCL, IBM, Infosys, IQ BackOffice, NTT DATA, Sopra Steria, Sutherland, TCS, Tech Mahindra, Wipro, and WNS.

Read the Research Byte based on this report.