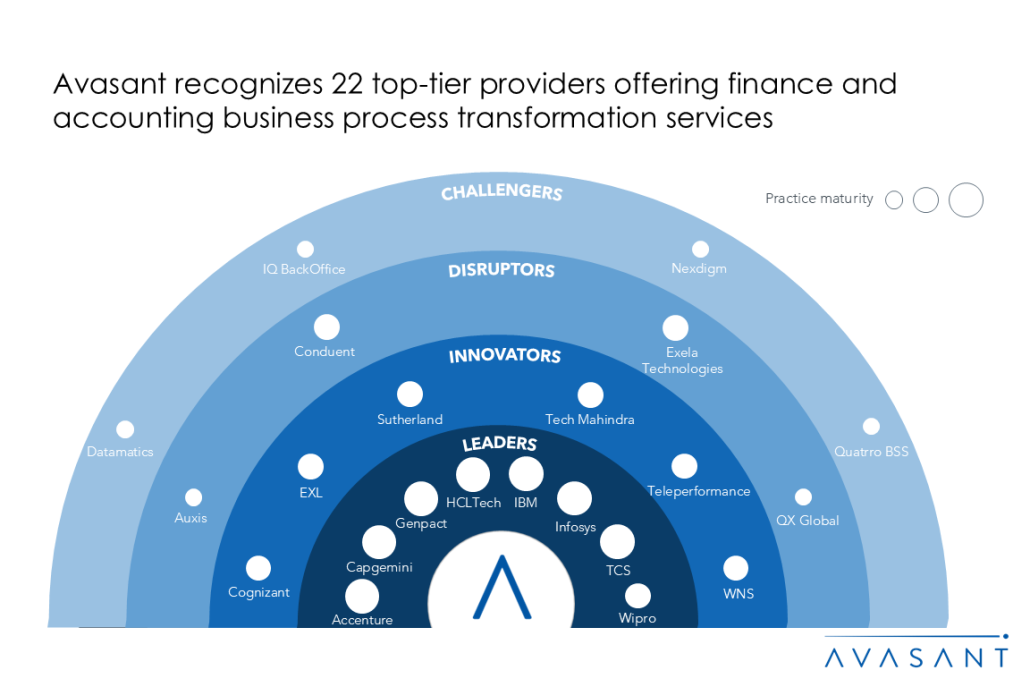

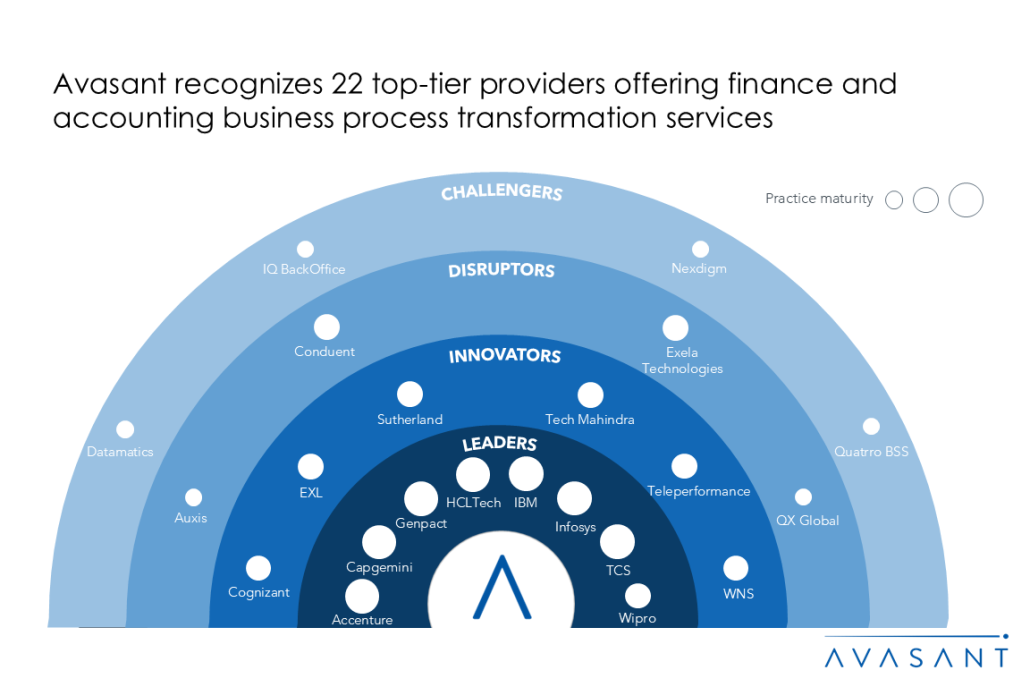

This RadarView provides a holistic view of the leading service providers offering finance and accounting (F&A) business process transformation services. It begins by summarizing key trends shaping the market’s supply side and continues with a detailed assessment of 22 service providers. Each profile presents an overview of the service provider, its key IP assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

As the F&A landscape evolves with advanced technologies and changing customer expectations, there is a rising emphasis on strategic advisory capabilities, with providers offering personalized, analytics-driven solutions that align with clients’ business goals. As organizations prioritize agility and scalability, service providers are also adopting innovative commercial models and fostering stronger ecosystem partnerships to deliver comprehensive digital transformation in finance and accounting operations.

The Finance and Accounting Business Process Transformation 2024–2025 RadarView highlights key supply-side trends in this space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in F&A business process transformation. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for their F&A processes.

Featured providers

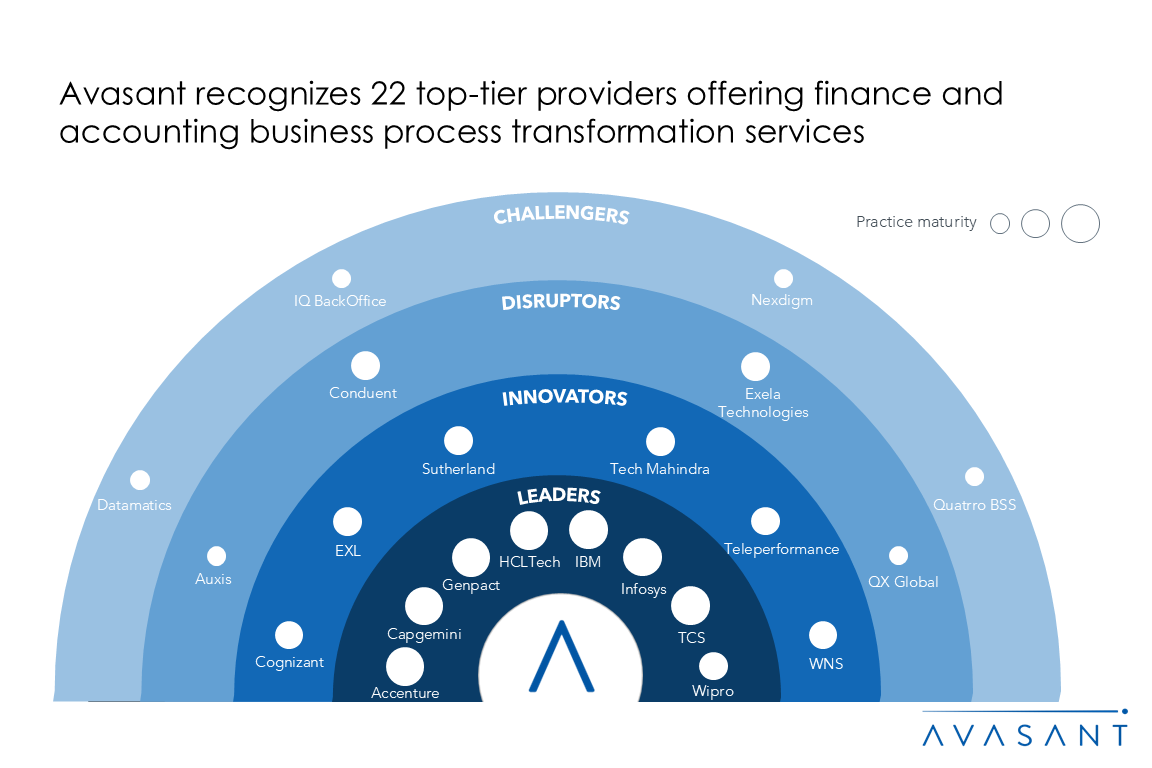

This RadarView includes a detailed analysis of the following F&A business process transformation service providers: Accenture, Auxis, Capgemini, Cognizant, Conduent, Datamatics, Exela Technologies, EXL, Genpact, HCLTech, IBM, Infosys, IQ BackOffice, Nexdigm, Quatrro BSS, QX Global, Sutherland, TCS, Tech Mahindra, Teleperformance, Wipro, and WNS.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of service providers that have brought the most value to the market over the past 12 months.

Table of contents

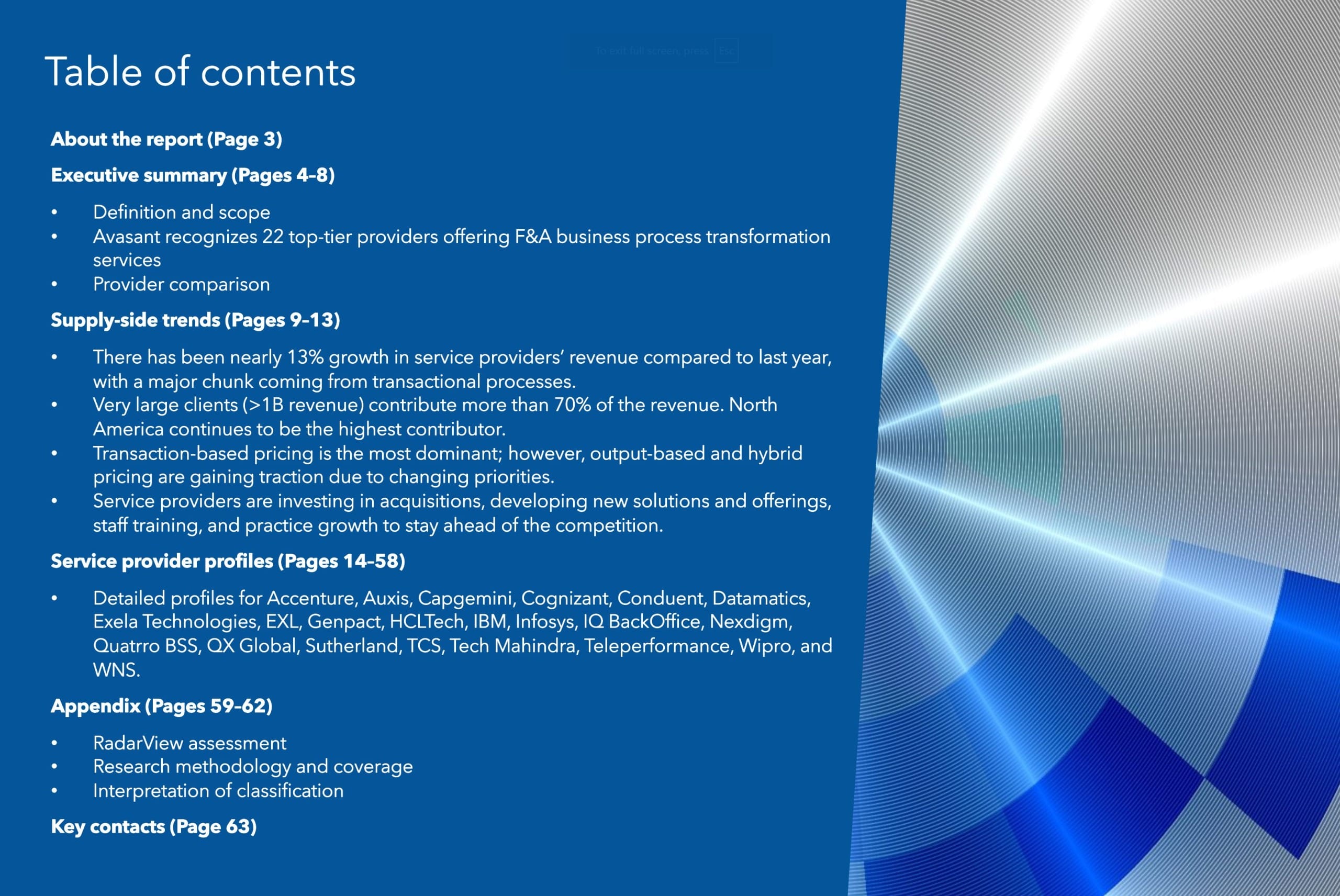

About the report (Page 3)

Executive summary (Pages 4–8)

- Definition and scope

- Avasant recognizes 22 top-tier providers offering finance and accounting business process transformation services

- Provider comparison

Supply-side trends (Pages 9–13)

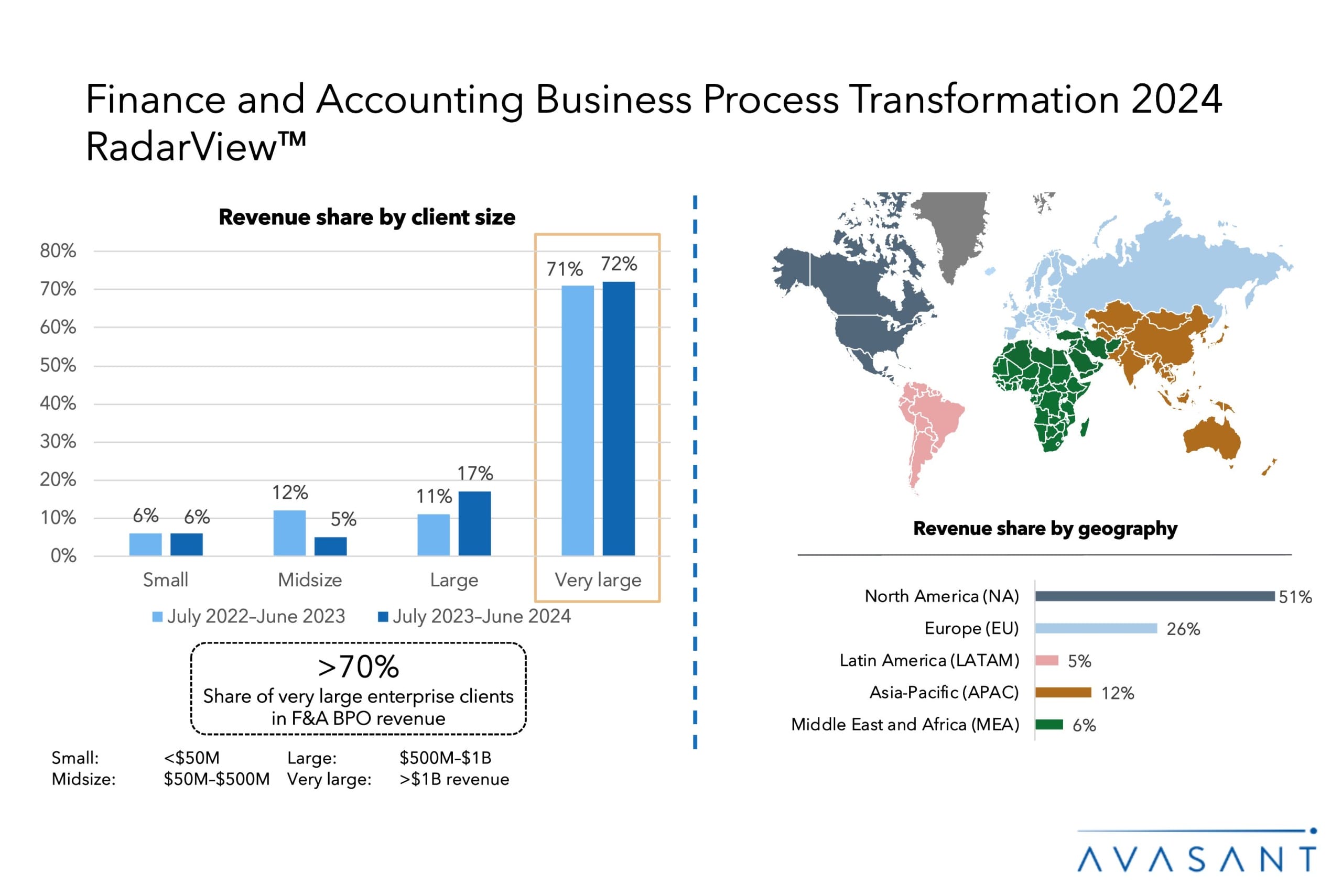

- Very large enterprises are driving F&A outsourcing, while North America continues to dominate the F&A BPO market.

- Transactional processes dominate the revenue and resource split, while FP&A, due to changing market dynamics, attracts clients’ attention.

- Enterprises are shifting to outcome/KPI-based and hybrid pricing models to ensure positive business impact rather than just transactional efficacy.

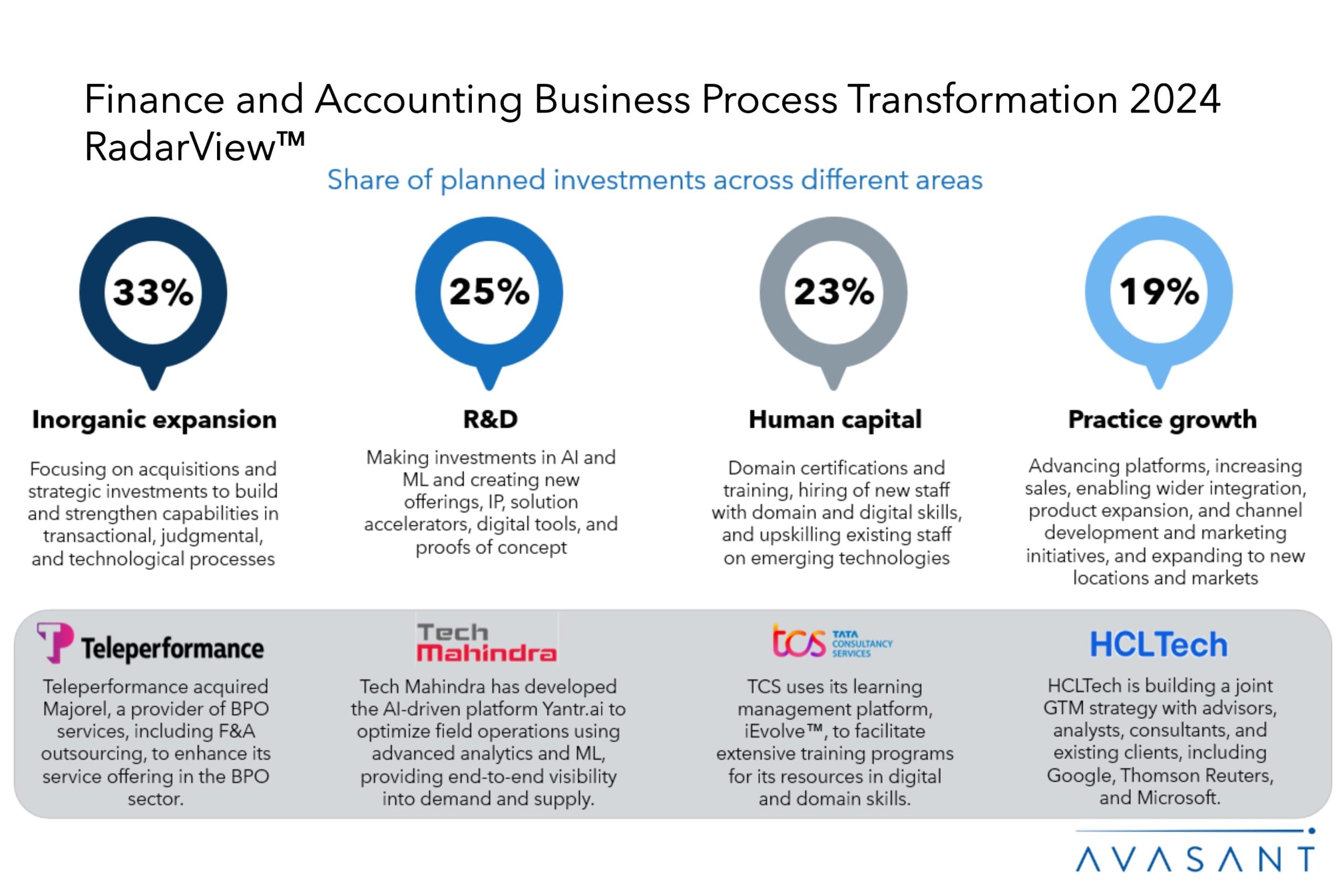

- Service providers are looking to gain an edge by investing in inorganic expansion and R&D initiatives.

Service provider profiles (Pages 14–58)

- Detailed profiles for Accenture, Auxis, Capgemini, Cognizant, Conduent, Datamatics, Exela Technologies, EXL, Genpact, HCLTech, IBM, Infosys, IQ BackOffice, Nexdigm, Quatrro BSS, QX Global, Sutherland, TCS, Tech Mahindra, Teleperformance, Wipro, and WNS.

Appendix (Pages 59–62)

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 63)

Read the Research Byte based on this report.

Please refer to Avasant’s Finance and Accounting Business Process Transformation 2024–2025 Market Insights for demand-side trends.