Digital real estate is the virtual space inside a virtual world that is sometimes available for purchase by consumers and enterprises. For enterprises, it is the space where your customers or partners interact with each other and your brand in the metaverse. Think of digital real estate as a brick-and-mortar store, a URL, or a social networking channel. It allows an enterprise to provide a brand experience to visitors. What will people navigating the virtual world through their avatars see when they come across your space in it? And what will they do there?

Although the term digital real estate is new, the concept of a digital location has been with us since the dawn of the Internet. From 1989 to the early 2000s, you could have thought of domains—the Internet addresses for websites—as digital locations. From the mid-2000s, social platforms and web-based services evolved with an emphasis on online collaboration, content sharing, and connectivity. For example, you may consider a popular YouTube channel or Facebook page as a virtual place anyone could create these. Now, with the metaverse as a virtual world, there is also a sense of place where organizations and individual users can buy and sell digital real estate. The value of these assets is based on what else is nearby—in the same virtual neighborhood.

For most enterprises, digital real estate is still a mystery. Even if the metaverse is on enterprise radar, there are still more questions than answers. Which of the early metaverses will thrive? How do you sell in the metaverse? Why should we pay for digital land when it is just a bunch of 1s and 0s? Is digital land not infinite as long as a metaverse provider keeps adding servers? Should we wait until all of this is a bit clearer? Consider the digital real estate question akin to Sears’ decision in the face of competition from Amazon. Sears, which used to be the world’s largest retailer and was founded as a mail-order company, missed the early potential of e-commerce. The metaverse is potentially the next disruptive medium to sell goods and services, and digital real estate is central to this sales strategy.

How do enterprises capitalize on this transitioning phase of opportunity? Early adopters will have the first slice of the metaverse pie, just as the first-mover advantage was crucial for companies adopting e-commerce without the promise of instant profits. In fact, Amazon took fourteen years to turn its first profit. The value was in the lessons learned in those fourteen years and the opportunity to gain mind share in a new space. The metaverse may take even longer to figure out.

This research byte outlines issues that organizations must consider when formulating their omniverse strategies for digital real estate.

The Evolving Concept of Digital Real Estate

In some ways, the metaverse has existed for decades in gaming environments with digital real estate, virtual economies, and even digital currencies (accepted in the game but bartered in real life). More recently, games like Fortnite have evolved from multiplayer shooting games to digital event spaces. The gaming world is part of the foundation of the metaverse. The metaverse is the simulation of a gaming platform transformed to imitate real life. The real estate in the metaverse is similar to that in the real world. But it is necessary to resolve several issues concerning digital real estate before widespread adoption.

Understanding the differences between platforms, products, and services is crucial when devising any corporate strategy, including digital real estate investments. The nuances between the two types of metaverses—decentralized and centralized—boil down to control. In decentralized metaverses, control remains within the community, whereas a central authority controls centralized metaverses. The rules for what you can or cannot build, how you interact with customers, and if it is even possible to own real estate vary across different metaverses.

After deciding whether your enterprise should invest in an existing metaverse (decentralized or centralized) or create a new metaverse, the next step is setting the experience. If and when it is fully realized, the omniverse will allow users to travel from one verse to another. These verses will take on an individual look and feel and have different customs and rules. Selling in multiple verses would require on-the-ground knowledge and understanding of local governance, compliance, preferences, and branding to cut through some of this static. Developing a brand experience would also be vital to your omniverse strategy. It would help if you thought about how your customer will move between verses and interact with your brand.

Perceived Limit on Digital Real Estate

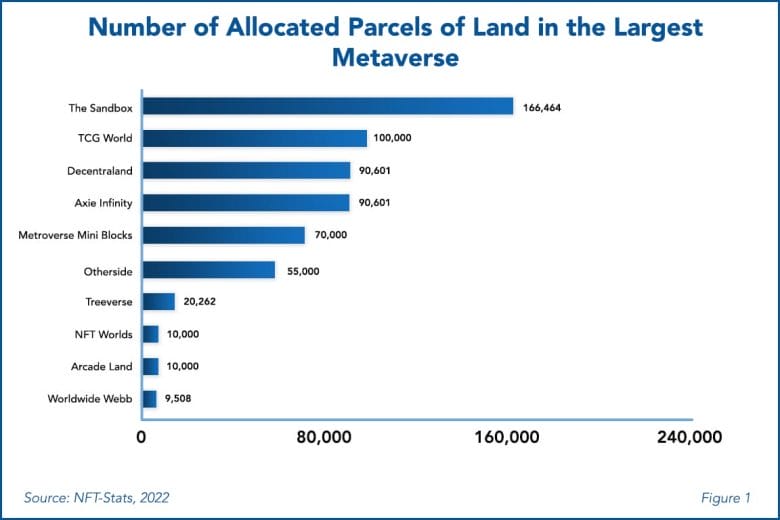

One may think that the digital universe is limitless, and digital real estate will also be infinite. At the end of the day, the metaverse is just modifiable code to fit a desired purpose. However, to drive demand and increase value, multiverse developers implement the scarcity principle. According to this principle, which states that scarce good has a higher value, the metaverse platforms make a finite number of digital plots available for purchase. For example, The Sandbox has stated that there will only ever be 166,464 LANDS available in their metaverse.

Figure 1, as of December 2022, shows the current number of allocated parcels of digital land across the largest metaverses. The Sandbox has the highest number of self-defined parcels of land, at 166,464. According to The Sandbox, 10% of the allocation—which equates to 16,704 plots—remains with it to host events and feature exclusive games. It reserves another 16% (25,920) of plots to distribute to its partners, creators, and gamers as rewards. The remaining 74% (123,000) of plots were for sale. As of March 2022, The Sandbox had sold 100,054 plots, leaving only 19% (23,000) of the total plots without owners. Those sold parcels can also be resold, similar to physical property, creating a market for digital real estate.

Although metaverse platforms have limited their number of parcels of land, nothing prevents them from increasing the number of parcels. Also, the total number of possible metaverses is unlimited. Anyone can develop a metaverse, sell virtual plots of land, and create a community. Therefore, scarcity may not be the only factor driving value for digital real estate.

Another aspect influencing land on the metaverse is the location. For instance, a limited number of plots will surround those owned by celebrities and brand-named stores, granting them a higher value. Major companies, such as Gucci, Nike, Disney, and Coca-Cola, already have a presence in the metaverse. As a result, these corporations are driving interest in the digital real estate market. Moreover, celebrities like Paris Hilton and Snoop Dogg are making waves in the metaverses and aiding the increase in the price of these digital plots of land. For example, a fan of Snoop Dogg paid $450,000 in 2021 to be his virtual neighbor in the metaverse. So, if you want to be “seen” outside Chanel’s store, you must be willing to pay. The infinite nature of digital real estate will drive value. Akin to the real world, the sought-after neighborhoods in the metaverse will command a premium value. The three vital criteria for real estate—”location, location, location”—also apply to the virtual world.

Investors also need to appreciate the foot traffic for these metaverses. According to Metaversed, there were 400 million monthly active metaverse users as of March 2022, of whom only 13.2% (about 53 million) were 18 years old and above. However, Metaversed includes large popular gaming worlds, such as Roblox, Fortnite, and Minecraft, in its definition of a metaverse. Nevertheless, understanding the potential audience in these metaverses will enable enterprises to devise their omniverse strategies.

Several questions about digital real estate still need to be answered. One, will these self-imposed allocation limits for metaverses increase or stay the same in the next few years? Two, will such changes appreciate or depreciate the value of your enterprise’s digital assets? Three, will there be a real limit on the total number of metaverses, or only a superficial limit that holds only a few metaverses worthy of investment? Four, what age group will dominate the metaverses? Since it is still early days for the metaverse and the platforms are scarcely even built, only time will answer these questions.

Risks with Digital Real Estate Volatility

Although every investment carries risk, investors need to consider the added risks associated with digital real estate, similar to any crypto asset. This accounts for instances where a metaverse platform fails or ceases to exist. The sudden disappearance of a digital project is not uncommon, one such cause is rug pulls.

A rug pull is a type of fraud that builds interest in a particular project or new crypto coin whose developers wait until the liquidity pool has a significant amount of funds and then “pull the rug from under it.” In 2021, according to a report by Chainanalysis, investors lost over 2.8 billion US dollars due to rug pulls, though this may be an inflated amount due to the illiquid nature of many cryptocurrencies.

Therefore, digital real estate has the potential to suffer the same fate. Rogue developers can create metaverse platforms to sell digital land and build seemingly legitimate communities. If these platforms go offline, all investments connected will also disappear. For example, WarOnRugs was a platform created to expose developers of rug pulls. Unexpectedly, even WarOnRugs did a rug pull after raising two million US dollars from investors.

Digital assets are also highly volatile. While issues of natural forces such as hurricanes and earthquakes cannot damage them physically, digital real estate properties face other risks such as cybercrime. Cyber threats have a significant impact on the value of digital assets. As crypto transactions are irreversible and anonymous, it creates an environment for cybercrime to thrive. Thus, investors should consider cybersecurity insurance policies and the financial obligations of loans before considering digital real estate purchases.

Risks in the Legal Surety of Digital Real Estate

Compared to physical real estate, which does not suddenly disappear unless there is a physical disaster, digital real estate solely relies on the existence of metaverse platforms. The drafted terms of use also provide the owners of these platforms with broad discretionary powers. For instance, section 1 of Decentraland’s terms of use states the following:

“The Foundation has no continuing obligation to operate the Tools and the Site and may cease to operate one or more of the Tools in the future, at its exclusive discretion, with no liability whatsoever in connection thereto.”

While NFTs and finalized transactions provide users with a symbol of ownership of digital assets, retaining use can be severely restricted if platforms decide to change or cease their operations. The owners of these platforms have diluted themselves of any liability. So, how does it affect your digital assets within a metaverse that has ceased operation? Well, digital assets will disappear with the metaverse platform. Therefore, enterprises need to pay attention to a metaverse’s terms of use and whether it will be easy to port their developed experiences to another metaverse.

Another issue is the scarcity of legal precedents. Many jurisdictions still do not have regulations and legislation concerning digital assets, including digital real estate. However, legal jurisprudence on digital assets is slowly growing, with a recent increase in litigation surrounding them. As noted earlier, the anonymous and irreversible nature of transactions on the blockchain makes them attractive to illicit actors who wish to hide their identities. But US and UK courts have been adopting innovative approaches to deal with anonymous defendants.

The digital nature of assets also poses challenges in suing someone who steals your digital real estate. In the physical world, there are traditional methods of serving court proceedings. But the anonymity of the digital asset space makes it impossible to use such methods. However, there may be alternatives. In January 2022, to circumvent the anonymity of the defendants in a case, the US Supreme Court allowed the use of airdropping—the process of distributing cryptocurrencies, tokens, and NFTs—as the service method. In this case, authorities airdropped the NFT with an embedded hyperlink to the legal notice for an asset freeze of the defendant’s digital wallet. Since platforms can restrict the defendant’s use and access, the authorities could effectively execute the legal notice. Similarly, the High Court of England adopted this method of serving court proceedings through NFTs.

While the laws on digital assets, blockchain, and other emerging technologies are still evolving, these recent US and UK cases show that legal approaches are not static. The courts are implementing innovative strategies to find recourse and justice for investors who fall victim to illicit actors. Nevertheless, investors should, consider all the risks and options to secure their digital assets.

Preparation for Digital Real Estate Strategy

An enterprise’s omniverse strategy should address at least the following seven key questions related to digital real estate:

-

- What is your intended use for the metaverse? (for example, marketing, increasing brand awareness, selling to customers, collaborating at the workplace, or creating a community)

- Which metaverse platforms are most promising, and who else is building there?

- What opportunities are there for you to locate near other important players building on those metaverse platforms?

- What is your plan for staking a claim to digital real estate in the most valued neighborhoods on metaverse platforms?

- Conversely, is there an opportunity for you to become an “anchor tenant” and draw others to build near you in that metaverse?

- Can you create a consortium of your ecosystem partners to go in and buy up digital real estate near one another and create a community?

- Do you want to invest in digital real estate beyond your planned needs to resell that property to others in the future?

Regardless of the type of metaverse (decentralized or centralized), it is important to know its rules and conventions and pick the ones that best fit your objectives. In any setting, whether virtual or physical, your organization should support the community rules to fit in as a good corporate citizen.

Future Considerations

With any new technology, there will be a teething phase. However, enterprises need to consider the above issues and strategize their eventual growth in this open business opportunity presented by the metaverse. Developing an omniverse strategy is one of the first steps before jumping into the metaverse. This strategy will guide enterprises to think virtually and horizontally as they build their presence outside the physical world.

Enterprises also need to leverage data as they consider their future in digital real estate. Understanding the space, customers, and the market is key to expanding any business. Therefore, investing in data that moves across the virtual, augmented, and physical realms is crucial in this digital era. Data will enable enterprises to identify gaps and remove silos to ensure a seamless transition between verses.

Most importantly, once the omniverse strategy is developed, organizations should ensure that it aligns with their business goals and objectives. The eventual omniverse strategy must be flexible to adjust to changes in technology and market conditions. Do not be left behind. Be innovative and creative and find new ways to engage and enhance customers’ experiences as they interact with you and your products/services. Digital real estate might be part of the answer.

By: Tracell Frederick, Senior Consultant, Avasant