From Process to Experience: When Payroll Transformation Meets Humanity

A quiet shift is changing how people experience work. It is no longer only about where people work or what they do. It is also about how they are paid, when they are paid, and what that says about how organizations value them.

For years, payroll has been seen as a necessary function that ensures accuracy, compliance, and timeliness. Success meant being invisible. However, in a world where people expect immediacy, personalization, and digital experiences, payroll can no longer remain a background process. It is becoming part of the broader employee experience, connecting people, technology, and trust.

The Rise of the Pay-as-You-Live Workforce

The way people are paid is changing. Employees now expect flexibility, control, and visibility over their earnings. Many people want the ability to access their wages as they are earned, rather than waiting for a fixed pay cycle.

Walmart’s partnership with PayActiv enables employees to access their wages as soon as they are earned, reducing financial stress and enhancing engagement. Uber’s Instant Pay offers its drivers similar access, allowing for almost immediate payment.

This is more than a convenience. It reflects a broader shift in workforce expectations, where flexibility and fairness are increasingly central to how people choose and remain with employers. Payroll now plays a fundamental role in shaping employees’ overall work experience, extending beyond its traditional function as an administrative support system.

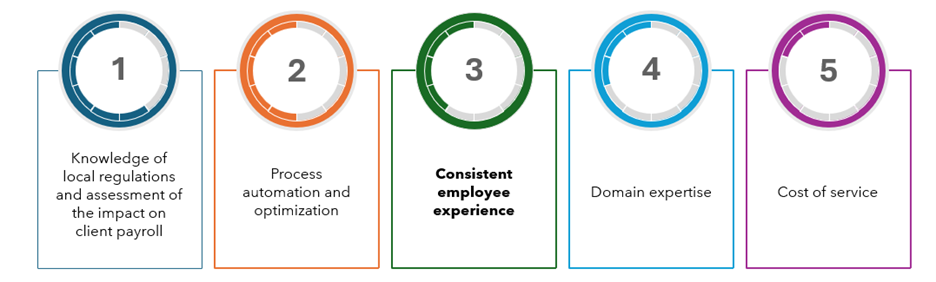

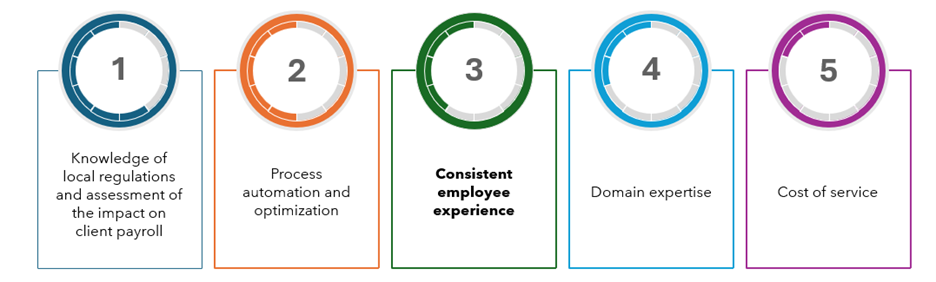

According to Avasant’s Payroll Business Process Transformation 2025–2026 RadarView™, consistent employee experience ranks third among the top five factors influencing payroll transformation engagements, following regulatory knowledge and process automation. This shows that payroll modernization is no longer focused only on compliance or cost reduction. It is also about enhancing the way employees interact with the organization each time they receive payment.

The consumerization of work has set new expectations for payroll. Employees now expect the same seamlessness they experience in their digital lives, for instance, curated playlists, one-click purchases, and real-time updates, to extend to their pay and benefits.

Earned wage access, flexible pay cycles, and adaptive compensation models are transforming the way people experience work. Payroll platforms are integrating with wellness and finance applications, helping employees save, budget, and plan. Personalized pay experiences are becoming an effective way to improve employee engagement and retention.

However, personalization introduces complexity. Every real-time payment must meet diverse compliance requirements, align with tax regimes, and safeguard personal data. Automation has made this level of personalization possible, but it has also elevated the importance of governance and human oversight.

Automation: The Enabler and the Equalizer

The future of payroll is characterized by intelligence, driven by automation, analytics, and AI. Modern payroll engines can process thousands of variations in real time, identify anomalies before they become errors, and ensure global compliance at scale.

This digital infrastructure has transformed payroll from a cost center into a strategic enabler. According to Avasant’s Annual HR Budgets, Staffing, and Process Metrics Study , organizations now allocate 15%–25% of their HR function budgets to technology investments, underscoring how automation and analytics have become foundational to building trust, enhancing agility, and promoting scalability in the workforce.

Yet automation alone is not enough. Algorithms can calculate compensation, but they cannot convey a sense of fairness. Machines can detect errors, but they cannot build confidence. The future of payroll transformation will be shaped by the recognition that although automation ensures precision, empathy ensures a sense of belonging.

Payroll professionals are becoming interpreters of data and architects of trust. Their insights now inform pay equity, diversity, and inclusion strategies, turning what was once a transactional function into a driver of corporate conscience.

In the era of intelligent systems, empathy has become a business differentiator. Employees do not just expect to be paid accurately; they expect to be understood. A single payroll error can erode trust, even when corrected quickly, while transparent and proactive pay communication fosters loyalty and a sense of belonging.

This is the paradox of digital payroll: precision is assumed, but empathy is remembered. Technology can streamline operations, but only human-centered design ensures that pay feels fair, transparent, and dignified. Organizations should adopt human-in-the-loop frameworks that blend automation with human context, embedding points of review, feedback, and personalization into every pay cycle. It is not just about compliance; it is also a matter of conscience.

The Road Ahead: Payroll with Purpose

At its core, payroll has always been about exchange: people putting in time and effort in return for pay. But today, that exchange means much more. It represents fairness, respect, and empowerment. As companies invest in real-time pay, analytics, and AI-based systems, they are also rethinking what fairness really means. In this pay-as-you-live world, fairness changes with data, context, and human understanding.

The next step in payroll transformation is about using technology thoughtfully. Every improvement should build trust and make employees feel valued, not replace human connection. Payroll modernization has evolved beyond a mere technological initiative; it now plays a critical role in enhancing the relationship between employees and the organization.

The success of future payroll systems will be determined not by their speed or technological sophistication, but by their ability to reliably execute core functions. It will depend on whether they help people feel secure, respected, and in control of their earnings. Companies that recognize this will lead the way, turning automation into confidence, data into fairness, and payroll into a source of purpose and trust.

By Riya Arora, Senior Research Analyst