This report helps enterprises chart out their action plan for digital transformation by understanding the latest trends in the automation space. It begins with a summary of key facts and trends. We continue with a detailed assessment of 24 leading service providers in the intelligent automation space. Each profile provides an overview of the service provider, their intelligent automation solutions, and a list of representative clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partnership ecosystem, and investments and innovation.

Why read this RadarView?

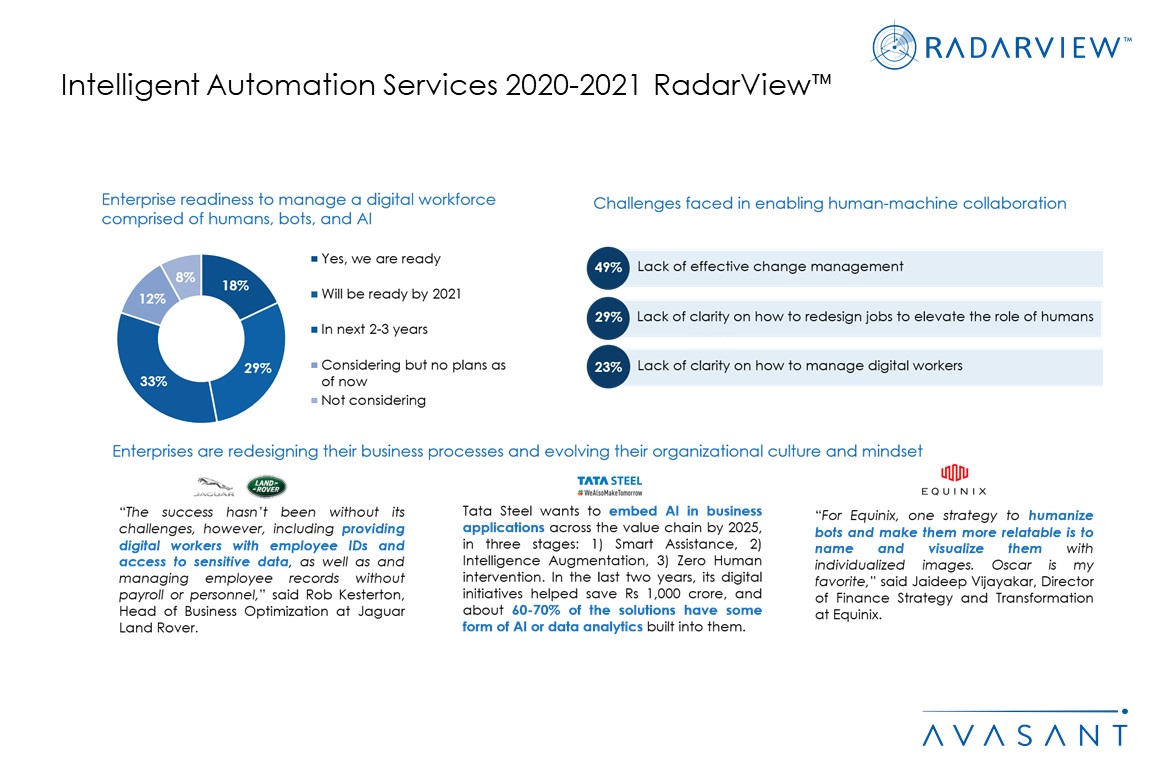

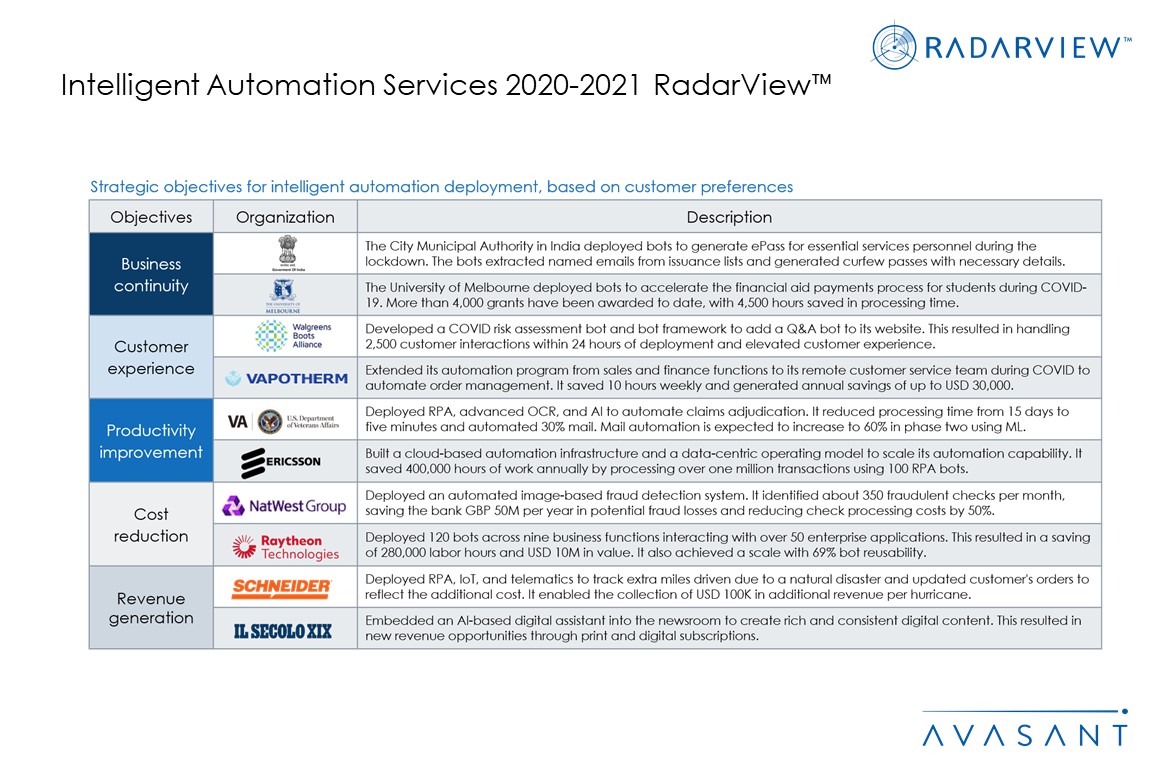

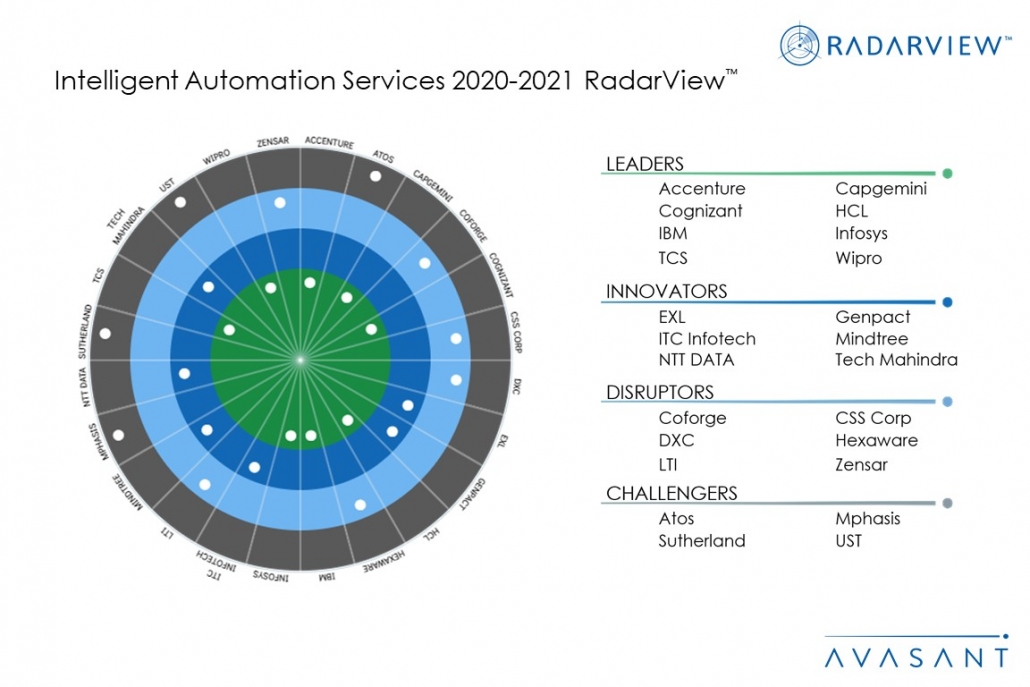

AI-based automation has boosted use cases for prediction and recommendation. Also, the enterprise demand for straight-through and touchless processing solutions has accelerated. Enterprises are now industrializing automation by developing a centralized program enabled by hyperautomation. They are embedding cognitive capabilities to handle exceptions and run integrated workflows. This report is designed to help enterprises identify the right service provider for implementing and scaling automation. It assesses the service providers based on their hyperautomation capabilities across the entire automation toolkit, flexibility in the pricing model, efforts to reduce TCO, maturity and scale of operations, and initiatives to increase citizen development and democratize RPA.

Featured Providers

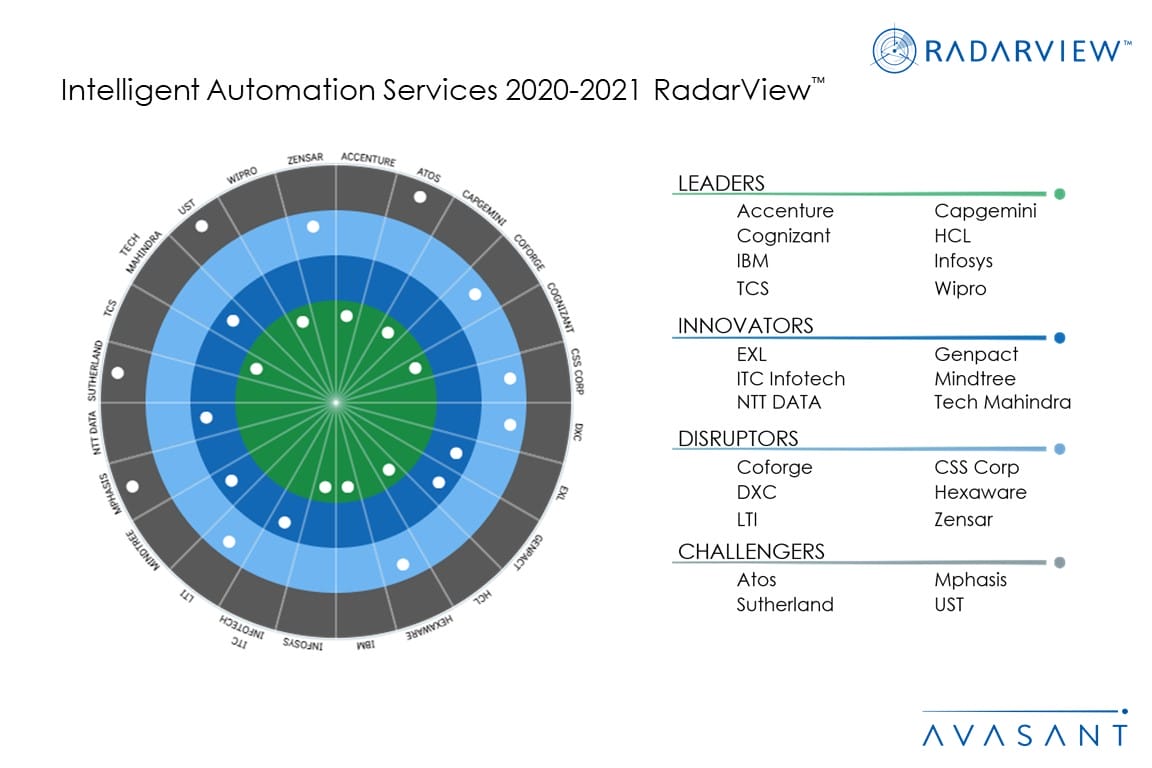

This RadarView includes an analysis of the following service providers in intelligent automation space: Accenture, Atos, Capgemini, Coforge, Cognizant, CSS Corp, DXC, EXL, Genpact, HCL, Hexaware, IBM, Infosys, ITC Infotech, LTI, Mindtree, Mphasis, NTT DATA, Sutherland, TCS, Tech Mahindra, UST, Wipro, Zensar.

Methodology

The industry insights and recommendations presented are based on our ongoing interactions with senior executives, vendors, subject matter experts, and Avasant Fellows, along with lessons learned from consulting engagements.

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and our ongoing market interactions. The assessment is across the three dimensions of practice maturity, partnership ecosystem, and investments and innovation leading to our recognition of those service providers that have brought the most value to the market over the last 12 months.

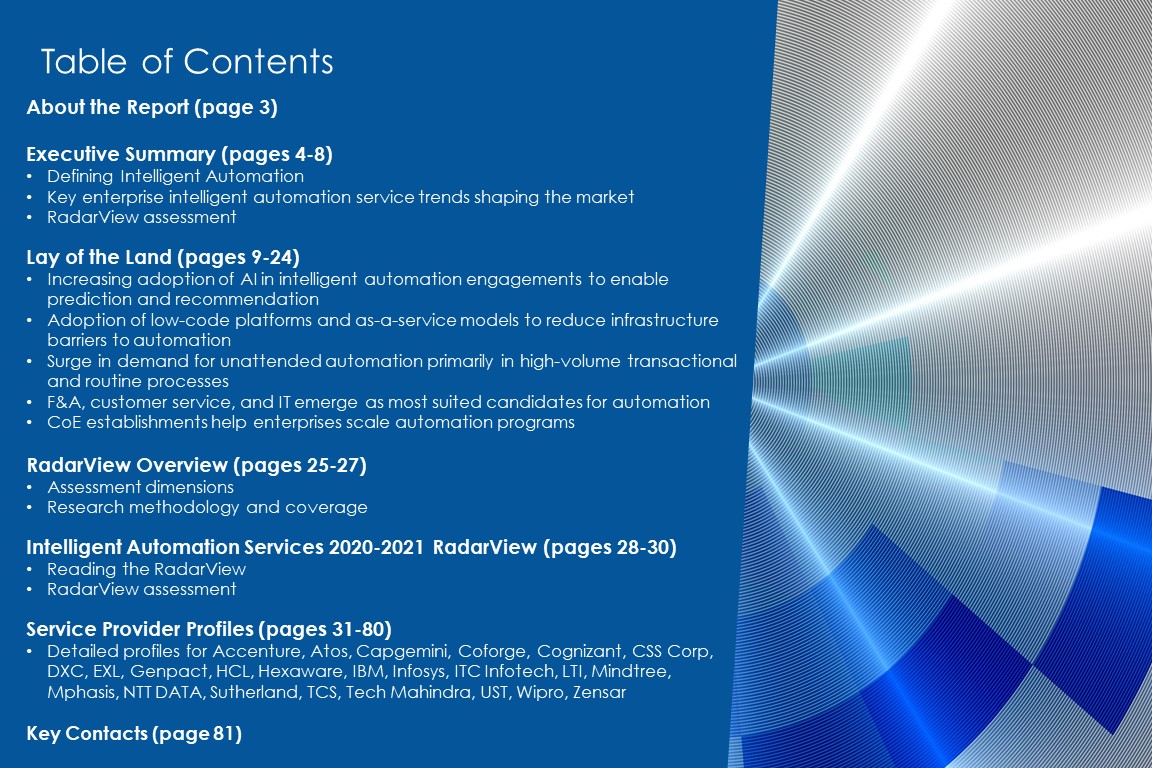

Table of Contents

About the Report (Page 3)

Executive Summary (Pages 4-8):

-

- Defining intelligent automation

- Key enterprise intelligent automation service trends shaping the market

- RadarView assessment

Lay of the Land (Pages 9-24)

-

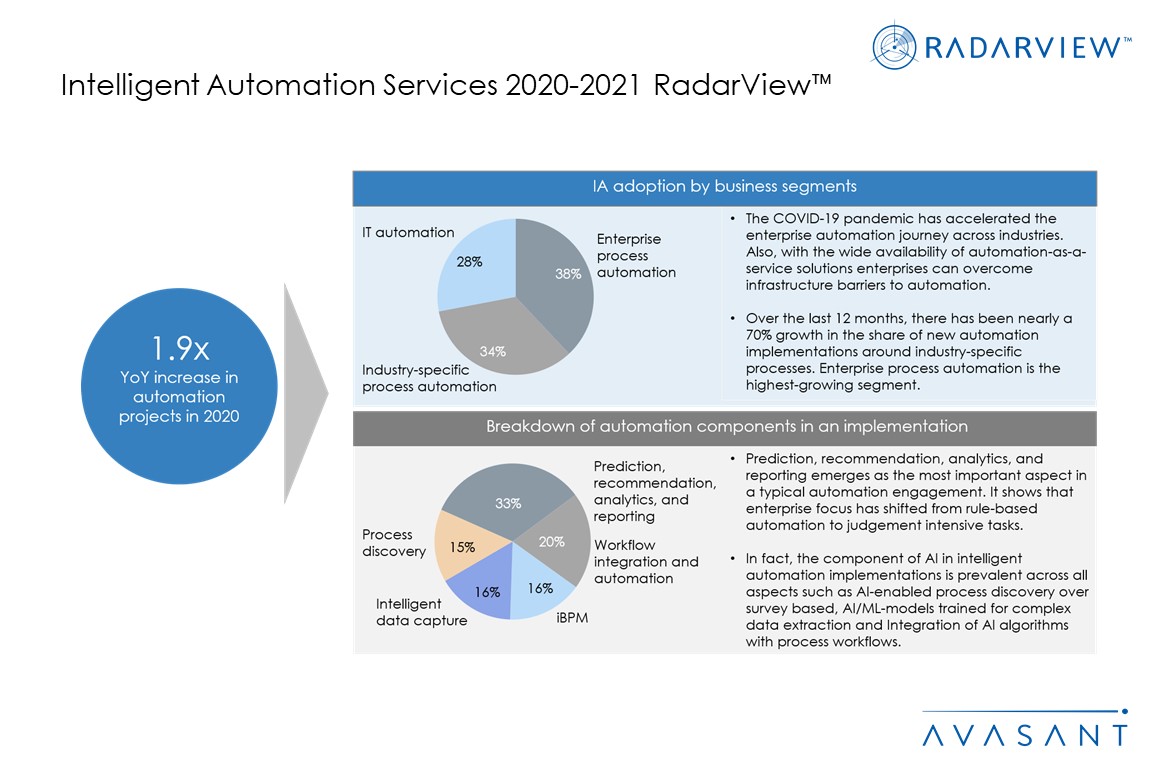

- Increasing adoption of AI in intelligent automation engagements to enable prediction and recommendation

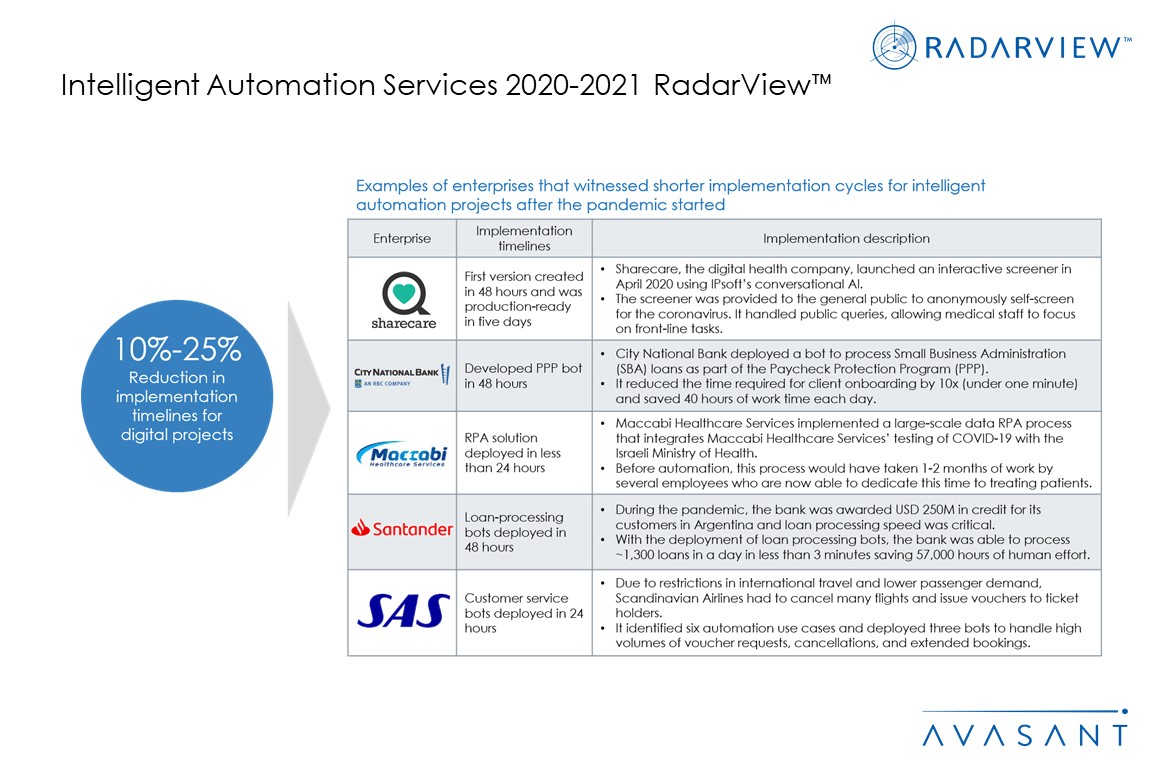

- Adoption of low-code platforms and as-a-service models to reduce infrastructure barriers to automation

- Surge in demand for unattended automation primarily in high-volume transactional and routine processes

- F&A, customer service, and IT emerge as most suited candidates for automation

- CoE establishments help enterprises scale automation programs

RadarView Overview (pages 25-27)

-

- Assessment dimensions

- Research methodology and coverage

Intelligent Automation Services 2020-2021 RadarView (pages 28-30)

-

- Reading the RadarView

- RadarView assessment

Service Provider Profiles (Pages 31-80)

-

- Detailed profiles for Accenture, Atos, Capgemini, Coforge, Cognizant, CSS Corp, DXC, EXL, Genpact, HCL, Hexaware, IBM, Infosys, ITC Infotech, LTI, Mindtree, Mphasis, NTT DATA, Sutherland, TCS, Tech Mahindra, UST, Wipro, Zensar.

Key Contacts (page 81)

Read the Research Byte based on this report.