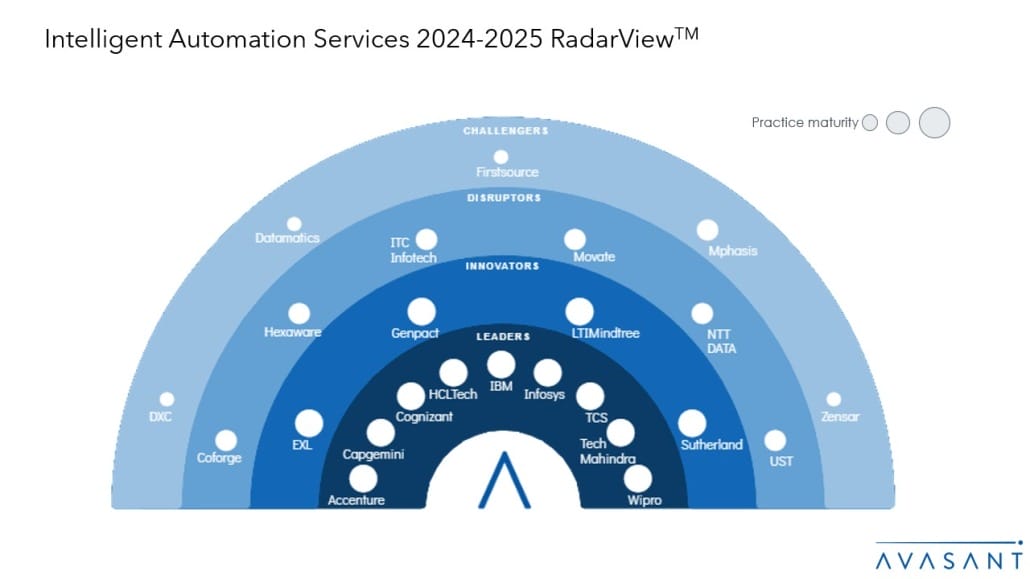

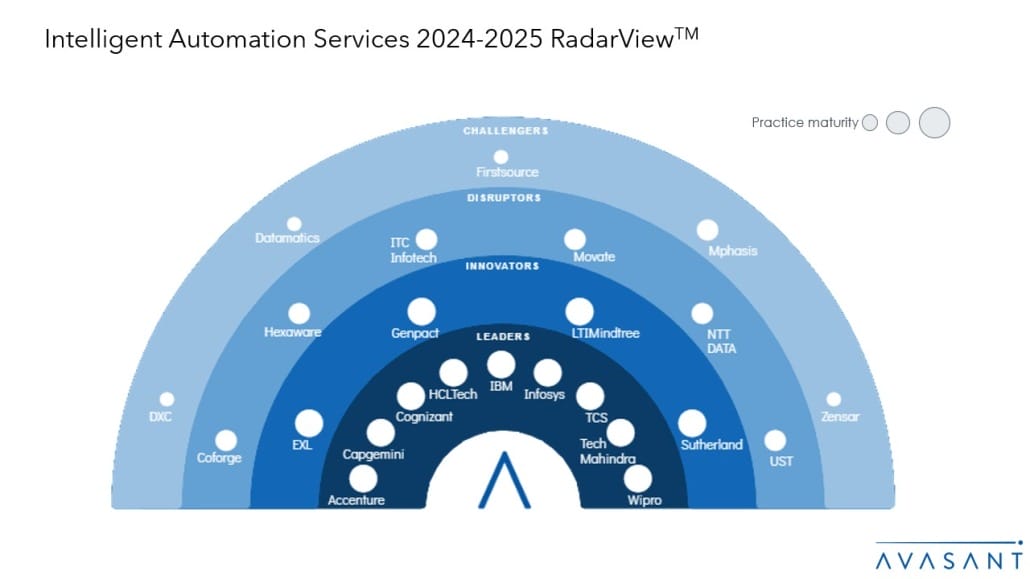

This RadarView™ aims to help enterprises understand the current state of intelligent automation (IA) and identify opportunities for leveraging this technology to streamline their business workflows. It begins with a summary of key trends shaping the supply side of the market. It continues with a detailed assessment of 24 providers delivering IA services. Each profile gives an overview of the service provider, its key IP assets, and a list of major clients and partnerships, along with brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, partner ecosystem, and investments and innovation.

Why read this RadarView?

Advancements in AI and generative AI (Gen AI) technologies such as synchronous AI agents, copilots, and autonomous visual reasoning tools, like Anthropic’s computer use, are revolutionizing the automation landscape. Enterprises are increasingly focusing on automating complex use cases that traditionally required intensive human intervention, including customer experience management, sales lead qualification, and real-time decision-making tasks. This shift has prompted organizations to elevate their investments in automation, prioritizing the development of truly touchless workflows capable of handling intricate processes. By leveraging these advanced AI capabilities, enterprises can achieve seamless integration, scalability, and higher operational efficiency.

The Intelligent Automation Services 2024–2025 RadarView™ highlights key supply-side trends in this space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in their IA journeys. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners to implement IA.

Featured providers

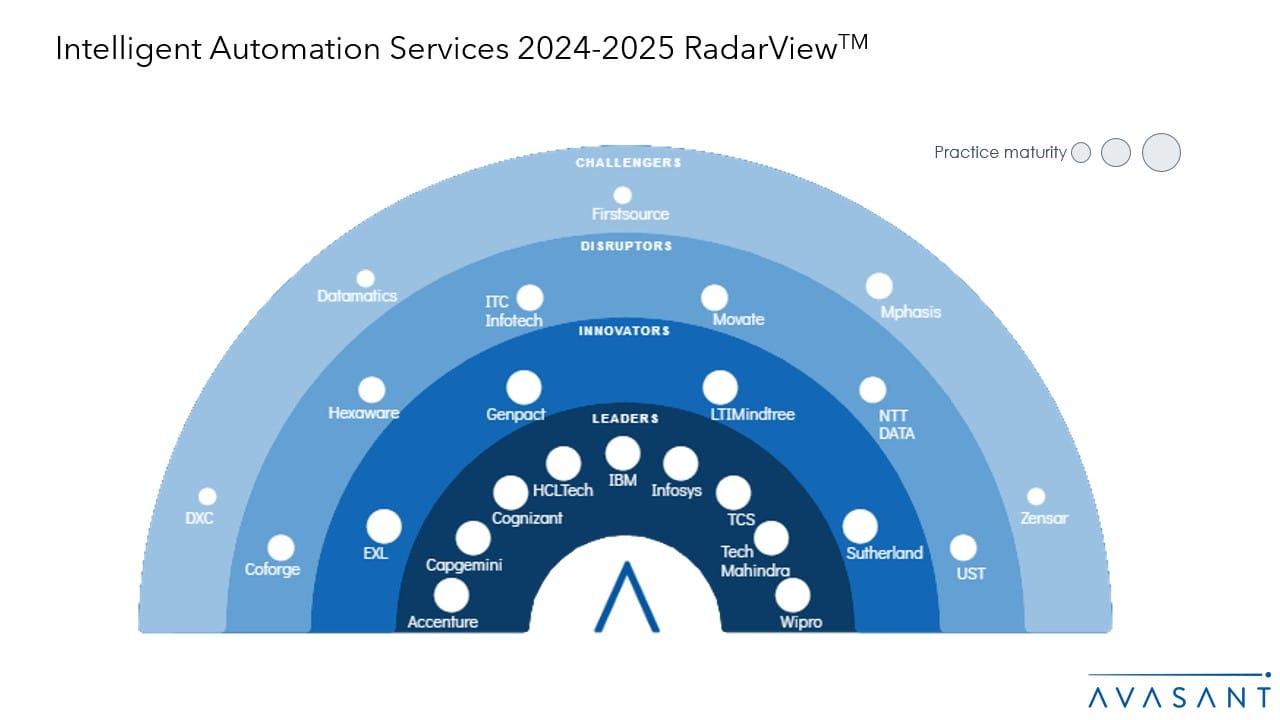

This RadarView includes a detailed analysis of the following IA service providers: Accenture, Capgemini, Coforge, Cognizant, Datamatics, DXC, EXL, Firstsource, Genpact, HCLTech, Hexaware, IBM, Infosys, ITC Infotech, LTIMindtree, Movate, Mphasis, NTT DATA, Sutherland, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, partner ecosystem, and investments and innovation, leading to our recognition of those service providers that have brought the most value to the market over the past 12 months.

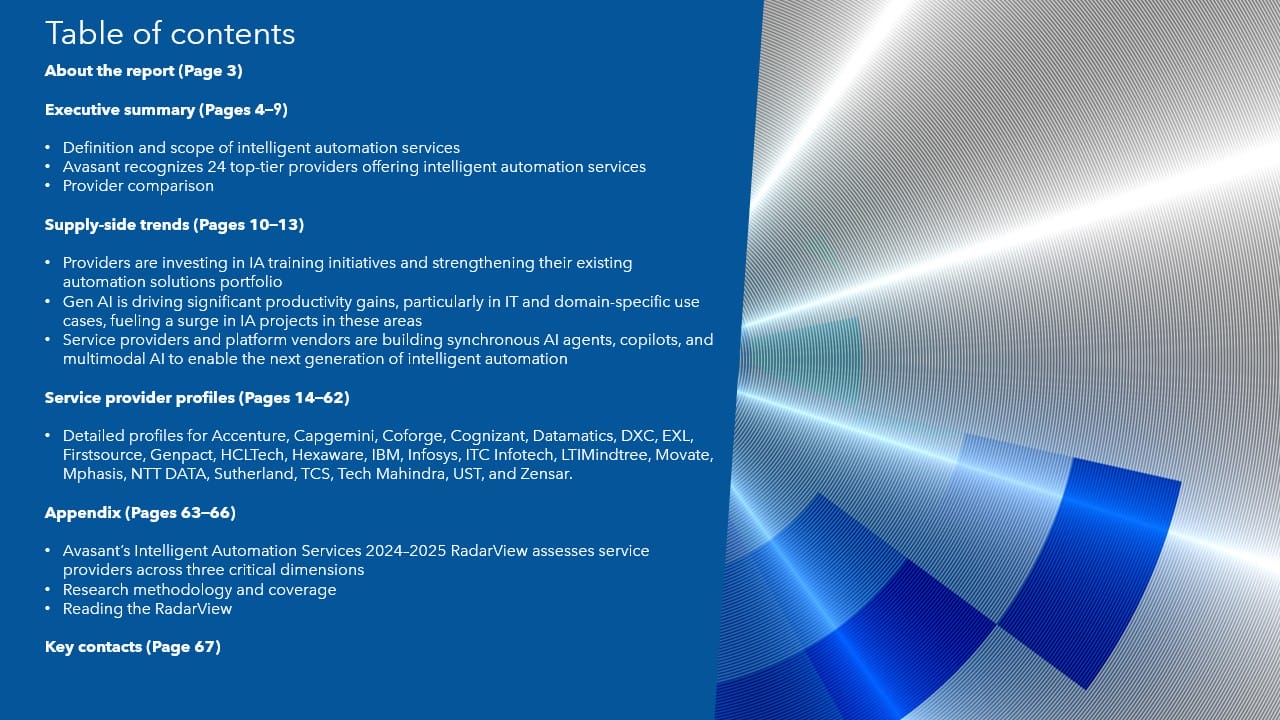

Table of contents

About the report (Page 3)

Executive summary (Pages 4–9)

-

- Definition and scope of intelligent automation services

- Avasant recognizes 24 top-tier providers offering intelligent automation services

- Provider comparison

Supply-side trends (Pages 10–13)

-

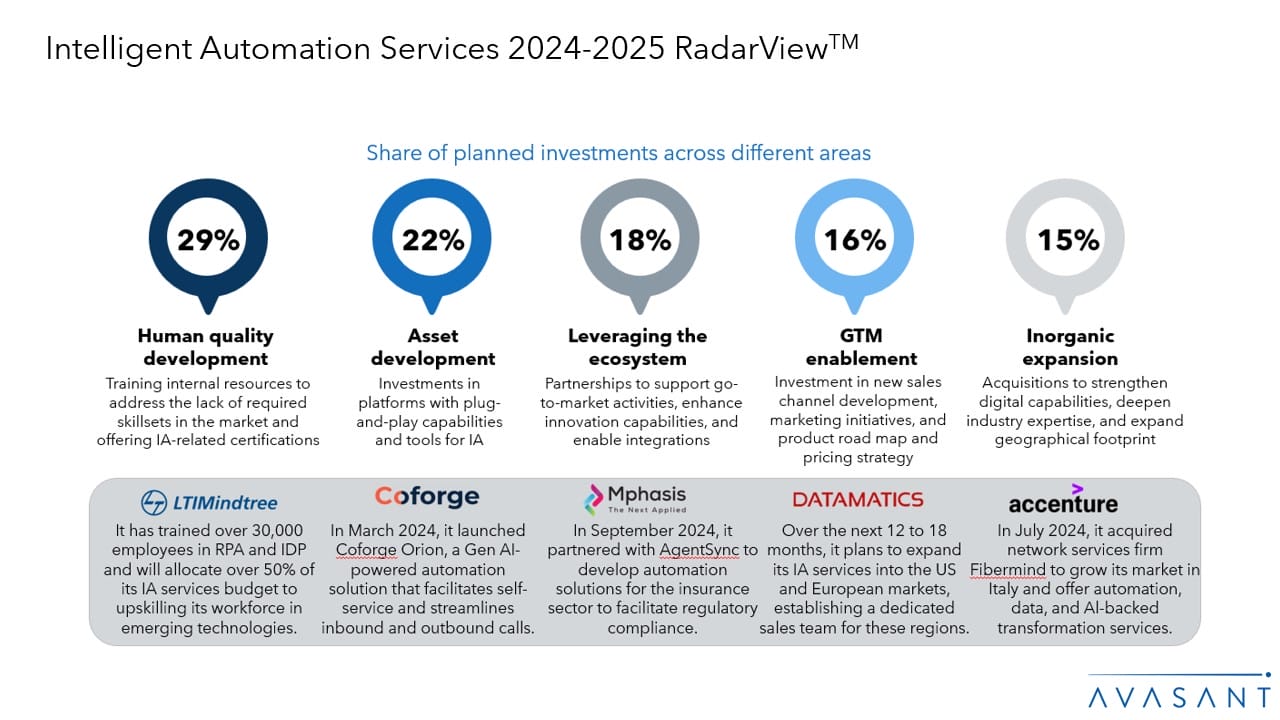

- Providers are investing in IA training initiatives and strengthening their existing automation solutions portfolio

- Gen AI is driving significant productivity gains, particularly in IT and domain-specific use cases, fueling a surge in IA projects in these areas

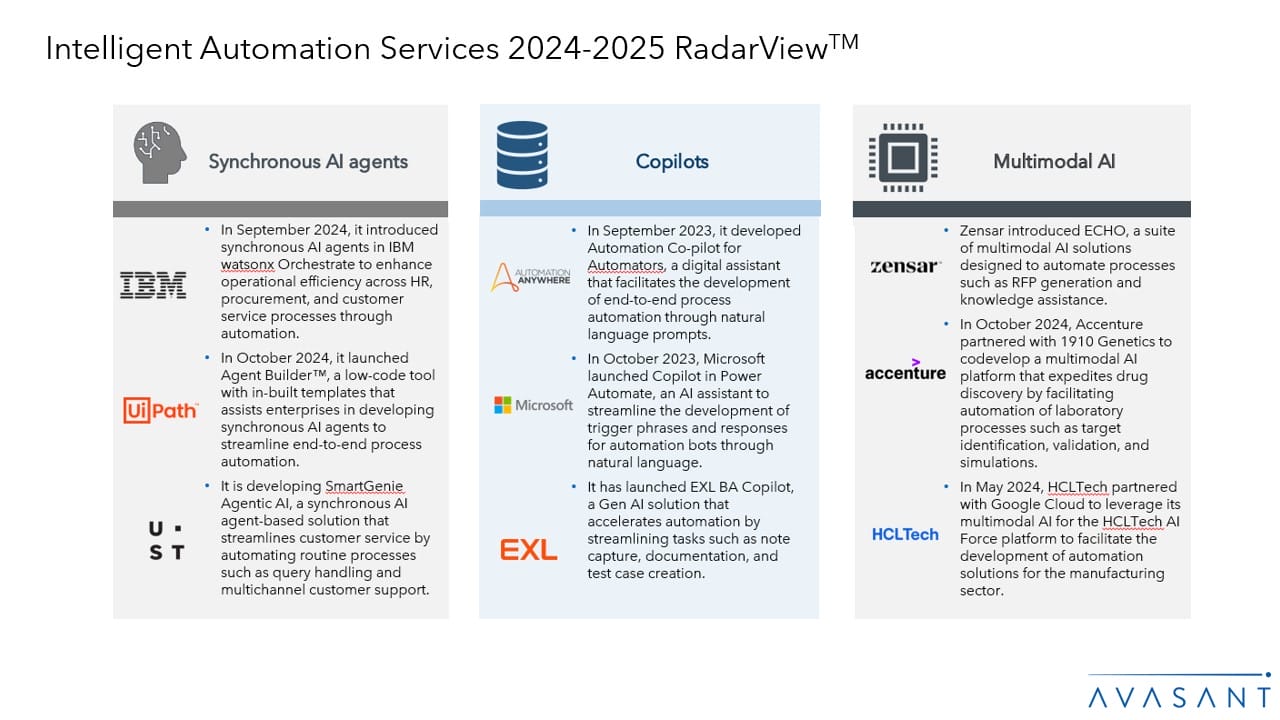

- Service providers and platform vendors are building synchronous AI agents, copilots, and multimodal AI to enable the next generation of intelligent automation

Service provider profiles (Pages 14–62)

-

- Detailed profiles for Accenture, Capgemini, Coforge, Cognizant, Datamatics, DXC, EXL, Firstsource, Genpact, HCLTech, Hexaware, IBM, Infosys, ITC Infotech, LTIMindtree, Movate, Mphasis, NTT DATA, Sutherland, TCS, Tech Mahindra, UST, Wipro, and Zensar.

Appendix (Pages 63–66)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Read the Research Byte based on this report. Please refer to Avasant’s Intelligent Automation Services 2024 Market Insights™ for detailed insights on the enterprises and demand-side trends.