The engineering and construction (E&C) industry has historically lagged in digital adoption, ranking among the least digitized sectors globally. While industries such as manufacturing built robust digital backbones, construction remained anchored in legacy systems and labor-intensive practices. Avasant’s IT Spending Trends in Construction and Trade Services 2024 highlights that IT budgets in construction are not only smaller in proportion to revenue but also stretched thin across fragmented organizations and project-based models. For small and mid-sized contractors, the industry’s backbone, these constraints often limit investment in next-generation platforms.

At the same time, structural challenges are intensifying. Associated Builders and Contractors estimates 439,000 net new workers will be required to meet US construction demand in 2025, even as persisting labor shortages remain acute. Additionally, the association reported that input costs rose at an annualized rate of 9.7% in early 2025. Regulatory and environmental pressures add another layer of complexity, with contractors facing tightening carbon mandates.

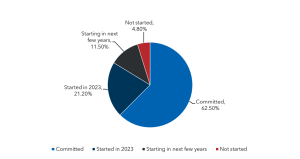

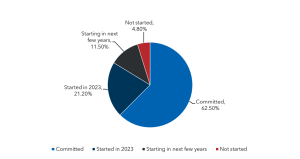

Where incremental digitization once sufficed, enterprises now see the need for accelerating the adoption of advanced technologies. Our IT Spending and Staffing Benchmarks 2025/2026: Chapter 15: Construction and Trade report found that organizations are now actively allocating a 1.3% average of their total IT spending on an AI budget. Recent research further underscores AI’s role. A study in the International Journal of Artificial Intelligence and Machine Learning shows that AI adoption in construction is linked to lean management principles of waste reduction and process efficiency (Figure 1). Uptake is particularly strong in the US and Canada, where integration with building information modelling (BIM) and computer-aided design (CAD) has accelerated deployment.

Figure 1. AI adoption to improve lean construction management

(Source: International Journal of Artificial Intelligence and Machine Learning)

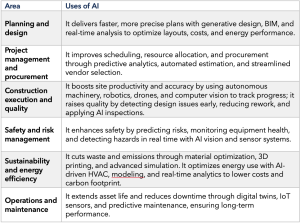

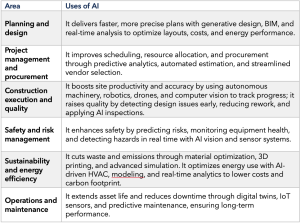

To better understand where AI is taking root, the following table maps AI applications across major stages of the construction value chain.

Table 1. Common uses of AI in construction

Viewed together, these use cases demonstrate how AI is embedding intelligence across the entire project life cycle, rather than remaining confined to isolated pilots. Avasant’s Engineering and Construction Digital Services 2025 Market Insights™ highlights two particular shifts shaping the construction value chain. Firstly, it observes how AI-driven procurement has become a frontline response to price volatility, with platforms using predictive analytics and real-time data to align supply chains, manage vendor risks, and reduce downtime. Secondly, it shows how autonomous sites serve as environments where AI-enabled robotics, drones, sensors, and equipment coordinate to execute tasks, monitor safety, and assure quality with minimal human input. These deployments address skilled labor shortages and long-standing productivity gaps, with AI inspections and automated workflows.

Together, these shifts signal movement from fragmented digitization toward intelligent construction pipelines.

Smarter Sourcing: AI as the Backbone of Procurement

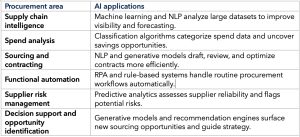

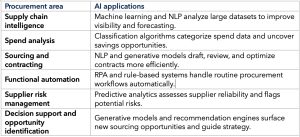

Procurement in construction is evolving from a transactional cost-control function into a carbon-aware pipeline enabled by AI. AI-driven platforms now reframe procurement as multi-objective optimization, driven by improving financial efficiency. The table below lists some of its applications in this area.

Table 2. Specific applications of AI in procurement processes

These applications show that procurement is no longer limited to cost control; it is becoming a digital backbone. Another application highlighted in an International Journal on Science and Research study is how predictive analytics forecasts demand patterns, material price volatility, and supplier reliability, while prescriptive analytics can further extend this by embedding ESG disclosure mandates and embodied-carbon budgets into procurement decisions. In practice, sourcing teams can now dynamically weigh variables such as cost, lead time, and even carbon intensity within a unified model.

Cloud-native construction platforms operationalize these capabilities by linking supplier databases, embodied-carbon models, and digital twins. This creates continuous feedback loops where strategies are automatically recalibrated in response to market shifts, emission thresholds, vendor availability and material inventory. To ensure trust and regulatory compliance, explainable AI (XAI) frameworks such as SHAP and LIME make transparent how trade-offs between price, carbon, and other factors are calculated. This is critical as compliance with the EU AI Act and emissions reporting standards expands.

The NAIOP Commercial Real Estate Corporation’s 2025 insights emphasize the role of AI copilots in procurement dashboards. These deliver real-time alerts on shortages, logistics disruptions, and commodity price spikes while simultaneously monitoring carbon footprints.

Procurement is no longer a support process but a strategic function that leverages AI to unify cost control, supplier engagement, and ESG compliance into a coherent framework for value derivation.

Intelligent Execution: The Rise of Autonomous Construction Sites

While AI-driven procurement provides a refined foundation, the rise of AI, robotics, and autonomous equipment is moving construction toward sites that can physically operate with minimal human intervention. Driverless excavators and haul trucks are already handling repetitive earthmoving tasks, while autonomous mobile robots transport materials across job sites. Drones, exoskeletons, and 3D printing systems extend this automation into surveying, inspections, and even assembly. These technologies do not replace human workers outright but instead augment their activities.

AI introduction into execution pipelines changes the workflow from the bottom. Heavy equipment is being retrofitted with AI-enabled control kits to automate grading, trenching, and pile-driving tasks with precision. Robotic systems using computer vision are advancing into high-skill tasks such as bricklaying and concrete finishing. These deployments are particularly important in the context of the US Bureau of Labor Statistics data showing an 8% decline in construction labor productivity over the past two decades, compared to a 54% increase across the private sector overall.

When paired with large vision-language models, drones deliver automated progress reporting with more than 90% accuracy, breaking down task completion by trade, zone, or schedule milestones. This eliminates manual reporting overheads and provides near real-time operational visibility. AI-equipped drones and fixed cameras also extend site safety management by flagging personal protective equipment (PPE) noncompliance and detecting unsafe conditions, enabling proactive interventions. As computer vision and anomaly detection models advance, safety oversight is shifting from reactive audits, such as weekly inspections, which consume over 40 hours of supervisor time, to continuous and automated monitoring.

The integration of AI in these technologies represents a new execution stack that expands on-site management from a purely physical activity into a digitally orchestrated process. Despite the shortage of skilled labor in this area, this phase is laying the groundwork for truly autonomous construction sites of the future.

At the Crossroads

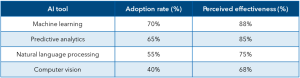

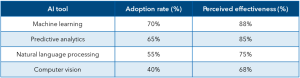

A 2024 study published in the International Journal of Research in Civil Engineering and Technology found that machine learning and predictive analytics have the highest adoption rates in project management, with computer vision and natural language processing expanding with selectiveness (Figure 2). Correlation analysis revealed strong usage links with improvements in time, cost, and quality metrics.

Figure 2. Adoption rates and perceived effectiveness of AI tools in construction project management

(Source: International Journal of Research in Civil Engineering and Technology)

Broader market data support this momentum. Avasant’s Applied AI Services 2024–2025 Market Insights™ notes that AI implementations surged 25% in the past year, with construction actively distributed across manufacturing (16%) and utilities/resources (6%). Avasant’s IT Spending Trends in Construction and Trade Services 2024 underscores further that despite historically low IT budgets, the sector is entering a pivotal stage of digital transformation. Meanwhile, Harvard Business Review reports that venture capital investment in construction technology is growing at 15 times the pace of the broader VC industry, signaling rising confidence in AI’s potential to transform the built environment.

Looking ahead, three trends will shape the next phase of transformation: autonomous machinery handling repetitive tasks, AI-powered vision systems and drones providing continuous oversight, and AI-driven procurement balancing cost with sustainability. For an industry plagued by stagnation and fragmented digitization, these developments mark the beginning of an AI-led reinvention of construction pipelines.

Nidhi T A, Presidential Intern, Avasant, and Sahaj Kumar, Associate Research Director, Avasant