In 2023, the Internet of Things (IoT) industry saw an 18% revenue growth, with more projects transitioning to the production stage. Industrial IoT remains at the forefront of IoT service adoption, driven by use cases such as predictive maintenance, asset management, and remote monitoring. This growth is supported by technological progress, including the amalgamation of edge computing with AI, analytics, and 5G for faster decision-making and increased efficiency. Moreover, the progression of digital twin technology is becoming crucial, impacting a range of applications from product development to addressing global issues such as climate change and supply chain disruptions.

Both demand- and supply-side trends are covered in Internet of Things Services 2024 Market Insights™ and Internet of Things Services 2024 RadarView™, respectively. These reports present a comprehensive study of IoT service providers and closely examine the market leaders, innovators, disruptors, and challengers.

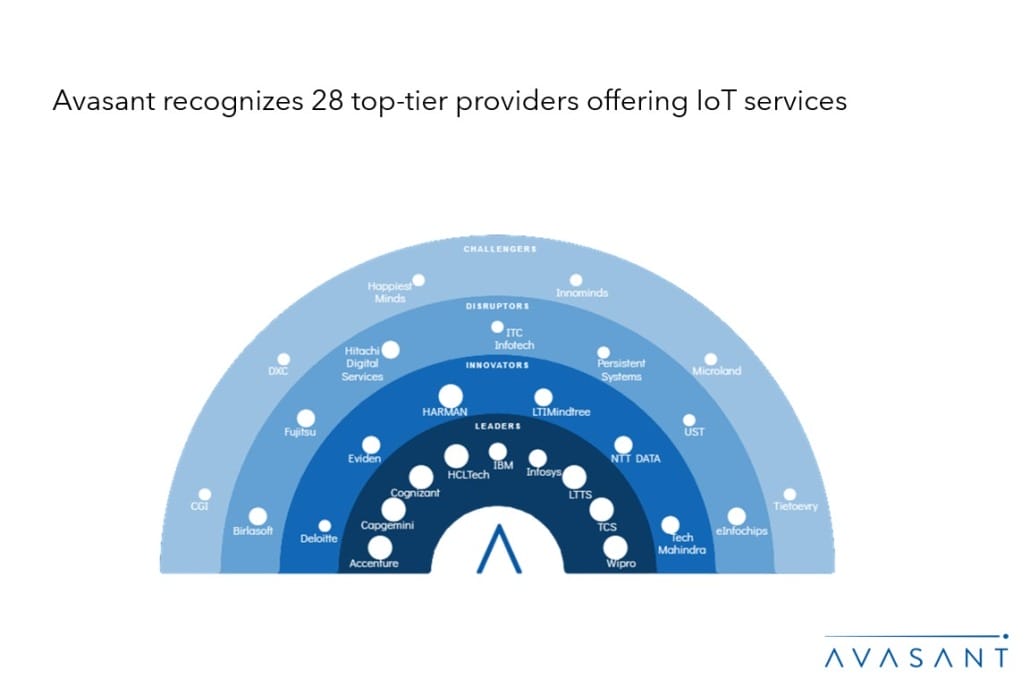

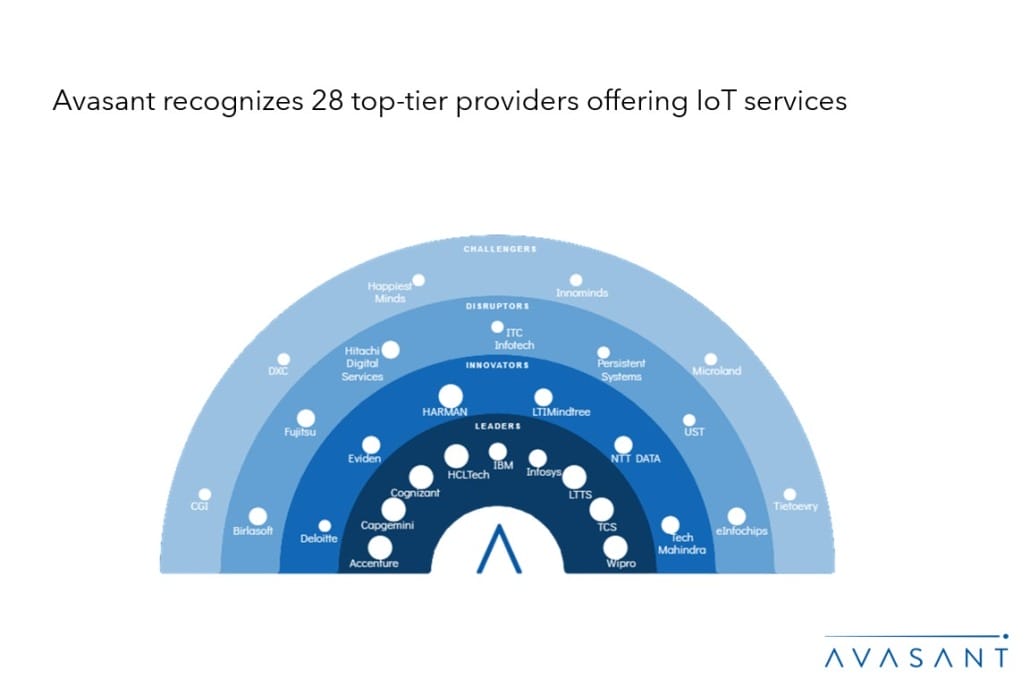

Avasant evaluated 42 providers using three dimensions: practice maturity, partner ecosystem, and investments and innovation. Of these providers, we recognized 28 that brought the most value to the market over the past 12 months.

The RadarView recognizes platform providers in four categories:

-

- Leaders: Accenture, Capgemini, Cognizant, HCLTech, IBM, Infosys, LTTS, TCS, and Wipro

- Innovators: Deloitte, Eviden, HARMAN Digital Transformation Solutions, LTIMindtree, NTT Data, and Tech Mahindra

- Disruptors: Birlasoft, Fujitsu, Hitachi Digital Services, ITC Infotech, Persistent Systems, UST, and eInfochips

- Challengers: CGI, DXC, Happiest Minds, Innominds, Microland, and Tietoevry

The following figure from the full report illustrates these categories:

“Today, organizations in many industries are poised to unleash the transformative potential of IoT across various use cases,” said Avasant Fellow Kim Terry. “By integrating technologies such as 5G, edge computing, computer vision, digital twin, and AI with IoT, enterprises are unlocking unprecedented value and innovation.”

The full report provides several findings and recommendations, including the following:

-

- IoT projects in production continue to rise, with production projects reaching 76% in 2023. Industrial IoT remains the most prominent adopter, with heightened demand for Industry 4.0 initiatives.

- Manufacturing, healthcare, and utilities remain the top three adopters of IoT in terms of industry verticals, with the three combined making up nearly 65% of the total projects.

- Digital twin technology is helping address global challenges, such as providing strategic planning for preventing supply chain disruption, monitoring climate change, transforming urban planning for sustainable, low-carbon smart cities, and enhancing agriculture by monitoring soil and weather to boost yield.

“Enterprises need to carefully evaluate their needs before selecting an IoT platform,” said Abhishek Dash, senior analyst at Avasant. “They should prioritize platforms that offer scalability, have strong security measures, provide seamless integration, and have advanced analytics features with AI capabilities.”

The RadarView also features detailed profiles of the top 28 service providers, including their solutions, offerings, and experience in their IoT services digital transformation journeys.

This Research Byte is a brief overview of the Internet of Things Services 2024 Market Insights™ and the Internet of Things Services 2024 RadarView™ (click for pricing).