In a new special survey in August through September, 2020, we found that a K-shaped recovery from the pandemic has begun. Nearly an equal number of companies have increased their IT budgets in response to the pandemic as those that decreased them, with slightly more actually increasing them.

For those unfamiliar with the term, a K-shaped recovery refers to a phenomenon where different parts of the economy diverge in their recovery. Their revenue (and subsequent IT budgets) resemble the arms of the letter K with some companies seeing increases and others seeing decreases. Of course, in any year, some organizations are increasing budgets and others are cutting them, but the effect at this year is more pronounced.

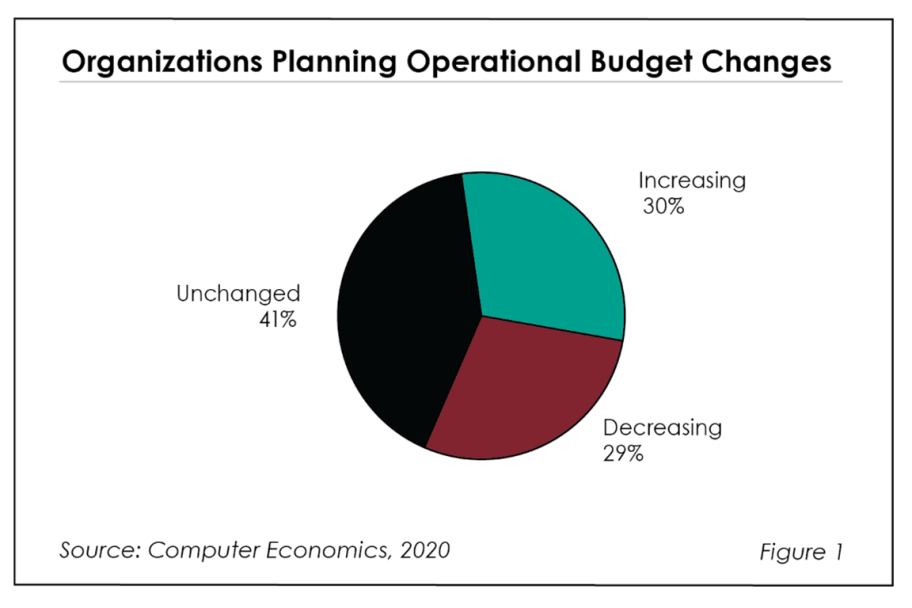

As seen in Figure 1 from our full report, Revisiting the Impact of COVID-19 on IT Organizations in 2020, 30% of respondents reported that they are increasing their IT operational budgets in response to the pandemic. Around 29% are decreasing their budgets, and 41% are leaving budgets unchanged.

The state of IT budgets in August and September is rather different than it was when we last conducted our special Coronavirus survey in April and May. At that time, we saw most companies in a wait-and-see mode with little movement in budgets. Most of the movement we did see was in cuts to IT budgets. Now, the majority of companies have chosen to go in one direction or the other. The decisions to react have been made.

“Of course, the big reason for increasing budgets is to respond to the increased need for employees to work from home,” said David Wagner, senior research director at Computer Economics, a service of Avasant Research, based in Los Angeles. “But what we’re also seeing is that successful companies are the ones with a strong digital presence. Organizations that can afford to are upping their digital game as the economy becomes increasingly about remote services.”

The goal of this report is to determine how IT budgets are changing in the face of the crisis. What we have found is that they’re going in two different directions, much like the economy. However, it is clear that those most prepared to meet a remote, digital world, are faring best in the current environment.

Restaurants, airlines, tourist destinations, and other industries relying on personal contact have suffered greatly. Some of these industries are unlikely to make a complete change to a digital experience. Airlines, for example, will not switch to a virtual experience, as its product is the physical movement of people and material. However, most services organizations can and must adjust to a more virtual experience. It takes IT to do that, particularly with budgets for digital transformation, cloud, IoT, e-commerce, and collaboration tools. Even companies struggling for revenue in this economy will need to find money to invest in these areas.

As we’ve seen with other recessions, we expect to see IT spending to flatten out even among those cutting budgets now. At the same time, IT spending should continue to creep up slowly for companies already starting to recover.

The full report outlines how the pandemic is affecting IT operational budgets, IT capital budgets, IT staff head counts, compensation, outsourcing, budgets for new projects, and the use of the public cloud. We also report how long IT leaders expect it will take for their budgets to recover from the recession. In addition, we forecast expected IT spending changes by industry for all of 2020, along with our recommendations for IT leaders in managing their spending through the crisis.

This Research Byte is based on our report on this subject, Revisiting the Impact of COVID-19 on IT Organizations in 2020. The full report is available at no charge for Avasant Research subscribers, or it may be purchased by non-subscribers directly from our website (click for pricing).