Due to the devastating effects of COVID-19 in the first quarter of 2020, the global economy went into a recession. Organizations faced abrupt changes and, for a while, all enterprise investments stood still. However, as the global economy tried to recover, many companies made changes to their operational budgets to respond to the new business landscape. Some changes addressed immediate requirements to keep the business running while others like budgetary changes ensured more long-term viability and growth.

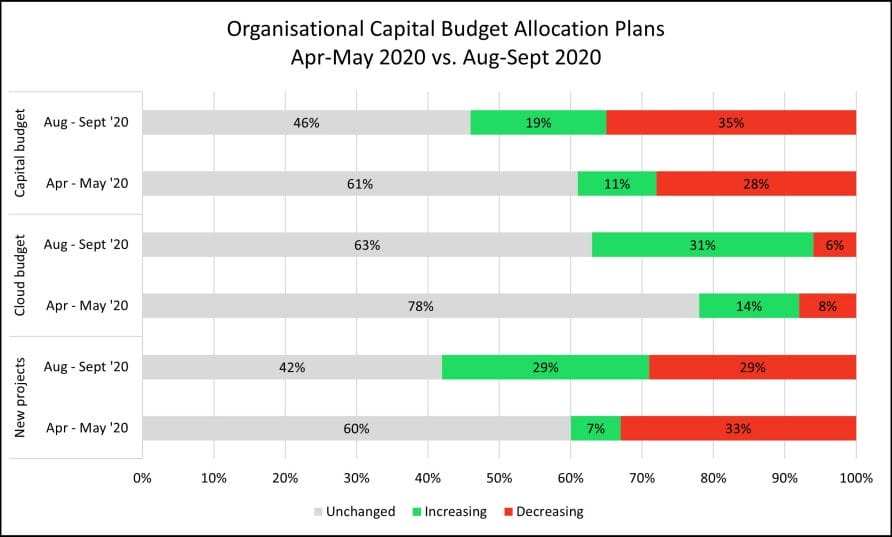

At Avasant, we have been tracking changes in the economy and their impact on businesses closely. To identify key budget allocation trends in response to COVID, we analyzed budget decisions from firms over two time periods. The first set of data was collected between April and May 2020 and the second between August and September 2020. The data collected covered whether companies had plans to increase, decrease, or retain technology spending levels. Avasant gathered and reviewed the planned spending pattern for 278 companies across large, midsize, and small organizations.

The findings clearly showed a freeze in response to the shock of the pandemic, as 61% of organizations did not change their capital budgets in April and May. However, by August and September, 54% had regained balance and made decisions to change the allocation. Some companies chose to reduce their capital budget, retaining cash while ascertaining the revenue impact of the pandemic. On the other hand, some organizations looked at COVID as an opportunity to bring about rapid digital transformation for long-term growth, investing in cloud and other net-new digital projects.

Across all organizations, the most common capital budget expenditure was preparing employees who were unable to work from the office. Companies set up digital platforms to enable collaboration and communication between employees, clients, and customers. Of the companies surveyed, 22% increased their outsourcing budgets to effectively create these digital platforms. Several companies also changed their operating models to continue engaging with customers. Various banks, automobile dealers, real estate companies, and luxury good companies started providing virtual visits and experiences to their customers.

Some businesses made investments, taking advantage of other immediate, pandemic-related opportunities. For example, companies such as L’Oreal, ExxonMobil, and Reckitt Benckiser started manufacturing hand sanitizers and disinfectants. Airbnb took a bet on the fact that people were likely to take vacations closer to home during the lockdown. They began engaging with homeowners at these locations, offering them to their customers. Travelers lodging less than 50 miles from their homes now constitutes the fastest-growing part of the Airbnb business. The company advertised its ability to offer isolated destinations and urged hosts to offer discounts to customers booking longer-term stays.

However, progressive organizations also took a long-term view and invested in driving fundamental changes to their businesses. Out of the over 250 companies surveyed in the Avasant-NASSCOM Digital Enterprise Survey 2020, 63% increased their digital investments in the following areas:

-

- Rapid cloud adoption

- Data and analytics

- IT security

What does this mean for the job market? There will be a boom in the number of tech jobs, but the required skills, mostly digital, will be different. For example, skills needed will include artificial intelligence (AI), machine learning (ML), data analytics, public cloud computing, autonomous things, smart spaces (smart cities and offices), blockchain, and augmented reality/virtual reality (AR/VR). We will eventually see a lot of movement in the quantum computing space as well.

According to the Center for Security and Emerging Technology, the number of AI job postings has more than doubled in 2020. This exponential growth in demand has significantly raised salaries for some jobs.

The biggest challenge this drastic change creates is the gap between demand and supply of AI and analytics specialists. Organizations need to invest in upskilling their current workforce. At the same time, higher education will need to adopt a curriculum addressing this gap in the intermediate and long-term.

Another challenge, as companies deploy AI, analytics, and cloud, requires sophisticated implementation of cybersecurity and smart technology. Growth for companies will mean doing business with more partners and attracting more customers. Businesses must better integrate with partners and customers for products and services.

As companies consider the post-COVID world, it is important that they do not make blanket cost cutting decisions that might eventually hamper their ability to transform and innovate. When adopting technology and digital methods, they need to be mindful of the risks caused due to security and cyber threats. Rushing into long term contracts with providers resulting in short term gains may come with unfavorable terms.

Analysis by Prashant Mishra and Swapnil Bhatnagar from Avasant.