Investments in gene editing, cancer vaccines, and treatments through microbiome and CAR-T therapies provide improved, personalized treatment to patients and reduces healthcare costs by more than 35%. Such advanced and innovative treatments leverage AI and analytics technologies to expedite the development cycle.

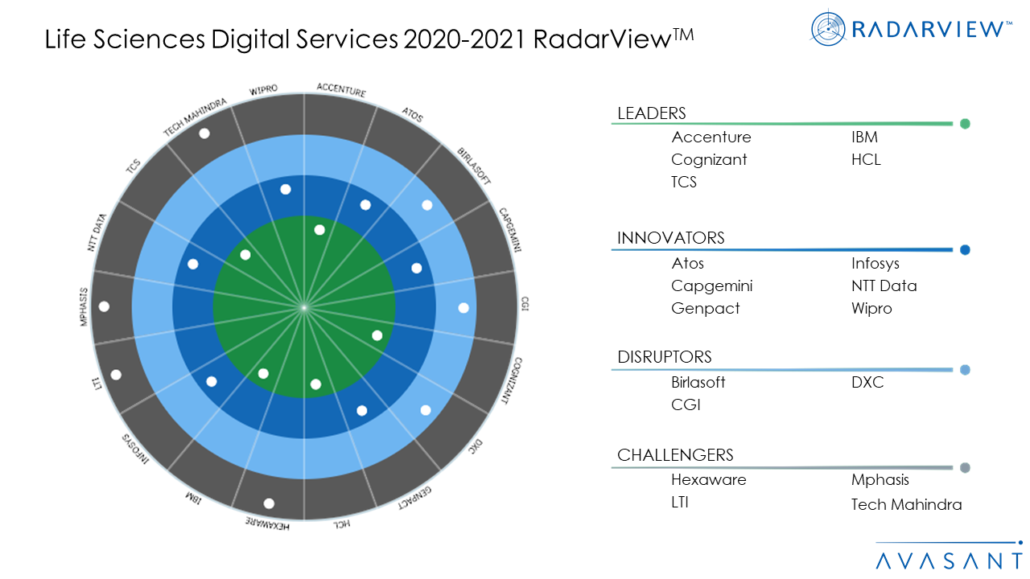

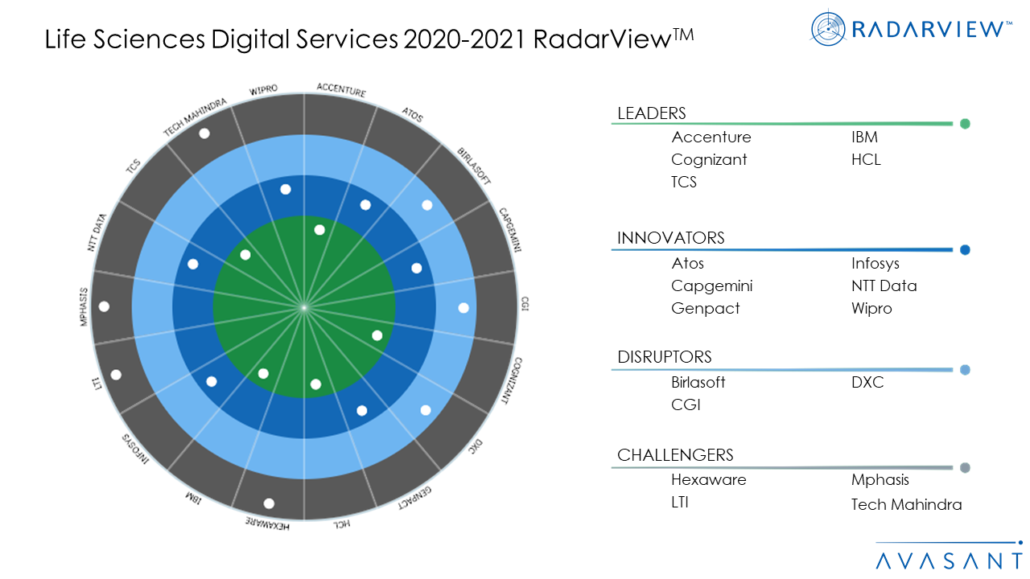

That is one of the top findings of Avasant’s new Life Sciences Digital Services 2020-2021 RadarviewTM report, a comprehensive, deep-dive study of life science industry, including top trends, analysis, recommendations, and a close look at the leaders, innovators, disruptors, and challengers in this market.

This report is aimed at providing information to assist enterprises in developing their action plans and identifying global service providers that can expedite their transformational journey. It highlights the key trends in the life science industry and the direction of the market over the next three years.

Avasant evaluated 34 providers using three dimensions: practice maturity, partnership ecosystem, and investments and innovation. Of the 34 providers, 18 are recognized as having brought the most value to the market over the past 12 months.

The RadarView methodology recognizes service providers in four categories:

-

- The leaders’ circle includes Accenture, Cognizant, HCL, IBM, and TCS.

- The innovators’ circle includes Atos, Capgemini, Genpact, Infosys, NTT Data, and Wipro.

- The disruptors’ circle includes Birlasoft, DXC, and CGI.

- The challengers’ circle includes Hexaware, LTI, Mphasis, and Tech Mahindra.

These four categories are illustrated in Figure 1 from the full report (click to enlarge):

“Life sciences companies need to leverage emerging technologies across the value chain to help differentiate them from their competitors,” said Pooja Chopra, Avasant’s research leader. “To leverage those new technologies, they should pursue domain-specific startups or partner with progressive service providers.”

The report includes recommendations for life science organizaitons:

- Redirect R&D budgets to build differentiated and patentable therapies for chronic and rare diseases:

- Increase the funding of therapies and drug development for chronic diseases, including cancer, heart diseases, diabetes, and rare diseases to cater to the changing population demographics.

- Free up capital for R&D by shifting new molecule-research budgets from non-chronic diseases to biosimilars and generics to take advantage of their quicker development cycles and lower cost.

- Identify applications for emerging tech, and implement them across the drug development lifecycle:

- Optimize drug development processes by leveraging digital technologies such as automation in pharmacovigilance processes and machine learning in identifying the right set of patients for testing.

- Make data capture and analysis central across the lifecycle—from clinical trials (Internet of Things-integrated medical devices for real-time patient data), to treatments (sensors in pills), and remote monitoring.

- Chart an investment plan to accelerate Internet of Medical Things (IoMT) adoption by targeting customers and healthcare enterprises:

- Partner with consumer companies such as Apple and Fitbit to tap into the consumer IoMT market (e.g. wearables, smart devices) by targeting health-conscious individuals and patients with chronic diseases.

- Invest in cybersecurity solutions and standardization of IoMT devices (for interoperability) for increased IoMT adoption by healthcare providers and approvals by healthcare payors.

- Invest in cutting-edge technology to accelerate to the next frontier—precision medicine:

- Accelerate the penetration of precision medicine by leveraging AI and analytics to generate insights critical for drug development, personalized treatment combinations, and prediction of disease risk.

- Partner with and fund startups to access niche expertise and digital capabilities (automation, AI, analytics) for innovative design of clinical trials, genomics, and to launch next-gen therapeutics.

The full report also features highly detailed, comprehensive RadarView profiles of the top 18 service providers along with their solutions, offerings, and experience in assisting life science enterprises in their digital transformation journey. This report also highlights how the service provider landscape has evolved, not only in terms of categorization but also in the way they are investing in developing talent, enhancing organizational structures, expanding geographic focus, and strengthening their partner network.