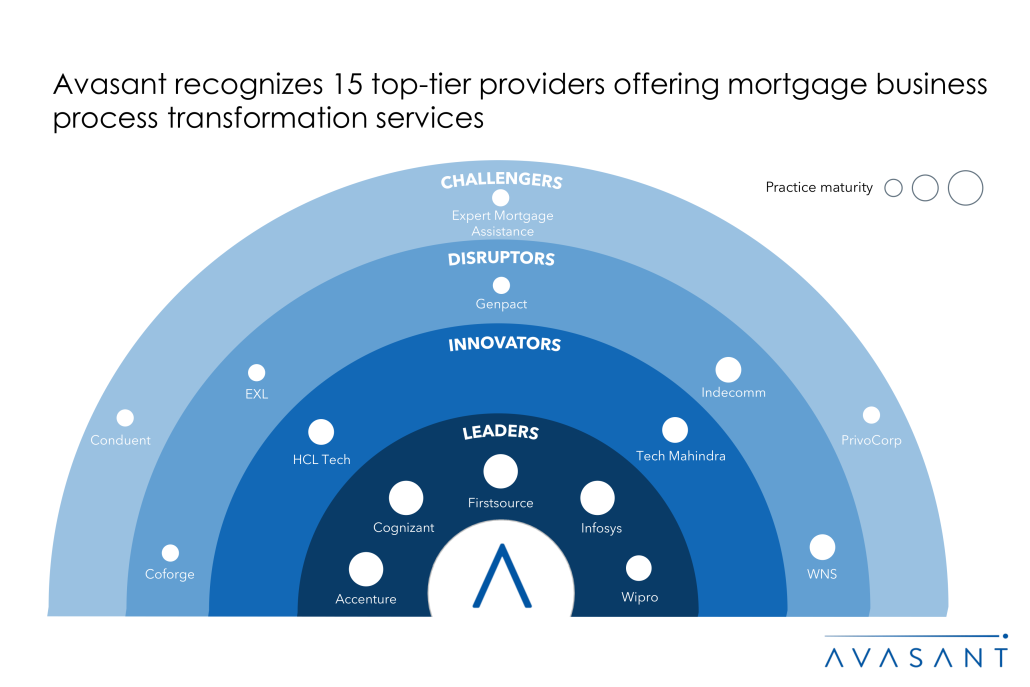

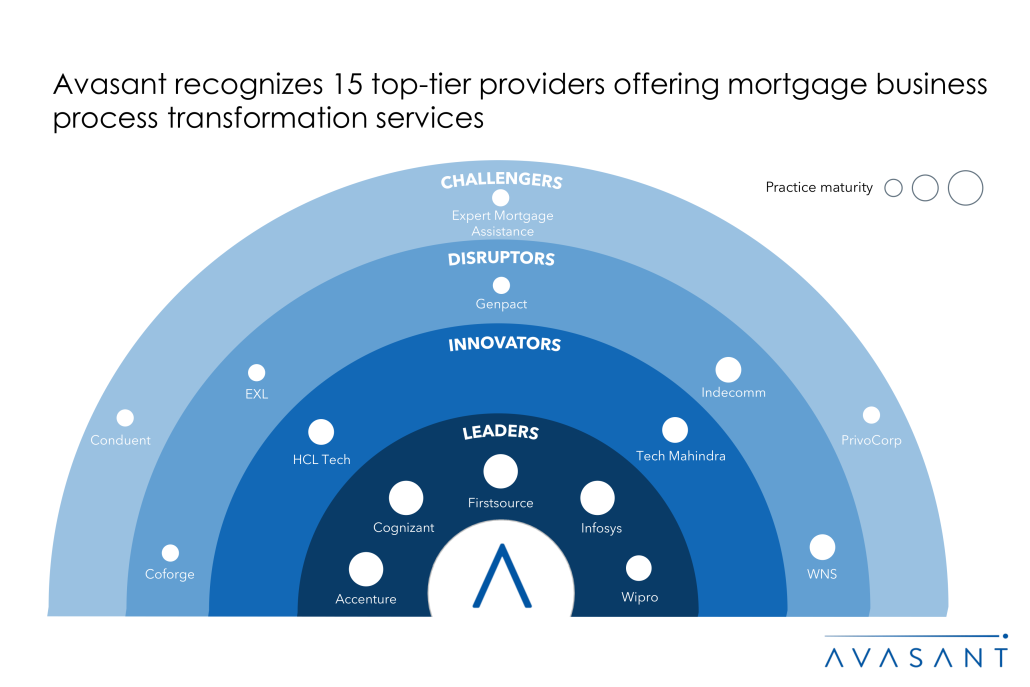

This RadarView™ provides a holistic view of the leading service providers offering mortgage business process transformation services. It begins by summarizing key trends shaping the market’s supply side and continues with a detailed assessment of 15 service providers. Each profile presents an overview of the service provider, its key IP assets, a list of clients and partnerships, and brief client case studies. Each profile concludes with analyst insights on the provider’s practice maturity, domain ecosystem, and investments and innovations.

Why read this RadarView?

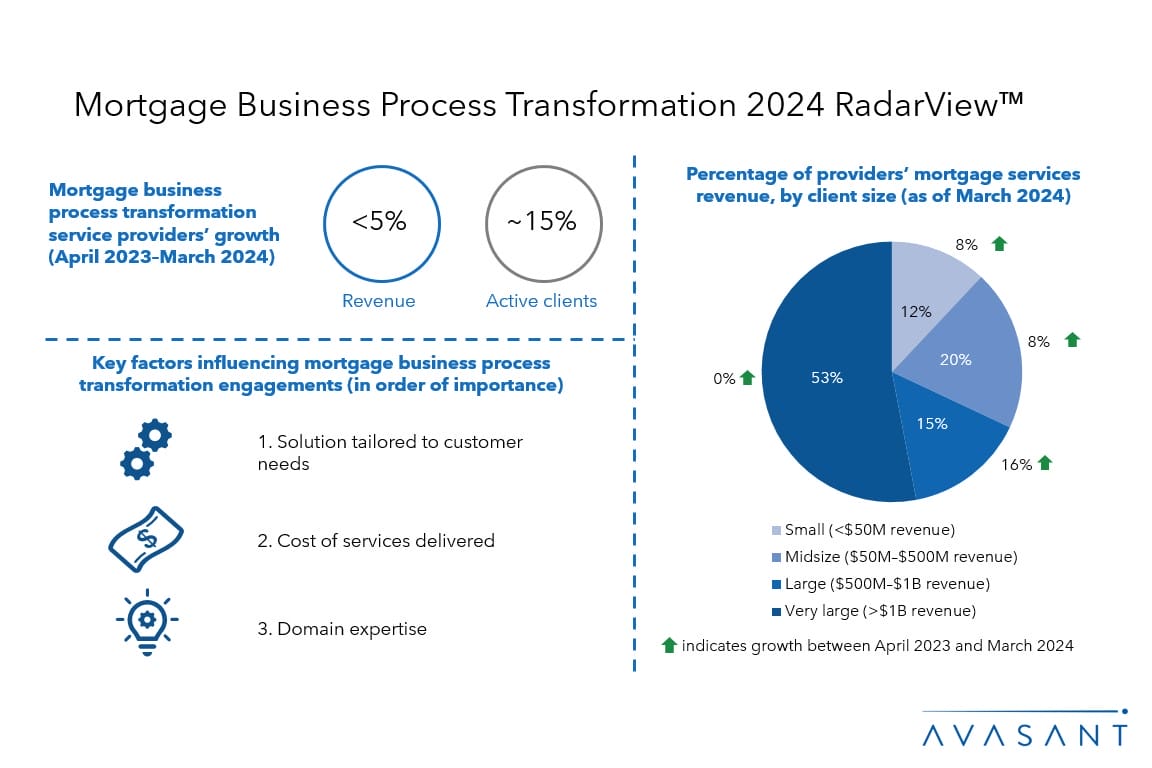

The mortgage business process industry is undergoing a significant transformation driven by technological advancements and evolving customer expectations. The players in this domain are rapidly adopting generative AI, ML, and RPA for tasks such as document processing and risk assessment. Additionally, there is a growing emphasis on customer experience, with service providers focusing on providing personalized and efficient services.

The Mortgage Business Process Transformation 2024 RadarView highlights key supply-side trends in this space and Avasant’s viewpoint on them. It aids companies in identifying top service providers to assist them in mortgage business process transformation. It also analyzes each service provider’s capabilities in technology and delivery support, enabling organizations to select the right strategic partners for their mortgage processes.

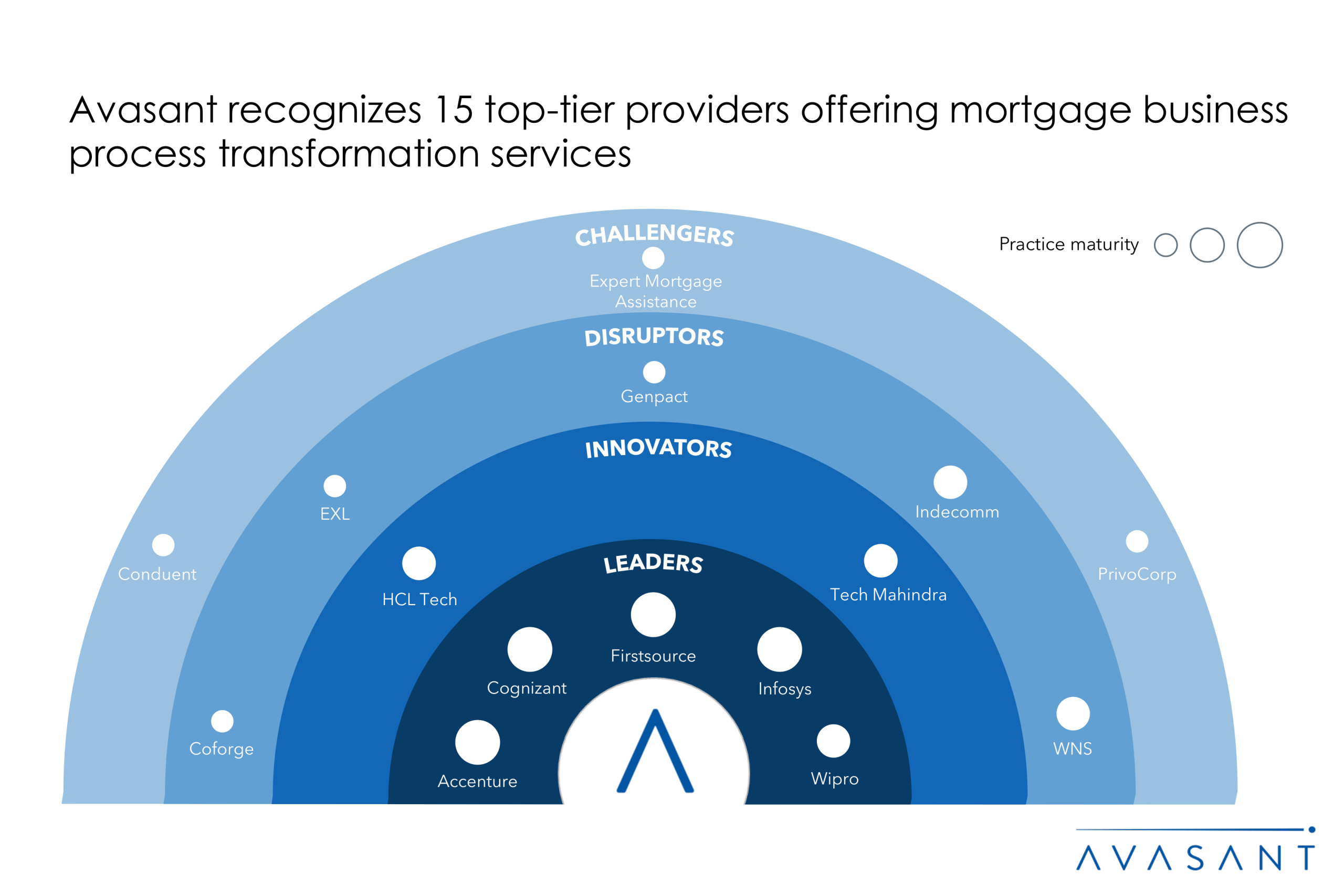

Featured providers

This RadarView includes a detailed analysis of the following mortgage business process transformation service providers: Accenture, Coforge, Cognizant, Conduent, EXL, Expert Mortgage Assistance, Firstsource, Genpact, HCLTech, Indecomm, Infosys, PrivoCorp, Tech Mahindra, Wipro, and WNS.

Methodology

Our evaluation of service providers is based on primary input from the providers, focused briefings, public disclosures, validation from their clients, and Avasant’s ongoing market interactions. The assessment is across the three dimensions of practice maturity, domain ecosystem, and investments and innovation, leading to our recognition of service providers that have brought the most value to the market over the past 12 months.

Table of contents

About the report (Page 3)

Executive summary (Pages 4–8)

-

- Definition and scope

- Avasant recognizes 15 top-tier providers offering mortgage business process transformation services

- Provider comparison

Supply-side trends (Pages 9–13)

-

- Service providers’ revenue growth is slackening; however, the number of clients has gone up owing to emerging regional and nonbank players

- Clients are favoring time-based and output/transaction-based pricing models with an emerging demand for hybrid pricing models

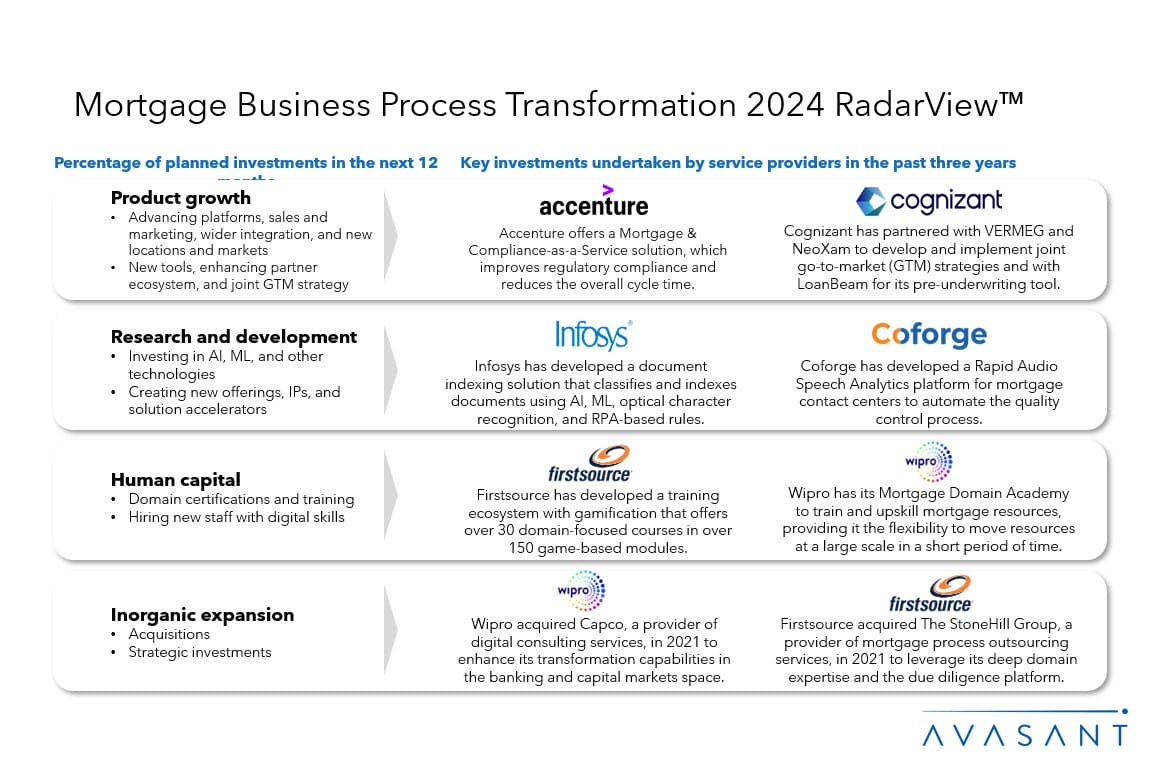

- Service providers are differentiating themselves to enhance their service offerings and maximize value for their clients

- There is a heightened emphasis on product growth as customer expectations have evolved due to the digitization of the end-to-end mortgage process

Service provider profiles (Pages 14–44)

-

- Detailed profiles for Accenture, Coforge, Cognizant, Conduent, EXL, Expert Mortgage Assistance, Firstsource, Genpact, HCLTech, Indecomm, Infosys, PrivoCorp, Tech Mahindra, Wipro, and WNS.

Appendix (Pages 45–48)

-

- RadarView assessment

- Research methodology and coverage

- Interpretation of classification

Key contacts (Page 49)

Read the Research Byte based on this report. Please refer to Avasant’s Mortgage Business Process Transformation 2024 Market Insights™ for demand-side trends.